Tag Archive: newsletter

Philipp Vorndran: “Wir werden auch in 30 Jahren noch von Kryptowährungen sprechen”

In unserem Videoformat „No Charts, Just Personality“ geht es um die Persönlichkeit hinter der Performance. Im fünften Teil des Interviews mit Philipp Vorndran spricht der Kapitalmarktstratege bei Flossbach von Storch mit Peter Ehlers und Malte Dreher, Herausgeber von DAS INVESTMENT, über Investments in Kryptowährungen wie Bitcoin und Ethereum, Vorndrans Wechsel zu Flossbach von Storch und Marketing in der Finanzbranche.

Kryptowährungen und die...

Read More »

Read More »

Credit Suisse cuts thousands of jobs to restore fortunes

Swiss bank Credit Suisse is shedding thousands of jobs, selling off parts of its business and raising billions in extra capital in a bid to reverse a downward spiral in fortunes.

Read More »

Read More »

Fake-Accounts von mir erkennen – Vorsicht! Aktuell gibt es viele Betrüger

Vorsicht! Wie Scammer meine und andere Identitäten nutzen, um Geld abzuzocken!

Neuer offizieller Telegram-Kanal: https://t.me/thorstenwittmann

Zum Klartext-E-Letter: https://thorstenwittmann.com/klartext/

Neuer offizieller Telegram-Account (und warum)

Wie wir alle wissen hat Social-Media Vor- und Nachteile. Einer der Nachteile ist, dass es für jeden fast problemlos möglich ist, eine falsche Identität vorzutäuschen.

Damit haben alle größeren...

Read More »

Read More »

Schon ab 50 CHF Gold und Silber Kaufen: philoro Gold Abo 2022 + Erfahrungen ? | Gutscheincode

? philoro 50 CHF Startguthaben fürs Goldabo Gutscheincode: SPARKOJOTE ►► http://sparkojote.ch/philoro

(bei der Verwendung des Gutscheincodes, unterstütz ihr meinen Kanal :-)

philoro Gold Abo 2022 + Erfahrungen: Gold und Silber Kaufen ?? |

Einfach und sicher Anlagemünzen sowie Gold- & Silberbarren kann man bei philoro Schweiz kaufen. Diese Erfahrungen habe ich mit Gold über die letzten Jahre gesammelt. Alle Vorteile und Nachteile und wo ich...

Read More »

Read More »

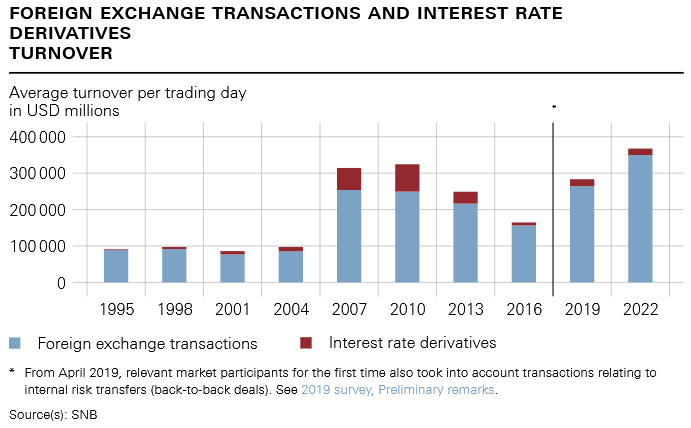

Turnover in foreign exchange and derivatives markets in Switzerland

The SNB has today published the results of the survey on turnover in foreign exchange and over-the-counter (OTC) derivatives markets in Switzerland. The data reflect the turnover in April 2022 of the banks surveyed.

Read More »

Read More »

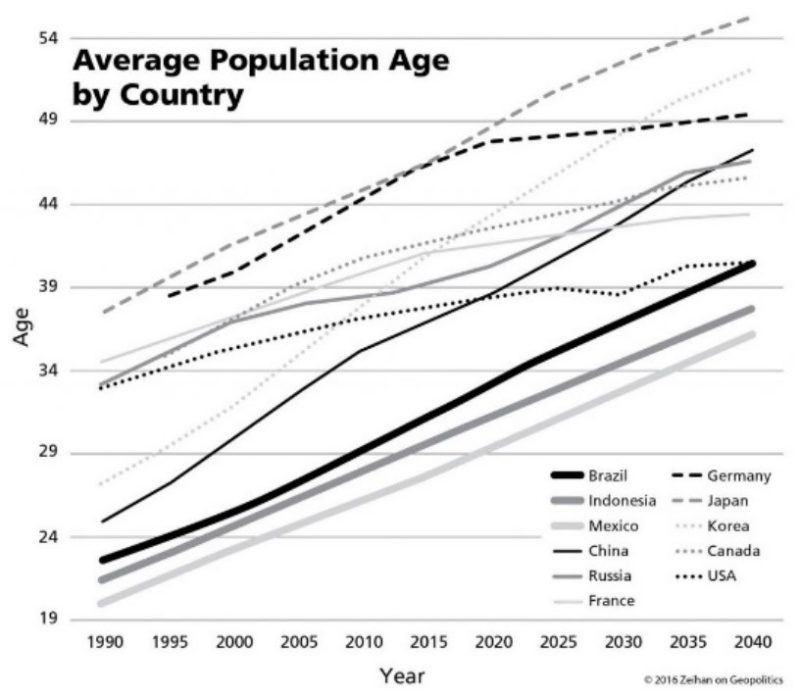

The Cleanest Dirty Shirt

It’s easy to overestimate the problems the United States faces while underestimating its strengths. The challenges are certainly significant. Politics have seldom been so divisive. The government is running an annual deficit of over a trillion dollars, with a total debt many times that. Inflation has spiked. The Fed has been hiking interest rates at a pace that could imperil the economy.

Read More »

Read More »

DAS sollte der Staat tun! Unpopulärer Blick auf das System: Wieso der Sparsame bestraft wird

Melden Sie sich beim kostenlosen Newsletter an: www.elsaessermarkus.de

und schreiben Sie uns eine Mail, wenn Sie den Bericht erhalten wollen.

_

Das Video sollte jeder über Erbschaft wissen. Das Steuersystem in Deutschland. Wieso die Erbschaftsteuer dem Mittelstand schadet. Überholte Freibeträge, Fairness und vieles mehr

Gefahren der Erbschaftssteuer

_

Dr. Markus Elsässer, Investor und Gründer der Value Fonds

„ME Fonds - Special Values“ WKN:...

Read More »

Read More »

Swiss federal buildings to get solar panel makeover

The Swiss government has pledged to install solar panels on as many federal buildings as possible to help boost the production of energy from renewable sources.

Read More »

Read More »

Charlie Munger’s Life Advice Will Leave You SPEECHLESS

Charlie Munger's Life Advice Will Leave You SPEECHLESSAll his life Charlie Munger admired Confucius. In this video, Mr. Munger shares almost 100 years of pure wisdom that he has managed to acquire over time. He elaborates on several big ideas that were enormously helpful during his long life.

Read More »

Read More »

This Will Happen To Gold & Silver Prices | Alasdair Macleod Gold & Silver Price Prediction

Alasdair Macleod talks about the coming Gold & Silver reversal and what will happen to Gold & Silver

#gold #silver #goldprice

Read More »

Read More »

Where Will All the Silver Come From? – MWU – 10.27.22

Another heck of a month behind us, and looking back, one thing in particular stands out: the crazy supply and demand situation in all commodities, particularly silver. This month, host Craig Hemke sits down with Eric’s business partner Conor O'Brien to break down all the gold and silver news you need to see what this means moving forward.

You can check out all our bullion products here: www.sprottmoney.com/bullion

Got questions for our experts?...

Read More »

Read More »

Gerd Kommer, Erichsen, Aktienfinder & Co – DIE DOKU über Deutschlands Finanz-Influencer

"Deutschland, deine Finfluencer" ist die erste große DOKU über die Finfluencer-Szene in Deutschland. extraETF nimmt euch mit auf einen coolen Roadtrip durch die Republik zu einigen der bekanntesten Finanz-Persönlichkeiten wie @Erichsen @Tradermacher @Finanzrocker @Gerd Kommer @Aktienfinder @Fortunalista @caminvesta und Jonathan Neuscheler.

ℹ️ Weitere Infos zum Video:

In den vergangenen Jahren haben sich die Angebote von...

Read More »

Read More »

Zocken oder Zaudern #009 Prof. Max Otte – Cannabis-Aktien – Google

In der neunten Folge von Zocken oder Zaudern, dem Finanz- und Wirtschaftsmagazin, beschäftigen sich Iris Aschenbrenner und Rolf Ostmann mit Cannabis-Aktien. Zudem werfen sie einen Blick auf das Uniper-Fiasko.

Read More »

Read More »

ATOMKRIEG – was wäre, wenn…? #shorts

Was passiert, wenn eine False Flag Aktion (egal von wem) gestartet wird? Wie wahrscheinlich ist das und welche Auswirkungen hätte das für uns? Alles im nächsten Themenvideo!

► Mein neues Buch

Du möchtest das erfolgreichste Wirtschaftsbuch 2021

"Die größte Chance aller Zeiten" bestellen?

Auf Amazon: https://amzn.to/3bfKWdN oder mit Signatur:

https://www.marc-friedrich.de/

► Friedrich & Partner Vermögenssicherung...

Read More »

Read More »

EURUSD moves toward session low. What next?

The 0.99515 level in the EURUSD is being eyed as the next downside target.

Close risk is now the parity level at 1.0000. Say below would be the best news for the sellers now.

Read More »

Read More »

Sind China-Aktien JETZT ein Kauf?

Bei China-Aktien sprechen viele von großen Chancen. Jedoch hat sich immer noch kein Boden gebildet. Ob es jetzt sinnvoll ist, China-Aktien zu kaufen und wie mein langfristiger Ausblick aussieht, erkläre ich im heutigen Video.

Hier kannst du das Buch bestellen:

https://jensrabe.de/ChinaAktienJetztEinKaufBuch

0:00 ETF Charts

2:40 Politische News

4:39 Investment oder Trade

13:19 Meine Denkweise

Vereinbare jetzt Dein kostenfreies Beratungsgespräch:...

Read More »

Read More »