Tag Archive: newsletter

DIE SECHS ZONEN STADT…

Klicke hier, um Dich gemeinsam mit Oli unabhängig zu machen:

? http://bit.ly/oli-ausbildung

Meine Webseite: https://tradingcoacholi.com/

►Mein Telegram Kanal: http://t.me/tradingcoacholi

►Folge Oliver auf Facebook: http://bit.ly/TOFBpage

►Folge Oliver auf Instagram: http://bit.ly/TOInst

►Oli macht auch TikToks: https://www.tiktok.com/@tradingcoacholi

►Abonniere Oliver auf YouTube: http://bit.ly/Oli-Kanal

DIE TRADING COMMUNITY VON OLIVER KLEMM...

Read More »

Read More »

Andreas Beck – warum der Star-Fonds-Manager optimistisch ist , seine Strategie für 2023/Aktien

Andreas Beck ist endlich back im Money Talk. Im Gegensatz zu den meisten Experten schaut er optimistisch ins neue Jahr . Wo er die positiven Impulse sieht und wie er sich mit seinem Fonds aufstellt, beschreibt er im Interview.

Mehr dazu in seinem neuen Buch , das Du hier bestellen kannst :

DAS NEUE BUCH VON ANDREAS BECK

https://amzn.to/3v0hQrv

#Aktien #AndreasBeck #Geldanlage

✅ HIER VERLOSE ICH ZU WEIHNACHTEN 10 HANDSIGNIERTE BÜCHER VON MIR...

Read More »

Read More »

Die erfolgreichste Anlagestrategie für die kommende Zeit

Im heutigen Video geht es darum, wie du in einer Zeit, in der alle Anlagemöglichkeiten gerade fallen, etwas findest, das dennoch eine profitable Anlagestrategie ist.

Read More »

Read More »

Trading Wochenanalyse für KW 51/2022 mit Marcus Klebe – DAX – DOW – EUR/USD – Gold #Chartanalyse

HIER geht´s direkt zur Demo-oder Livekontoeröffnungt:

https://partners.jfdbrokers.com/visit/?bta=35101&nci=5424

In dieser Analyse blickt Marcus Klebe auf die vergangene Handelswoche im DAX, Dow, EUR/USD und Gold und bespricht wichtige charttechnische Bereiche und mögliche Bewegungen für die kommenden Handelstage.

#Chartanalyse #MarcusKlebe #LevelUpTrading

DAX: xx:xx

DOW JONES: xx:xx

EUR/USD: xx:xx

GOLD: xx:xx

WTI xx:xx

DAX/ DE30Cash -...

Read More »

Read More »

KLIMA “Proteste” der letzten Generation: DAS ist ihr PERFIDER PLAN!

Klima "Aktivisten" der letzten Generation lassen die Luft aus den Reifen von SUVs, kleben sich auf die Straße und schänden historische Kunstwerke! Die Politik sollte aufhören wegzuschauen und den Rechtsstaat mobilisieren. Was uns Bürger angeht, wir können und sollten uns dagegen wehren.

Gratisaktie bei Depoteröffnung für ETFs & Sparpläne gewinnen ► http://link.aktienmitkopf.de/Depot *

20 € in Bitcoin bei Bison-App ►...

Read More »

Read More »

Ist die ENERGIEWENDE gescheitert? (Interview Fritz Vahrenholt)

Ist unsere Energiepolitik gescheitert? Haben wir verlernt Risiken einzugehen und setzen wir unsere grüne Energieideologie über die Entwicklung und Forschung stabiler und sicherer Alternativen? In diesem sehenswerten Interview mit Prof. Dr. Fritz Vahrenholt (Politiker, Chemiker und Buchautor) besprechen wir unter anderem, ob Klimakleber eine eigene "Religion" bilden, wieso die hohen Gas- und Strompreise politisch gewollt sind, wie präsent...

Read More »

Read More »

CBDCs & World Economic Forum | Lexikon der Finanzwelt mit Ernst Wolff

Die höchste Konzentration von Vermögen in immer weniger Händen,

die höchste Konzentration von Macht in immer weniger Institutionen und

der dadurch ermöglichte historisch einmalige Demokratieabbau.

Read More »

Read More »

Jahresausblick 2023 – darauf solltet Ihr Euch vorbereiten

Liebe YouTube Freunde,

das Jahr 2022 neigt sich dem Ende zu. Es war ein sehr turbulentes Jahr - und das wird 2023 auch. Viele Investoren und Anleger haben Geld verloren, weitere werden es noch tun.

Read More »

Read More »

Immokredite: Jetzt besser fix oder variabel verzinsen?

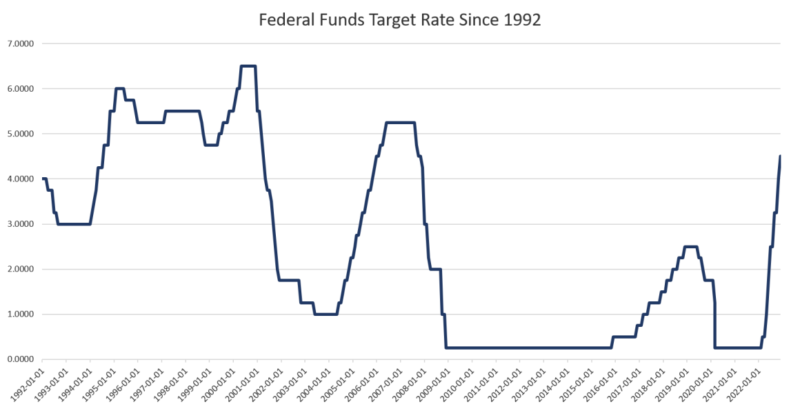

EZB und FED erhöhen die Zinsen um weitere 0,5%. Aktuell sehen wir eine inverse Zinskurve, ein Anzeichen einer Rezession. Aber was bedeutet diese Zinsentwicklung für Immobilieninvestoren und ihre Finanzierungen?

Read More »

Read More »

Jeden Monat Dividenden: Mit diesen ETFs!

Dividenden ETFs: Jeden Monat Dividende!

Kostenloses Depot eröffnen: ►► https://link.finanzfluss.de/go/depot?utm_source=youtube&utm_medium=554&utm_campaign=comdirect-depot&utm_term=kostenlos-25&utm_content=yt-desc *?

Zur ETF Suche: ►► https://www.finanzfluss.de/informer/etf/suche/ ?

In 4 Wochen zum souveränen Investor: ►►...

Read More »

Read More »

Bringt euer Geld in Sicherheit ?

?Hol dir 100 CHF Trading Credits bei einer Aktien-Depoteröffnung ►► http://sparkojote.ch/swissquote *

(only for swiss residents)

Bringt euer Geld in Sicherheit ?

Ist unser Geld auf der Bank eigentlich sicher? Wie ich persöhnlich die Dinge handhabe und was meine Empfehlungen sind, teile ich euch in diesem Video mit.

#geld #sicherheit #Finanzrudel

? Kein Geld mehr für Aktien? ►►...

Read More »

Read More »

Austerity: A Real Solution to Help Heal the U.S. Economy

Austerity works. We know what it is and don’t like it, but it works. It usually means cutting your consumption and spending, paying down your debts, pawning assets, and working more hours to restore your economic situation.

Read More »

Read More »

Deutschland in der Krise – Mein Statement

Deutschland ist bestenfalls nur noch mittelmäßig. In zahlreichen Gebieten hängt Deutschland im internationalen Vergleich hinterher, was dramatische Auswirkungen auf das Leben jedes Einzelnen haben könnte. Wo momentan die Probleme liegen und welche 4 Schritte du zur Vorbereitung tun solltest, erkläre ich dir im heutigen Video.

KOSTENLOSES BUCH - "Börse ist ein Business" von Jens Rabe

https://jensrabe.de/DeKriseStatementBuch

Nur für kurze...

Read More »

Read More »

The Fed’s Powell Admits “I Don’t Know What We’ll Do” in 2023

The Federal Reserve's Federal Open Market Committee (FOMC) on Wednesday announced it will raise the target federal funds rate by 50 basis points, bringing the target rate to 4.5 percent. Wednesday's rate hike followed four hikes in a row of 75 basis points, and is the smallest rate hike since March.

Read More »

Read More »

NATO: Russia’s President Putin is planning for long war; Putin meets top military brass | WION

We are close to the end of 2022 but it's been 10 months since Russia invaded Ukraine even after witnessing defeat in three Ukrainian cities. Russian President Vladimir Putin is not ready to back, so how far will this go?

Read More »

Read More »

Missouri Bill Would End Capital Gains, Invest State Funds in Gold and Silver, Establish State Gold Depository

(Jefferson City, Missouri, USA -- December 14, 2022) - A state senator from St. Charles County has introduced a bill in Missouri to eliminate income taxes on sales of gold and silver, invest state funds in gold and silver, and establish the Missouri Bullion Depository.

Read More »

Read More »