Tag Archive: newsletter

Japan Surprises

The Bank of Japan surprised

everyone may lifting the 10-year yield curve cap to 0.50% from 0.25%.The BOJ also said it would increase its bond purchases to

JPY9 trillion (~$68 bln) a month compared to the current JPY7.3 trillion.

BOJ Kuroda, whose term ends

next April, insisted that the easy monetary policy stance will continue.

The surprise decision sent

ripples across the capital markets. Japanese stocks slumped, with the

Nikkei falling...

Read More »

Read More »

512€ für den ersten BITCOIN gekauft #shorts

?Hol dir 100 CHF Trading Credits bei einer Aktien-Depoteröffnung ►► http://sparkojote.ch/swissquote *

(only for swiss residents)

▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬

☛ Die BESTEN Gutscheine aus dem Finanzrudel ☚

Tools die ich tagtäglich nutze findet ihr hier. Mein 6-stelliges Aktien-Depot habe ich bei Swissquote und Yuh. Für meine privaten Finanzen nutze ich Zak von der Bank Cler. Meine Säule 3a für die Altersvorsorge betreibe ich bei frankly der Zürcher...

Read More »

Read More »

1000 € oder Party machen? ??#shorts

? https://betongoldwebinar.com/yts ?Jetzt Gratis Immobilien-Webinar ansehen!

Gerald Hörhan ist der österreichische Selfmade Multi-Millionär mit Lederjacke und 50+ Millionen EUR Immobilienportfolio, und erklärt auf diesem Kanal, wie auch in seiner Investmentpunk Academy, finanzielle Grundlagen und komplexes Finanz-Insider-Wissen einfach, kurzweilig und verständlich. Als erfolgreicher Investmentbanker mit Harvard Abschluss, verdiente er sich schnell...

Read More »

Read More »

Wichtige Morning News mit Oliver Klemm #21

Klicke hier, um Dich gemeinsam mit Oli unabhängig zu machen:

? http://bit.ly/oli-ausbildung

Meine Webseite: https://tradingcoacholi.com/

►Mein Telegram Kanal: http://t.me/tradingcoacholi

►Folge Oliver auf Facebook: http://bit.ly/TOFBpage

►Folge Oliver auf Instagram: http://bit.ly/TOInst

►Oli macht auch TikToks: https://www.tiktok.com/@tradingcoacholi

►Abonniere Oliver auf YouTube: http://bit.ly/Oli-Kanal

DIE TRADING COMMUNITY VON OLIVER KLEMM...

Read More »

Read More »

BoJ überrascht und setzt Indizes weiter zu – “DAX Long oder Short?” mit Marcus Klebe – 20.12.22

HIER geht´s direkt zur LIVE- oder DEMOKONTOERÖFFNUNG:

https://partners.jfdbrokers.com/visit/?bta=35101&nci=5424

Ich freue mich über eure Daumen ???

#DAX #MarcusKlebe #Trading

ÜBER JFD:

WER WIR SIND:

JFD ist eine führende Unternehmensgruppe, die Finanz- sowie Investmentdienstleistungen und -aktivitäten anbietet. Die Muttergesellschaft, JFD Group Ltd, wurde im Dezember 2011 gegründet und ist heute ein international lizenzierter, globaler...

Read More »

Read More »

Weekly Market Pulse: Happy Holidays

We received a host of economics reports this past week; some good, others not so much. The week started with the Consumer Price Index report coming in better than expected at an increase of just 0.1% from the previous month (7.1% from a year ago), compared with respective estimates of 0.3% and 7.3%.

Read More »

Read More »

Price manipulation to be banned in Swiss energy sector

Switzerland plans to enact laws to prevent price manipulation and insider trading in its domestic energy markets.

Read More »

Read More »

Why Central Banks Will Choose Recession Over Inflation

While many market participants are concerned about rate increases, they appear to be ignoring the largest risk: the potential for a massive liquidity drain in 2023. Even though December is here, central banks’ balance sheets have hardly, if at all, decreased. Rather than real sales, a weaker currency and the price of the accumulated bonds account for the majority of the fall in the balance sheets of the major central banks.

Read More »

Read More »

Growth forecasts for Switzerland lowered further

Growth forecasts for Switzerland have been revised downwards for the current year and 2023 by the KOF Swiss Economic Institute, amid fears of a global recession and the war in Ukraine. The economists also changed their predictions for inflation.

Read More »

Read More »

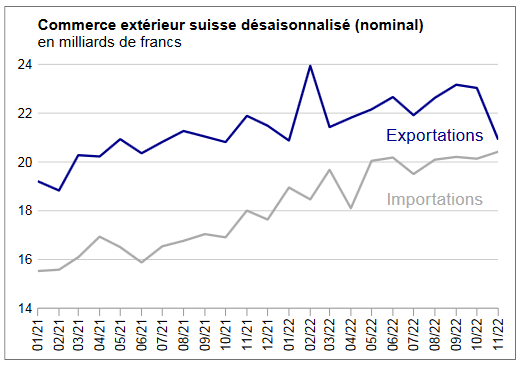

Swiss Trade Balance November 2022: pharmaceuticals weigh down exports

In November 2022, seasonally adjusted exports plunged by almost a tenth while imports increased by 1.4% month on month. At the exit in particular, the chemical-pharmaceutical sector weighed down the result. The trade balance closes with a small surplus of half a billion francs.

Read More »

Read More »

Submit Questions for Alasdair Macleod on Liberty and Finance!

BUY SILVER & GOLD and support this channel! Personal service, competitive pricing, and over three-decades in business.

Read More »

Read More »

Alternative Weihnachtsansprache von Max Otte am 25.12.2022 um 19:00 Uhr. hier zu sehen:

Https://www.youtube.com/@PolitikSpezial ?

Die vergangenen Jahre waren politisch nicht einfach. Familien sind auseinandergegangen, Freundschaften zerbrochen – wegen unterschiedlicher Meinungen.

Max Otte wird am ersten Weihnachtsfeiertag eine alternative Weihnachtsansprache halten, um hierfür Lösungen und Anregungen zu präsentieren.

Read More »

Read More »

Börsenprognosen 2023: Was davon zu halten ist | Livestream

DAX landet bei 15.000 Punkten, S&P 500 bei 4.000 - die Experten überbieten sich mal wieder mit Prognosen für 2023. Was ist von den ganzen Glaskugelergebnissen zu halten?

Schreib uns gern in den Livechat und diskutier am Montag ab 19:00 Uhr mit!

Hol Dir die Finanztip App mit allen News für Dein Geld:

https://apps.apple.com/de/app/finanztip/id1607874770

https://play.google.com/store/apps/details?id=de.finanztip.mobileapp

Wertpapierdepots von...

Read More »

Read More »

Reply to @Greg.Blunt

The most important thing I’m doing in my life right now is passing along what I’ve learned to others so they can be #successful. #principles #raydalio #shorts

Read More »

Read More »

WERDE ICH BALD GESPERRT?!

Klicke hier, um Dich gemeinsam mit Oli unabhängig zu machen:

? http://bit.ly/oli-ausbildung

Meine Webseite: https://tradingcoacholi.com/

►Mein Telegram Kanal: http://t.me/tradingcoacholi

►Folge Oliver auf Facebook: http://bit.ly/TOFBpage

►Folge Oliver auf Instagram: http://bit.ly/TOInst

►Oli macht auch TikToks: https://www.tiktok.com/@tradingcoacholi

►Abonniere Oliver auf YouTube: http://bit.ly/Oli-Kanal

DIE TRADING COMMUNITY VON OLIVER KLEMM...

Read More »

Read More »

2022-12-18 Retirement Lifestyle Advocates Radio w/ Alasdair Macleod

The systemic risks, particularly from foreign banking networks like the Eurozone and Japan, which are very highly leveraged, are very, very substantial. And with contracting bank credit, they merely get heightened.

Read More »

Read More »

Die 10 Top-Aktien für 2023 – Barron’s Magazin

► Sichere Dir meinen Report, mit Tipps zu Gold, Aktien, ETFs - 100% gratis: http://lars-erichsen.de/

► NEU: Gewinne von bis zu +170%… Mein exklusives Lars-Erichsen-Depot: https://www.rendite-spezialisten.de/video/depot/

In diesem Video werde ich euch die legendären Top 10 für das Jahr 2023 des Anleger-Magazins Barrons zeigen. Es lohnt sich hinzuschauen, denn die Auswahl für das Jahr 2022 war richtig gut. Sie haben den Gesamtmarkt mit ihrer Auswahl...

Read More »

Read More »

Biomassekraftwerke am Ende – Staat zieht den Stecker – 2 GW vor dem Aus

✘ Werbung:

Mein Buch Allgemeinbildung ► https://amazon.de/dp/B09RFZH4W1/

Das Gesetz zur Gewinnabschöpfung bei regenerativen Energien wie #Photovoltaik und #Windkraft begrenzt die Verkaufspreise im Stromgroßhandel. Leider hat der Gesetzgeber übersehen, dass Biomassekraftwerke auf Rohstoffe angewiesen sind, die im Preis ebenfalls gestiegen sind. Da das Gesetz rückwirkend zum Einsatz kommt, zieht man den Betreibern der #Kraftwerke den Boden unter den...

Read More »

Read More »

Uniper – ausserordentliche Hauptversammlung 2022

Link zu meinen Onlinekursen: https://thomas-anton-schuster.coachy.net/lp/finanzielle-unabhangigkeit

Vortrags- und Seminartermine, sowie kostenlose Anforderung des Aktienbewertungsblatts: https://aktienerfahren.de

Read More »

Read More »