Tag Archive: newsletter

Objection, Professor Harari! Logic Proves the Existence of Free Will

Yuval Noah Harari, professor of history at Hebrew University in Jerusalem, is not only a best-selling author but also a top advisor to Klaus Schwab, founder and front man of the World Economic Forum (WEF).

In 2018, Harari wrote: “Unfortunately, ‘free will’ isn’t a scientific reality. It is a myth inherited from Christian theology.”

And, in a 2019 interview, Harari said:

Humans today are a hackable animal—an animal that can be hacked. . . . Hacking...

Read More »

Read More »

Millionär über Gras rauchen & chillen ?#shorts

? https://betongoldwebinar.com/yts ?Jetzt Gratis Immobilien-Webinar ansehen!

Gerald Hörhan ist der österreichische Selfmade Multi-Millionär mit Lederjacke und 50+ Millionen EUR Immobilienportfolio, und erklärt auf diesem Kanal, wie auch in seiner Investmentpunk Academy, finanzielle Grundlagen und komplexes Finanz-Insider-Wissen einfach, kurzweilig und verständlich. Als erfolgreicher Investmentbanker mit Harvard Abschluss, verdiente er sich schnell...

Read More »

Read More »

Live-Einblicke ins Depot: Mit Strategie erfolgreich ins Jahr 2023

Eines der wichtigsten Konzepte an der Börse ist "Stärke kaufen, Schwäche verkaufen". Damit du das Konzept verinnerlichen kannst, um bessere Ergebnisse an der Börse zu erzielen, zeige ich es dir an konkreten Beispielen in meinem Depot.

KOSTENLOSES BUCH - "Börse ist ein Business" von Jens Rabe

https://jensrabe.de/EinblickDepotBuch

Nur für kurze Zeit. Solange der Vorrat reicht.

0:00 Stärke kaufen, Schwäche verkaufen

1:06 passende...

Read More »

Read More »

Du sollst nur 1 Mal pro WOCHE DUSCHEN! Steuert Menschheit auf ABGRUND ZU?

Wenn man sich die gängigen Artikel und News über den Klimawandel anschaut, könnte man meinen, dass egal was wir auch tun, es nicht reichen wird! Ich plädiere heute für mehr Rationalität statt Klima-Hysterie, Fakten statt Mythen und Lösungen, statt Klimakleberei

0:00 Klimahysterie

1:30 Angst lähmt uns

3:00 Wieviel CO2-Emissionen in Deutschland?

6:30 Kapitalismus Schuld am Klimawandel???

7:30 Nur noch 1x Duschen pro Woche?

9:30 International Medien...

Read More »

Read More »

The World Ahead 2023: five stories to watch out for

What stories should you be following in 2023? From India becoming the world’s most populous country, to an illegal drug that might be approved as a medicine, The Economist offers its annual look at the year ahead.

00:00 - The World Ahead 2023

00:35 - India's population potential

04:30 - Psychedelic medicines

08:06 - Japan’s markets mayhem?

12:45 - Repairing the world

15:50 - The coronation's colonial concerns

Read more on The World Ahead 2023:...

Read More »

Read More »

Help the Institute Build the Foundations of Liberty. Donate before 2023!

Forty years ago, I was worried. I had had the honor of working with Ludwig von Mises. But, not long after his death, the greatest economist and defender of freedom in the twentieth century was being ignored.

Some years before, I had worked for the great Neil McCaffrey at his Arlington House Publishers. One day, I was called into his office and asked, “How’d you like to be Ludwig von Mises’s editor?”

I was to correct and bring back into print three...

Read More »

Read More »

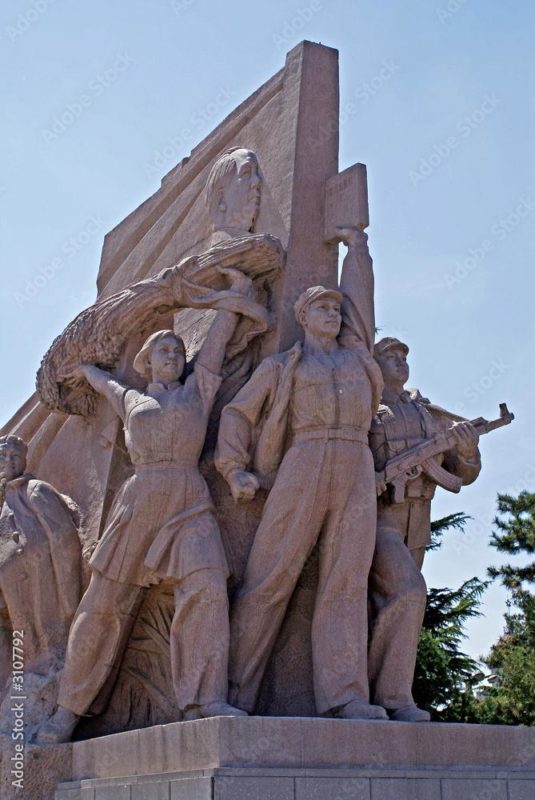

The Great Leap Backward*

[This piece is an excerpt from Chapter 13 of The Great Reset and the Struggle for Liberty: Unraveling the Global Agenda, to be released January 10, 2023.]

This chapter derisively refers to the notorious Great Leap Forward (1958–1961) as the Great Leap Backward. But China’s Great Leap Forward is not the ultimate object of my scorn. That scorn is reserved for the contemporary project conducted by people, who, if they knew anything about history, or...

Read More »

Read More »

Stock market end of 2022: Watch these critical price levels.

How will the stock market, as represented by the Nasdaq in this technical analysis, end the year? Watch the critical price levels on the short and long term. The way that market participants (buyers and sellers) react to them will be key.

Visit https://www.forexlive.com/technical-analysis for additional technical analysis perspectives on the markets.

Read More »

Read More »

Wichtige Morning News mit Oliver Klemm #26

Gratis Trading-Workshop (Jetzt in 2023 absichern): https://us02web.zoom.us/webinar/register/2216698238673/WN_HGjVPNwDQlCJ34S41vZeyA (jetzt anmelden!)

Klicke hier, um Dich gemeinsam mit Oli unabhängig zu machen:

? http://bit.ly/oli-ausbildung

Meine Webseite: https://tradingcoacholi.com/

►Mein Telegram Kanal: http://t.me/tradingcoacholi

►Folge Oliver auf Facebook: http://bit.ly/TOFBpage

►Folge Oliver auf Instagram: http://bit.ly/TOInst

►Oli macht...

Read More »

Read More »

Nasdaq futures technical analysis

Seems that there reward vs. risk potential, at the potential breakout up of this bull channel on the hourly timeframe, supports going for a Long.

Read More »

Read More »

Geld sparen bei Parfums: Dupes #shorts

Depot eröffnen & loslegen:

⭐ Flatex (in Österreich keine Depotgebühr): *https://www.minimalfrugal.com/flatex.at

⭐DADAT (Dividendendepot für Österreicher/Innen): *https://minimalfrugal.com/dadatdepot

► Trade Republic: (um 1€ Aktien kaufen): *https://www.minimalfrugal.com/traderepublic

► Smartbroker: *https://www.minimalfrugal.com/smartbroker

► Comdirect: *http://www.minimalfrugal.com/comdirect

► Onvista:...

Read More »

Read More »

Gerd Kommer: “Die Renditen der letzten Jahre sind langfristig nicht wiederholbar“

Im neuen Podcast von großmutters-sparstrumpf spricht Christian Thiel mit Dr. Gerd Kommer. Er erklärt warum in den kommenden Jahren niedrigere Renditen zu erwarten sind, weshalb Aktien trotzdem langfristig die beste Wahl sind und wie die Zukunft des Bitcoin aussehen könnte.

https://kleine-finanzzeitung.de/

Der Podcast für Investoren und alle, die wissen wollen, wie auch sie mit der richtigen Strategie den Index schlagen können. Feedback und Fragen...

Read More »

Read More »

WAS IST EIGENTLICH AUS NORDSTREAM GEWORDEN?

Klicke hier, um Dich gemeinsam mit Oli unabhängig zu machen:

? http://bit.ly/oli-ausbildung

Meine Webseite: https://tradingcoacholi.com/

►Mein Telegram Kanal: http://t.me/tradingcoacholi

►Folge Oliver auf Facebook: http://bit.ly/TOFBpage

►Folge Oliver auf Instagram: http://bit.ly/TOInst

►Oli macht auch TikToks: https://www.tiktok.com/@tradingcoacholi

►Abonniere Oliver auf YouTube: http://bit.ly/Oli-Kanal

DIE TRADING COMMUNITY VON OLIVER KLEMM...

Read More »

Read More »

Mein Silber Ausblick 2023

► Sichere Dir meinen Report, mit Tipps zu Gold, Aktien, ETFs - 100% gratis: http://lars-erichsen.de/

► NEU: Gewinne von bis zu +170%… Mein exklusives Lars-Erichsen-Depot: https://www.rendite-spezialisten.de/video/depot/

Jahresausblicke sind keine ganz einfache Disziplin, aber ich behaupte mal ganz frech, dass ich die Edelmetalle und insbesondere Silber in den letzten Jahren und in den Jahresausblicken ganz gut im Griff hatte. Deswegen möchte ich...

Read More »

Read More »