Tag Archive: newsletter

WIR WERDEN VON GEBURT BIS TOD ÜBERWACHT

Gratis Trading-Workshop (Jetzt in 2023 absichern): https://us02web.zoom.us/webinar/register/2216698238673/WN_HGjVPNwDQlCJ34S41vZeyA (jetzt anmelden!)

Klicke hier, um Dich gemeinsam mit Oli unabhängig zu machen:

? http://bit.ly/oli-ausbildung

Meine Webseite: https://tradingcoacholi.com/

►Mein Telegram Kanal: http://t.me/tradingcoacholi

►Folge Oliver auf Facebook: http://bit.ly/TOFBpage

►Folge Oliver auf Instagram: http://bit.ly/TOInst

►Oli macht...

Read More »

Read More »

Ich kann nicht mehr…Im Jahr ████ sind DIESE Jobs weg! (SO sicherst du dich ab!)

Gratis Trading-Workshop (Jetzt in 2023 absichern): https://us02web.zoom.us/webinar/register/2216698238673/WN_HGjVPNwDQlCJ34S41vZeyA (jetzt anmelden!)

Klicke hier, um Dich gemeinsam mit Oli unabhängig zu machen:

? http://bit.ly/oli-ausbildung

Meine Webseite: https://tradingcoacholi.com/

►Mein Telegram Kanal: http://t.me/tradingcoacholi

►Folge Oliver auf Facebook: http://bit.ly/TOFBpage

►Folge Oliver auf Instagram: http://bit.ly/TOInst

►Oli macht...

Read More »

Read More »

2023: Gewaltiger Umbruch! – Ernst Wolff im Gespräch mit Krissy Rieger

Heute sprechen wir über das Jahr 2023:

- Deutsche Wirtschaft grün gestalten

- Vollkaskomentalität

- Sozialismus

- Migrationskrise

- Ukraine-Russland Krieg

- EU einigt sich auf weiteres Bargeldverbot

- Elon Musk

- Pressefreiheit

- Kritisches Denken erlernen

Das neue Buch "World Economic Forum: Die Weltmacht im Hintergrund" ist hier erhältlich:

►► https://bit.ly/3zuC9jz (Die ersten 2000 signierten Exemplare (Klarsicht Verlag) )

►►...

Read More »

Read More »

Warren Buffett spricht eine bedenkliche WARNUNG aus: JAHRESAUSBLICK 2023

In diesem Video spreche ich mit unserem Experten Stephan Richter über die Marktaussichten im Jahr 2023.

Jetzt zum kostenfreien Workshop anmelden?:

► https://investorenausbildung.de/jahresausblick-jetzt-eintragen

vereinbare jetzt Dein kostenloses Beratungsgespräch??:

► https://go.investorenausbildung.de/3n29OKX

kostenloses Webinar ansehen???:

► https://go.investorenausbildung.de/3zRHbI0

Aktienanalyse auf Knopfdruck?:

►...

Read More »

Read More »

Erfolgreich Ziele (um)setzen: Börsenjahr 2023 Tipp 2

Das Jahr 2023 hat gerade begonnen und wir alle wollen auch in diesem Jahr erfolgreich an der Börse handeln. Aus diesem Grund gebe ich dir diese Woche sieben Tipps, die dir den perfekten Start ins Börsenjahr 2023 sichern. In diesem Video lernst du, wie du dir realistische Ziele für deinen Handel setzt und diese umsetzen kannst.

Sicher dir jetzt dein Ticket für den Börsen-Strategie-Tag:

https://jensrabe.de/boersenstrategietag2023

Vereinbare jetzt...

Read More »

Read More »

KRYPTO-TRENDS 2023: WAS DU JETZT WISSEN MUSST!

"Willst du wissen, was im Krypto-Markt im Jahr 2023 auf uns zukommt? Dann schau dir unbedingt unsere neueste Episode an! Wir geben dir einen Überblick über die wichtigsten Krypto-Trends, die du jetzt kennen musst. Von der zunehmenden Adoption von Kryptowährungen bis hin zu den neuesten regulatorischen Entwicklungen – wir haben alles abgedeckt.

Read More »

Read More »

Deutschland wird im Moment vor die Wand gefahren | Max Otte im Gespräch mit Flavio von Witzleben

Zum Start ins neue Jahr 2023 sprach Max #Otte mit dem unabhängigen Journalisten Flavio von Witzleben, der unter anderem für Rubikon News (https://www.rubikon.news/) tätig ist.

Zu den Themen des Interviews gehören die folgenden:

- #Reichsbürger-Razzia: PR-Aktion oder reale Gefahr?

- Ist das jetzt der "#Weltsystemcrash"?

- Geopolitik: #Ukraine-Krieg, Rolle Russlands & Ende des Petrodollars

Das Interview ist bereits auf dem Kanal von...

Read More »

Read More »

YOUNG GLOBAL LEADERS! Klaus Schwabs beste Freunde – Great Reset Teil 3

Die Young Global Leaders sind eine "Community" die 1992 von Klaus Schwab ins Leben gerufen wurde. Im ersten Ausbildungsjahrgang waren Angela Merkel, Nicholas Sarkozy und andere Talente mit dabei. Für Schwab und sein WEF ein Top Investment

Video 1 über das GREAT Reset BUCH

Video 2 über die Machenschaften von Klaus Schwab

? Mein Buch! Der Rationale Kapitalist ►►http://amzn.to/2kludNT

?JETZT auch als Hörbuch bei Audible ►►...

Read More »

Read More »

Das Finanzamt weiß ab 2023 alles! (neues Gesetz)

► Mein neues Buch

Du möchtest das erfolgreichste Wirtschaftsbuch 2021

"Die größte Chance aller Zeiten" bestellen?

Auf Amazon: https://amzn.to/3EC3fqA oder mit Signatur:

https://www.marc-friedrich.de/

► Friedrich & Partner Vermögenssicherung

https://www.friedrich-partner.de/

► Social Media

Twitter: http://www.twitter.com/marcfriedrich7

Instagram: https://www.instagram.com/marcfriedrich7/

TikTok:...

Read More »

Read More »

Neues Jahr und die Volatilität geht weiter – US Opening Bell mit Marcus Klebe – 03.01.23

HIER geht´s zum kostenlosen JFD Livetradingroom: https://attendee.gotowebinar.com/register/5477297854855570446?source=marcus-social-media

Folge uns auf:

Telegramm: https://t.me/jfdbank_de

LinkedIn: https://www.linkedin.com/showcase/jfd...

Facebook: https://www.facebook.com/JFDGermany/

Twitter: https://twitter.com/JFD_Group

Webseite: https://www.jfdbank.com/de...

Read More »

Read More »

VIDEO: A technical look at the EURUSD, USDJPY and GBPUSD to start the trading day

The USD rose vs the EUR and GBP but is dipping in early NY trading. Meanwhile the USD fell and is now rising vs the JPY.

It is the start of the new year and that has the markets a little more awake with some active trading ranges in some of the major currency pairs.

The EUR and the GBP moved lower vs the USD in early European trading helped by some weaker inflation data and warmer weather perhaps which has some inflation fears abating. However,...

Read More »

Read More »

Financial Resolutions that Actually Stick

(1/3/23) The watchword for 2023: "Muck." Predictions for the markets: A tough year ahead; making financial resolutions: What can you control in your household? There will be new taxes this year. Where have all the go-getters gone? Act your wage; not finding worth in work. some families can collect six-figure incomes by staying home; waking up early & making your bed; setting up an emergency fund; Secure Act 2-0: Incentivizing savings;...

Read More »

Read More »

BARGELD ABGESCHAFFT AM WEIHNACHTSMARKT ZÜRICH #shorts

?Hol dir 100 CHF Trading Credits bei einer Aktien-Depoteröffnung ►► http://sparkojote.ch/swissquote *

(only for swiss residents)

▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬

☛ Die BESTEN Gutscheine aus dem Finanzrudel ☚

Tools die ich tagtäglich nutze findet ihr hier. Mein 6-stelliges Aktien-Depot habe ich bei Swissquote und Yuh. Für meine privaten Finanzen nutze ich Zak von der Bank Cler. Meine Säule 3a für die Altersvorsorge betreibe ich bei frankly der Zürcher...

Read More »

Read More »

The Dollar Jumps

Overview: Market participants have returned from the New Year celebrations apparently with robust risk appetites. Equities and bonds are rallying, and the dollar has surged higher. The markets seem to be looking past the surge in China's Covid cases and anticipates a recovery, helping Chinese equities lead Asia Pacific bourses higher, where Japanese markets are still on holiday.

Read More »

Read More »

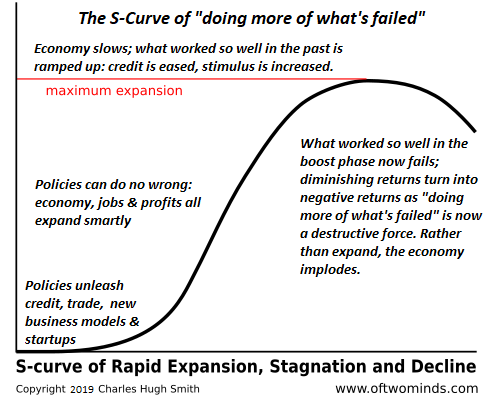

Misunderstanding War, Money and Prosperity

If the consensus of experts misunderstand money, credit and prosperity, how are we going to advance? Describing all the ways experts got it wrong is a thriving cottage industry. Expertise is itself contentious, as conventional expertise legitimized by credentials, prestigious institutional positions, scholarship, prizes, etc. can be wielded to promote the interests of the expert or whomever is funding the expert.

Read More »

Read More »

DAX steht 200 Punkte im Plus zu 2022 – “DAX Long oder Short?” mit Marcus Klebe – 03.01.23

HIER geht´s direkt zur LIVE- oder DEMOKONTOERÖFFNUNG:

https://partners.jfdbrokers.com/visit/?bta=35101&nci=5424

Ich freue mich über eure Daumen ???

#DAX #MarcusKlebe #Trading

ÜBER JFD:

WER WIR SIND:

JFD ist eine führende Unternehmensgruppe, die Finanz- sowie Investmentdienstleistungen und -aktivitäten anbietet. Die Muttergesellschaft, JFD Group Ltd, wurde im Dezember 2011 gegründet und ist heute ein international lizenzierter, globaler...

Read More »

Read More »

“Markets and civil society are win-win institutions, government and politics are zero-sum.”

Division, friction and polarization have been on the rise in the West for at least a decade, but the escalation we saw during the “covid years” was especially worrying. Over the last year, this “worry” has become a truly pressing concern, even a real emergency one might argue, as inflationary pressures and an actual war were added to the mix of political and social tensions.

Read More »

Read More »