Tag Archive: newsletter

So viele habe ich zu Millionären gemacht

🔥 Es ist cool reich zu sein und es ist noch cooler, die Menschen um mich herum reich werden zu sehen!

Einige sind während meiner Dealmaking Masterclass zu Millionären geworden,andere sind mit Millionen gestartet und haben noch mehrere dazuverdient. 💰

Die Dealmaking Masterclass ist kein Online-Kurs von irgendeinem Guru, sondern ein einjähriges Mentoring-Programm,in dem du die Skills und das Know-how von echten Profi-Investoren, Multimillionären...

Read More »

Read More »

Experte warnt: Bargeldverbot kommt 2027

Hansjörg Stützle warnt in diesem brisanten Interview: Wir steuern mit Vollgas auf die schleichende Abschaffung des Bargelds zu – und damit verlieren wir unsere letzte echte finanzielle Freiheit und Anonymität. Er zeigt auf, was jeder Einzelne jetzt sofort tun kann, um das Bargeld noch zu retten. Seine Petition, um die Verdrängung des Bargelds zu stoppen, läuft noch bis ca. Mitte 2026 – hier unterschreiben: https://bargeldverbot.info/petition/...

Read More »

Read More »

Helmut Kohl zerlegt Merz komplett: “Muss ein Bundeskanzler aushalten!”

✅ Meine Depotempfehlung 👉 https://link.aktienmitkopf.de/Depot *

Beginne mit dem Investieren beim Freedom24-Broker:

Mehr als 40.000 Aktien und ETFs mit transparenter Preisgestaltung

Direkter Zugang zu 15 globalen Börsen und Märkten

Kostenl,knjoser persönlicher Assistent und Anlageideen

Erhalte bis zu 20 Aktien gratis dazu für die Aufladung deines Kontos:

https://link.aktienmitkopf.de/Depot *

Trete der Aktien mit Kopf ProLounge bei und erhalte...

Read More »

Read More »

EL SISTEMA DE PENSIONES ESPAÑOL ES EL MÁS DEFICITARIO

Mi nuevo libro ya está disponible:

"El nuevo orden económico mundial: EE. UU., China, Europa y el descontento global" (Deusto)

☑ Amazon: https://amzn.eu/d/6wTTNJI

☑ Casa del libro: https://www.casadellibro.com/libro-el-nuevo-orden-economico-mundial/9788423438891/16782241

Te animo a suscribirte a mi canal y te invito a seguirme en mis redes sociales:

☑ Twitter - https://twitter.com/dlacalle

☑ Instagram -...

Read More »

Read More »

2026-Crash? Bitcoin fällt, Hanging Man warnt

Sei beim Kapitaltag 2026 mit Stephan und Florian dabei: https://kapitaltag.de/

▬ Kontakt ▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬

Vereinbare jetzt Dein kostenloses Beratungsgespräch🤝🏽:

► https://go.investorenausbildung.de/3n29OKX

kostenloses Webinar ansehen👨🏽🏫:

► https://go.investorenausbildung.de/3zRHbI0

Aktienanalyse auf Knopfdruck📈:

► https://go.investorenausbildung.de/3zVtfwv

kostenloses Buch sichern📘:

► https://go.investorenausbildung.de/3xJn7ow

▬ Über Mich...

Read More »

Read More »

DAS ändert sich 2026 aus finanzieller Sicht! | Finanzfluss

Rentenanpassung, Steuersenkung und Heizkosten: Das ändert sich 2026 für dich!

Kostenloses Depot eröffnen: ►► https://link.finanzfluss.de/go/depot?utm_source=youtube&utm_medium=892&utm_campaign=comdirect-depot&utm_term=kostenlos-25&utm_content=yt-desc *📈

Finanzfluss Copilot: App für dein Vermögen ►► https://link.finanzfluss.de/r/copilot-app-yt 📱

ℹ️ Weitere Infos zum Video:

Von Renten- und Steueranpassungen bis zu neuen...

Read More »

Read More »

Eskalation: Elon Musk sperrt Werbe-Konto der EU Kommission!

✅ Meine Depotempfehlung 👉 https://link.aktienmitkopf.de/Depot *

Beginne mit dem Investieren beim Freedom24-Broker:

Mehr als 40.000 Aktien und ETFs mit transparenter Preisgestaltung

Direkter Zugang zu 15 globalen Börsen und Märkten

Kostenl,knjoser persönlicher Assistent und Anlageideen

Erhalte bis zu 20 Aktien gratis dazu für die Aufladung deines Kontos:

https://link.aktienmitkopf.de/Depot *

Trete der Aktien mit Kopf ProLounge bei und erhalte...

Read More »

Read More »

Brauchst Du jetzt Laufzeit-ETFs für sichere Rendite? iBonds & Co. im Check

Depot-Vergleich 2025: Die besten Broker & Aktiendepots

Smartbroker+* ► https://www.finanztip.de/link/smartbroker-depot-text-youtube/yt_mc5-c1RAXmk

Traders Place* ► https://www.finanztip.de/link/tradersplace-depot-text-youtube/yt_mc5-c1RAXmk

Finanzen.net Zero* ► https://www.finanztip.de/finanzennetzero-depot-text-youtube/yt_mc5-c1RAXmk

Scalable Capital* ► https://www.finanztip.de/link/scalablecapital-depot-text-youtube/yt_mc5-c1RAXmk

Trade...

Read More »

Read More »

Der 6-stellige Fehler: Warum dieser Unternehmer $50% seines Kapitals verlor

Im heutigen Interview mit Simon Bene geht es um seinen größten Rückschlag, den Verlust von 50 Prozent seines Kapitals durch einen einzigen Fehlklick im Jahr 2022. Du erfährst, warum viele Unternehmer wegen ihrer Champions League Mentalität schlechte Trader sind und wie Simon mit 200 Kleinst Trades seine Disziplin zurückgewann.

Vereinbare jetzt dein kostenfreies Strategiegespräch:

https://jensrabe.de/Q4Termin25

Börsen-News:...

Read More »

Read More »

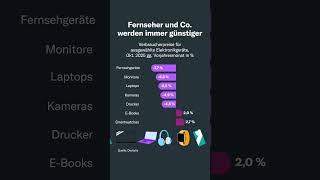

Fernseher und Co. werden immer günstiger

Elektronik wird billiger – jetzt zuschlagen? 💸

📺 Fernseher sind im Oktober 2025 im Schnitt 10,6 % günstiger als im Vorjahr!

🖥️ Auch Monitore (-6,3 %), Laptops (-5,5 %) und Kameras (-4,9 %) kosten deutlich weniger.

🖨️ Drucker sind 4,5 % günstiger geworden – perfekt, wenn Dein Homeoffice ein Upgrade braucht.

📈 Nur E-Books (+2,0 %) und Smartwatches (+2,7 %) sind etwas teurer geworden.

💡 Preissenkungen bei Technik bedeuten: Jetzt ist ein guter...

Read More »

Read More »

Renten-Pakt ins Desaster: GEFAHR für ETFs und Aktien in Deutschland!

✅ Meine Depotempfehlung 👉 https://link.aktienmitkopf.de/Depot *

Beginne mit dem Investieren beim Freedom24-Broker:

Mehr als 40.000 Aktien und ETFs mit transparenter Preisgestaltung

Direkter Zugang zu 15 globalen Börsen und Märkten

Kostenl,knjoser persönlicher Assistent und Anlageideen

Erhalte bis zu 20 Aktien gratis dazu für die Aufladung deines Kontos:

https://link.aktienmitkopf.de/Depot *

Trete der Aktien mit Kopf ProLounge bei und erhalte...

Read More »

Read More »

When Silver Becomes Art: Crucifixion & Lady Liberty in .925 #silver #sterlingsilver #Jesus #liberty

🔔 SUBSCRIBE TO MONEY METALS EXCHANGE ON YOUTUBE

➤ http://bit.ly/mmx-youtube

When Silver Becomes Art: Crucifixion & Lady Liberty in .925

https://www.moneymetals.com/buy/silver/silver-statues

Most people think silver investing is just about bullion bars and rounds. In this video, we show how sterling silver statues turn your silver stack into display-worthy art—with real precious metals weight behind it.

We’re featuring two stunning Rearden...

Read More »

Read More »

La industria alemana colapsa y puede arrastrar a Europa

Alemania dispara su deuda en plena destrucción industrial e inflación persistente, desatando un riesgo económico para toda Europa.

Mi nuevo libro ya está disponible:

"El nuevo orden económico mundial: EE. UU., China, Europa y el descontento global" (Deusto)

☑ Amazon: https://amzn.eu/d/6wTTNJI

☑ Casa del libro: https://www.casadellibro.com/libro-el-nuevo-orden-economico-mundial/9788423438891/16782241

Te animo a suscribirte a mi canal y...

Read More »

Read More »

Die Partnerwahl kann dich alles kosten!

Die richtige Partnerwahl ist eine der wichtigsten Finanzentscheidungen deines Lebens. 💍💸

Falscher Partner? Du verlierst Geld, Ressourcen und Reputation 🏚️

Richtiger Partner? Ihr multipliziert euch gegenseitig, in Energie, Wachstum und Erfolg. 🚀

Im Zweifelsfall lieber Single als finanziell gescheitert und dein Haus verlieren.

#finanzmindset

#beziehungenundgeld

#wachstumspartner

Read More »

Read More »