Tag Archive: newsletter

Leitrim GAA Podcast: Andy Moran – Sn 3 Ep 1

To kick start season three of the Leitrim GAA Podcast, Senior Football Manager Andy Moran drops in to chat through the departures and newcomers to the Leitrim panel for next season, along with some changes to his backroom staff as they prepare during an busy off season.

Moran speaks about the changes to the panel and backroom staff as they look to build on the growth shown this year, 12 months on from his appointment Moran is not putting the feet...

Read More »

Read More »

Trading Wochenanalyse für KW 50/2022 mit Marcus Klebe – DAX – DOW – EUR/USD – Gold #Chartanalyse

HIER geht´s direkt zur Demo-oder Livekontoeröffnungt:

https://partners.jfdbrokers.com/visit/?bta=35101&nci=5424

In dieser Analyse blickt Marcus Klebe auf die vergangene Handelswoche im DAX, Dow, EUR/USD und Gold und bespricht wichtige charttechnische Bereiche und mögliche Bewegungen für die kommenden Handelstage.

#Chartanalyse #MarcusKlebe #LevelUpTrading

DAX: xx:xx

DOW JONES: xx:xx

EUR/USD: xx:xx

GOLD: xx:xx

WTI xx:xx

DAX/ DE30Cash -...

Read More »

Read More »

Angriff aufs Bargeld I EU beschließt Bargeldverbot ab 01.01.2023

Das Bargeld wird seit Jahren eingeschränkt. Ob es der 500 Euro Schein ist, der nicht mehr gedruckt wird, oder die höhe von akzeptierten Bargeldzahlungen, oder gar das komplette Verbot in der Nutzung von Bargeld! An vielen Fronten wird dem Bargeld der Kampf angesagt. Immer mit dem trojanischen Pferd "Terrorismus- und Geldwäschebekämpfung"

Gratisaktie bei Depoteröffnung für ETFs & Sparpläne gewinnen ► http://link.aktienmitkopf.de/Depot...

Read More »

Read More »

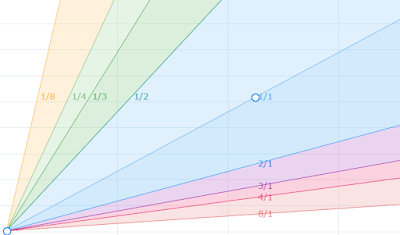

So kommst du NOCH günstig an Silber und Gold

Im heutigen Video schauen wir uns an, welche Möglichkeiten Du hast, Edelmetalle zu kaufen. Statt dem regulären physischen Kauf von Barren gibt es nämlich noch eine andere Methode.

kostenloses Online-Training: Wie du von fallenden und stetigen Märkten profitierst und Aktien vermieten kannst???:

► https://go.investorenausbildung.de/3EjSUzA

vereinbare jetzt dein kostenloses Beratungsgespräch??:

► https://go.investorenausbildung.de/3hTNP9D...

Read More »

Read More »

Menschenfeindliche Agenda | TEIL II – Ernst Wolff im Gespräch mit Claus Roppel

In diesem Interview spricht Ernst Wolff mit Claus Roppel) über die mögliche bevorstehende finanzielle Diktatur, die vierte industrielle Revolution und den Einfluss der künstlichen Intelligenz auf unsere Menschheit. Allen voran das Thema Freiheit steht hier im Vordergrund, welches auch Mittelpunkt seines neuen Kinderbuches ist, dass dieses Jahr veröffentlicht wurde. Die Story hinter dem Buch sowie spannende Aussagen zu Twitter und Elon Musks...

Read More »

Read More »

The Yuan Puts Together its Strongest Two Week Rally in Decades and it has Nothing to do with its Trade Surplus (which Shrank more than expected)

The G10 currencies traded with a heavier bias against the dollar last week. The Swiss franc was the sole exception, and it edged up about 0.25%. The thwarted putsch in Germany and the relaxation of vaccine and quarantine protocols in China were notable developments.

Read More »

Read More »

In & Out: Das habe ich ausgemistet und gekauft im November

Zu den anderen Videos:

Laura's Video:

Fina's Video:

Agnes' Video:

Linda's Video: https://youtu.be/-uq-9OGI0Vw

Depot eröffnen & loslegen:

⭐ Flatex (in Österreich keine Depotgebühr): *https://www.minimalfrugal.com/flatex.at

⭐DADAT (Dividendendepot für Österreicher/Innen): *https://minimalfrugal.com/dadatdepot

► Trade Republic: (um 1€ Aktien kaufen): *https://www.minimalfrugal.com/traderepublic

► Smartbroker:...

Read More »

Read More »

Twitter Krieg: Elon Musk gegen die Wirtschaftselite – so kannst DU davon profitieren!

Liebe YouTube Freunde,

wir sprechen explizit über den Twitter Krieg. Welche Chancen hat Elon Musk gegen die Wirtschaftselite? Denn eins ist klar, wenn Musk diese Schlacht, in den nächsten 2 Jahren gewinnt, wird es etliche Verlierer geben. Meine Prognose, auf was ihr achten solltet und wie ihr davon profitieren könnt, erfahrt ihr in diesem Video.

Was ist eure Meinung zu dem Thema? Wen seht ihr in der besseren Position? Schreibt es in die...

Read More »

Read More »

Investieren in Hedgefonds, Private Equity und Co.: Lohnen sich alternative Investments?

Sind alternative Investments sinnvoll für Privatanleger?

Kostenloses Depot eröffnen: ►► https://link.finanzfluss.de/go/depot?utm_source=youtube&utm_medium=552&utm_campaign=comdirect-depot&utm_term=kostenlos-25&utm_content=yt-desc *?

In 4 Wochen zum souveränen Investor: ►► https://link.finanzfluss.de/go/campus?utm_source=youtube&utm_medium=552&utm_campaign=ff-campus&utm_term=4-wochen&utm_content=yt-desc ?

ℹ️...

Read More »

Read More »

Ich zähle alle Aktien auf (weil ich es kann.)

?Hol dir 100 CHF Trading Credits bei einer Aktien-Depoteröffnung ►► http://sparkojote.ch/swissquote *

(only for swiss residents)

Ich zähle alle Aktien auf (weil ich es kann.)

#aktien #Dividenden #Finanzrudel

?Yuh 50 CHF Trading Credit mit dem Aktionscode: YUHSPARKOJOTE ►► http://sparkojote.ch/yuh

▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬

☛ Die BESTEN Gutscheine aus dem Finanzrudel ☚

Tools die ich tagtäglich nutze findet ihr hier. Mein 6-stelliges Aktien-Depot habe...

Read More »

Read More »

Auto Kaufen oder Leasen?

? https://betongoldwebinar.com/yt ?Jetzt Gratis Immobilien-Webinar ansehen!

Beim Auto kaufen stellt sich für viele die Frage: Das Auto kaufen oder leasen - was ist besser? Gibt es Autos, die nach dem Kauf sogar eine Wertsteigerung erfahren und falls ja, ist das Auto dann ein Investment? Worauf du beim Autokauf achten musst und wie du dabei sogar noch Geld sparen kannst, erklärt in diesem Video der österreichische Selfmade Multi-Millionär Gerald...

Read More »

Read More »

Droht das Ende des Optionshandels? – Q&A mit Jens

Am 29.11.2022 habe ich in unserem Webinar zahlreiche Fragen der Teilnehmer beantwortet. Da die Zeit aber nicht für alle Fragen gereicht hat, beantworte ich in diesem 2. Video weitere spannende Fragen, die auch dich mit deinem Börsenhandel weiterbringen können.

KOSTENLOSES BUCH - "Börse ist ein Business" von Jens Rabe

https://jensrabe.de/QAndAMitJensBuch

Nur für kurze Zeit. Solange der Vorrat reicht.

0:00 Finviz kostenlos?

1:42 Welche...

Read More »

Read More »

Central Banks. CPI. Technicals. The major drivers in the markets this week.

A look at the technicals in play as well for the week starting December 12, 2022.

The week is finally here.

The US CPI will kickstart the markets on Tuesday and that will transition into the Fed decision on Wednesday. Then when that is done, the SNB, BOE and ECB will all announce their interest rate decisions on Friday before the transition into the year end.

To better prepare, it is important to understand the key levels in play from a...

Read More »

Read More »

BALD WIRD ES TEUER!

Klicke hier, um Dich gemeinsam mit Oli unabhängig zu machen:

? http://bit.ly/oli-ausbildung

Meine Webseite: https://tradingcoacholi.com/

►Mein Telegram Kanal: http://t.me/tradingcoacholi

►Folge Oliver auf Facebook: http://bit.ly/TOFBpage

►Folge Oliver auf Instagram: http://bit.ly/TOInst

►Oli macht auch TikToks: https://www.tiktok.com/@tradingcoacholi

►Abonniere Oliver auf YouTube: http://bit.ly/Oli-Kanal

DIE TRADING COMMUNITY VON OLIVER KLEMM...

Read More »

Read More »

Five G10 Central Banks Meet and US CPI on Tap

Half of the G10 central banks meet in the week ahead. The Fed is first on December 14, and the ECB, BOE, Swiss National Bank, and Norway's Norges Bank meet the following day. Before turning a thumbnail sketch of the central banks, let us look at the November US CPI, which will be reported as the Fed's two-day meeting gets underway on December 13.

Read More »

Read More »

The Corporate Fairy Tale Is Dying as Economic Reality Sets In

At least since 2008, the financial world has been in a financial spiral caused by central banks’ growing monetary impression. As a consequence, key economic concepts (e.g., that business cycles are caused by credit expansion, and higher prices by monetary expansion) started to be considered just “old ideas” and their defenders prophets of the apocalypse.

Read More »

Read More »

The G7 Cap on Russian Oil Is a Subsidy to China

There are many mistakes in the G7 agreement to put a cap on Russian oil. The first one is that it does not hurt Russia at all. The agreed cap, at $60 a barrel, is higher than the current Urals price, above the five-year average of the quoted price and higher than Rosneft’s average netback price.

Read More »

Read More »