Tag Archive: newsletter

AHOGADOS POR LA DEUDA PÚBLICA. Economix

#deuda #economia #crisis #españa #inversiones #macroeconomía #sanchez

Programa completo aquí: &t=147s

Te animo a suscribirte a mi canal y te invito a seguirme en mis redes sociales:

☑ Twitter - https://twitter.com/dlacalle

☑ Instagram - https://www.instagram.com/lacalledanie

☑ Facebook - https://www.facebook.com/dlacalle

☑ Página web - https://www.dlacalle.com

☑ Mis libros en Amazon - https://www.amazon.es/Daniel-Lacalle/e/B00P2I78OG...

Read More »

Read More »

7080 Währungsrisiko des Anlegers

Mehr zum Thema erfahren? Besuchen Sie uns auf https://www.fintool.ch

?? Auf diesen Kanälen könnt ihr uns erreichen:

–––––––––––––––––––––––––––––––––––––––––––––

►Unsere Website: https://www.fintool.ch

►Unser FACEBOOK: https://www.facebook.com/fintool

►Unser LinkedIn: https://www.linkedin.com/company/fint...

►Unser INSTAGRAM: https://www.instagram.com/fintool.ch/...

Read More »

Read More »

Trading Systemportfolios verstehen und erfolgreich anwenden

✅ Gratis Trading Basiskurs: https://thomasvittner.com/traderkurs1

▶️ Alle Ausbildungsangebote: https://thomasvittner.com/trading-angebote/

In diesem Video zeige ich den Einfluss eines klug zusammengesetzten System of Systems, also eines System Portfolios. Ihr erfahrt, warum man sich nicht nur auf eine System Type verlassen darf und warum die Kombination unterschiedlicher Strategien das Traden einfacher macht.

Achtung: nur für ernsthafte Trader...

Read More »

Read More »

Wichtige Morning News mit Oliver Klemm #17

Klicke hier, um Dich gemeinsam mit Oli unabhängig zu machen:

? http://bit.ly/oli-ausbildung

Meine Webseite: https://tradingcoacholi.com/

►Mein Telegram Kanal: http://t.me/tradingcoacholi

►Folge Oliver auf Facebook: http://bit.ly/TOFBpage

►Folge Oliver auf Instagram: http://bit.ly/TOInst

►Oli macht auch TikToks: https://www.tiktok.com/@tradingcoacholi

►Abonniere Oliver auf YouTube: http://bit.ly/Oli-Kanal

DIE TRADING COMMUNITY VON OLIVER KLEMM...

Read More »

Read More »

Week Ahead: Highlights include Fed, US CPI; ECB, BoE, SNB, Norges Bank

MON: UK GDP Estimate (Oct), Chinese M2/New Yuan Loans (Nov).TUE: OPEC MOMR; BoE Financial Stability Report; German CPI Final (Nov), UK

Unemployment Rate (Oct)/Claimant Count (Nov), EZ ZEW (Dec), US CPI (Nov),

Japanese Tankan (Q4), New Zealand Current Account (Q3).WED: FOMC Policy Announcement, IEA OMR; UK CPI (Nov), Swedish CPIF (Nov), EZ

Industrial Production (Oct), US Export/Import Prices (Nov), Japanese

Exports/Imports (Nov).THU: ECB, BoE,...

Read More »

Read More »

S&P 500 technical analysis before Dec FOMC meeting

We are coming near an interesting technical junction at 3937. An area of tripple support on one hand, but, on the other hand, a potential break down of a bear flag. Watch the 2hr timeframe chart for ES, the S&P 500 E-mini Futures and note the patterns and price junction as the market heads into the Big Wednesday and most important day of the end of the year, the FOMC meeting.

Visit ForexLive.com for additional perspectives.

Read More »

Read More »

WAS BRINGT DAS LETZTE FED UPDATE DES JAHRES FÜR 2023??

Das letzte FED Meeting, was gibt es uns vor? Wie wird 2023 aussehen, eher Bullish, Bearish oder neutral? Die wichtigsten Punkte erfährst du in diesem Video.

————

#JulianHosp #Bitcoin #Blockchain

————

Kostenlose DeFi Academy: https://bit.ly/julianhospacademy

-----------

Hat dir das Video gefallen? Gib mir nen DAUMEN HOCH ? bzw. TEILE dieses Video um gemeinsam AT, DE und CH #cryptofit zu machen!

? Kein Video mehr verpassen? ABONNIERE meinen...

Read More »

Read More »

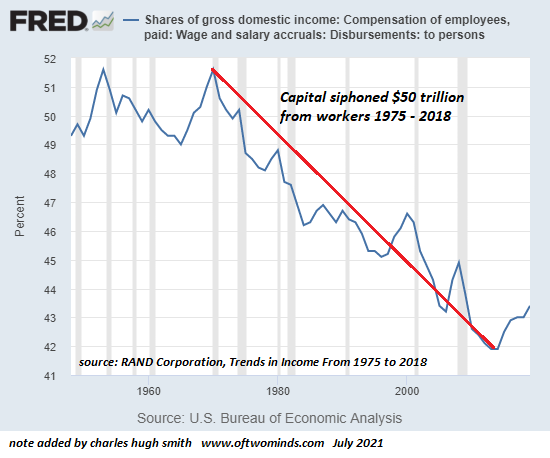

How Things Fall Apart

That's how things fall apart: insiders know but keep their mouths shut, outsiders are clueless, and the decay that started slowly gathers momentum as the last of the experienced and competent workforce burns out, quits or retires. Outsiders are shocked when things fall apart. Insiders are amazed the duct-tape held this long.

Read More »

Read More »

WIE ICH MEIN GELD VERDIENE…DAS KANNST AUCH DU!

Klicke hier, um Dich gemeinsam mit Oli unabhängig zu machen:

? http://bit.ly/oli-ausbildung

Meine Webseite: https://tradingcoacholi.com/

►Mein Telegram Kanal: http://t.me/tradingcoacholi

►Folge Oliver auf Facebook: http://bit.ly/TOFBpage

►Folge Oliver auf Instagram: http://bit.ly/TOInst

►Oli macht auch TikToks: https://www.tiktok.com/@tradingcoacholi

►Abonniere Oliver auf YouTube: http://bit.ly/Oli-Kanal

DIE TRADING COMMUNITY VON OLIVER KLEMM...

Read More »

Read More »

Putinversteher, Covidiot, Schwurbler – zerstörte Meinungskultur? (Daniele Ganser)

Selten waren wir als Gesellschaft so gespalten wie in den letzten Jahren. Fast ein jeder kann von einer kaputten Freundschaft und Familienstreit berichten.

Viele wurden als "Verschwörungstheoretiker, Putinversteher, Covidiot, Schwurbler usw." betitelt, sobald man eine andere Meinung als das Narrativ hatte. Auch Daniele Ganser (Historiker und Publizist) ist in seinem Leben durch seine These zum Anschlag des 9/11 oft in solche Situationen...

Read More »

Read More »

Leitrim GAA Podcast: Andy Moran – Sn 3 Ep 1

To kick start season three of the Leitrim GAA Podcast, Senior Football Manager Andy Moran drops in to chat through the departures and newcomers to the Leitrim panel for next season, along with some changes to his backroom staff as they prepare during an busy off season.

Moran speaks about the changes to the panel and backroom staff as they look to build on the growth shown this year, 12 months on from his appointment Moran is not putting the feet...

Read More »

Read More »

Trading Wochenanalyse für KW 50/2022 mit Marcus Klebe – DAX – DOW – EUR/USD – Gold #Chartanalyse

HIER geht´s direkt zur Demo-oder Livekontoeröffnungt:

https://partners.jfdbrokers.com/visit/?bta=35101&nci=5424

In dieser Analyse blickt Marcus Klebe auf die vergangene Handelswoche im DAX, Dow, EUR/USD und Gold und bespricht wichtige charttechnische Bereiche und mögliche Bewegungen für die kommenden Handelstage.

#Chartanalyse #MarcusKlebe #LevelUpTrading

DAX: xx:xx

DOW JONES: xx:xx

EUR/USD: xx:xx

GOLD: xx:xx

WTI xx:xx

DAX/ DE30Cash -...

Read More »

Read More »

Angriff aufs Bargeld I EU beschließt Bargeldverbot ab 01.01.2023

Das Bargeld wird seit Jahren eingeschränkt. Ob es der 500 Euro Schein ist, der nicht mehr gedruckt wird, oder die höhe von akzeptierten Bargeldzahlungen, oder gar das komplette Verbot in der Nutzung von Bargeld! An vielen Fronten wird dem Bargeld der Kampf angesagt. Immer mit dem trojanischen Pferd "Terrorismus- und Geldwäschebekämpfung"

Gratisaktie bei Depoteröffnung für ETFs & Sparpläne gewinnen ► http://link.aktienmitkopf.de/Depot...

Read More »

Read More »

So kommst du NOCH günstig an Silber und Gold

Im heutigen Video schauen wir uns an, welche Möglichkeiten Du hast, Edelmetalle zu kaufen. Statt dem regulären physischen Kauf von Barren gibt es nämlich noch eine andere Methode.

kostenloses Online-Training: Wie du von fallenden und stetigen Märkten profitierst und Aktien vermieten kannst???:

► https://go.investorenausbildung.de/3EjSUzA

vereinbare jetzt dein kostenloses Beratungsgespräch??:

► https://go.investorenausbildung.de/3hTNP9D...

Read More »

Read More »

Menschenfeindliche Agenda | TEIL II – Ernst Wolff im Gespräch mit Claus Roppel

In diesem Interview spricht Ernst Wolff mit Claus Roppel) über die mögliche bevorstehende finanzielle Diktatur, die vierte industrielle Revolution und den Einfluss der künstlichen Intelligenz auf unsere Menschheit. Allen voran das Thema Freiheit steht hier im Vordergrund, welches auch Mittelpunkt seines neuen Kinderbuches ist, dass dieses Jahr veröffentlicht wurde. Die Story hinter dem Buch sowie spannende Aussagen zu Twitter und Elon Musks...

Read More »

Read More »

The Yuan Puts Together its Strongest Two Week Rally in Decades and it has Nothing to do with its Trade Surplus (which Shrank more than expected)

The G10 currencies traded with a heavier bias against the dollar last week. The Swiss franc was the sole exception, and it edged up about 0.25%. The thwarted putsch in Germany and the relaxation of vaccine and quarantine protocols in China were notable developments.

Read More »

Read More »