Tag Archive: newsletter

Secession Is Inevitable. War to Prevent It Is Optional.

The answer lies not in doubling down on political unity, maintained through endless violence or threats of violence. Rather, the answer lies in peaceful separation.

Original Article: "Secession Is Inevitable. War to Prevent It Is Optional."

This Audio Mises Wire is generously sponsored by Christopher Condon.

Read More »

Read More »

What Will Jerome Powell Break Next?

HAVE YOU SUBSCRIBED TO "Before the Bell?" https://www.youtube.com/channel/UCFmyKJKseEMQp1d14AjvMUw

(3/8/23) Jerome Powell testifies as expected to the Senate Banking Committee, promising more rate hikes for as long as it takes to quell inflation. There is now a 70% chance of a .5% rate hike this month; terminal rate is now anticipated to reach 5.6%. The on way to bring down inflation is to create a recession. Recap of Money Smart Kids...

Read More »

Read More »

Klartext zur Politik! (Was uns bevorsteht) ?

? Schütze Dich vor digitaler Überwachung mit NordVPN (Rabattaktion):

http://nordvpn.com/marc

Hier geht's zum gesamten Talk:

-ATssaI

► Mein Merch:

https://shop.marc-friedrich.de/

► Mein neues Buch

Du möchtest das erfolgreichste Wirtschaftsbuch 2021

"Die größte Chance aller Zeiten" bestellen?

Auf Amazon: https://www.amazon.de/shop/marcfriedrich oder mit Signatur:

https://www.marc-friedrich.de/

► Friedrich & Partner...

Read More »

Read More »

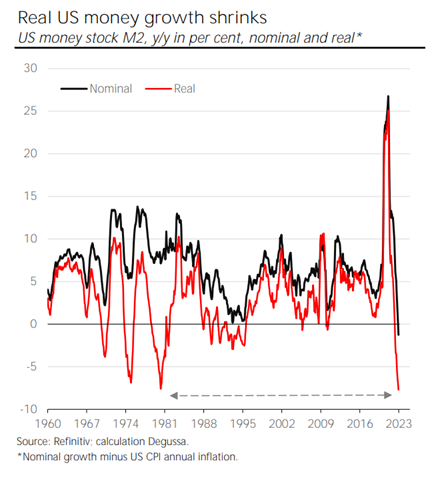

Odds Are Rising That the Fed Will Trigger the Next Bust

From March 17, 2022, to the end of January 2023, the US Federal Reserve (Fed) increased its federal funds rate from practically zero to 4.50–4.75 percent. The rise in lending rates came in response to skyrocketing consumer goods price inflation: US inflation rose from 2.5 percent in January 2022 to 9.1 percent in June. Notwithstanding inflation falling to 6.4 percent in January 2023, the Fed continues to signal to markets that it will continue to...

Read More »

Read More »

Powell Sends the Two-Year Yield above 5% and Ignites Powerful Dollar Rally

Overview: Federal Reserve Chair Powell's comments to

the Senate Banking Committee were seen as hawkish by the market, even though it

has been clear to most observers that the 5.10% median terminal rate that the

Fed projected in December would be increased. Also, it seemed well appreciated

a few Fed officials support a 50 bp hike at the February 1 FOMC meeting, two

days before a "hot" jobs report that showed over 500k jobs were

filled. It...

Read More »

Read More »

NY Times: Ukrainisches Kommando sprengte Nordstream Pipelines?

Steckte die Ukraine selbst hinter dem Anschlag auf die Nordstream Pipelines? Das legt ein neuer Artikel der New York Times nahe, und wirft damit mehr Fragen auf, als er beantwortet. Alle Entwicklungen im Update-Video

?? 4% Rendite bei Bondora mit 5 Euro Startbonus ►► https://goo.gl/434rmp *

? Tracke deine Dividenden mit dieser App http://myfinances24.de/mydividends24

? Mein Buch! Der Rationale Kapitalist ►►http://amzn.to/2kludNT

?JETZT auch als...

Read More »

Read More »

Warte bis zum Schluss… ? #ukraine #nordstream #satire

? Schütze Dich vor digitaler Überwachung mit NordVPN (Rabattaktion):

http://nordvpn.com/marc

Quelle:

► Mein Merch:

https://shop.marc-friedrich.de/

► Mein neues Buch

Du möchtest das erfolgreichste Wirtschaftsbuch 2021

"Die größte Chance aller Zeiten" bestellen?

Auf Amazon: https://www.amazon.de/shop/marcfriedrich oder mit Signatur:

https://www.marc-friedrich.de/

► Friedrich & Partner Vermögenssicherung...

Read More »

Read More »

Chinese companies choose Switzerland over US and UK to raise money overseas

Chinese companies are flocking to Switzerland to raise capital after being discouraged from listing in the US by geopolitical tensions and in Britain by tougher audit standards.

Read More »

Read More »

How to Build Massive Wealth & Pay No Taxes…Legally! – Robert Kiyosaki, @TomWheelwrightCPA

Join Robert Kiyosaki and his trusted tax advisor, Tom Wheelwright, as they discuss the idea of paying taxes as being “patriotic”. The truth? 99% of the tax code is essentially an instruction manual on how to not pay taxes. The governments of the world are really asking us to partner with them to grow the economy. And, when you do it correctly - you pay no taxes (and the economy grows). The less you pay in taxes, the more money you have to invest!...

Read More »

Read More »

Live-Trading mit Rüdiger Born Analyse, Trading-Ideen & Daytrading 07.03.23

Schauen Sie dem Profi-Trader Rüdiger Born jede Woche online und live über die Schulter.

Erleben Sie einen der bekanntesten Daytrader Deutschlands bei der Arbeit: Screening der Märkte, Chartanalyse, Trademanagement und vieles mehr. Dabei anschaulich und in einfacher Sprache auch für Anfänger gut verständlich und nachvollziehbar.

? Unsere täglichen Marktanalysen finden Sie hier: https://www.xtb.com/de/Marktanalysen/Taegliche-Marktanalysen

???...

Read More »

Read More »

While the focus was on Powell Tuesday there were also remarks from the ECB and SNB

Swiss National Bank Chair Jordan threatened FX intervention!

A couple of posts from Tuesday ICYMI while Powell was hogging the spotlight:

ECB Knot: ECB can be expected to keep raising rates for quite some time after March

ECB can be expected to keep raising rates for quite some time after March

And, SNB Chairman: We cannot rule out that we will have to tighten monetary policy again

We can use interest rates but also sell foreign...

Read More »

Read More »

Real Estate Markets Are Addicted to Easy Money

On Friday, residential real estate brokerage firm Redfin released new data on home prices, showing that prices fell 0.6 percent in February, year over year. According to Redfin's numbers, this was the first time that home prices actually fell since 2012. The year-over-year drop was pulled down by especially large declines in five markets: Austin (-11%), San Jose, California (-10.9%), Oakland (-10.4%), Sacramento (-7.7%), and Phoenix (-7.3%)....

Read More »

Read More »

Making Nonsense from Sense: Debunking Neo-Calvinist Economic Thought

Neo-Calvinist economic thought claims that prices and private property cause scarcity. However, they provide no methodology for their claims.

Original Article: "Making Nonsense from Sense: Debunking Neo-Calvinist Economic Thought"

This Audio Mises Wire is generously sponsored by Christopher Condon.

Read More »

Read More »

Why Chris Vermeulen is Bullish About Gold and Silver Long-Term

#ChrisVermeulen of thetechnicaltrader.com joins Dave Russell of GoldCore TV and explains his reasons why he is long-term bullish on #gold. We also look at the gold and #silver monthly charts.

According to Chris, the charts suggest we are still in course to see a big rally in precious metals. Is this the beginning of the next bull market?

Stay tuned to find out more in this episode with Chris Vermeulen.

#GoldChart #SilverChart #TechnicalAnalysis...

Read More »

Read More »

Is it worth having kids?

Fertility rates are falling across the rich world, as more and more people are weighing up whether to have children. Raising them can be stressful and cost a fortune, but they might bring you a lot of joy. So all things considered, on International Women's Day, is it worth having kids?

#internationalwomensday #iwd2023

00:00 - Is it worth having kids?

00:36 - Do kids make parents happy?

03:12 - Why people used to have more children

04:11 - The...

Read More »

Read More »

Wo kommt Corona her? (Labortheorie/FBI)

? Schütze Dich vor digitaler Überwachung mit NordVPN (Rabattaktion):

http://nordvpn.com/marc

Was vor kurzem noch eine Verschwörungstheorie war, könnte nun doch Realität werden. Immer mehr Hinweise verdichten sich, dass das Coronavirus durch menschliche Einflussnahme aus dem Labor stammt und nicht von einem Tiermarkt. Zuletzt haben das FBI als auch das US-Energieministerium die Labortheorie favorisiert.

Empfohlenes Buch:

https://amzn.to/3SWWh6u

►...

Read More »

Read More »

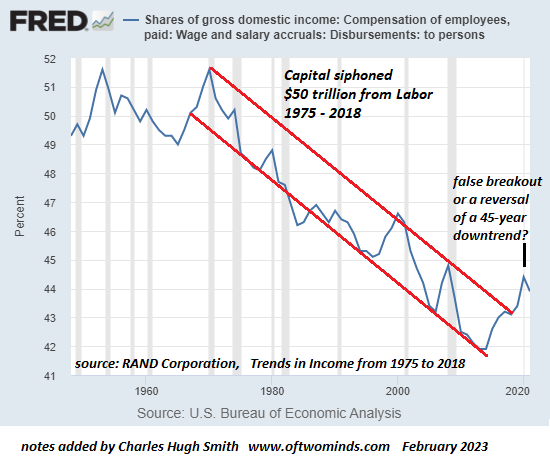

What If There Are No Solutions?

The unencumbered realist concludes that there are no solutions within a status quo structure that is itself the problem. Realists who question received wisdom and conclude the status quo is untenable are quickly labeled pessimistsbecause the zeitgeist expects a solution is always at hand--preferably a technocratic one that requires zero sacrifice and doesn't upset the status quo apple cart.

Read More »

Read More »

DIE EU HAT IHREN URSPRUNG VERGESSEN…

NEUER GRATIS TRADING WORKSHOP (3. - 5. März 2023):

? https://us02web.zoom.us/webinar/register/9216758012881/WN_XKE_2oV-QjWsy2PgXG8xDQ

Jetzt anmelden!! Plätze begrenzt...

Klicke hier, um Dich gemeinsam mit Oli unabhängig zu machen:

? http://bit.ly/oli-ausbildung

Meine Webseite: https://tradingcoacholi.com/

Inhaltsverzeichnis:

►Mein Telegram Kanal: http://t.me/tradingcoacholi

►Folge Oliver auf Facebook: http://bit.ly/TOFBpage

►Folge Oliver auf...

Read More »

Read More »