Tag Archive: newsletter

Swiss government aims to cut 2 billion from 2024 budget

Like many governments across the world, Switzerland’s federal government is spending more than it collects. Extraordinary spending on Covid and refugees has pushed Switzerland’s finances into the red, a situation Karin Keller-Sutter, the current finance minister, hopes to eliminate by 2024.

Read More »

Read More »

Hörbuch Allgemeinbildung: Kapitel 16/22 – Selbst- und Fremdbestimmung

✘ Werbung:

Mein Buch Allgemeinbildung ► https://amazon.de/dp/B09RFZH4W1/

Die Geisteswissenschaften und Naturwissenschaften arbeiten seit langem an dem Thema, ob die Zukunft des Individuums selbst bestimmt sein kann. Als Ingenieur habe ich dazu keine endgültige Meinung. Aber ich weiß, wie ich mein unbewusstes Ich so beeinflussen kann, dass am Ende des Tages das rauskommt, was ich langfristig für mich vorgenommen habe. Wichtige Hilfsmittel in dieser...

Read More »

Read More »

End the Welfare-Warfare State

By any measure, the conversion of America to a welfare-warfare state has been a disaster. It is time to end this deadly and destructive political and economic experiment. Consider some examples:

1. After embroiling America in forever wars in Afghanistan, Iraq, Syria, Somalia, and other parts of the world, the Pentagon has succeeded in getting us closer to nuclear war since 1962, when it did the same in the run-up to the Cuban Missile Crisis.

Read More »

Read More »

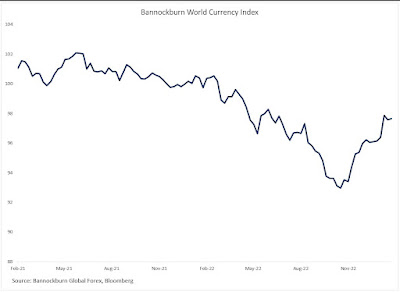

Bannockburn World Currency Index Recoups 50% of Loss since June 2021 High, with Golden Cross

The Bannockburn’s World Currency Index (BWCI) is a

GDP-weighted currency basket representing the currencies of the top 12

economies, with the eurozone counted as one.

The US is the world’s largest economy and the dollar’s share

of the index is almost 31%. China is the second-largest economy and has a

nearly 22% weight.

The euro is next with a 19% weight, followed by Japan with

about a 7.5% weight. After that, the weights drop off to less than 5%...

Read More »

Read More »

The death of the middle class is the death of civil society

Part II of II by Claudio Grass, Hünenberg See, Switzerland

The blame game

As we know from every crisis in human history, and especially the more recent ones, the most important item on any politician’s agenda is to find someone else to blame for it. It can be a foreign foe in the form of a hostile state, it can be an “enemy within”, usually long-standing political opponents and their supporters, or it can even be some invisible villain like...

Read More »

Read More »

Echt nachhaltig investieren mit diesen Fonds?

Nachhaltig Investieren ist an sich eine super Sache. Doch kann man wirklich nachhaltig investieren? Saidi zeigt Euch Beispiele von nachhaltigen, aktiven Fonds und warum diese Probleme mit der Nachhaltigkeit haben.

Hier geht's zum erwähnten Video:

Kann Deine Geldanlage überhaupt nachhaltig sein?►

Wertpapierdepots von Finanztip empfohlen (Stand 22.12.2022):

Finanzen.net Zero* ►...

Read More »

Read More »

Questioning the Military Necessity of Dropping Atomic Bombs on Japanese Cities

One of the most devastating moments in American history took place on August 6 and August 9, 1945, with the bombings of Hiroshima and Nagasaki. Approximately three hundred thousand civilians, forty-three thousand soldiers, forty-five thousand Korean slave laborers, and over a thousand American citizens (including twenty-three prisoners of war) would die.

Read More »

Read More »

Nach den US-Techgiganten folgt SAP mit Stellenstreichungen

Link zu meinen Onlinekursen: https://thomas-anton-schuster.coachy.net/lp/finanzielle-unabhangigkeit

Vortrags- und Seminartermine, sowie kostenlose Anforderung des Aktienbewertungsblatts: https://aktienerfahren.de

Read More »

Read More »

Dirk Müller: Tesla-Aktie nach Zahlen – Brutale Käufe bei ausgeschlachtetem Kurs

?? Jetzt Cashkurs-Mitglied werden ►► 1 Monat für €9,90 statt €17,70 ►https://bit.ly/Cashkurs9_90

3️⃣ Tage gratis testen ►►► https://bit.ly/3TageGratis

? Gratis-Newsletter ►►►https://bit.ly/CashkursNL

? YouTube-Kanal abonnieren ►►► https://www.youtube.com/@cashkurscom

Cashkurs.com - Wirtschaft. Finanzen. Börse. Ehrlich! Unabhängig! Direkt!

????? ??? ??? ????? ??????????? ??? ???? ?ü???? ????:

https://bit.ly/Update230126

(Bei diesem Video...

Read More »

Read More »

Subdued Ending to a Quiet Week, Ahead of Next Week’s Fireworks

Overview: Leaving aside the Australian dollar, which

is benefiting from the optimism over China's re-opening and a reassessment of

the trajectory of monetary policy after a stronger than expected inflation

report, the other G10 currencies traded quietly this week and are +/- less than

0.5%. The risk-on honeymoon to start the year remains intact. The MSCI Asia

Pacific Index has risen every day this week and index of mainland shares that

trade in...

Read More »

Read More »

DAS verändert ALLES #ai #chatgpt #ki

Die Künstliche Intelligenz ist im Vormarsch!

► Mein Merch:

https://shop.marc-friedrich.de/

► Mein neues Buch

Du möchtest das erfolgreichste Wirtschaftsbuch 2021

"Die größte Chance aller Zeiten" bestellen?

Auf Amazon: https://amzn.to/3WePFAu oder mit Signatur:

https://www.marc-friedrich.de/

► Friedrich & Partner Vermögenssicherung

https://www.friedrich-partner.de/

► Social Media

Twitter: http://www.twitter.com/marcfriedrich7...

Read More »

Read More »

Zinsschlacht zwischen Scalable Capital und Trade Republic + noch bessere Alternative

Du hast mehr als 10.000 Euro auf Deinem Girokonto? Dann nimm Dir jetzt unbedingt kurz Zeit und sehe Dir das Video an. Es geht darum, wie Du mehr Ertrag bei sogar weniger Risiko bekommst und Deine Liquidität optimal anlegst. Scalable Capital und Trade Republic bieten gerade gute Alternativen zu den 0% bei den meisten Girokonten aber es gibt auch noch bessere Alternativen.

Insgesamt beziffert sich das Geldvermögen der Deutschen schätzungsweise auf...

Read More »

Read More »

Strom- und Gaspreise gesunken: Wie Du die Preisbremsen schlägst | Livestream

Die Preise für Strom und Gas sinken jetzt wieder. Also jetzt wechseln oder lieber die Preisbremsen regeln lassen? Saidi und Xenia gehen im Livestream die besten Optionen gemeinsam mit Euch durch. Habt Ihr noch Fragen? Dann schreibt sie uns in den Livechat diskutiert am Dienstag ab 19:00 Uhr mit!

Hol Dir die Finanztip App mit allen News für Dein Geld:

https://apps.apple.com/de/app/finanztip/id1607874770...

Read More »

Read More »

Andreas Beck: Immobilienpreise 2023, wie geht es weiter? Hat Deutschland 2023 einen Immobiliencrash?

Andreas Beck: Darum schätzt du die Immobilien-Preise 2023 falsch ein

✘ Bestes Aktien Analyse-Tool► https://bit.ly/3wWKAT5 ?

✘ Günstigstes Aktien-Depot: https://bit.ly/3HtE5KP ?

✘ Seriös Krypto kaufen: https://bit.ly/3HxBlwR wir beide erhalten 9€ Bonus?

Quellen aus dem Video:

Immobilienpreise sind in den letzten Jahren seit der Finanzkrise stark angestiegen. Vor allem in den letzten beiden Jahren, als die Niedrigzinspolitik den Peak erreicht...

Read More »

Read More »

Gefahr für Immobilien 2023: Preiseinbruch, Zwangshypothek und Nachbesicherung

Immobilien 2023 – Preise brechen ein und Gefahr Enteignung wächst

Kostenfreies Immobilien-Training: https://thorstenwittmann.com/kostenfreies-immobilien-training

Freitagstipps abonnieren: https://thorstenwittmann.com/klartext/

Immobilien 2023 – Preise brechen ein und Enteignungsgefahr steigt jeden Tag weiter an – was tun?

Einbrechende Preise, Gefahr von Zwangshypotheken und Nachbesicherung, CO2-Umlagen und einiges mehr … die Gefahren bei...

Read More »

Read More »

20 Jahre Dividendenstrategie pur: Fondsmanager Dr. Jan Ehrhardt im Interview mit Mario Künzel

Der DJE – Dividende & Substanz ist mit seinem Fokus auf eine anlegerfreundliche Unternehmenspolitik ein Grundpfeiler der DJE-Strategien. Der globale Aktienfonds kombiniert Dividendenerträge mit Aktienkursgewinnen und wird seit Tag eins gemanagt von Dr. Jan Ehrhardt.

Am 27. Januar feiert der Fonds sein 20-jähriges Jubiläum.

Im Interview mit Mario Künzel spricht Fondsmanager Dr. Jan Ehrhardt über seine Investmentphilosophie, die Ursprünge des...

Read More »

Read More »

Aktien die bald Dividenden-Könige werden

?Hol dir 100 CHF Trading Credits bei einer Aktien-Depoteröffnung ►► http://sparkojote.ch/swissquote *

(only for swiss residents)

Aktien die bald Dividenden-Könige werden ?

In diesem Video geht es um die sogenannten "Dividenden-Könige", Unternehmen, die seit vielen Jahren in Folge eine hohe und regelmäßige Dividende an ihre Aktionäre auszahlen. Ich erklären, warum diese Unternehmen für Anleger interessant sein können und welche Faktoren...

Read More »

Read More »

Ep. 223: Marc Faber Interview with Michael Covel on Trend Following Radio

My guest today is Marc Faber, a Swiss investor based in Thailand. He is the publisher of the Gloom Boom & Doom Report newsletter and the director of Marc Faber Ltd, which acts as an investment advisor and fund manager.

The topic is economics.

In this episode of Trend Following Radio we discuss:

▪️ Current state of Russia

▪️ Changing geopolitics

▪️ Faber’s experience living through the Cold War

▪️ The difference between Crimea’s value to the...

Read More »

Read More »