Tag Archive: newsletter

The Phillips Curve Is an Economic Fable

Keynesians and fellow travelers hold the Phillips curve to be sacrosanct. But because the Phillips curve cannot establish causality, it is useless as economic theory.

Original Article: "The Phillips Curve Is an Economic Fable"

This Audio Mises Wire is generously sponsored by Christopher Condon.

Read More »

Read More »

Discutí con Yolanda Díaz hace 6 años… NO HA SERVIDO DE NADA

Te animo a suscribirte a mi canal y te invito a seguirme en mis redes sociales:

☑ Twitter - https://twitter.com/dlacalle

☑ Instagram - https://www.instagram.com/lacalledanie

☑ Facebook - https://www.facebook.com/dlacalle

☑ Página web - https://www.dlacalle.com

☑ Mis libros en Amazon - https://www.amazon.es/Daniel-Lacalle/e/B00P2I78OG

¡Un saludo!

Read More »

Read More »

Will Mobile Banking in the Future Limit Access to Your Money? | Lance Roberts #Shorts (3/20/23)

HAVE YOU SUBSCRIBED TO "Before the Bell?" https://www.youtube.com/channel/UCFmyKJKseEMQp1d14AjvMUw

(3/20/23) The SVB failure was an issue of falling collateral value and the velocity of money through mobile banking. Regional banks are also facing aftereffects; what is "too big to fail?" What are the realities of remaining risk in the system? Is a limitation on mobile banking coming?

Hosted by RIA Advisors Chief Investment...

Read More »

Read More »

Dirk Müller: Credit Suisse-Rettung – Der neue „Lehmann“-Moment

????? ??? ??? ????? ?????? ??? ???? ?ü???? ????:

https://bit.ly/230320_Marktupdate

(Bei diesem Video handelt es sich um einen kurzen Ausschnitt aus dem Marktupdate vom 20.03.2023 auf Cashkurs.com.)

?Jetzt Cashkurs-Mitglied werden ►► 1 voller Monat für €9,90 ► https://bit.ly/Cashkurs9_90

3️⃣ Tage gratis testen ►►► https://bit.ly/3TageGratis

? Gratis-Newsletter ►►►https://bit.ly/CashkursNL

? YouTube-Kanal abonnieren ►►►...

Read More »

Read More »

Socialism Isn’t about Creating Economies. It Is about Amassing Political Power

Ludwig von Mises wrote Socialism: An Economic and Sociological Analysis, a small book published in 1922, which demonstrated that economic calculation in a socialist commonwealth is impossible. Of course, Mises assumed that the purpose of an economy, even a socialist one, was supposed to produce goods and services, which determined its success or failure.

Alain Besançon wasn’t an Austrian or a Misesian, but he wrote Anatomie d’un spectre: l’Économie...

Read More »

Read More »

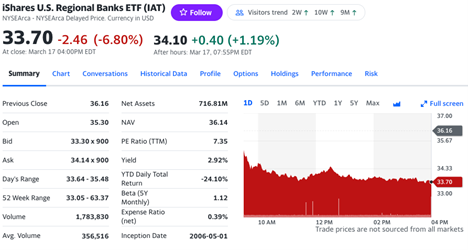

It Turns Out That Hundreds of Banks Are at Risk

It’s the weekend, but our fresh Financial Crisis does not sleep. And a recent study says we’ve only seen the tip of the iceberg.

The Washington Post yesterday wrote: “If banks were suddenly forced to liquidate their bond and loan portfolios, the losses would erase up to 91 percent of their combined capital cushion.” In other words, we were already right up against the edge.

The Post cites two studies that total unrealized losses in the system are...

Read More »

Read More »

Bankenkrise kurz erklärt #creditsuisse

► Mein Merch:

https://shop.marc-friedrich.de/

► Mein neues Buch

Du möchtest das erfolgreichste Wirtschaftsbuch 2021

"Die größte Chance aller Zeiten" bestellen?

Auf Amazon: https://www.amazon.de/shop/marcfriedrich oder mit Signatur:

https://www.marc-friedrich.de/

► Friedrich & Partner Vermögenssicherung

https://www.friedrich-partner.de/

► Social Media

Twitter: http://www.twitter.com/marcfriedrich7

Instagram:...

Read More »

Read More »

Terms of UBS Acquisition Wipes out Additional Tier 1 Capital and Spurs Fresh Concerns

Overview: UBS takeover of Credit Suisse, the sale of

Signature bank assets, and the daily dollar swaps could have helped stabilize

the budding banking crisis. However, the wipeout of the additional tier 1

capital cushion (16 bln Swiss francs) at Credit Suisse has raised concern about

the vulnerability of other such assets, which post-GFC is a $275 bln market in

Europe. Asia Pacific equities was a sea of red, led by a 2.65% drop in the Hang

Seng...

Read More »

Read More »

Bleibt Europa mittelfristig wettbewerbsfähig? Podcast mit Dr. Ulrich Kaffarnik

Die Inflationsraten kühlen langsam ab, die Kerninflation jedoch bleibt hartnäckig. Für die Federal Reserve bedeutet das weiterhin Handlungsdruck. Mit der Pleite der Silicon Valley Bank machen sich erste Auswirkungen der restriktiveren Notenbankpolitik allerdings bereits bemerkbar.

Wie kritisch sind die Entwicklungen im Bankensektor?

Nicht nur die Notenbank, auch die US-Regierung sucht nach Antworten auf die Inflation. Mit dem Inflation Reduction...

Read More »

Read More »

Credit Suisse ENTEIGNUNG! 200 US Banken JETZT bedroht!

Die Credit Suisse Enteignung wurde am Wochenende vollzogen. Anleihen im Wert von 17 Milliarden Dollar sind wertlos. Anleihen in Asien crashen. Alle News im Überblick

? Hier kaufe ich Aktien ► http://link.aktienmitkopf.de/Depot *

??5 Euro Startbonus bei Bondora ►► https://goo.gl/434rmp *

? Tracke deine Dividenden mit dieser App http://myfinances24.de/mydividends24

? Mein Buch! Der Rationale Kapitalist ►►http://amzn.to/2kludNT

?JETZT auch als Hörbuch...

Read More »

Read More »

Wichtige Morning News mit Oliver Klemm #76

Klicke hier, um Dich gemeinsam mit Oli unabhängig zu machen:

? http://bit.ly/oli-ausbildung

Meine Webseite: https://tradingcoacholi.com/

►Mein Telegram Kanal: http://t.me/tradingcoacholi

►Folge Oliver auf Facebook: http://bit.ly/TOFBpage

►Folge Oliver auf Instagram: http://bit.ly/TOInst

►Oli macht auch TikToks: https://www.tiktok.com/@tradingcoacholi

►Abonniere Oliver auf YouTube: http://bit.ly/Oli-Kanal

DIE TRADING COMMUNITY VON OLIVER KLEMM...

Read More »

Read More »

The quiet Fed is ready to speak

While the expectations for the Fed was turned upside down, the Fed was in a quiet period, where not a word was said. On Wednesday, the Fed will be ready to speak when they announce their rate decision. Has the market gone too far, during the Feds silence? Much will depend on if the Fed will take the ECB approach and address financial fires and monetary policy with different tools.

Read More »

Read More »

BANKENKRISE! Credit Suisse – erklärt! (UBS)

► Mein Merch:

https://shop.marc-friedrich.de/

? Marc lädt Dich ein nach Schwäbisch Gmünd!

https://www.marc-friedrich.de/marc-laedt-ein

► Friedrich & Partner Vermögenssicherung

https://www.friedrich-partner.de/

► Bitcoin

Wo seriös BITCOIN kaufen und lagern? Alles Wichtige findest du hier:

https://www.friedrich-partner.de/bitcoin-handbuch

► Mein neues Buch

Du möchtest das erfolgreichste Wirtschaftsbuch 2021

"Die größte Chance aller...

Read More »

Read More »

Swiss National Bank provides substantial liquidity assistance to support UBS takeover of Credit Suisse

UBS today announced the takeover of Credit Suisse. This takeover was made possible with the support of the Swiss federal government, the Swiss Financial Market Supervisory Authority FINMA and the Swiss National Bank.

Read More »

Read More »

Es geht darum, wie du dein Mindset ins Spiel bekommst

Klicke hier, um Dich gemeinsam mit Oli unabhängig zu machen:

? http://bit.ly/oli-ausbildung

Meine Webseite: https://tradingcoacholi.com/

Inhaltsverzeichnis:

►Mein Telegram Kanal: http://t.me/tradingcoacholi

►Folge Oliver auf Facebook: http://bit.ly/TOFBpage

►Folge Oliver auf Instagram: http://bit.ly/TOInst

►Oli macht auch TikToks: https://www.tiktok.com/@tradingcoacholi

►Abonniere Oliver auf YouTube: http://bit.ly/Oli-Kanal

►Folge Oliver auf...

Read More »

Read More »

Mit dem richtigen Geld-Bewusstsein zu mehr Reichtum und Erfüllung – Bruno Würtenberger (Teil 1/2)

In diesem spannenden Experten-Interview spreche ich mit Bruno Würtenberger über ein erfolgreiches Ged-Bewusstsein.

vereinbare jetzt Dein kostenloses Beratungsgespräch??:

► https://go.investorenausbildung.de/3n29OKX

kostenloses Webinar ansehen???:

► https://go.investorenausbildung.de/3zRHbI0

Aktienanalyse auf Knopfdruck?:

► https://go.investorenausbildung.de/3zVtfwv

kostenloses Buch sichern?:

► https://go.investorenausbildung.de/3xJn7ow

▬ Über...

Read More »

Read More »

UBS EILMELDUNG! Schweiz will Credit Suisse Enteignung!

Die UBS Großbank hat ein Angebot für 1/8! des Wertes der Credit Suisse AG gemacht! Dies wäre eine Zäsur für die Aktionärsrechte in Europa

? Hier kaufe ich Aktien ► http://link.aktienmitkopf.de/Depot *

??5 Euro Startbonus bei Bondora ►► https://goo.gl/434rmp *

? Tracke deine Dividenden mit dieser App http://myfinances24.de/mydividends24

? Mein Buch! Der Rationale Kapitalist ►►http://amzn.to/2kludNT

?JETZT auch als Hörbuch bei Audible ►►...

Read More »

Read More »

Fed interest rate decision with technical analysis and forecast

See more at

https://www.forexlive.com/technical-analysis/fed-interest-rate-decision-with-technical-analysis-and-forecast/

Read More »

Read More »