Tag Archive: newsletter

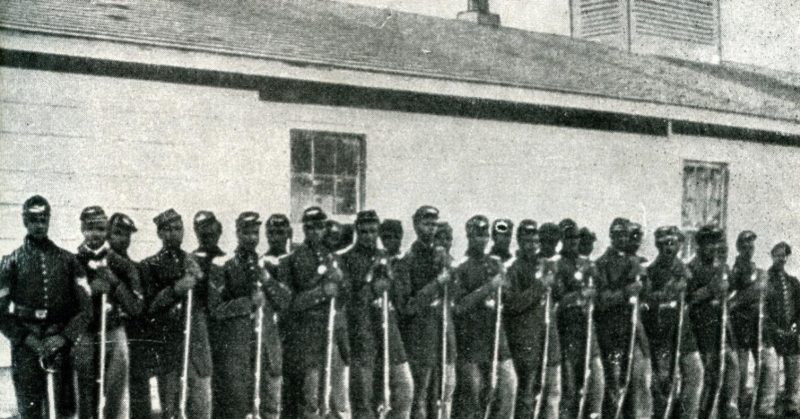

The Forgotten Lessons of Government-Enforced Race Relations

On April 23, 2003, in South Side Chicago, Reverend Jeremiah Wright cursed America for treating blacks as less than human.

Such harsh rhetoric should not seem surprising given the US government’s history of involvement in race relations. Judge Andrew P. Napolitano takes us through that history in his book Dred Scott's Revenge: A Legal History of Race and Freedom in America.

Most readers have heard about black lynchings that gripped the South for...

Read More »

Read More »

How Government Spending Hurts the Economy

[In this chapter from Man, Economy, and State, Murray Rothbard explains how government employees consume productive resources, while both taxes and government spending distort the economy.]

For years, writers on public finance have been searching for the “neutral tax,” i.e., for that system of taxes which would keep the free market intact. The object of this search is altogether chimerical. For example, economists have often sought uniformity of...

Read More »

Read More »

Wie investiert Gerd Kommers Hund?

Die besten Finanzprodukte! ►► https://link.finanzfluss.de/extern/empfehlungen

Kostenloses Depot eröffnen: ►► https://link.finanzfluss.de/extern/depot?utm_source=youtube&utm_medium=qtk4IzEELOA&utm_campaign=haupt-depot&utm_term=kostenlos&utm_content=yt-desc *?

In 4 Wochen zum souveränen Investor: ►►...

Read More »

Read More »

Löst die Aktienrente das deutsche Rentenproblem?

So soll die Aktienrente die deutschen Renten mitfinanzieren!

Kostenloses Depot eröffnen: ►► https://link.finanzfluss.de/go/depot?utm_source=youtube&utm_medium=574&utm_campaign=comdirect-depot&utm_term=kostenlos-25&utm_content=yt-desc *?

In 4 Wochen zum souveränen Investor: ►► https://link.finanzfluss.de/go/campus?utm_source=youtube&utm_medium=574&utm_campaign=ff-campus&utm_term=4-wochen&utm_content=yt-desc ?

ℹ️...

Read More »

Read More »

Was bedeutet es Stillhalter zu sein?

Https://traderiq.net/youtubetiq

In mehreren Live Webinaren werden wir Schritt-für-Schritt aufzeigen, wie jeder an der Börse hohe Renditen bekommen kann - ohne sich vor einem Crash zu fürchten.

Du erfährst:

• Wie Du Aktien mit Rabatt einkaufen kannst

• Wie Du sie gegen einen Crash versicherst

• Und wie Du sie für monatliche Mieteinnahmen vermietest - genau wie Immobilien

Klicke jetzt auf den Link, melde Dich 100% gratis an und mit wenigem Klicks...

Read More »

Read More »

Will there be a Powell Pivot? – Adam Taggart

The big question among experts is “Will the Fed actually pivot?”

As you may have noticed, the Federal Reserve has been raising interest rates to help cure soaring inflation. Traders worry that continuing the rate hikes could tip the US into a looming recession. Just as we thought we were headed in that direction, data showed US job openings in August plummeted—the most since early in the pandemic—leading to speculation the Fed might “pivot” from...

Read More »

Read More »

Switzerland sees surge in numbers of foreign workers

The number of new foreign workers moving to Switzerland on long-term contracts increased by a quarter last year compared to 2021, according to official statistics.

Read More »

Read More »

Ferocious battle of disinformation in Ukraine War, Russia blaming Ukraine for Bucha | Latest | WION

Ukraine is fighting away from the battlefield and that's a ferocious battle of disinformation. The Pro-Russian agitators are seeking to shift blame for many war crimes on Ukraine.

Read More »

Read More »

Why Ron Paul Is Right

The great Dr. Ron Paul has been right about all the major issues that confront the world today. He is right about the Fed, the Ukraine war, the FBI, and so much else. How has he managed to do that? What has given him wisdom unique on the political scene today? The answer is simple.

Read More »

Read More »

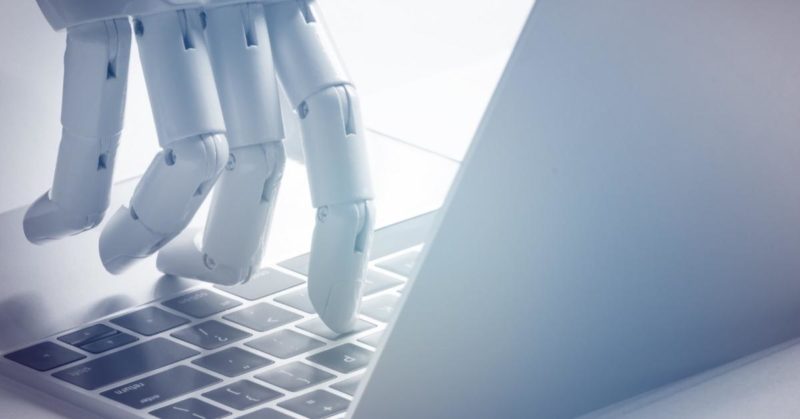

Will AI Learn to Become a Better Entrepreneur than You?

Contemporary businesses use artificial intelligence (AI) tools to assist with operations and compete in the marketplace. AI enables firms and entrepreneurs to make data-driven decisions and to quicken the data-gathering process. When creating strategy, buying, selling, and increasing marketplace discovery, firms need to ask: What is better, artificial or human intelligence?

Read More »

Read More »

UN LUSTRO PERDIDO, REFORMA LABORAL FRACASADA Y MERCADOS

#inversiones #economia #crisis #macroeconomía #economix #mercados

Te animo a suscribirte a mi canal y te invito a seguirme en mis redes sociales:

☑ Twitter - https://twitter.com/dlacalle

☑ Instagram - https://www.instagram.com/lacalledanie

☑ Facebook - https://www.facebook.com/dlacalle

☑ Página web - https://www.dlacalle.com

☑ Mis libros en Amazon - https://www.amazon.es/Daniel-Lacalle/e/B00P2I78OG

¡Un saludo!

Read More »

Read More »

The Economics of American Gerontocracy

With Yale economics professor Yusuke Narita suggesting mass suicide—seppuku—as the answer to Japan's rapidly aging demographics, Jeff and Bob take a hard look at the economics and humanity of greying America.

Richard Hanania, "Gerontocracy Versus Western Civilization": Mises.org/HAP383a

Bob on opting out of Social Security: Mises.org/HAP383b

[embedded content]

Read More »

Read More »

Why Nigeria is crucial to democracy in Africa

Nigeria's youth are fighting for a better, cleaner government. What can this political awakening tell us about the state of democracy across Africa?

00:00 - Why Nigeria matters

01:06 - Nigeria’s security crisis

03:42 - How corruption threatens Nigeria’s democracy

05:26 - How young Nigerians are driving change

11:31 - Youth protests across Africa

Sign up to The Economist’s daily newsletter: https://econ.st/3QAawvI

Read more of our Africa...

Read More »

Read More »

Fighting Inflation Really Means Fighting the Federal Reserve

These days, the Fed and Chairman Jerome Powell are claiming the title of "inflation fighters." The more appropriate moniker should be "inflationists."

Original Article: "Fighting Inflation Really Means Fighting the Federal Reserve"

This Audio Mises Wire is generously sponsored by Christopher Condon.

Read More »

Read More »

Good Causes, Brand Trust, and Profits: Why YouTuber’s Private Charity Is Wrongly Criticized

No good deed goes unpunished claims the old proverb, and twenty-four-year-old YouTuber Jimmy Donaldson’s recent charity act of helping one thousand blind people see again has the world divided on the moral circumstances surrounding his private charity. Some would go so far as calling his benevolence a “stunt.” They are utterly wrong, and understanding his reasoning and motives behind the charity acts should negate any critique.

A Successful, Yet...

Read More »

Read More »

Government Inflation Reading Still Comes in Hot, Tech Layoffs Continue

? SUBSCRIBE TO MONEY METALS EXCHANGE ON YOUTUBE

➤ http://bit.ly/mmx-youtube

As investors digest the latest readings on inflation, employment, and consumer spending, precious metals markets are wavering on fears of further rate hikes. Inflation continues to run well above the Federal Reserve’s 2% target.

Read the Full Transcript Here:...

Read More »

Read More »

Money versus Monetary Policy

With all due respect to Niall Ferguson, whom I've heard of, and Huw van Steenis, whom I've not, this tweet is quite preposterous. I've personally met more than five people who understand money just in my own circles.

What they mean is “monetary policy,” which is in fact very difficult to understand—given it effectively operates as a political program within the muddled field of macroeconomics. Monetary policy, unlike money per se, is ad hoc,...

Read More »

Read More »