Tag Archive: newsletter

China Enters the Doom Loop

China's authoritarian gerontocracy has built a Doom Loop with Chinese characteristics, with over half the economy now crashing.

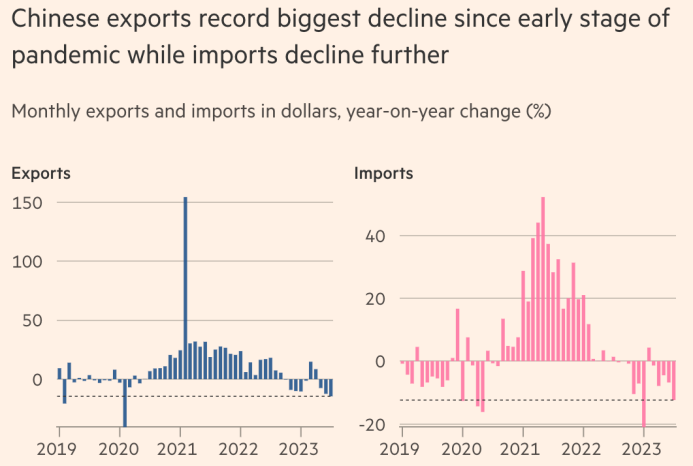

Chinese exports are now plunging at the fastest pace since the covid lockdowns: Exports fell 14.5% on the year, driven by a 21% drop in exports to Europe and a 23% drop to the US.

Meanwhile, imports to China are also falling -- 12.4% on the year -- as shrinking manufacturing buys fewer inputs and households buy less.

In...

Read More »

Read More »

Is the Monopoly Board Game Like Real Markets?

It feels like a silly thing to say, but board games are not real life. Playing a few rounds of Operation does not make you a surgeon. Unlike in Battleship, real-world battleships do not sit still on a ten-by-ten grid.

Similarly, Monopoly does not correlate to “free-market capitalism,” despite anticapitalist claims like this tweet with over a million views:

There’s literally a children’s board game that demonstrates that “free-market capitalism”...

Read More »

Read More »

Von der Leyens Supergau! Böses Gas, Gutes Gas!

Letzten Sommer lobte Ursula Von der Leyen den neuen Gaspartner Aserbaidschan noch als "vertrauenswürdigen Partner und Gaslieferanten" Doch nun blockiert der Diktator Aliyev den Lachin Korridor und etwa 120.000 Armenier sind von Hilfsgüterlieferungen abgeschnitten!

? Meine Aktiendepot Empfehlung mit bis zu 4,1 % für Einlagen in EUR

Bis zu 5,8 % für Einlagen in USD https://link.aktienmitkopf.de/Depot *

Bildrechte: Dati Bendo, Attribution,...

Read More »

Read More »

Aussie Recovers from Poor Jobs Data, but Nokkie is Weaker Despite Rate Hike

Overview: Encouraged by the continued stream of US data, which

suggests that the world's largest economy is accelerating, the US 10-year yield

is approaching last year's 4.33% high, and the dollar's run has lifted it to

new highs for the year against the Japanese yen, Chinese yuan, and the

Australian and New Zealand dollars. Even a rate hike by Norway did not stop the

dollar from rising against the krone. The greenback is firmer against most of

the...

Read More »

Read More »

Possible decline for EURJPY | Market Outlook with Exness

The euro-yen pair is currently trading close to its all-time high, but technical indicators suggest the possibility of a correction towards the downside. The first point of support is expected to be around the ¥156 price area. The yen's continuous incline of the decade bond yields is the primary narrative driving its possible further strength.

This week, the Japanese and European inflation rates are the most significant releases expected on...

Read More »

Read More »

Baerbock DESASTER! Es ist unfassbar!

200.000 Liter Kerosin wurden sinnlos verpulvert und aus dem Regierungsjet über Abu Dhabi abgelassen! WDR springt auch noch für die Außenministerin in die Bresche und stellt klar: alles nicht so schlimm fürs Klima! Und nun kommen auch noch neue Gerüchte auf!

? Meine Aktiendepot Empfehlung mit bis zu 4,1 % für Einlagen in EUR

Bis zu 5,8 % für Einlagen in USD https://link.aktienmitkopf.de/Depot *

Bildrechte: Olaf Kosinsky, CC BY-SA 3.0 DE...

Read More »

Read More »

S&P 500 Technical Analysis

Here's a quick technical analysis on the S&P 500 with some fundamental background.

For more visit ForexLive.com

Read More »

Read More »

Ist die Börse 2023 ein großes Puzzle? – DJE-plusNews August 2023 mit Mario Künzel

#china #news #konjunktur #wachstum

Obwohl die inverse Zinskurve auf eine Rezession hindeutet und die Wirtschaftsentwicklung in Deutschland und China enttäuschend ist, haben sich viele Börsenindizes positiv entwickelt. Wie passt das zusammen?

In dem monatlich stattfindendem DJE-plusNews reflektiert Mario Künzel, Referent Investmentstrategie, die Marktgeschehnisse der vergangenen vier Kalenderwochen und gibt Ihnen einen Ausblick auf die kommenden...

Read More »

Read More »

Wichtige Morning News mit Oliver Klemm #161

Kostenfreies Video-Training (Durch Trading in 2023 absichern) ? https://oliverklemmtrading.com/casestudy-1?utm_source=youtube&utm_medium=social&utm_campaign=tradingcoacholi&utm_term=morning-news&utm_content=1

Klicke hier, um dich direkt gemeinsam mit Oli unabhängig zu machen ?...

Read More »

Read More »

My advice to investors who are just beginning their journey

Passing along my advice to #investors who are just beginning their journey. #principles #raydalio #finance #investing

Read More »

Read More »

The Ultimate Guide to Silver Quarters #preciousmetals

? The Ultimate Guide to Silver Quarters ?

- Silver quarters are a popular investment and collectible. In this guide, we'll teach you everything you need to know about silver quarters, from their history to their value.

- #silverquarters #silvercoin #coincollecting #coininvestment #moneymetals #investment #preciousmetals #silver

➡️ - Article link: ⬇️➡️https://www.moneymetals.com/guides/silver-quarters

? SUBSCRIBE TO MONEY METALS EXCHANGE ON...

Read More »

Read More »

Can Fractional Reserve Banking Survive the Twenty-First Century?

Banker and financial expert Caitlin Long believes that fractional reserve banking is closer than ever to collapse, and she has a 100 percent reserve banking solution in progress.

Original Article: "Can Fractional Reserve Banking Survive the Twenty-First Century?"

Read More »

Read More »

BOMBAZO JAVIER MILEI: ¿Se puede implementar aquí su programa?

#milei #mileipresidente #libertad #liberal #argentina #españa #elecciones2023

Te animo a suscribirte a mi canal y te invito a seguirme en mis redes sociales:

☑ Twitter - https://twitter.com/dlacalle

☑ Instagram - https://www.instagram.com/lacalledanie

☑ Facebook - https://www.facebook.com/dlacalle

☑ Página web - https://www.dlacalle.com

☑ Mis libros en Amazon - https://www.amazon.es/Daniel-Lacalle/e/B00P2I78OG

¡Un saludo!

Read More »

Read More »

Immos 2023: Sollte man JETZT einsteigen?

? https://betongoldwebinar.com/yt ?Jetzt Gratis Immobilien-Webinar ansehen!

Die #Immobilienpreise sind in vielen deutschen und österreichischen Städten bereits um 25-30% gefallen. War's das schon, oder fallen die Preise am #Immobilienmarkt weiter? Droht nach der jahrzehntelangen Boomphase nun eine ebenso lange Durststrecke, oder ist jetzt bereits wieder der richtige Zeitpunkt für einen #Immobilienkauf? Das analysiert heute der österreichische...

Read More »

Read More »

Historische Chance? Diese Aktien sind 50% unterbewertet!

► Den Kanal von Sebastian Hell findest du hier: https://www.youtube.com/c/Hellinvestiert

► Sichere Dir meinen Report, mit Tipps zu Gold, Aktien, ETFs - 100% gratis: http://lars-erichsen.de/

Die ganze Welt, zumindest mal die Anleger-Welt, fragt sich praktisch tagtäglich was ist jetzt mit Gold? Steigt der Preis? Fällt der Preis? Ist Gold überbewertet? Ist Gold unterbewertet? So einfach ist das gar nicht zu beantworten, zumindest mal mit Blick auf...

Read More »

Read More »

Inflation Is a Giant “Skim” on the American People

The price of a McDonald’s hamburger in the United States has inflated 3.75 percent annually over the last seventy years. McDonald’s has grown from a tiny hamburger stand in Des Plaines, Illinois, to the second largest fast-food chain on earth. Scale economies alone (never mind process and productivity improvements) should’ve allowed the price of a burger to decline materially over this period.

Why didn’t it? What forces and institutions have...

Read More »

Read More »

Bitcoin-ETF: Gamechanger oder Geldmacherei? Prof. Dr. Sandner über MiCA, Anonymität & Stablecoins!

Sind Bitcoin ETFs sinnvoll und was bringt die MiCA Regulierung? Prof. Dr. Sandner im Interview!

Seriöse Bitcoin-Börse ►► https://link.finanzfluss.de/go/bitcoin-boerse *?

Sicheres Bitcoin-Wallet ►► https://link.finanzfluss.de/go/ledger-nano-s *?

ℹ️ Weitere Infos zum Video:

Im heutigen Video sprechen wir mit dem Kryptoexperten Prof. Dr. Philipp Sandner über Bitcoin ETFs und die MiCA Regulierungen. Das vollständige Interview, inklusive vieler...

Read More »

Read More »

Is this the end of fiat currency? – Robert Kiyosaki, @1MarkMoss

In this episode, Robert Kiyosaki and his guest, Mark Moss, delve into the importance of understanding history to predict the future. They discuss the Medici family's role in creating the modern monetary system, the significance of sound money like the gold coin called the florin, and the current state of the global economy.

Both Robert and Mark express concerns about the US dollar, rising national debt, inflation, and the potential collapse of...

Read More »

Read More »