Tag Archive: newsletter

Don’t Miss the Next Chinese Bull Run: Seizing Opportunities in the Chinese Stock Market Rebound

Embark on a comprehensive journey into the world of technical analysis with our latest video, focused on capturing the burgeoning opportunities in the rebounding Chinese stock market. Centered around the MCHI ETF, a key instrument for tapping into China's vast equity market, this video is a treasure trove for investors and traders aiming to leverage the immense potential of one of the world's foremost economies.

As we navigate through the...

Read More »

Read More »

Softer Tokyo CPI Buys BOJ Time while Moody’s Cuts the Outlook for China’s Debt following Fiscal Stimulus and the Continued Property Slump

Overview: Outside of the Australian dollar, which

has fallen by around 0.6% following the RBA meeting and the softer final PMI,

which may have dragged the New Zealand dollar a lower by around 0.25%, the

other G10 currencies trading little changed ahead of the start of the North

American session. The eurozone and UK final PMIs were revised higher. Central

European currencies lead the emerging market currencies. China reported better

than expected...

Read More »

Read More »

The awakening of the working class

Part I of II, by Claudio Grass, Switzerland

It is a worn-out cliché that many (if not most) political zealots meet their downfall because of their arrogance. “Pride goes before destruction, a haughty spirit before a fall,” the proverb goes, and it does prove true more often than not. The specific kind of pride, or haughty spirit, or plain hubris in this case, has to do with the certainty that some people have (one can’t imagine how and why...

Read More »

Read More »

Comprehensive Analysis of American Express (AXP) Stock: Navigating Through 2020-2029

? Decoding American Express's Long Term Market Trends and Projections

Embark on an insightful journey with us as we analyze American Express (AXP) stock, covering the critical developments from the onset of 2020 to the current day. This video is tailored for investors and traders who are eager to grasp the pivotal factors influencing AXP stock, focusing on vital price levels, Volume Weighted Average Price (VWAP), and volume profile insights. Our...

Read More »

Read More »

Axon (AXON) Stock Analysis: Unveiling Key Trends and Predictions (2020-2029)

? Navigating the Future of Axon: A Strategic Stock Analysis

Join us as we embark on a detailed exploration of Axon's (formerly known as Taser) stock journey from the beginning of 2020 to today. In this video, we focus on deciphering the critical price points, the Volume Weighted Average Price (VWAP), and volume profile specific to AXON stock. This analysis is meticulously designed for investors and traders who are keen on understanding the nuances...

Read More »

Read More »

In-Depth Analysis of Amazon (AMZN) Stock: Key Levels, Volume Analysis & Future Outlook (2020-2029)

? Exploring Amazon's Stock Journey: A Comprehensive Technical Perspective

Join us in this detailed exploration of Amazon (AMZN) stock's performance, tracing its path from the dawn of the 2020 decade to today. Our focus is on critical price levels, the Volume Weighted Average Price (VWAP), and volume profile analysis. This video is crafted for both traders and investors aiming to grasp potential pivotal price points that may be vital for future...

Read More »

Read More »

AMD LONG TERM TECHNICAL ANALYSISINCLUDING KEY PRICE LEVELS

AMD Long-Term Technical Analysis: Key Price Levels, VWAP & Volume Profile (2020-2029)

In this video, we're taking an extensive look at AMD's stock performance from the beginning of the 2020 decade to the present, focusing on key price levels, VWAP (Volume Weighted Average Price), and the volume profile. Whether you're an investor or a trader, this analysis is designed to highlight potential key price points that could be crucial in the...

Read More »

Read More »

Lauterbach wird von Stanford Professor komplett zerlegt!

Lauterbach wird von einem Professor von der Stanford Universität scharf kritisiert! Der Minister sei "völlig uninformiert über COVlD und wäre außerdem inkompetent"

Aktiendepot-Empfehlung:

4,2 % Zinsen und 6,12% für Einlagen in USD https://link.aktienmitkopf.de/Depot *

Bildrechte: By Olaf Kosinsky - Own work, CC BY-SA 3.0 de, https://commons.wikimedia.org/w/index.php?curid=82138744

??5 Euro Startbonus bei Bondora ►► https://goo.gl/434rmp...

Read More »

Read More »

USDJPY Technical Analysis

Here's a quick technical analysis USDJPY with some fundamental background.

For more visit ForexLive.com

Read More »

Read More »

Gold mit Fakeausbruch – Wie gefährlich ist das jetzt?

Vereinbare jetzt Dein kostenfreies Beratungsgespräch:

https://jensrabe.de/Q4Termin23

Tägliche Updates ab sofort auf

https://aktienkannjeder.de

Schau auf meinem Instagram-Account vorbei:

@jensrabe_official

https://www.instagram.com/jensrabe_official

ALLE Bücher von Jens Rabe:

https://jensrabe.de/buecherYT

Nur für kurze Zeit. Solange der Vorrat reicht.

Börsen-News

https://jensrabe.de/newsletter-yt

Hinweis: Derzeit wird unser Kanal von Bots mit...

Read More »

Read More »

Why India is a Rising Power

Here’s why I think #India is a rising #power. #geopolitics #changingworldorder #principles #raydalio

Read More »

Read More »

Gold price soars to record high before dramatic plunge; Buyers still in play

Gold experienced a volatile trading day, hitting an all-time high of $2146.79 before sharply falling. Despite being below previous swing highs, buyers remain active. The market is now more neutral.

Read More »

Read More »

Cryptocurrency: Integrity Destroyer or Policy Scapegoat?

Is cryptocurrency a scam or is it a legitimate alternative to state-corrupted money? Political elites want to eliminate it altogether, but that alone should tell us we need to better understand this alternative money source.

Original Article: Cryptocurrency: Integrity Destroyer or Policy Scapegoat?

Read More »

Read More »

GBPUSD revisits support levels, with bears gaining momentum.

GBPUSD tests floor area, bearish bias intensifies as price falls below moving average and seeks to break key support levels

Read More »

Read More »

Chris Vermeulen on Gold: This Is A Super Cycle At Play

On the back of gold hitting all-time highs overnight, GoldCore CEO, Dave Russell took some time with #ChrisVermeulen about why the record was broken, why #gold has now pulled back and what to expect in the long-term.

It’s not just the gold price they cover in this 20 minute chat, look out for #goldminers, uranium stocks and silver futures.

As ever, we love to hear your thoughts on these videos and what the gold price means for your investment...

Read More »

Read More »

NZDUSD soars to new high, but is backing off. Traders watching 61.8% retracement.

The NZDUSD has reached a new high but backs off. Hold, and a potential rally towards the previous swing area is expected. However, a drop below key support could lead to a decline to the 200-day MA

Read More »

Read More »

Nächster Milliarden Trick von Lindner und Scholz fliegt auf!!!

Der von Christian Lindner mit den Worten "Rechtssicherheit" kommentierte Nachtragshaushalt ist laut Bundesrechnungshof ebenfalls verfassungswidrig! Es wird immer schlimmer!

Aktiendepot-Empfehlung:

4,2 % Zinsen und 6,12% für Einlagen in USD https://link.aktienmitkopf.de/Depot *

Bildrechte: By © Raimond Spekking / CC BY-SA 4.0 (via Wikimedia Commons), CC BY-SA 4.0, https://commons.wikimedia.org/w/index.php?curid=131691038

??5 Euro...

Read More »

Read More »

Gold! Neues Kursziel: 3.367 US-Dollar!

► Höre Dir meinen neuen Podcast "Buy the Dip" an, mit Sebastian Hell und Timo Baudzus: https://buythedip.podigee.io/

Ich bin mir ziemlich sicher, dass Gold bis auf 3.367 USD steigen wird. Wie man mit einem solchen Kursziel umgeht und was das für den eigene Handel und für die eigene Anlage bedeutet, möchte ich euch gerne in diesem Video zeigen. Legen wir los.

► Sichere Dir meinen Report, mit Tipps zu Gold, Aktien, ETFs - 100% gratis:...

Read More »

Read More »

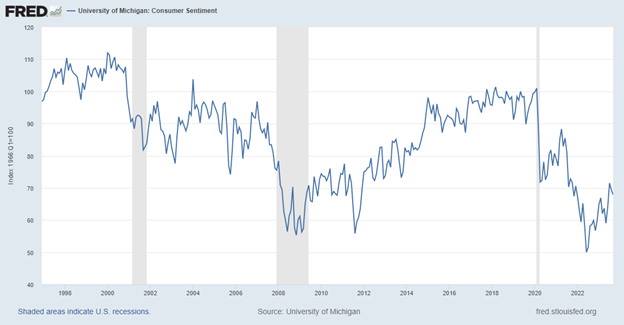

Paul Krugman Blames Economic Pessimism on Partisanship. He’s Wrong.

Paul Krugman can’t figure out why everybody is so bummed about the economy. From his perspective, we should all be jumping for joy, praising Joe Biden, and publicly signing fifty-year commitments to vote Democrat. Official statistics show that “unemployment is still near a 50-year low, yet inflation has been falling fast.” But the ignorant masses simply won’t get with the picture. Krugman admits “surveys of consumer sentiment and political polls...

Read More »

Read More »