Tag Archive: newsletter

Alice Weidel zerlegt Ampel in 60 Sekunden!

Sozialismus hat nie funktioniert und wird es auch nie! Die aktuelle Misere hat Alice Weidel bereits 2021 vorhergesehen!

Meine Depotempfehlung 3,9 % Tagesgeld-Zinsen und 5,3% für Einlagen in USD

https://link.aktienmitkopf.de/Depot*

? Tracke deine Dividenden mit dieser App http://myfinances24.de/mydividends24

Bildrechte: By Olaf Kosinsky - Own work, CC BY-SA 3.0 de, https://commons.wikimedia.org/w/index.php?curid=78126595

? Mein Buch! Der Rationale...

Read More »

Read More »

3 ETF Geheim-Tipps für hohe Renditen!

► Folge mir auf LinkedIn: https://www.linkedin.com/in/erichsenlars/

Im heutigen Video möchte ich mich mal, gemeinsam mit Euch, ein wenig weg vom Mainstream bewegen und nicht auf die Aktien blicken, die garantiert irgendwo jeden Tag unter die Lupe genommen werden. Wir schauen auf drei ETFs, bei denen ich davon ausgehe, dass sie so niemand auf dem Schirm hat: Also 3 echte Geheimtipps!

► Mein exklusives Lars-Erichsen-Depot:...

Read More »

Read More »

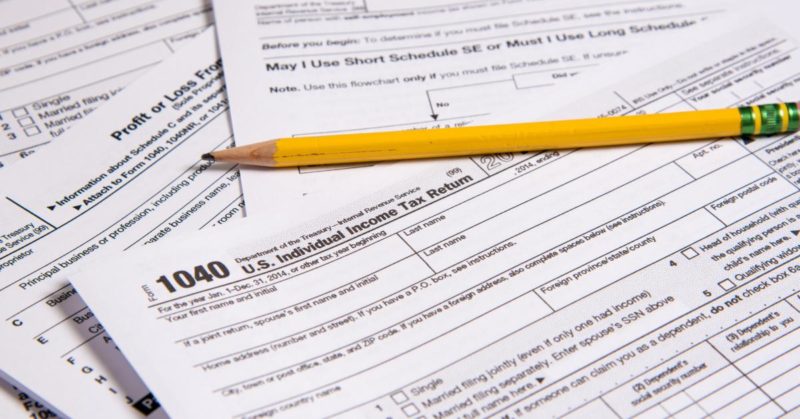

Forget the Alleged Social Contract: Taxes Are Coercive

Taxes are not a contractual obligation between the state and the individuals it governs. By definition, taxes are noncontractual debts in which the state is the creditor, and the payment of these debts is demanded through coercion and violence.

Read More »

Read More »

Dirk Müller: Bauernproteste wachsen zu Unternehmensprotesten an – einfache Lösung nicht gewollt?

? ????????.???: ????? ? ????? ?ü? ?€ ?????? ►► https://bit.ly/Cashkurs_1

? Gratis-Newsletter inkl. täglichem DAX-Update ►►► https://bit.ly/CashkursNL

? YouTube-Kanal abonnieren ►►► https://www.youtube.com/@cashkurscom

Bildrechte: Cashkurs.com / Gorodenkoff - Shutterstock.com

#dirkmueller #cashkurs #unternehmensprotest #informationsvorsprung

https://www.cashkurs.com – Ihre unabhängige Finanzinformationsplattform zu den Themen Börse, Wirtschaft,...

Read More »

Read More »

200.000 Dollar für einen Bitcoin? #bitcoin #etf

200.000 Dollar für einen Bitcoin? ? #bitcoin #etf

? Ab 2024 eröffnen sich für Privatanleger in der EU neue Investionsmöglichkeiten. Die European Long Term Investment Funds, kurz ELTIFs, werden eingeführt.

? 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community für finanzielle...

Read More »

Read More »

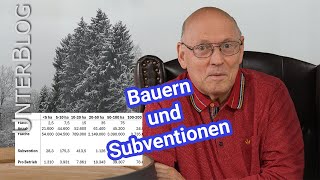

Subventionen für Bauern – Kampf gegen kleine und mittlere Betriebe

✘ Werbung:

Mein Buch Katastrophenzyklen ► https://amazon.de/dp/B0C2SG8JGH/

Kunden werben Tesla-Kunden ► http://ts.la/theresia5687

Mein Buch Allgemeinbildung ► https://amazon.de/dp/B09RFZH4W1/

-

Viel wird darüber geredet, dass Subventionen falsch wären und Bauern auch viel zu viele Subventionen erhielten. Das stimmt zum Teil. Subventionen sind immer schlecht. Doch wer erhält in der #Landwirtschaft die Subventionen? Vor allem staatliche...

Read More »

Read More »

Stock Strategies to Buy Gold

There's one asset that's stood the test of time – gold. It's been the go-to shield against financial storms throughout history, whether we're talking about inflation, economic rollercoasters, failed currencies, or even the chaos of war.

But here's the exciting part – you don't limit yourself to just owning some physical gold, like coins or bullion. There's a whole world of possibilities out there.

Host Greg Arthur and Rich Dad Wealth Expert Andy...

Read More »

Read More »

Switzerland marks start of China’s ‘high-level exchange’ with Europe

Chinese Premier Li Qiang is visiting Switzerland this week. The official state visit by China’s second highest ranking official signals a renewal in Sino-Swiss ties and the kick-off of his “high-level exchange” with Europe. Here’s what you need to know about official Swiss-Chinese relations.

Read More »

Read More »

Völliges Versagen von Özdemir!

Die Ampel reagiert auf die Bauernproteste! Aber nicht durch weniger Steuern und weniger Bürokratie, sondern durch mehr Steuern und mehr Bürokratie! Wie bitte???

Meine Depotempfehlung 3,9 % Tagesgeld-Zinsen und 5,3% für Einlagen in USD

https://link.aktienmitkopf.de/Depot*

? Tracke deine Dividenden mit dieser App http://myfinances24.de/mydividends24

Bildrechte: By Leonhard Lenz - Own work, CC0,...

Read More »

Read More »

Introduction to the Chinese Edition of How to Think about the Economy: A Primer

To the Chinese reader:

It is safe to say that economics suffers at least as many fallacies and misunderstandings as any other field of study. Had physics suffered the same level of issues, we would not have seen much—if any—of the progress that we have made over the past centuries. Yet, economics—the queen of the social sciences—keeps being misrepresented, if not abused, and we suffer the consequences.

Those consequences are primarily in the form...

Read More »

Read More »

Unfassbar! Strack-Zimmermann verliert die Nerven!

Strack-Zimmermann, Hendrik Wüst und Nouripour verlieren mal wieder die Nerven!

Meine Depotempfehlung 3,9 % Tagesgeld-Zinsen und 5,3% für Einlagen in USD

https://link.aktienmitkopf.de/Depot*

? Tracke deine Dividenden mit dieser App http://myfinances24.de/mydividends24

Bildrechte: By Olaf Kosinsky - Own work, CC BY-SA 3.0 de, https://commons.wikimedia.org/w/index.php?curid=79559739

? Mein Buch! Der Rationale Kapitalist ►►http://amzn.to/2kludNT...

Read More »

Read More »

Gold Technical Analysis

#gold #xauusd #technicalanalysis

In this video you will learn about the latest fundamental developments for Gold. You will also find technical analysis across different timeframes for a better overall outlook on the market.

----------------------------------------------------------------------

Topics covered in the video:

0:00 Fundamental Outlook.

0:37 Technical Analysis with Optimal Entries.

2:18 Upcoming Economic Data....

Read More »

Read More »

Wichtige Morning News mit Oliver Klemm #234

Kostenfreies Video-Training (Durch Trading in 2024 absichern) ? https://oliverklemmtrading.com/casestudy-1?utm_source=youtube&utm_medium=social&utm_campaign=tradingcoacholi&utm_term=morning-news&utm_content=1

Klicke hier, um dich direkt gemeinsam mit Oli unabhängig zu machen ?...

Read More »

Read More »

BIS, Swiss National Bank and World Bank Launch Token Project Promissa

Today, many international financial institutions (including multilateral development banks) are partly funded by financial instruments known as promissory notes, most of which are still paper-based.

While the current system provides the operational controls for member nations to make subscription and contribution payments to institutions like the World Bank, the custody of outstanding promissory notes can be digitised to address operational...

Read More »

Read More »

Wie wirst du selbst zum Selfmade-Millionär?

Faszination-Freiheit heute aus :

Wie wirst du selbst zum Selfmade-Millionär? #selfmademillionär #finanziellefreiheit #reichtum

Thorsten Wittmann® Finanzielle Freiheit leben

Du kannst dir die heutige Ausgabe hier auf YouTube ansehen oder auch bei deinem gewünschten Podcastanbieter anhören (Suche: Thorsten Wittmann / Faszination Freiheit).

Hier geht es zu meinem Podcast: https://thorstenwittmann.com/podcast/

Gratis unsere besten Finanztipps...

Read More »

Read More »

2024 Coins

New year, new coins! How will your silver stack up by the end of 2024?

#silverstacking #silverstacker #silver #bullion #silvercoins #new #2024 #investments #moneygoals #money #moneymetals #coincollecting #Coins #silverbugs #eagle #Britannia

? SUBSCRIBE TO MONEY METALS EXCHANGE ON YOUTUBE

➤ http://bit.ly/mmx-youtube

▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬

★★FOLLOW MONEY METALS EXCHANGE ★★

FACEBOOK ➤ https://www.facebook.com/MoneyMetals

TWITTER ➤...

Read More »

Read More »

Reflections on the Rothbard Graduate Seminar

The Rothbard Graduate Seminar (RGS) provides an opportunity to learn about Austrian economics at a high level.

Original Article: Reflections on the Rothbard Graduate Seminar

Read More »

Read More »

The Escalating Tensions in the Red Sea Are a Bad Omen

With the Houthis in Yemen firing on commercial ships in the Red Sea, the US is contemplating yet another Middle East conflict. As we see again, aggression leads to more aggression.

Original Article: The Escalating Tensions in the Red Sea Are a Bad Omen

Read More »

Read More »

Privatizing Roads Solves the Problem of Road Closures

All of us have experienced government road closures and the traffic and safety nightmares they create. Private roads may be the answer to solving the problem.

Original Article: Privatizing Roads Solves the Problem of Road Closures

Read More »

Read More »

El PSOE No Hace Más que ENDEUDARNOS

Te animo a suscribirte a mi canal y te invito a seguirme en mis redes sociales:

☑ Twitter - https://twitter.com/dlacalle

☑ Instagram - https://www.instagram.com/lacalledanie

☑ Facebook - https://www.facebook.com/dlacalle

☑ Página web - https://www.dlacalle.com

☑ Mis libros en Amazon - https://www.amazon.es/Daniel-Lacalle/e/B00P2I78OG

¡Un saludo!

Read More »

Read More »