Tag Archive: newsletter

La INFLACIÓN es SIEMPRE un Fenómeno Monetario

Link de la charla completa - &t=5905s

Te animo a suscribirte a mi canal y te invito a seguirme en mis redes sociales:

☑ Twitter - https://twitter.com/dlacalle

☑ Instagram - https://www.instagram.com/lacalledanie

☑ Facebook - https://www.facebook.com/dlacalle

☑ Página web - https://www.dlacalle.com

☑ Mis libros en Amazon - https://www.amazon.es/Daniel-Lacalle/e/B00P2I78OG

¡Un saludo!

Read More »

Read More »

El Socialismo está EN CONTRA de la Actividad Empresarial

Link de la charla completa - &t=5905s

Te animo a suscribirte a mi canal y te invito a seguirme en mis redes sociales:

☑ Twitter - https://twitter.com/dlacalle

☑ Instagram - https://www.instagram.com/lacalledanie

☑ Facebook - https://www.facebook.com/dlacalle

☑ Página web - https://www.dlacalle.com

☑ Mis libros en Amazon - https://www.amazon.es/Daniel-Lacalle/e/B00P2I78OG

¡Un saludo!

Read More »

Read More »

A la IZQUIERDA No le importa el PROGRESO

Link de la charla completa - &t=5905s

Te animo a suscribirte a mi canal y te invito a seguirme en mis redes sociales:

☑ Twitter - https://twitter.com/dlacalle

☑ Instagram - https://www.instagram.com/lacalledanie

☑ Facebook - https://www.facebook.com/dlacalle

☑ Página web - https://www.dlacalle.com

☑ Mis libros en Amazon - https://www.amazon.es/Daniel-Lacalle/e/B00P2I78OG

¡Un saludo!

Read More »

Read More »

Thüringen Eklat: Grüne laufen Sturm!

Die Grünen laufen Sturm, weil ein CDU Landrat mit AfD Wahlprogramm sich ans Gesetz hält!

Meine Depotempfehlung 3,9 % Tagesgeld-Zinsen und 5,3% für Einlagen in USD

https://link.aktienmitkopf.de/Depot*

? Tracke deine Dividenden mit dieser App http://myfinances24.de/mydividends24

? Mein Buch! Der Rationale Kapitalist ►►http://amzn.to/2kludNT

?JETZT auch als Hörbuch bei Audible ►► https://goo.gl/iWvTRR

Haftungsausschluss: Anlagen in Wertpapieren und...

Read More »

Read More »

Shamrock

SHAMROCK rounds! ? Celebrate the Irish holiday by adding these festive rounds to your silver stack.

CALL OR GO ONLINE TO ORDER! https://www.moneymetals.com/silver-irish-shamrock-1-troy-ounce-9999-fine/198 ✨

#round #silver #silverstacking #bar #coin #money #metals #moneymetals #investment #financialfreedom #beyourownbank #shamrock #clover #stpatty #st #patrick #stpatricks #marchmadness

? SUBSCRIBE TO MONEY METALS EXCHANGE ON YOUTUBE

➤...

Read More »

Read More »

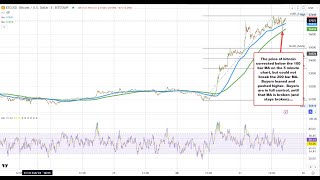

AUDUSD consolidates within a narrow range with key technical targets. Market waits.

The AUDUSD consolidates above the 100 bar MA on the 4-hour chart and key swing area, and below the 200-day MA and 200 bar MA on 4-hour chart.

Read More »

Read More »

The Heroic Julian Assange

Julian Assange may soon be extradited to the United States, where he will face prosecution that could end in his imprisonment for life. He is in fact a hero, who should be honored rather than punished. American foreign policy is based on the pursuit of global hegemony and to achieve this goal, our “leaders” engage in torture and murder. Assange brought these crimes to public attention through his publication of the “WikiLeaks” documents he got from...

Read More »

Read More »

How State-Funding of Activist Groups Makes Britain Less Safe

Recently in the United Kingdom, an asylum claimant named Abdul Ezedi threw a corrosive substance over a woman, leaving her with life-changing injuries. Ezedi, who had arrived illegally in the back of a lorry in 2016, had been denied asylum twice. In 2018, he was given only a suspended sentence after being convicted of sexual assault. Finally, in 2020 he was granted asylum to protect him from prosecution after he claimed to have converted to...

Read More »

Read More »

After Two Years, Neocons Desperate For More War in Ukraine

In a recent CNN interview, the normally very confident US Under Secretary of State Victoria Nuland sounded a little desperate. She was trying to make the case for Congress to pass another $61 billion dollars for the neocons’ proxy war project in Ukraine and she was throwing out the old slogans that the neocons use when they want funding for their latest war.Asked by CNN whether she believes that Congress will eventually pass the bill, Nuland...

Read More »

Read More »

Batalla Cultural SIN COMPLEJOS, Mi Charla con Esperanza Aguirre

Te animo a suscribirte a mi canal y te invito a seguirme en mis redes sociales:

☑ Twitter - https://twitter.com/dlacalle

☑ Instagram - https://www.instagram.com/lacalledanie

☑ Facebook - https://www.facebook.com/dlacalle

☑ Página web - https://www.dlacalle.com

☑ Mis libros en Amazon - https://www.amazon.es/Daniel-Lacalle/e/B00P2I78OG

¡Un saludo!

Read More »

Read More »

The Green Energy Legislation Debate – Mike Mauceli, Daniel Turner

In this episode of the Energy Show with REI Energy, Mike Mauceli and his guest Daniel Turner, founder and CEO of Power the Future, discuss the opaque nature of policy-making in the U.S., specifically concerning green energy.

Turner believes that the Green New Deal policy is misleading and causing harm to the energy industry and the American economy. They highlight the hypocrisy of key figures promoting green energy who do not live sustainably...

Read More »

Read More »

Laden fliegt auseinander, Kontrollverlust & Nawalny – Ernst Wolff im Gespräch mit Krissy Rieger

Laden fliegt auseinander, Kontrollverlust & Nawalny - Ernst Wolff im Gespräch mit Krissy Rieger

Kostenlose unzensierte News-Beiträge:

►► https://www.meinopinio.com/blog

Mehr zu Krissy Rieger:

Finanzkanal ►► / @chrisrieger91

Zweitkanal ►► / @krissy.rieger2

Instagram ►► https://www.instagram.com/krissy.rieg...

Twitter ►► https://twitter.com/krissyrieger?lang=de

Telegram ►► https://t.me/KrissyRieger

____________________

? Alle Termine...

Read More »

Read More »

Haben wir dir jahrelang den falschen ETF empfohlen? ? #snp500

Haben wir dir jahrelang den falschen ETF empfohlen? ? #snp500

? Wenn man den S&P 500 Index mit dem MSCI World vergleicht, hat dieser in der Vergangenheit viel besser abgeschnitten. Und schaut man sich US-amerikanische Finfluencer an, werden dort auch nur ETFs auf den S&P 500 und nicht den MSCI World empfohlen.

? 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als...

Read More »

Read More »

Musst Du 2024 den ETF wechseln? | Geld ganz einfach

Depot-Vergleich 2024: Die besten Broker & Aktiendepots

ING* ► https://www.finanztip.de/link/ing-depot-yt/yt_jvdDBXsNfw4

Finanzen.net Zero* ► https://www.finanztip.de/link/finanzennetzero-depot-yt/yt_jvdDBXsNfw4

Trade Republic* ► https://www.finanztip.de/link/traderepublic-depot-yt/yt_jvdDBXsNfw4

Scalable Capital* ► https://www.finanztip.de/link/scalablecapital-depot-yt/yt_jvdDBXsNfw4

Justtrade

Traders Place* ►...

Read More »

Read More »

Polyphasischer Schlaf – Schlafen Sie stückweise und gewinnen Sie an Lebenszeit

✘ Werbung:

Mein Buch Katastrophenzyklen ► https://amazon.de/dp/B0C2SG8JGH/

Kunden werben Tesla-Kunden ► http://ts.la/theresia5687

Mein Buch Allgemeinbildung ► https://amazon.de/dp/B09RFZH4W1/

-

Alle Welt betet uns vor, dass wir 8 Stunden am Tag am Stück schlafen sollen. Dieser #Schlaf wäre das Beste für den Menschen. Zahlreiche Menschen machen das nicht. Sie schlafen in der Nacht deutlich weniger und holen den verpassten Schlaf mit einem...

Read More »

Read More »

Japan: X Millionen mit japanischen Aktien verdient / #Measured Move

Mit welchem Trade habe ich 3 Millionen verdient? Wie ich diese Chance gefunden habe und wie du selbst auch solche Chancen finden und ergreifen kannst, erkläre ich dir im heutigen Video.

Vereinbare jetzt dein kostenfreies Beratungsgespräch:

https://jensrabe.de/Q1Termin24

Tägliche Updates ab sofort auf:

https://aktienkannjeder.de

Schau auf meinem Instagram-Account vorbei:

@jensrabe_official

https://www.instagram.com/jensrabe_official

ALLE Bücher...

Read More »

Read More »

Besser schlafen mit Notgroschen: Deine wichtigste Sicherheitsreserve

Für Emil und Xenia ganz klar der wichtigste Sicherheitsbaustein bei ihren Finanzen: Der Notgroschen auf dem Tagesgeld.

Read More »

Read More »

NZDUSD traders set up for RBNZ rate decision in the new trading day

The RBNZ will announce their rate decision at 8 PM ET later today. What technical levels are in play through the rate decision?.

Read More »

Read More »

Swiss exports to Russia suspected of evading sanctions

Since the beginning of the Ukraine war, Swiss exports to countries close to Russia have increased significantly – which points to a possible evasion of sanctions.

Read More »

Read More »