Tag Archive: newsletter

UPDATE: EURUSD continues its run to the downside & trades to new lows.Sellers in control.

Sellers force their way below the swing area at 1.0795 and 1.0803 and stay below. Key risk level now and going forward.

Read More »

Read More »

The US broader indices are lower with both the S&P and Nasdaq below MA levels.

What will keep the seller in control in the short term, and what are the next targets that give sellers more control?

Read More »

Read More »

“Desire Paths” and the Problem with Central Planning

I recently attended the Austrian Economics Research Conference, which is held annually at the Mises Institute on the campus of Auburn University. After an inspiring day of presentations, I began my trek back to the Auburn University Hotel. As I made my way down the sidewalk, I found myself walking along a well-trodden dirt path. Soon enough I was back on the sidewalk, and I turned around, quickly realizing I had taken the “wrong” path. The correct...

Read More »

Read More »

Ricarda Lang Eklat auf Pressekonferenz!

Chrupalla zerlegt Ricarda Lang und Phoenix Reporterin spielend!

Depotempfehlung 3,9 % Tagesgeld-Zinsen und 5,3% für Einlagen in USD

https://link.aktienmitkopf.de/Depot *

Originalvideo: &ab_channel=JHT

Bildrechte: By TC2021 - Own work, CC BY-SA 4.0, https://commons.wikimedia.org/w/index.php?curid=106177275

? Tracke deine Dividenden mit dieser App http://myfinances24.de/mydividends24

? Mein Buch! Der Rationale Kapitalist...

Read More »

Read More »

Oh Gold! Why Do They Hate You So?

The mainstream financial media seems to have a particular disdain for gold. Why is that?

In this episode of Money Metals' Midweek Memo, host Mike Maharrey gives some examples of mainstream folks dumping on gold and offers some theories as to why they always seem to think it's time to sell the yellow metal - no matter what.

He also offers a little food for thought for people who think that just because there hasn't been a financial or economic...

Read More »

Read More »

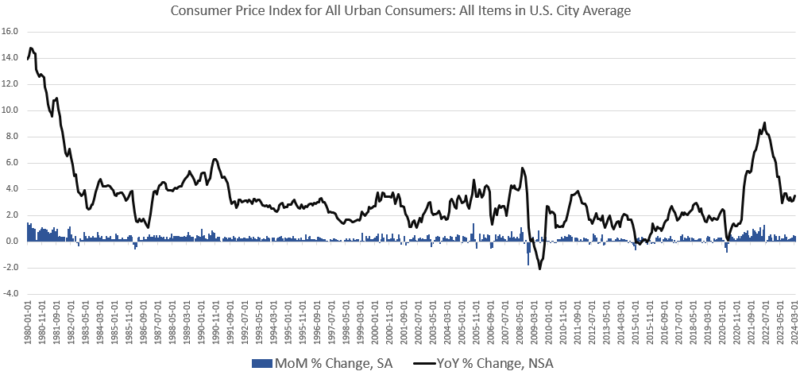

4-10-24 Can Social Security Be Saved?

It's CPI Day (with m/m inflation clocking in with a .4% increase, and a y/y gain to 3.8%, hotter than expected). Sheila Jackson-Lee's science experiment; the NFIB Survey does not bode well for small businesses:Sentiment falls to a new low based on poor sales. There remains a dichotomy between headline economic news and what's happening behind the scenes. Markets break below the 20-DMA, but regain support. Why what really matters is the data the Fed...

Read More »

Read More »

McConnell Cannot Stop the Non-Interventionist Tide

Even Republican stalwarts like current Senate Minority Leader Mitch McConnell are starting to notice that something is shifting in the party. While McConnell announced recently that he would step down as Republican leader in the US Senate, in an interview last week he was adamant that he would continue to serve out his term in the Senate with one purpose in mind: “fighting back against the isolationist movement in my own party.”He sounds...

Read More »

Read More »

Is Gold Warning Us Or Running With The Markets?

Having risen by about 40% since last October, Gold is on a moonshot. Many investment professionals consider gold prices to be a macro barometer, measuring the level of anxiety in the economy, inflation, currency, and geopolitics.

Read More »

Read More »

US CPI, New Security Initiatives with Tokyo and Manila, Bank of Canada Meeting

Overview: The dollar has been confined to narrow ranges ahead of the US CPI report. Given the backup of US rates and the stronger-than-expected jobs growth, the greenback's performance has been unimpressive.

Read More »

Read More »

Wie viel Rente kann man maximal bekommen? #rente

Wie viel Rente kann man maximal bekommen? #rente

? 2015 haben wir es uns zur Mission gemacht, Menschen zu ermutigen, ihre Finanzen in die eigenen Hände zu nehmen. Angefangen als YouTube-Kanal mit Erklärvideos, haben wir uns innerhalb weniger Jahre zur größten Community für finanzielle Selbstentscheider im deutschsprachigen Raum entwickelt.

? Möchtest du deine persönlichen Finanzen in den Griff bekommen? Wir wollen dir ermöglichen, Verantwortung...

Read More »

Read More »

EILT: die letzte Warnung wurde ignoriert (schnell handeln!)

Kostenfreies Video-Training (Durch Trading in 2024 absichern) ? https://oliverklemmtrading.com/casestudy-1?utm_source=youtube&utm_medium=social&utm_campaign=tradingcoacholi&utm_term=morning-news&utm_content=1

Klicke hier, um dich direkt gemeinsam mit Oli unabhängig zu machen ?...

Read More »

Read More »

Invasion Alert

Many Americans care about the dangers of mass immigration. Are they right to be concerned? In what follows, I’ll try to show that they are right. Immigration of elements hostile to American values does indeed pose a grave threat. But, if we are libertarians, don’t we have to defend “open borders”? I will argue that we don’t.One of the most obvious reasons mass immigration is a problem is its immense cost—hundreds of billions of dollars. A post from...

Read More »

Read More »

Marktausblick Mit Stefan Breintner und Markus Koch März 2024

Marketing-Anzeige: #aktien #geldanlage #investieren

Nach wie vor scheinen die Märkte nur eine Richtung zu kennen: Aufwärts. Insbesondere die starke amerikanische Wirtschaft und die Aussicht auf Zinssenkungen zum Sommer regen die Fantasie der Anleger an. Wie es weitergeht, diskutieren Stefan Breintner, DJE-Research Leiter und Wall-Street-Experte @kochwallstreet. Dazu diese und weitere Themen:

✅ Kommen chinesische Aktien wieder?

✅ Sind...

Read More »

Read More »

Maischberger: Hirschhausen verliert jegliche Selbstbeherrschung!

Hirschhausen dreht frei! Wie kommt er zu diesen völlig wirren Gedanken-Experimenten? Es ist mir ein absolutes Rätsel!

Depotempfehlung 3,9 % Tagesgeld-Zinsen und 5,3% für Einlagen in USD

https://link.aktienmitkopf.de/Depot*

Bildrechte: By Sandro Halank, Wikimedia Commons, CC-BY-SA 3.0, CC BY-SA 3.0, https://commons.wikimedia.org/w/index.php?curid=49605610

? Tracke deine Dividenden mit dieser App http://myfinances24.de/mydividends24

? Mein Buch!...

Read More »

Read More »

Biden’s Inflation Narrative Dies as Price Growth Rises to a Seven-Month High

According to the Bureau of Labor Statistics' latest price inflation data, CPI inflation in March rose to a seven-month high, and price inflation hasn't proven nearly as transitory as the regime's economists have long predicted. According to the BLS, Consumer Price Index (CPI) inflation rose 3.5 percent year over year during March, without seasonal adjustment. That’s the thirty-seventh month in a row of inflation well above the Fed’s arbitrary 2...

Read More »

Read More »

Gold hat endgültig die höheren Weihen erhalten

Wie ein mit Helium gefüllter Ballon steigt Gold immer weiter empor. Die üblichen Verdächtigen für den Höhenrausch sind Überschuldung und geopolitische Krisen. Doch kommen unabhängig davon zusätzliche Argumente hinzu, die im Trend weiter für Gold sprechen. Robert Halver mit seiner Einschätzung zu Gold

Read More »

Read More »

Wichtige Morning News mit Oliver Klemm #279

Kostenfreies Video-Training (Durch Trading in 2024 absichern) ? https://oliverklemmtrading.com/casestudy-1?utm_source=youtube&utm_medium=social&utm_campaign=tradingcoacholi&utm_term=morning-news&utm_content=1

Klicke hier, um dich direkt gemeinsam mit Oli unabhängig zu machen ?...

Read More »

Read More »