Tag Archive: New Zealand

FX Daily, October 08: Markets Catch Collective Breath

The S&P 500 and NASDAQ closed at their highest levels in around a month yesterday, recouping Tuesday's presidential tweet-driven drop. We thought the market overreacted to the end of the fiscal talks as many had already recognized that a stimulus agreement was unlikely before the election, but the near round-trip seen in stocks and bonds was surprising.

Read More »

Read More »

FX Daily, August 13: Dollar Remains Offered

The poor price action on Tuesday in the S&P 500 was shrugged off, and new highs for the recovery were made as the record high nears. The dollar, on the other hand, seemed to find plenty of sellers against most of the major currencies. The yen was a notable exception.

Read More »

Read More »

FX Daily, May 14: Risk Appetites Wane

Overview: Risk appetites have been gradually waning this week. US equity losses mounted yesterday after Tuesday's late sell-off. Asia Pacific equities were off, with many seeing at least 1.5% drops. Europe's Dow Jones Stoxx 600 is off a little more to double this week's decline and leaves it in a position to be the biggest drop since panicked days in mid-March.

Read More »

Read More »

FX Daily, May 13: Will Powell have any more Luck Pushing against Negative Rate Expectations in the US?

Overview: Another late sell-off in US shares, this one perhaps related to the sobering assessment by the leading medical adviser for the Trump Administration about the risks of opening too early, failed to deter investors in the Asia Pacific region. Although Japanese shares slipped, most other markets rose. India led the way (~2%) after a fiscal stimulus program was announced.

Read More »

Read More »

FX Daily, March 23: Greenback Demand Not Satisfied by Swap Lines

Overview: In HG Wells' "War of the Worlds," the common cold repelled a Martian invasion. Now, a novel coronavirus is disrupting everything and everywhere. Global equities continue to get hammered, though the apparent relative resilience of Japan may have spurred some buying of Japanese equities.

Read More »

Read More »

FX Daily, December 11: Sterling Holds Firm Despite Tighter Poll

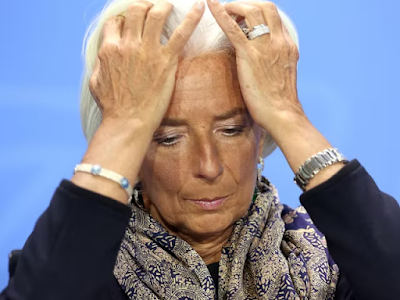

Overview: The capital markets continue to tread water as investors await this week's key events. The first, the FOMC meeting concludes later today. Tomorrow features the UK election, where the race appears to have tightened, and Lagarde's first ECB meeting at the helm. Global equities continue consolidating the recent gains. Asia Pacific equity markets were mostly higher.

Read More »

Read More »

FX Daily, November 13: Investors Temper Euphoria

Overview: The recent rise in equity markets and backing up in yields spurred many observers to upgrade their macroeconomic outlooks rather than the other way around. Yet we continue to see may worrisome signs. It is not just trade, though, of course, that is part of it. Sentiment itself is fragile and will likely follow prices.

Read More »

Read More »

Dollar Mixed on Central Bank Thursday

As expected, the Fed cut rates by 25 bp; the dollar firmed after the decision but has since given back some gains. During the North American session, there will be a fair amount of US data. BOE is expected to keep rates steady; UK reported August retail sales. SNB and BOJ kept rates steady, as expected; Norges Bank unexpectedly hiked 25 bp.

Read More »

Read More »

FX Daily, April 17: Veracity of Chinese Data Questioned, but Lifts Sentiment Nevertheless

The veracity of Chinese data will be questioned by economists, but today's upbeat reports round out a picture that began with stronger exports and a surge in lending. Chinese officials, we argue, had a "Draghi moment" and decided to do "whatever it takes" to strengthen the economy in the face of US tariffs and during the 70th anniversary of the Revolution.

Read More »

Read More »

If Bitcoin Is A Bubble…

Our earlier articles on bitcoin discuss the crypto asset as a currency and a commodity. Both papers focused on the consequences of bitcoin’s defining feature: the asymptotic supply limit of 21 million coins. This gives it an unusual juxtaposition of demand uncertainty and supply certainty (as well as inelasticity). As a currency, it gives rise to a tension between its use as a store of value and as medium of exchange.

Read More »

Read More »

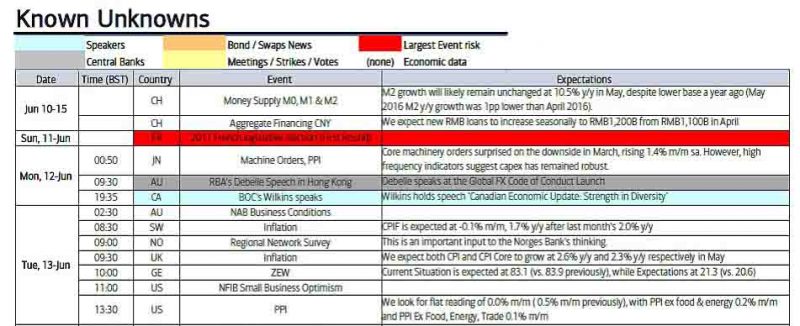

Key Events In The Coming Busy Week: Fed, BOJ, BOE, SNB, US Inflation And Retail Sales

After a tumultous week in the world of politics, with non-stop Trump drama in the US, a disastrous for Theresa May general election in the UK, and pro-establishment results in France and Italy, this is shaping up as another busy week ahead with multiple CB meetings, a full data calendar and even another important Eurogroup meeting for Greece.

Read More »

Read More »

Money, Markets, & Mayhem – What To Expect In The Year Ahead

If you thought 2016 was full of market maelstroms and geopolitical gotchas, 2017's 'known unknowns' suggest a year of more mayhem awaits... Here's a selection of key events in the year ahead (and links to Bloomberg's quick-takes on each).

Read More »

Read More »

Negative and the War On Cash, Part 2: “Closing The Escape Routes”

History teaches us that central authorities dislike escape routes, at least for the majority, and are therefore prone to closing them, so that control of a limited money supply can remain in the hands of the very few. In the 1930s, gold was the escape route, so gold was confiscated. As Alan Greenspan wrote in 1966:

Read More »

Read More »

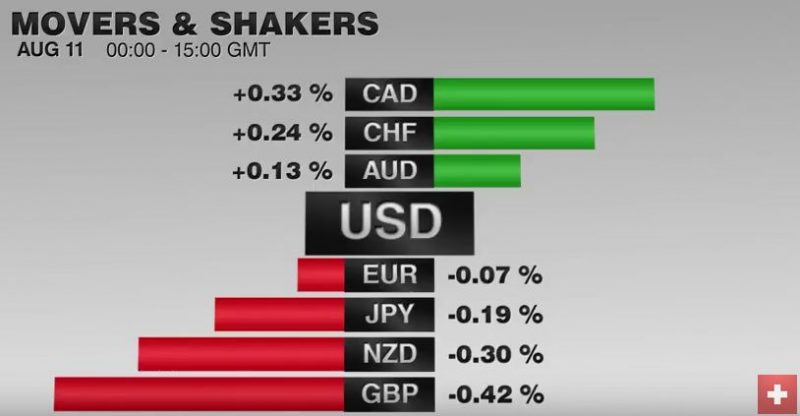

FX Daily, August 11: Sterling Struggles to Find a Bid, While RBNZ Can’t Knock Kiwi Down

Once again, EUR/CHF reverses in the middle of the week. A part from technical reasons, the weak French CPI (+0.4% YoY) and Italian CPI (-0.2% YoY) exercised downwards pressure on the euro. The US dollar has found steadier footing today after trading heavily yesterday. There are two main themes. The first is sterling’s heavy tone.

Read More »

Read More »

Global Peace Index: Only 10 countries not at war (among them Switzerland)

The world is becoming a more dangerous place and there are now just 10 countries which can be considered completely free from conflict, according to authors of the 10th annual Global Peace Index, among them Switzerland.

Read More »

Read More »

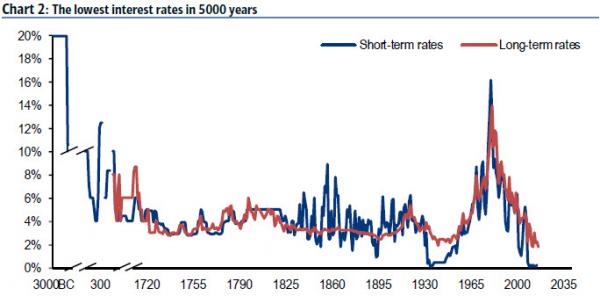

Visualizing “The 5000 Year Long Run” In 18 Stunning Charts

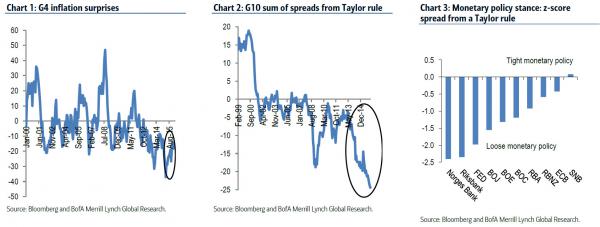

In the long run, as someone once said, we are all dead, but in the meantime, as BofAML's Michael Hartnett provides a stunning tour de force of the last 5000 years illustrates long-run trends in the return, volatility, valuation & ownership of financi...

Read More »

Read More »

Bank Of America Reveals “The Next Big Trade”

Markets have stopped focusing on what central banks are doing and are "positioning for what they believe central banks may or may not do," according to BofA's Athanasios Vamvakidis as he tells FX traders to "prepare to fight the central banks," as th...

Read More »

Read More »