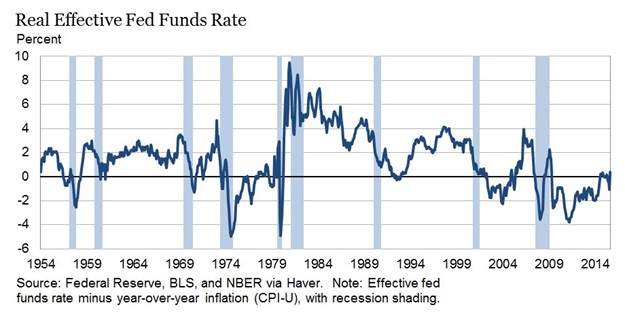

The Inflation Illusion We hear more and more talk about the possibility of imposing negative interest rates in the US. In a recent article former Fed chairman Ben Bernanke asks what tools the Fed has left to support the economy and inter alia discu...

Read More »

Tag Archive: negative rates

SNB Monetary Policy Assessment and Critique

We examine the SNB monetary assessment statement of March 17 and the Swiss economy. We explain why negative rates may be a "toothless measure" if a central bank wants to weaken a currency. They have rather an inexpected consequence, they slow down GDP growth, in particular for banks and pension funds.

Read More »

Read More »

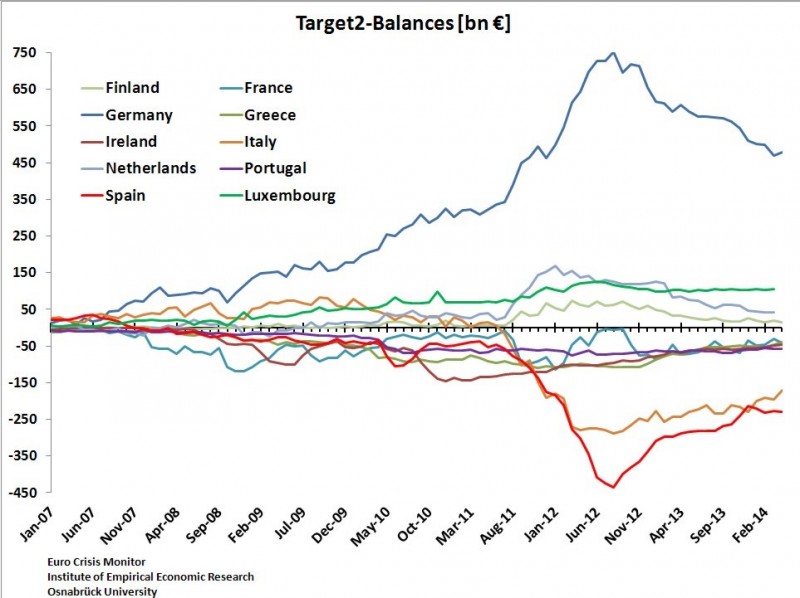

Negative Rates for Bundesbank TARGET2 Surplus?

The ECB surprised with negative rates on excess reserves, on the deposit facility and even on TARGET2. We clarify whether the Bundesbank, as a member of the euro system, must pay negative interest rates on its huge TARGET2 surplus.

Read More »

Read More »

Germany: Last European Country with Lots of Cash Under Matresses

In June 2014, the ECB decided to introduce negative rates on the excess reserves of banks. We explain that German banks had already removed most excess liquidity before the ECB meeting of June 2014, and they will continue to do so. Hence hardly any German bank will pay negative rates after the recent ECB decisions at that meeting.

Read More »

Read More »

The Swiss-tuation: Negative LIBOR

[unable to retrieve full-text content]We're through the looking glass, people! Not only is Abercrombie & Fitch paying people not to wear its clothing, but now some bank somewhere claims to be getting a negative rate to lend Swiss francs in the short term to another bank.

Read More »

Read More »

From One Crisis to Another: One Month T-Bill Yields Go Negative Again

[unable to retrieve full-text content]The one-month T-bill yields zero again, as God intended, and even briefly turned negative this morning, as investors scramble for the safest, most-liquid assets they can find.

Read More »

Read More »