Tag Archive: negative rates

FX Daily, February 05: Position Squaring Weighs on the Dollar Ahead of the Jobs Report

Overview: While equities continue to march higher, the dollar is softer amid position squaring ahead of the US jobs data. Gold has stabilized after yesterday's shellacking. Estimates for US nonfarm payrolls appear to have been creeping higher, encouraged by the ADP, PMI, and weekly initial jobless claims.

Read More »

Read More »

FX Daily, February 4: Negative Rates and the Bank of England: Having Your Cake and Eating it Too

Overview: The euro has been sold through $1.20 for the first time since December 1 and has now given back roughly half of the gains scored from the US election (~$1.16) to the early January high (~$.1.2350). More broadly, the greenback is bid against most of the major currencies, with the Australian dollar more resilient after reported record iron ore exports and all but a handful of emerging market currencies.

Read More »

Read More »

FX Daily, January 13: PBOC Sends Signal as Market Looks Past Impeachment Vote

The US dollar is regaining ground lost in yesterday's setback against the major currencies. Sterling is the notable exception. It was toying with the $1.37 area, perhaps helped by the Governor of the Bank of England signal that there still are hurdles to adopting negative interest rates, which the futures market is still discounting for as soon as midyear.

Read More »

Read More »

FX Daily, May 21: Markets Pull Back after Flirting with Breakouts

Overview: New two and a half month highs in the S&P 500 yesterday failed to have much sway in the Asia Pacific region and Europe today as US-China tensions escalate and profit-taking set in. Perhaps it is a bit of "buy the rumor sell the fact" type of activity on the back of upticks in the preliminary PMI reading and hesitancy about pushing for what appeared to be breakouts.

Read More »

Read More »

FX Daily, May 20: Fed Funds Futures No Longer Imply Negative Rates

Overview: Another late sell-off of US equities, ostensibly on questions over Moderna's progress on a vaccine, failed to deter equity gains in the Asia Pacific region. China was a notable exception, but the MSCI Asia Pacific Index rose for the fourth consecutive session. European shares are little changed, but reflects a split.

Read More »

Read More »

FX Daily, May 18: Yuan Slumps as US-Chinese Tensions Rise

Overview: Despite somber warnings that the US economic recovery can stretch to the end of next year, investors have begun the new week by taking on new risks. Most equity markets in the Asia Pacific region rose, with Australia leading the large bourses with a 1% gain. India was an outlier, suffering a 2.4% loss, and Taiwan's semiconductor sector was hit, and the Taiex fell 0.6%.

Read More »

Read More »

FX Daily, May 14: Risk Appetites Wane

Overview: Risk appetites have been gradually waning this week. US equity losses mounted yesterday after Tuesday's late sell-off. Asia Pacific equities were off, with many seeing at least 1.5% drops. Europe's Dow Jones Stoxx 600 is off a little more to double this week's decline and leaves it in a position to be the biggest drop since panicked days in mid-March.

Read More »

Read More »

FX Daily, May 8: Jobs and Negative Fed Funds Futures

Overview: The S&P 500 closed near its session lows for the third day running yesterday but failed to deter the bulls in Asia-Pacific, where most markets rose by more than 1%. Taiwan, Korea, and Australia lagged a bit though closed higher. Europe's Dow Jones Stoxx 600 is firm, and the modest gains (~0.5%) would be enough to ensure a higher weekly close if it can be maintained.

Read More »

Read More »

FX Daily, March 26: Rumor Bought, Fact Sold

Overview: Speculation that the US Senate would pass the large stimulus bill worth around 10% of US GDP is thought to have fueled a bounce in equities in recent days. The bill was approved and will now go to the House, where a vote is expected tomorrow. If the rumor was bought, the fact has been sold. The first to crack was the Asia Pacific region.

Read More »

Read More »

FX Weekly Preview: China Returns, ECB Record, Fed Minutes and the Week Ahead

Many high-income countries experienced little growth but strong price pressures in the 1970s. Since the mainstream economics said the two were mutually exclusive, a new term had to be created, hence stagflation. Fast forward almost half a century later, and mainstream economists are still having a problem deciphering the linkages between prices and economic activity, such as inflation and employment.

Read More »

Read More »

Fed GDP Projections

“It is not surprising the Fed once again failed to take action as their expectations for economic growth were once again lowered. In fact, as I have noted previously, the Federal Reserve are the worst economic forecasters on the planet.

Read More »

Read More »

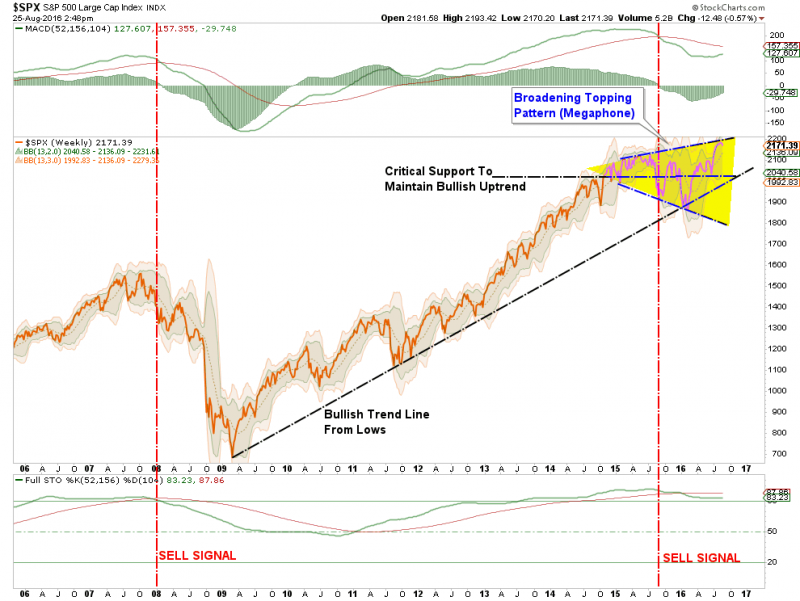

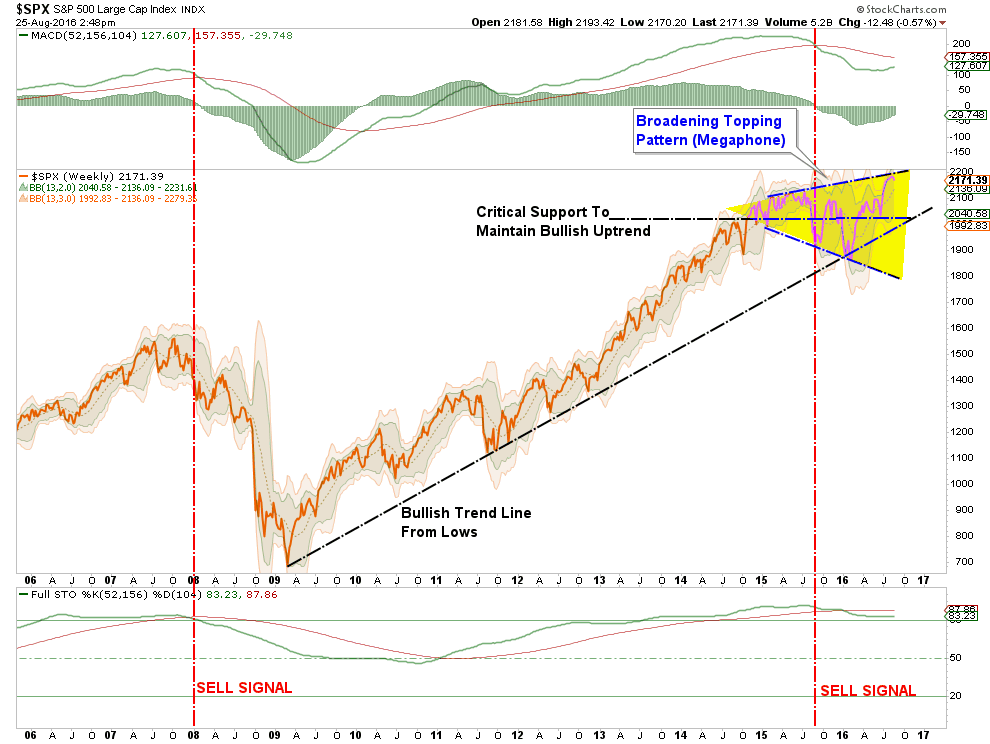

Weekend Reading: Another Fed Stick Save, An Even Bigger Bubble

As I noted on Thursday, the Fed non-announcement gave the bulls a reason to charge back into the markets as “accommodative monetary policy” is once again extended through the end of the year. Of course, it is not surprising the Fed once again failed ...

Read More »

Read More »

Cash in a box catches on as Swiss negative rates bite

It’s a sign the world is getting used to negative interest rates when what once seemed bizarre starts looking like the norm. Consider Switzerland, where more and more companies are taking out insurance policies to protect their cash hoards from theft or damage.

Read More »

Read More »

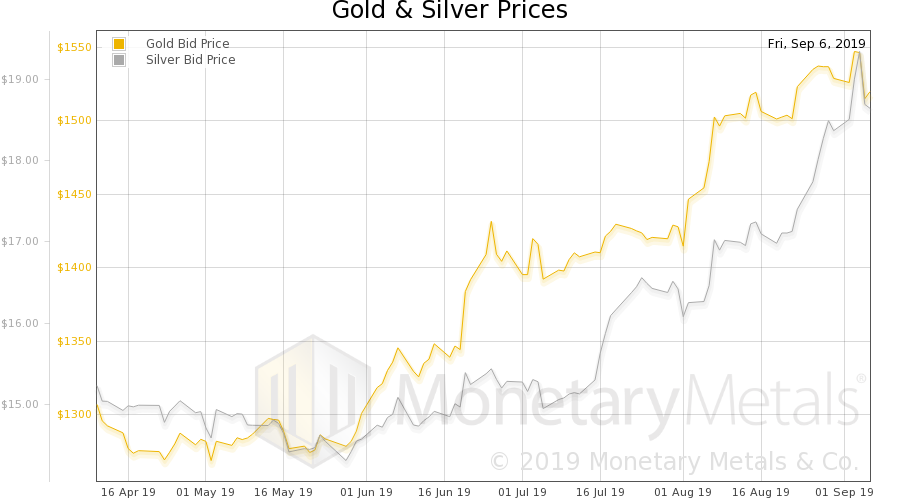

Weekend Reading Negative Rates: The Coin Flip Market

As summer begins to fade, and kids return to school, the focus once again turns to the annual event of Central Bankers in Jackson Hole, Wyoming. However, if you only looked at the market as a gauge as to the excitement of the event, well it must have been one pretty boring after-party.

Read More »

Read More »

Going Dutch? Netherlands Joins The 10Y NIRP Club

For the first time in Dutch history, 10Y government bond yields have turned negative (-0.001% intraday) closing at 0.00%... Joining Switzerland, Japan, Germany, and Denmark... Pushing Global NIRP bonds over the $13 trillion!

Read More »

Read More »

Buffett: I Might Consider Taking Money Out of Banks If They Charge for Deposits

With persistently low interest rates around the globe, billionaire investor Warren Buffett told CNBC on Monday he’d consider taking money out of banks, especially if negative interest rates result in customers being charged to park their money in accounts.

Read More »

Read More »