Tag Archive: Macroview

Business Indicators Present a Contrasting Picture of the Euro Area

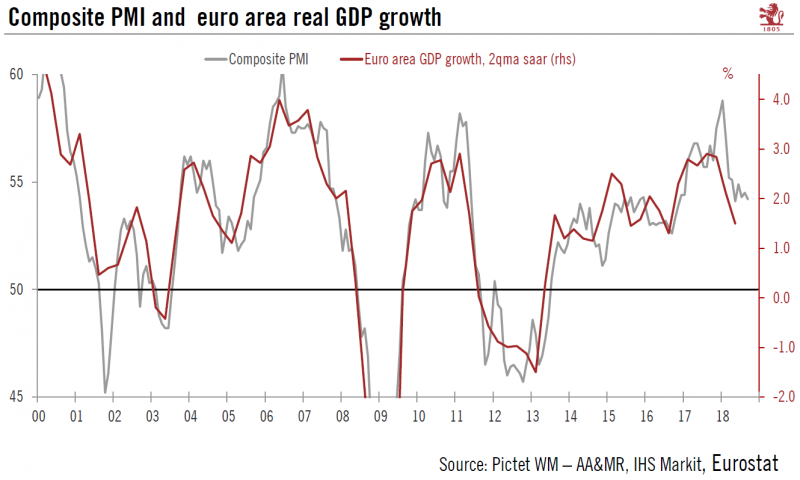

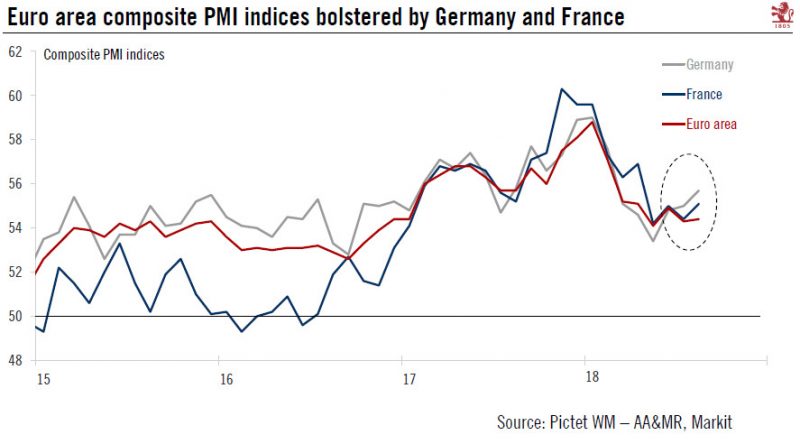

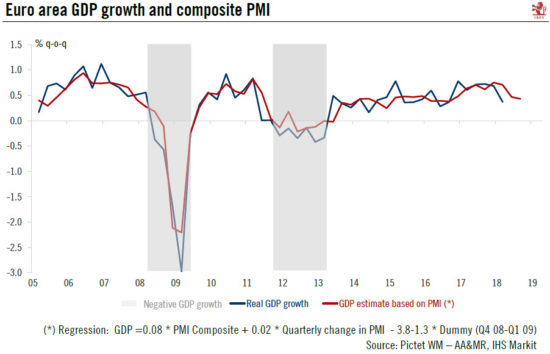

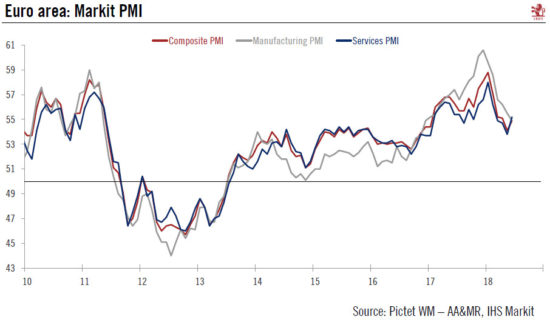

Euro area flash composite PMI dipped slightly to in September and came in slightly below consensus expectations. Activity in services picked up and weakened further in manufacturing, which continued its decline since the start of the year, falling to 53.3 in September from 54.6 in August. New export orders failed to grow for the first time since June 2013.

Read More »

Read More »

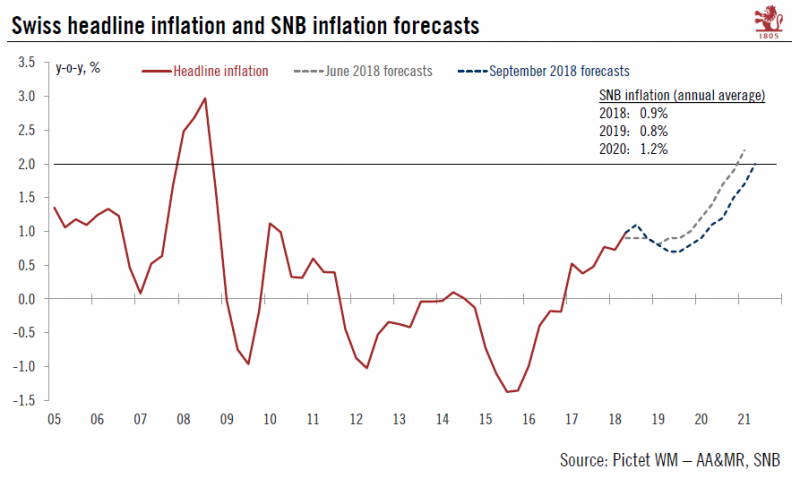

Cut to Swiss inflation forecast

The Swiss National Bank has revised down its medium-term forecast for consumer inflation. We still expect a first SNB rate hike in September 2019. At the end of its quarterly monetary assessment meeting, the Swiss National Bank (SNB) left its main policy rates unchanged.

Read More »

Read More »

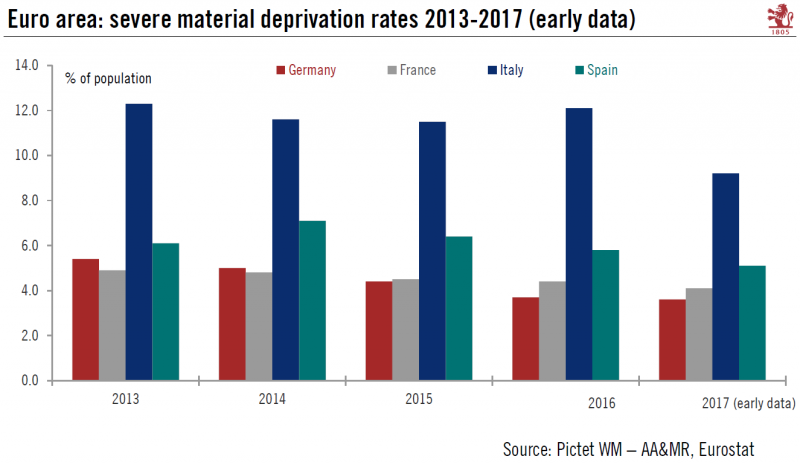

Italian material deprivation rates still the worst among large euro area economies

Latest poverty figures provide government with an argument for fiscal stumulus.Severe material deprivation rates gauge the proportion of people whose living conditions are severely affected by a lack of resources. According to Eurostat, “it represents the proportion of people living in households that cannot afford at least four of the following nine items: mortgage or rent payments, utility bills, hire purchase instalments or other loan payments;...

Read More »

Read More »

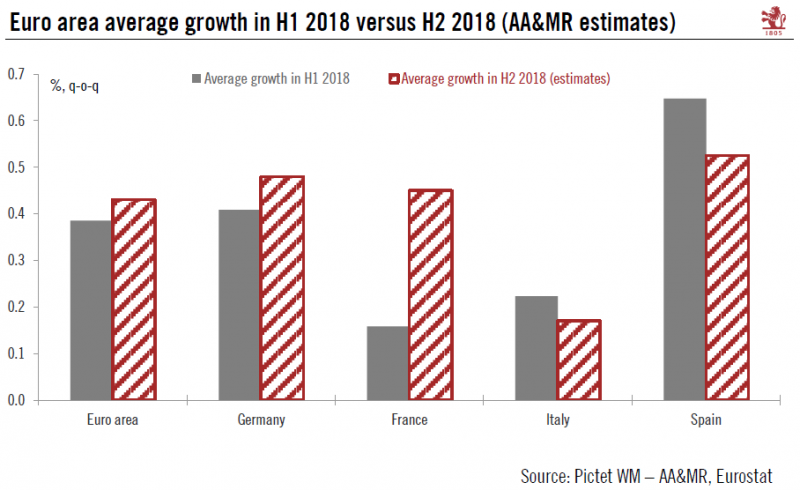

Contrasting Fortunes within the Euro Area

The four biggest euro area economies slowed in H1 2018 due to a number of factors, including weak exports. We expect a rebound in H2—except in Italy, where political uncertainty has been denting business confidence. Forward indicators show that Italy is the only of the four major euro area economies to face weaknesses both in export-led manufacturing and services, due domestic political uncertainties (including the upcoming state budget) as well as...

Read More »

Read More »

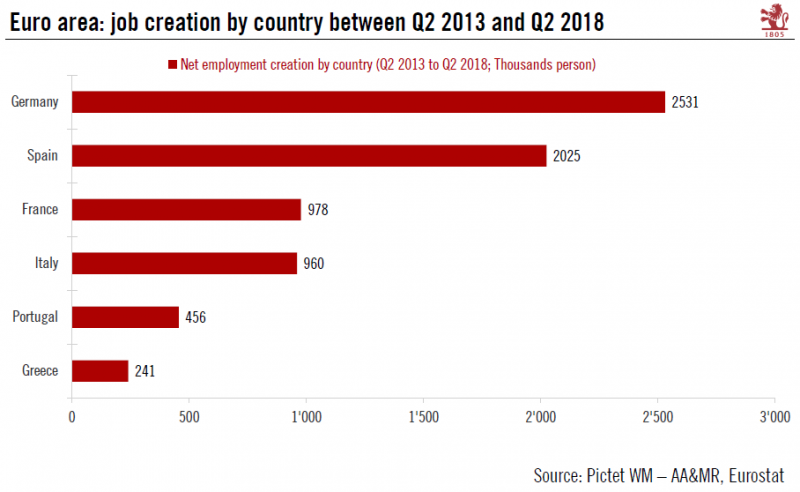

European labour market remains in rude health

But there is room for further improvement.This week euro area employment data confirmed that labour market recovery remains on track. Employment grew at 0.4% q-o-q in Q2 2018, marking the 20th consecutive quarter of expansion. Employment is now 2.4% above its pre-crisis (2008) level. Since Q2 2013, 9.2 million jobs have been created in the euro area.

Read More »

Read More »

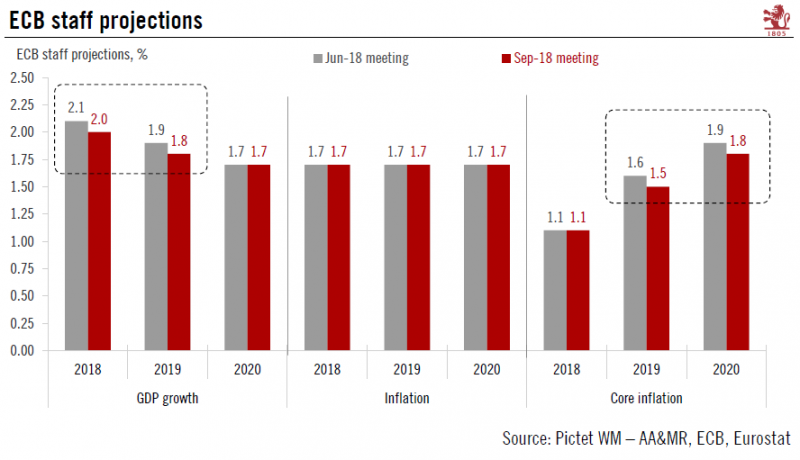

A successful bank should be boring

No changes to the ECB’s monetary stance and policy guidance mean we are holding to our forecasts for quantitative easing and rate hikes.The ECB made no change to its monetary stance and policy guidance at its 13 September meeting. The end of quantitative easing (QE) was confirmed for after December, following a final reduction in the pace of net asset purchases to EUR15bn per month in Q4 2018.Much of the focus was on the updated ECB staff...

Read More »

Read More »

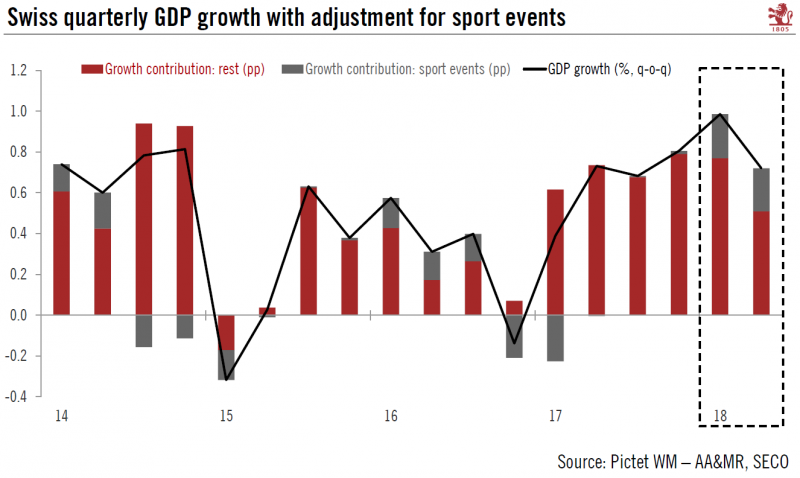

Switzerland Q2 growth numbers are impressive, but details are mixed

Manufacturing and sports events served as boosts to growth, while domestic consumption was a letdown.The latest Swiss GDP figures were impressive. According to the State Secretariat for Economic Affairs’ quarterly estimates, Swiss real GDP grew by 0.7% q-o-q in Q2, slightly above our 0.6% projection and consensus. Average growth in the first half of 2018 was therefore the strongest since 2010.

Read More »

Read More »

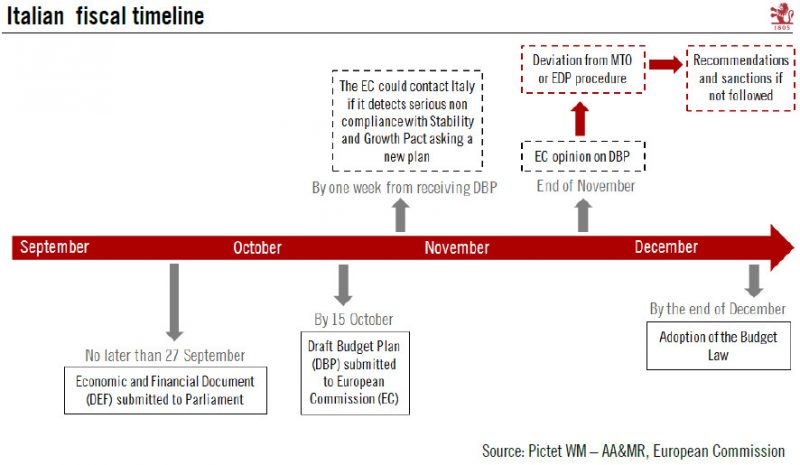

Italian 2019 draft budget: a bumpy road ahead

Tensions between Rome and Brussels could lead to significant market volatility before an agreement is found. September will be a key month for gauging the Italian government’s budgetary plans for 2019. The government has communicated neither a precise timeline for implementing the measures announced in its ‘contract for government’ nor a precise cost analysis for these measures.

Read More »

Read More »

Euro Area PMIs: Still Little Good News Below the Surface

Although euro area flash PMI indices were roughly in line with expectations in August, some details were less positive than the headline numbers, suggesting that downside risks have not yet disappeared. True, at face value, the small rise in the euro area composite PMI index, from 54.3 in July to 54.4 in August, is consistent with resilient real GDP growth, close to the 0.4% q-o-q pace recorded in Q2.

Read More »

Read More »

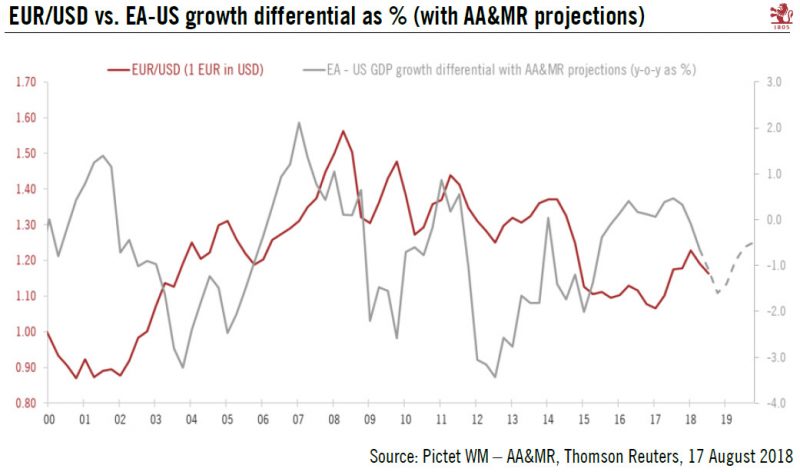

A trying time for euro

The euro has hit new lows against the US dollar. We are revising down our EUR/USD projections for the next few months.The euro broke to the downside from its tight trading range relative to the US dollar since the end of May. These new lows go against our expectations of a gradual appreciation of the single currency relative to the greenback in the second half of the year and indicate that we have underestimated the short-term risks related to the...

Read More »

Read More »

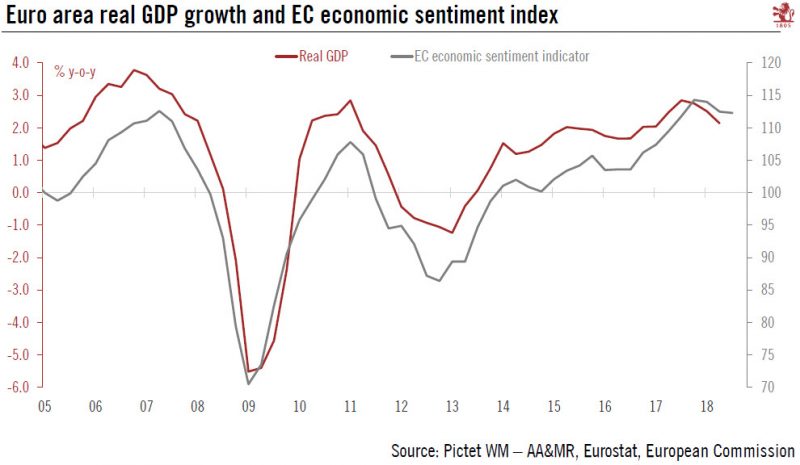

Revising our euro area 2018 GDP growth forecast down

The cut to our growth forecast reflects slippage in euro area data.According to Eurostat’s preliminary flash estimate, euro area real GDP expanded by 0.3% q-o-q in Q2 2018, below consensus expectations. This was the weakest growth in two years and is down slightly from GDP growth of 0.4% q-o-q in Q1.Following today’s GDP growth data and recent economic indicators, we have revised down our GDP growth forecast for 2018.

Read More »

Read More »

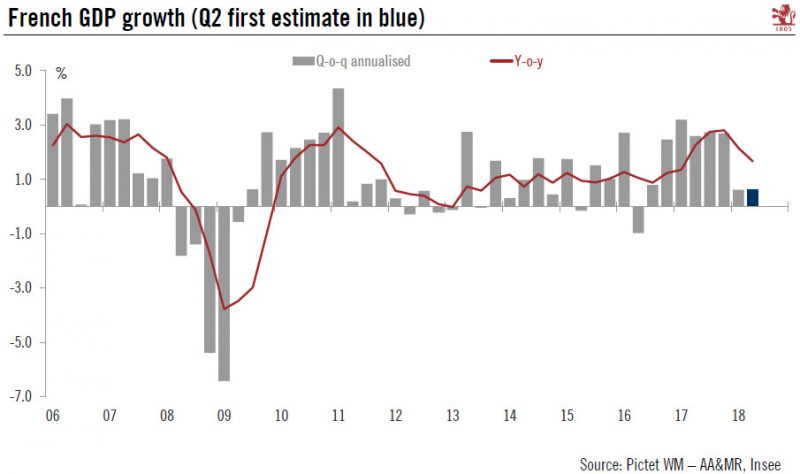

French Q2 GDP growth marks time

A number of one-off factors hurt growth dynamics, but there are many reasons to think that expansion will pick up in the rest of this year. France is the first country in the euro area to publish Q2 GDP figures. The economy expanded by 0.2% q-o-q in Q2, the same pace as the previous quarter and below consensus expectations of 0.3%.

Read More »

Read More »

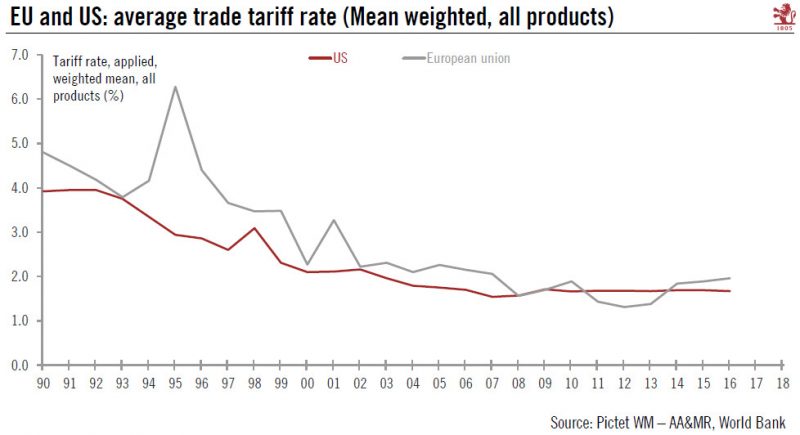

Ceasefire in US/EU tariff dispute

The two sides have agreed to discuss lowering barriers to transatlantic trade, helping to de-escalate tensions. While positive, the US’s dispute with China still needs watching.US President Trump and EU Commission President Juncker this week struck an unexpected deal to de-escalate the trade dispute between the EU and the US.

Read More »

Read More »

Message from the ECB: Enjoy summer!

Today’s Governing Council meeting did little to break the seasonal torpor. We continue to expect its first rate hike to come in September 2019. There was no change in interest rates or forward guidance at today’s ECB Governing Council meeting.

Read More »

Read More »

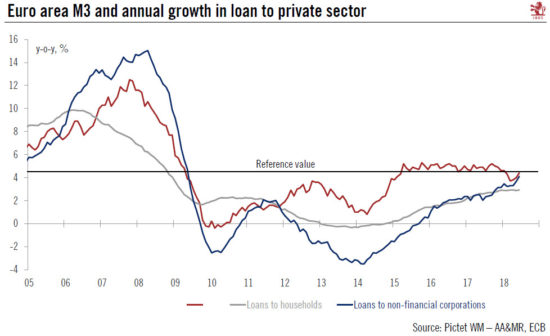

Euro Area Lending Dynamics in Good Shape

The ECB’s M3 and credit report for June just published confirms that lending dynamics continue to be in a good shape in the euro area, boding well for private investment. Bank credit flows to non-financial corporations (adjusted for seasonal effects and securitisations) amounted to €10bn in June, down from €25bn in May.

Read More »

Read More »

Euro area PMIs on the soft side

Markit’s euro area flash PMI surveys for July came in on the soft side. The composite PMI for the euro area fell to 54.3 in July from 54.9 in June, below consensus expectations. At the sector level, the manufacturing PMI index rose marginally, putting a halt to six consecutive months of decline.

Read More »

Read More »

Swiss franc’s defensive features likely to come back into fashion

Despite heightened trade tensions, the Swiss franc has been relatively weak against the US dollar of late. The defensive features of the franc seem to be outweighed by an unsupportive interest rate differential. But the continuing threat of escalation in trade disputes and extreme short speculative positioning on the franc mean the latter has upside potential.

Read More »

Read More »

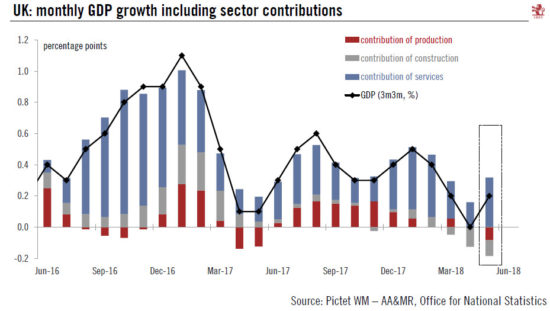

Europe chart of the week – UK GDP growth

Short-term rebound in the UK, driven by services.The Office for National Statistics (ONS) published this week a new rolling monthly estimate of UK GDP. The release pointed to a rebound of growth in Q2 (quarterly data will be published on August 8). According to the ONS, the rolling three-month growth to end-May was 0.2%, compared to 0% in the three months to end-April (see chart below).Looking at the details, the services sector (79% of the...

Read More »

Read More »

Euro area: a slight rebound

The final reading for the euro area composite Purchasing Managers’ Index (PMI) rose from 54.1 in May to 54.9 in June, slightly higher than the initial estimate of 54.8. However, the manufacturing PMI fell further, to an 18-month low of 54.9, due to weakness in France and Germany.

Read More »

Read More »

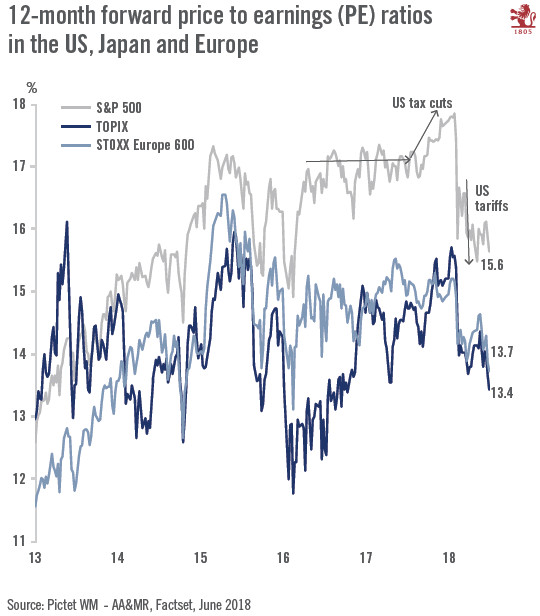

House View, July 2018

On a tactical, rolling three-to-six-month basis, we are tilting away from a bullish to a neutral stance on developed-market equities as trade and political frictions are rising. That said, we remain more upbeat on their prospects after the summer.

Read More »

Read More »