Tag Archive: Macroview

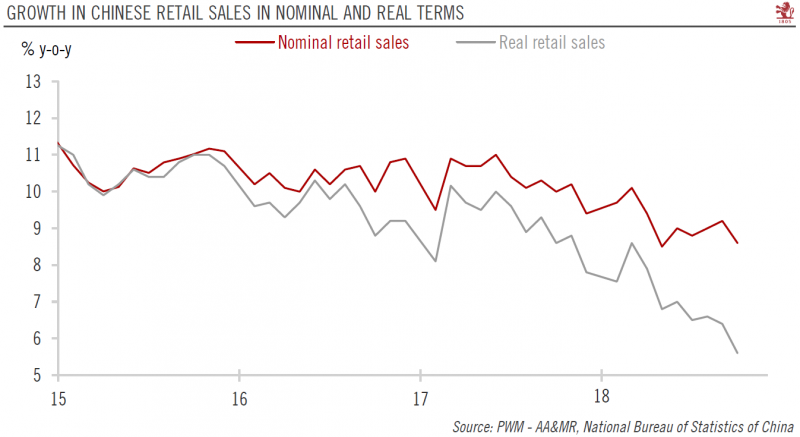

China hard data for October reveals mixed picture

Disappointing consumption numbers point to growth deceleration in early 2019, but government measures beginning to be felt.Hard data out of China for October was mixed. On the positive side, growth in infrastructure picked up, suggesting the government’s fiscal policy easing is taking effect in the real economy. Industrial production numbers stopped declining, and the mining sector has a particularly strong performance.

Read More »

Read More »

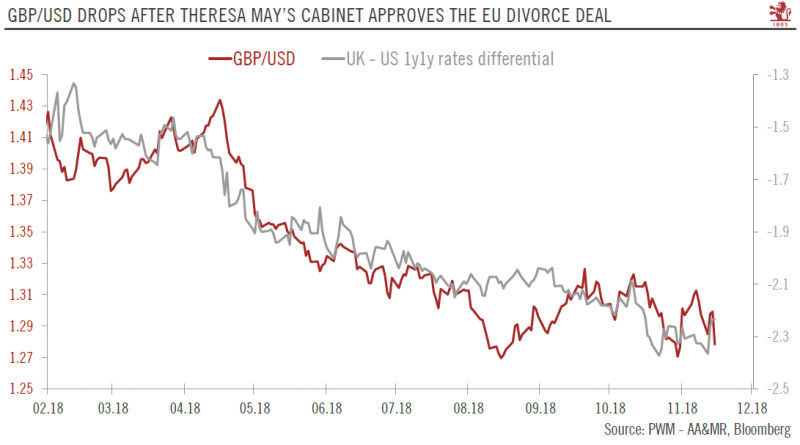

After May’s divorce deal: the road ahead for Brexit

But significant political challenges lie ahead before the 29 March deadline for Brexit. Sterling likely to be in the spotlight for several months.Theresa May’s cabinet has approved her divorce deal with the European Union (EU). A few cabinet secretaries have resigned, including Brexit Secretary Dominic Raab because the deal keeps the UK in a transitory ‘customs union’ with the EU, which in his view continues to give the EU too much influence on UK...

Read More »

Read More »

Italian government sticks to its 2019 deficit plan

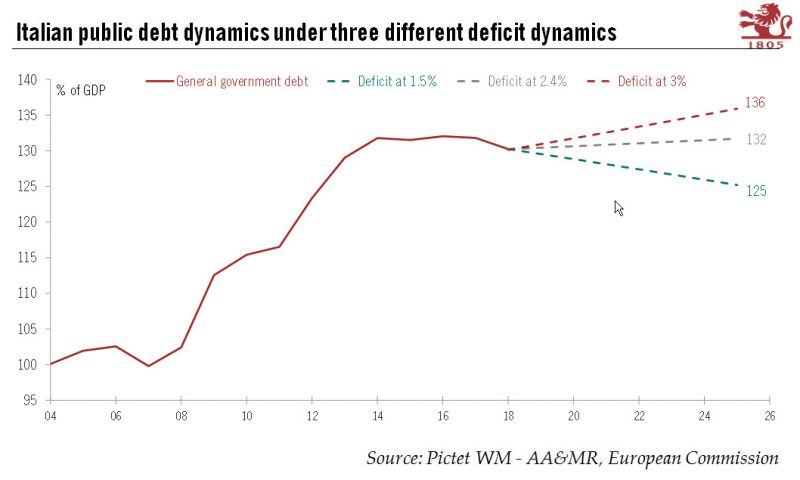

The minor concessions continued in the revised plan presented to the European Commission are unlikely to dissuade Brussels from launching sanctions.In a letter to the European Commission on 13 November, the Italian government confirmed that it would aim for a budget deficit at 2.4% of GDP in 2019 and reasserted its real growth forecast of 1.5% for next year.

Read More »

Read More »

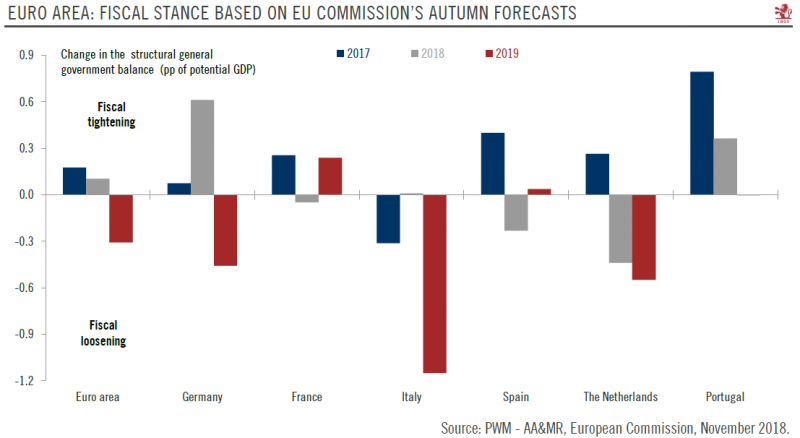

Euro area’s fiscal policy to turn supportive of growth next year

Modest fiscal easing could help counter mounting external risks and slowing growth indicators.Euro area member states have all submitted their 2019 Draft Budgetary Plans (DBP) to the European Commission (EC) by now. These show that, collectively and based on EU Commission’s autumn forecasts, the euro area’s fiscal stance1 will turn supportive in 2019, although it varies significantly from one country to the next.

Read More »

Read More »

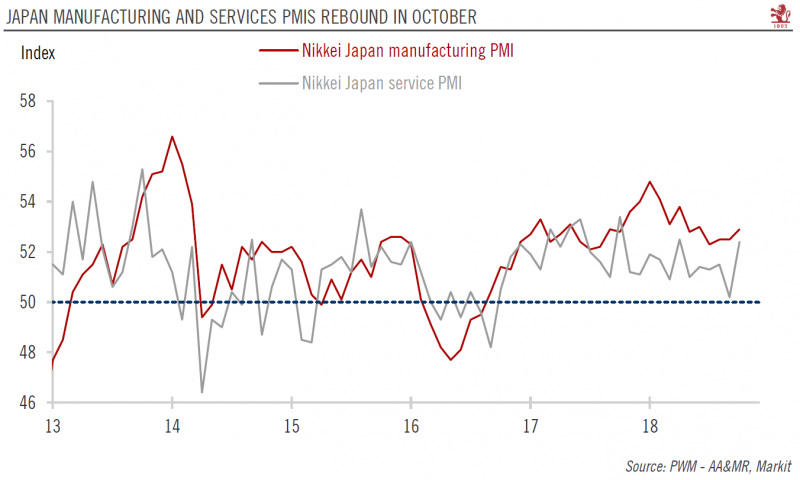

Japan services PMI rebounds strongly in October

The domestic economy is retaining its momentum, but external headwinds are building.The Japanese services purchasing managers index (PMI) rose sharply in October, surging by 2.2 points to 52.4, after a notable drop in September. The manufacturing PMI rose as well, but more moderately, reaching 52.9 in October from 52.4 in September.

Read More »

Read More »

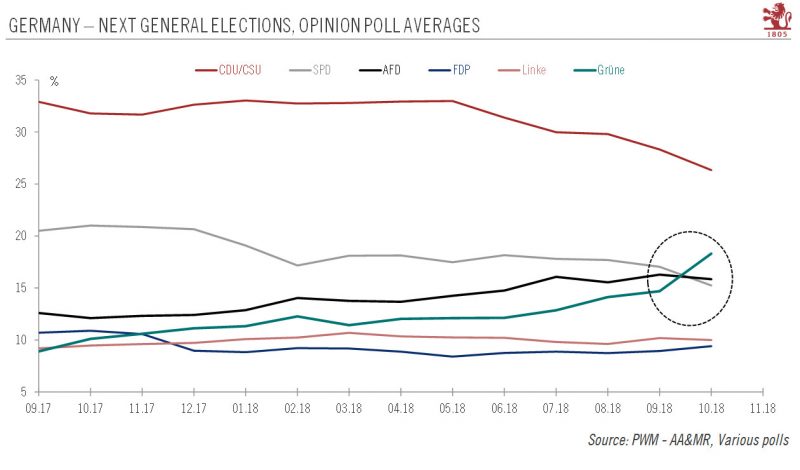

The Beginning of the End for Angela Merkel

As a consequence of the heavy drop of support in recent regional elections, Chancellor Merkel has declared she would not run again for leadership of the CDU at the 6-8 December party convention. Merkel also said she would retire from politics at the end of the current parliament in 2021. It is questionable whether she will get that far, and well before then, the transition to a new leader amid a loss of electoral support for the main centre-right...

Read More »

Read More »

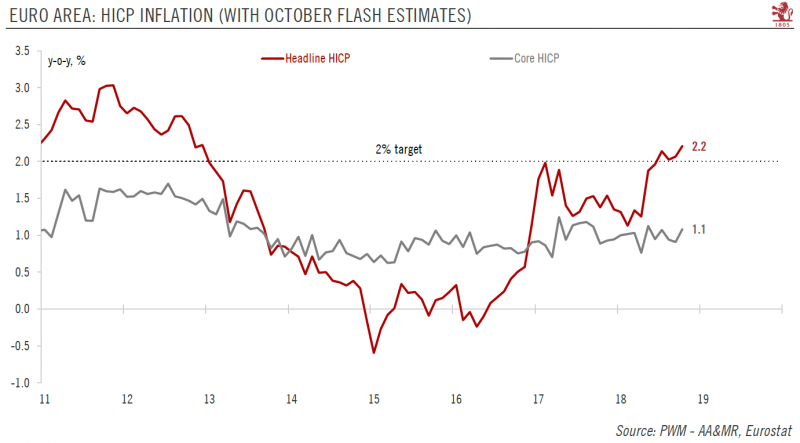

Rebound in inflation data brings some relief to the ECB

Euro area flash HICP rose from 2.1% year on year (y-o-y) in September to 2.2% in October, in line with expectations and the highest level since December 2012. Crucially, core inflation (HICP excluding energy, food, alcohol and tobacco) rebounded from 0.9% to 1.1% in October.

Read More »

Read More »

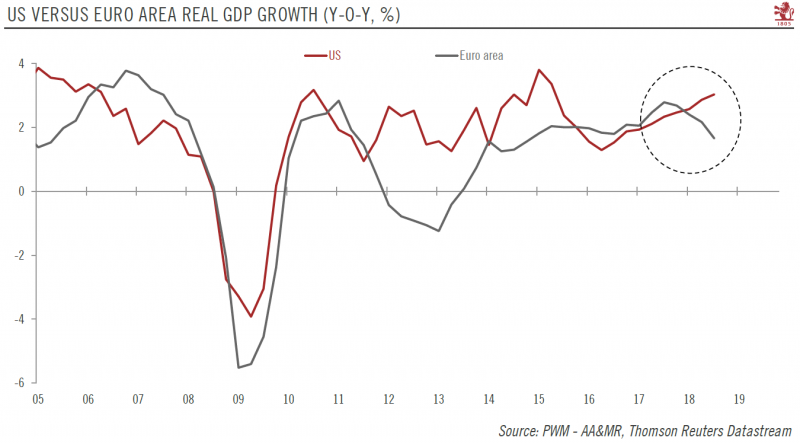

Euro area’s initial growth figures for Q3 prove disappointing

While growth in France rebounded, Italy stalled in Q3. Our full-year forecast for the euro area remains unchanged but is clearly at risk.According to initial estimates, growth in the euro area slowed in Q3 to 0.2% q-o-q (quarter on quarter) from 0.4% in Q2. These latest GDP results were below consensus expectations and our own forecast.

Read More »

Read More »

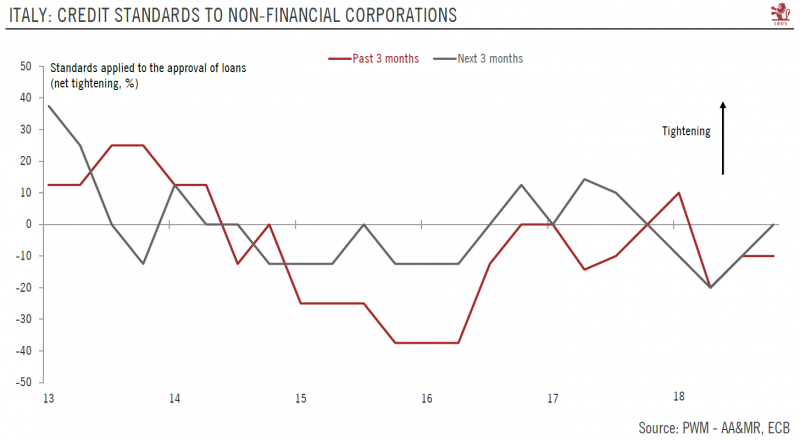

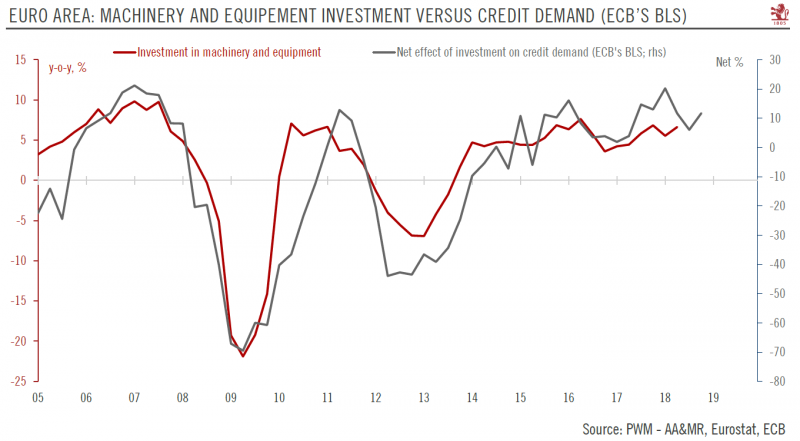

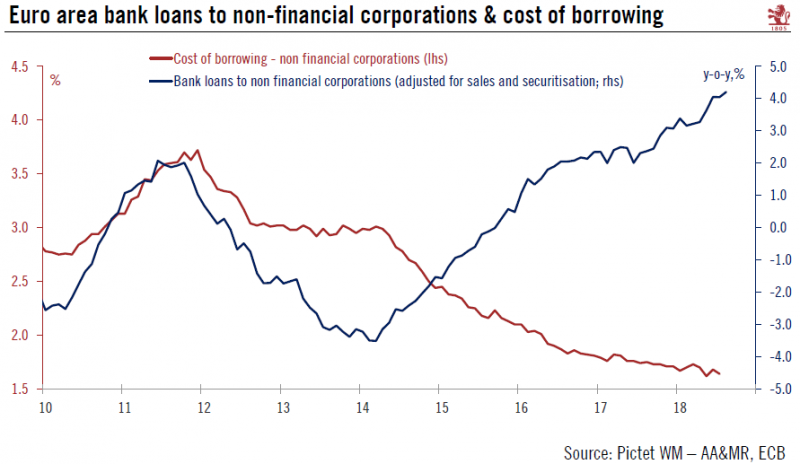

Credit Conditions in the Euro Area Remain Supportive of Investment Recovery

Investment is an important driver of the business cycle and a key determinant of potential growth. In the euro area, total investment makes up about 20% of GDP. Construction, machinery and equipment (including weapons systems), intellectual property rights and agricultural products account, respectively, for 48%, 32%, 18% and 2% of total investment.

Read More »

Read More »

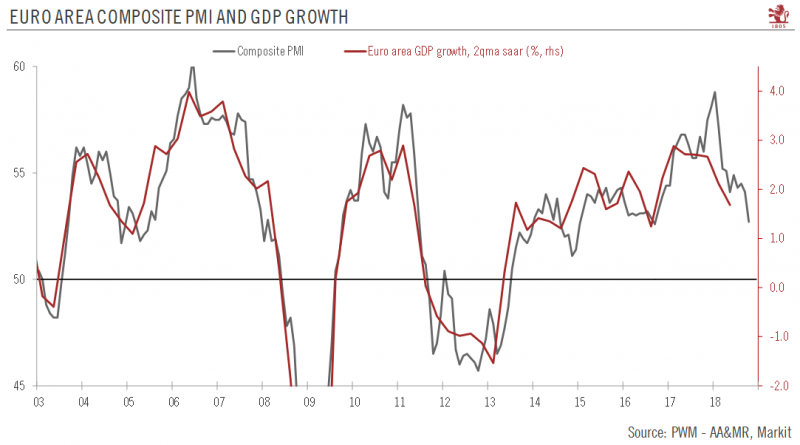

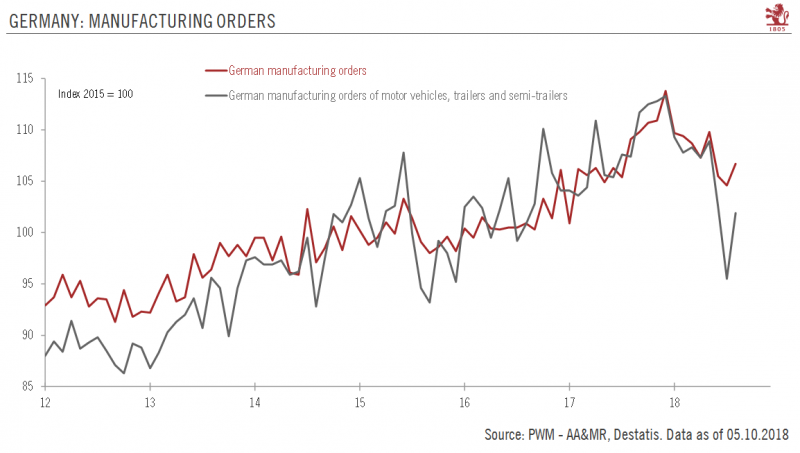

Gloomy Signals for Euro Area Manufacturing

The euro area economy started the fourth quarter on a weak note; the flash composite PMI dipped to 52.7 in October from 54.1 in September. Both manufacturing and services showed a notable loss of momentum. A common feature in France and Germany was the weakness in manufacturing, where both countries posted similar declines.

Read More »

Read More »

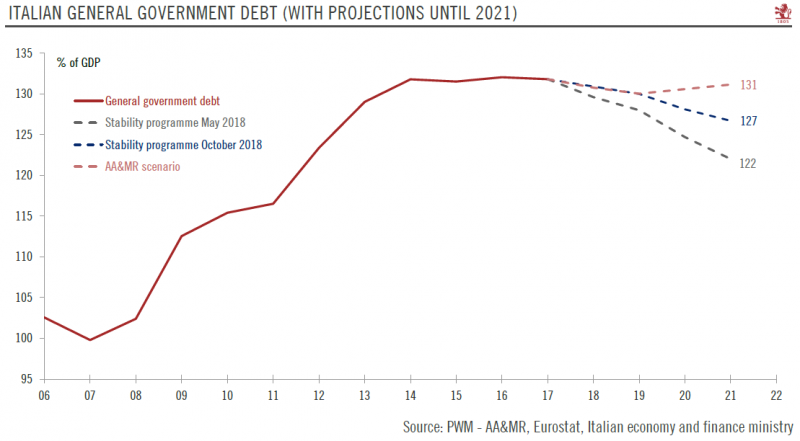

Bumpy Road Ahead for Italian Budget

Rome’s budget plans put it on a collision course with the European Commission. The Italian government has submitted its 2019 draft budget plan (DBP) to the European Commission. The proposed DBP is not in line with European Union rules and sets the government on a collision course with the European authorities.

Read More »

Read More »

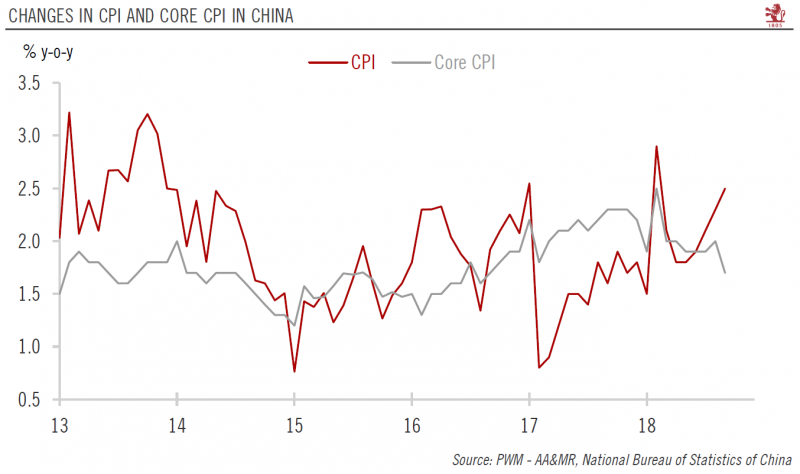

Inflation Environment remains Benign in China

The headline consumer price index (CPI) in China picked up slightly in September, rising by 2.5% year-over-year (y-o-y) compared with 2.3% in August, driven by higher food price and fuel prices. Excluding food and energy, core inflation in China actually eased to 1.7% y-o-y in September from 2.0% in August.

Read More »

Read More »

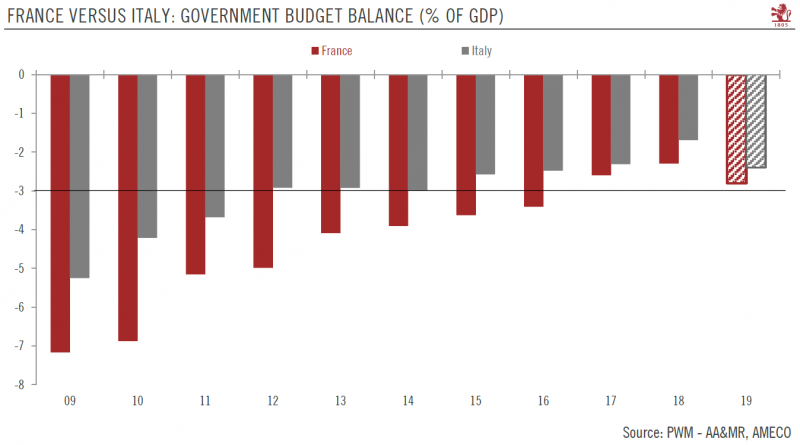

Devil is in the details: Italian and French deficits are not quite comparable

Italy’s structural weakness explain higher level of concern around its deficit target.Each EU member state is currently preparing 2019 budget plans for formal submission to the European Commission (EC) before mid- October. Among them, France and Italy’s budget plans have been raising eyebrows. Why is the EC concerned about Italy’s proposed 2.4% GDP deficit target for 2019 and not France’s target of 2.8%?

Read More »

Read More »

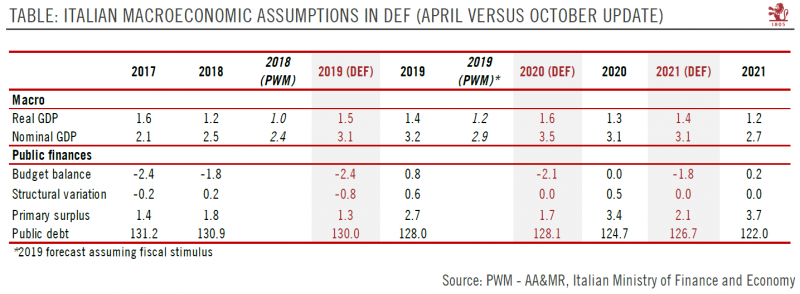

Squaring off over the Italian budget

The Italian government’s budget plans set it on a collision course with the European Commission. The road to some kind of agreement is likely to be long and bumpy. The Italian government has confirmed its deficit target at 2.4% of GDP for 2019. This represents significant slippage from a previous budget deficit target of 0.8% in 2019.

Read More »

Read More »

German September PMIs surprisingly weak

Recent German soft and hard data in the manufacturing sector has been surprisingly weak. Data released today showed that the final manufacturing PMI fell to 53.7 in September, from 55.9 in August. Factory orders rose by 2.0% month-on-month (m-o-m) in August, having contracted for six out of the seven previous months.

Read More »

Read More »

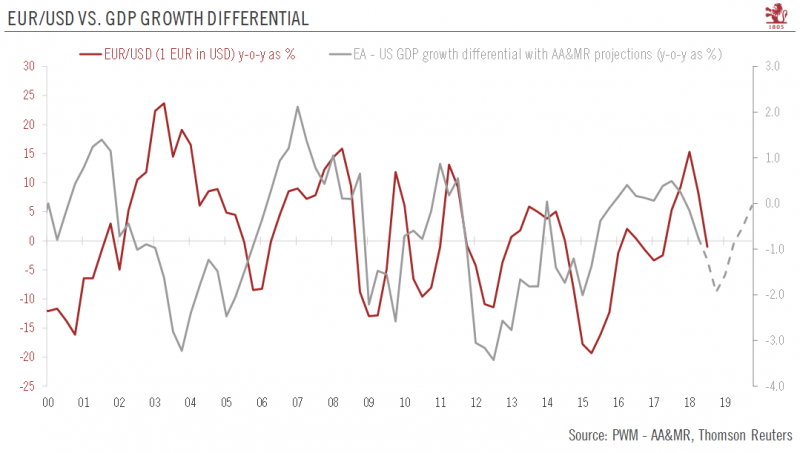

Further consolidation of EUR/USD rate likely

Short-term noise means we are neutral on the euro over the next three months, but see potential for its gradual appreciation against the dollar thereafterWe have long argued that growth and interest rate differentials are two key components for the direction of the US dollar. Both these drivers should continue to support the dollar over the short term.

Read More »

Read More »

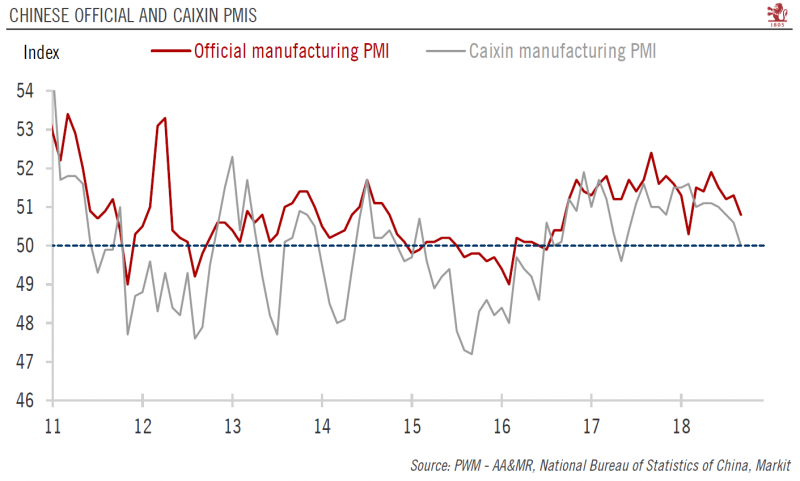

Chinese PMI data points to further growth moderation

More policy support is expected, and may lead to slight rebound in Q4.China’s manufacturing PMIs softened further in September, indicating that growth momentum is likely continued to moderate in Q3 and that the weakness may extend into Q4.In response to the weakening growth momentum, especially in the context of escalating trade tensions with the US, the Chinese government has turned to policy easing since June.

Read More »

Read More »

Italy tests the EU’s tolerance

The populist government’s plans to increase the deficit could set it on a collision course with Brussels. We remain bearish Italian bonds and euro peripheral bonds in general.Leaders of Italy’s coalition government and the finance minister yesterday agreed on a 2.4% GDP deficit target. The new target is higher than our expectation of a deficit “above but close to 2.0%” in 2019.

Read More »

Read More »

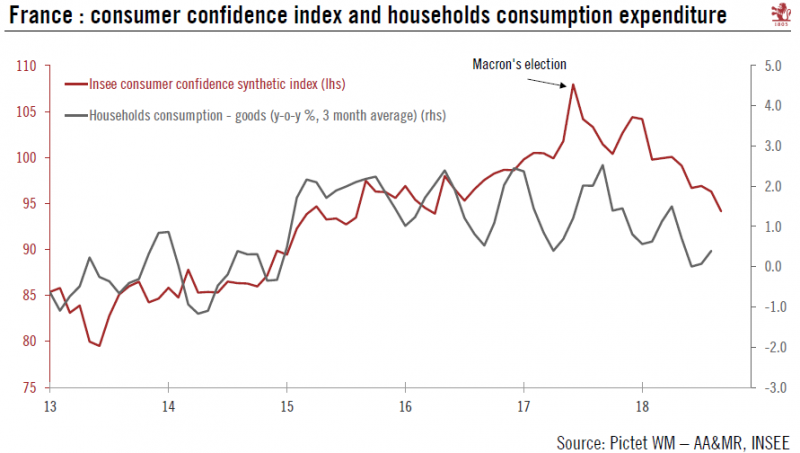

A bit too early to be worried about French consumers

Despite the recent fall in French consumer confidence, spending should pick up in the second half of the year. The French economy disappointed in the first half of this year. While there was a widespread ‘soft patch’ in the euro area, the source and size of the slowdown in France stands out. The real GDP growth rate fell by 0.5 points, much more than the rest of the euro area. Moreover, while the slowdown in the other countries was mainly due to...

Read More »

Read More »

Credit Growth Remains Buoyant in the Euro Area

Financial conditions remain supportive and are not expected to tighten much in the coming months. Lending to non-financial corporations in the euro grew by an annual 4.2% in August, its fastest rate since April 2009. Forward-looking indicators suggest that euro area credit growth should remain strong over the coming months.

Read More »

Read More »