Tag Archive: Macroview

Gold to consolidate before further leg up

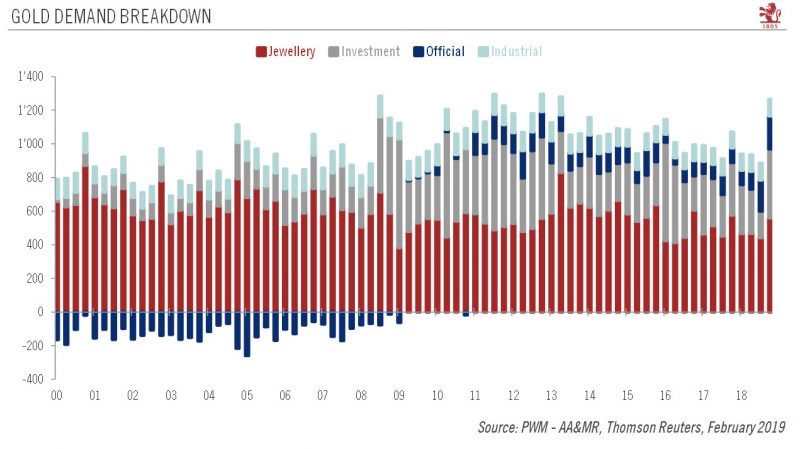

Some recent factors supporting gold are fading. However, while gold could sag in the short term, medium-term prospects look better.Last year ended on a very strong note for gold demand, with a significant increase in jewellery and investment demand in the fourth quarter (see chart), leading to strong price performance (7.7% in US dollar terms in Q4).

Read More »

Read More »

Euro area : What if car tariffs lie ahead ?

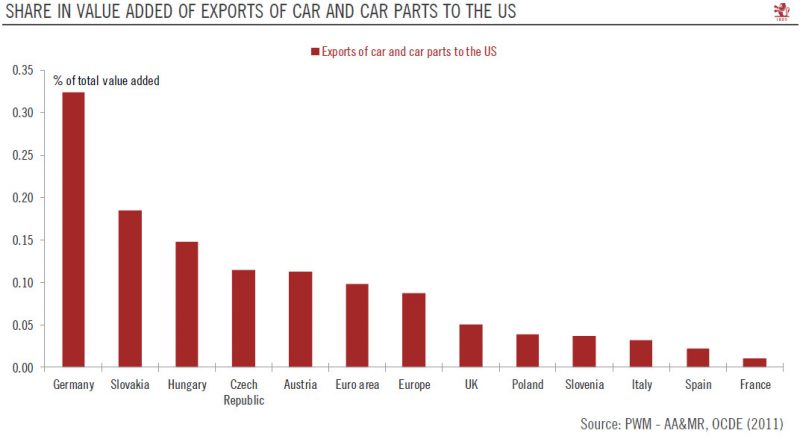

New US auto tariffs may impact the economy significantly more than the previous tariffs on steel and aluminium.Among the key risks for our euro area outlook, the threat of US auto tariffs is of major importance.The US Commerce Department’s investigation on national security threats posed by auto imports is due to be concluded on 17 February.

Read More »

Read More »

Exports save the day for French GDP growth

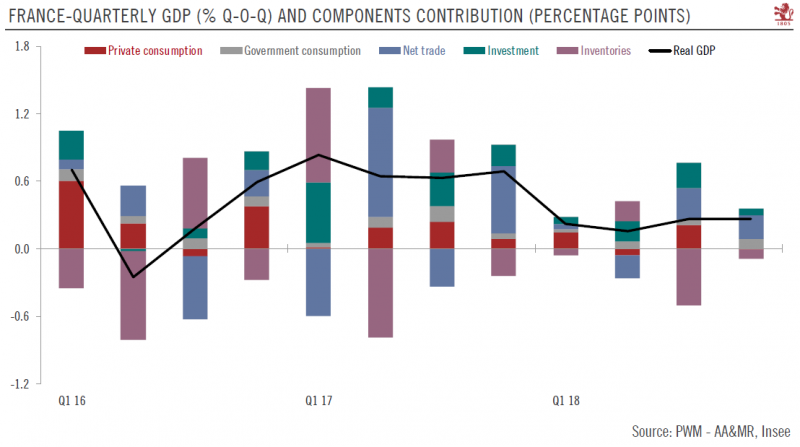

Prospects for French economic growth are looking up, but disruptions to consumption are possible.French GDP rose by 0.3% quarter-on-quarter (q-o-q) in Q4, the same pace as in Q3. The details reveal that Q4 exports surged significantly, while household consumption and investment slowed. This left growth for the year at +1.5%, following +2.3% in 2017.

Read More »

Read More »

Update on euro area economic activity

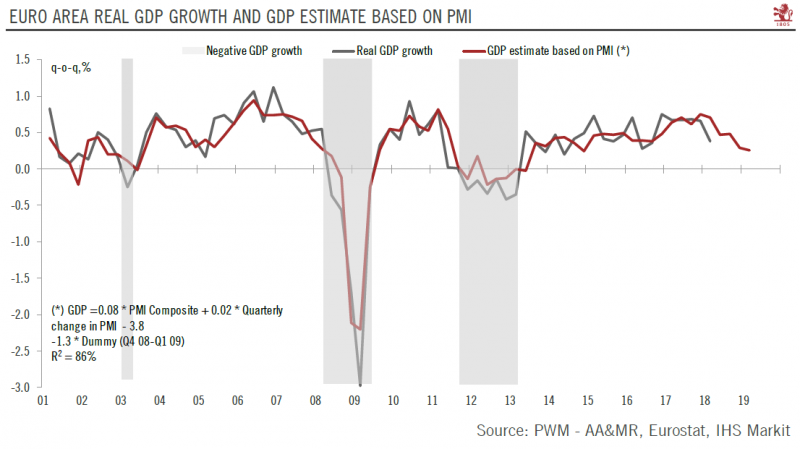

The balance of risks to growth in the region is still tilted to the downside.The big question about the euro area economy is when the bottom of the slowdown will be reached. A rebound was already expected in Q4 2018, but at the start of this year there are still few signs of recovery. Flash composite PMI numbers for the region declined by 0.4 points to 50.7 in January, the weakest level since July 2013.

Read More »

Read More »

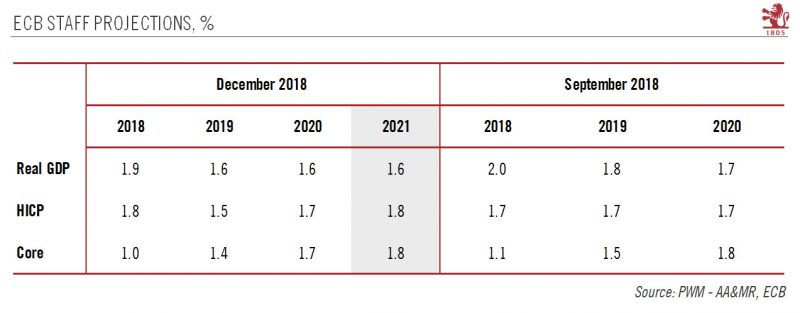

European Central Bank likely to stick to script

The ECB is comfortable with current market expectations for rate hikes.At its latest meeting in December, the ECB turned more cautious, lowering its growth forecasts but showing no sign of panic regarding the loss in euro area economic momentum. Risks were considered as “broadly balanced”, but moving to the downside.

Read More »

Read More »

Outlook for euro periphery bonds

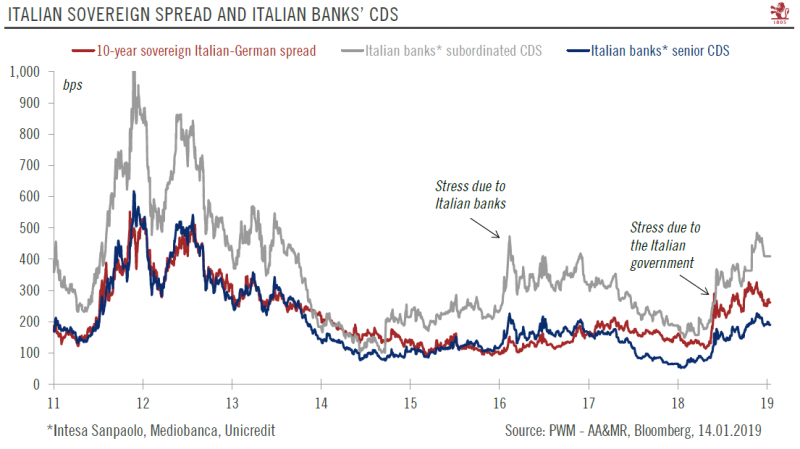

Economic fundamentals should come back into focus, but politics still a factor.After a year when peripheral countries’ old demons made a reappearance, with, in particular, Italy’s public debt back in the spotlight, the focus should shift to economic fundamentals in 2019. Both the Spanish and Italian economies are set to slow down, although the situation is more serious in Italy.

Read More »

Read More »

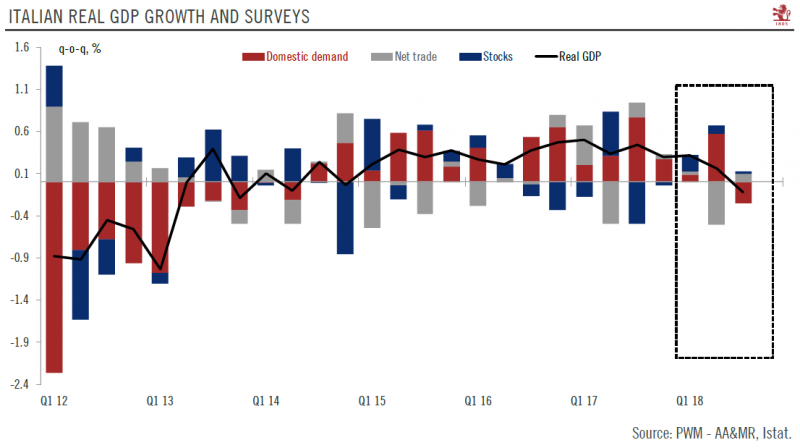

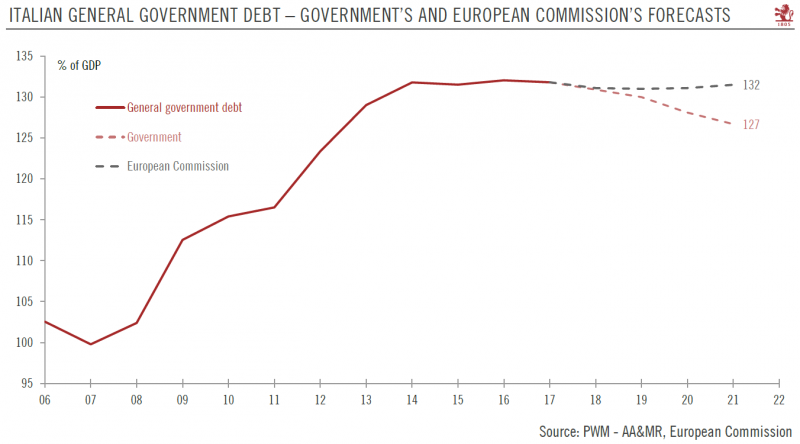

Concerns about Italy have not gone away

Rome and Brussels reached a compromise on the Italian government’s budget plans last month. But there are plenty of reasons for thinking this will be a challenging year for Italy.After battling for more than two months over a 2019 budget plan defiantly non-compliant with the EU fiscal rules, Rome and Brussels struck a last-minute agreement in December that avoided opening an Excessive Deficit Procedure (EDP).

Read More »

Read More »

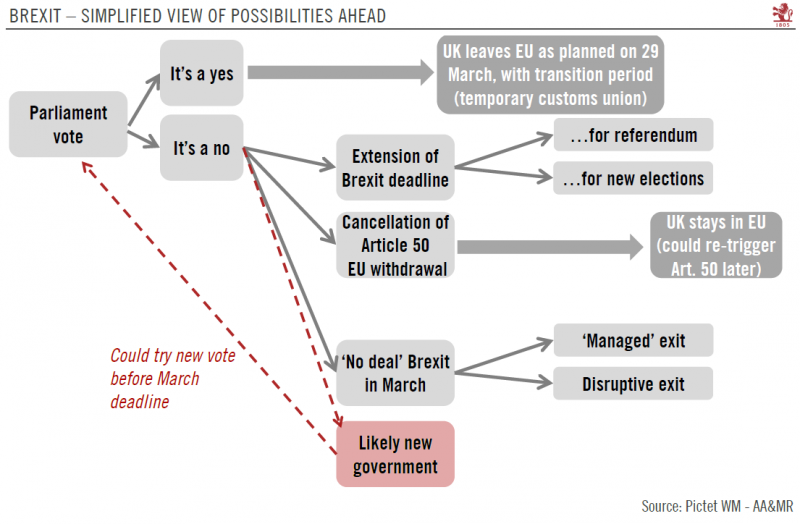

UK Politicians remain stuck in the mire

Next week’s vote on the divorce deal is likely to be defeated, and there is precious little time for an alternative before the Brexit deadline in March.The British parliamentary vote on Theresa May’s EU divorce deal will be on 15 January. The deal is likely to be rejected, as there has been little progress since December, when a first vote was called off for lack of support.

Read More »

Read More »

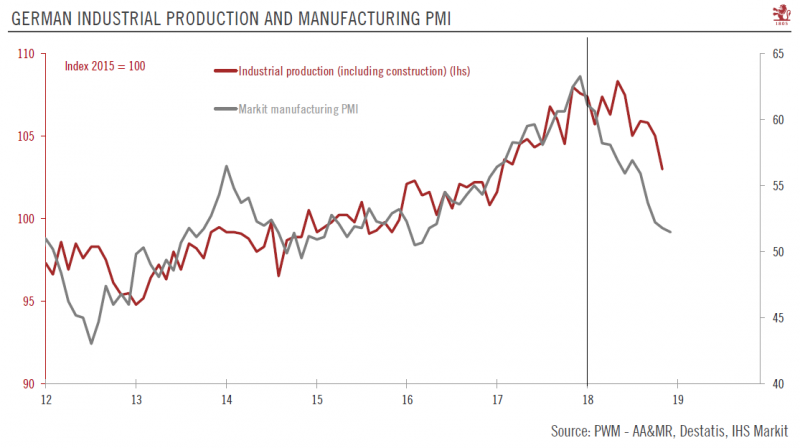

Germany is Stagnating

Sagging industrial production and confidence figures point to weak Q4 GDP. German industrial production (including construction) fell by 1.9% month-on-month in November, extending the sector’s decline to five out the six last prints. Year on year, industrial production was down by 4.6%, the worst performance since November 2009.

Read More »

Read More »

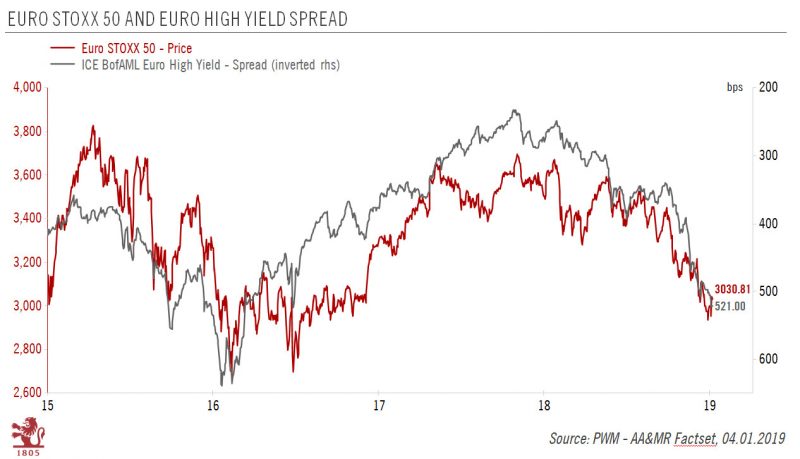

Euro Credit: 2019 Outlook

Last year was a difficult one for euro credit, with both the ICE Bank of America Merrill Lynch (ICE BofAML) investment grade (IG) and high yield (HY) indices posting negative total returns. This was entirely due to wider credit spreads, as medium-term German government bonds yields fell slightly.

Read More »

Read More »

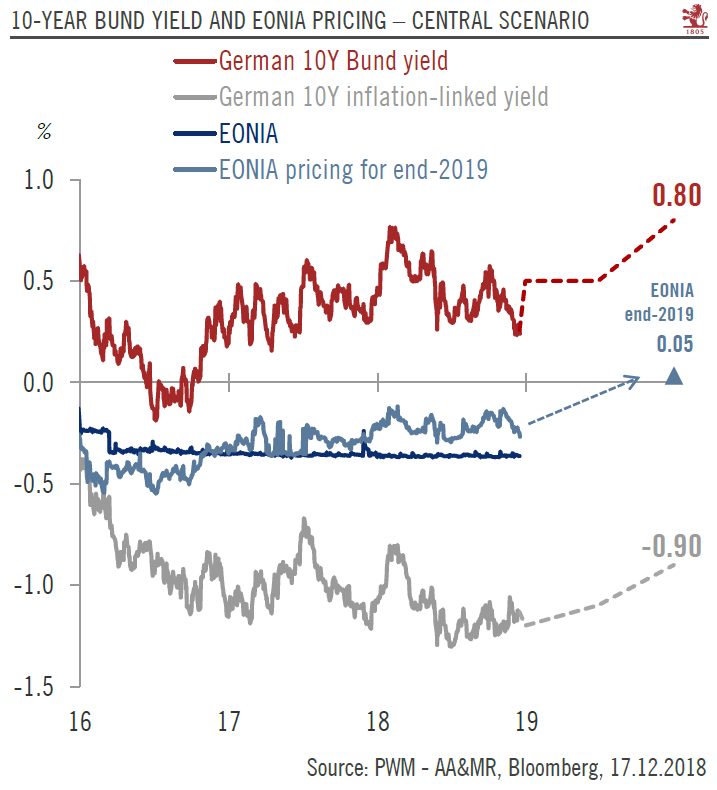

Core Euro Sovereign Bonds 2019 Outlook

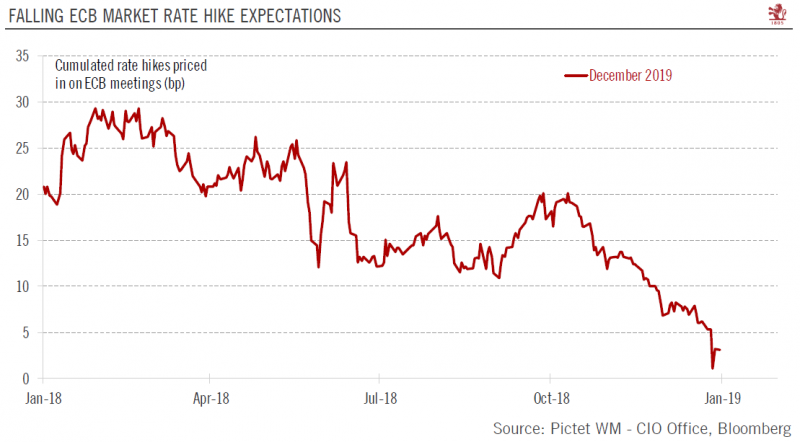

In our central scenario, we expect the 10-year Bund yield to rise gradually to 0.8% by the end of next year from 0.26% on 17 December. Underpinning this upward movement is our expectation of a cumulative deposit rate hike of 40 basis points (bps) by the ECB, against current market expectations of only 10 bps.

Read More »

Read More »

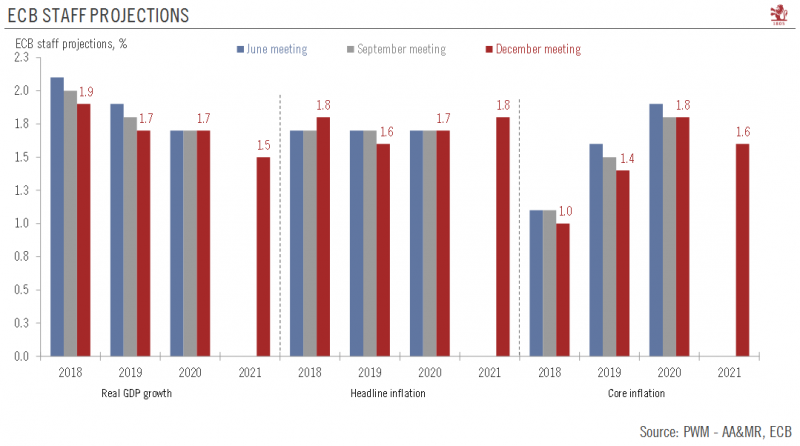

ECB: Still Broadly Confident, but Caution Increasing

The ECB kept its key rates unchanged (i.e. the main refinancing at 0.00%; the marginal lending facility rate at 0.25% and the deposit rate at -0.4%), in line with consensus. The ECB’s forward guidance on interest rates was kept unchanged. The ECB expects its policy rates to “remain at their present levels at least through the summer of 2019”.

Read More »

Read More »

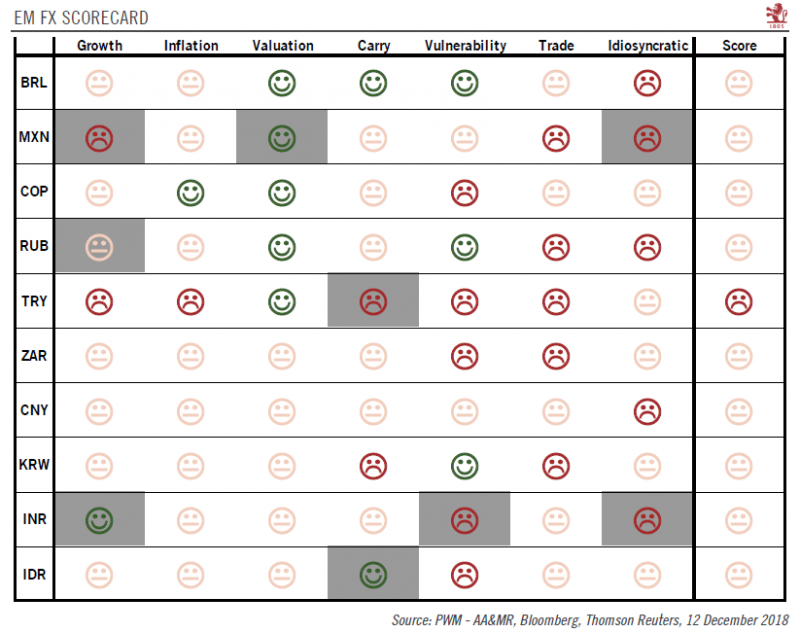

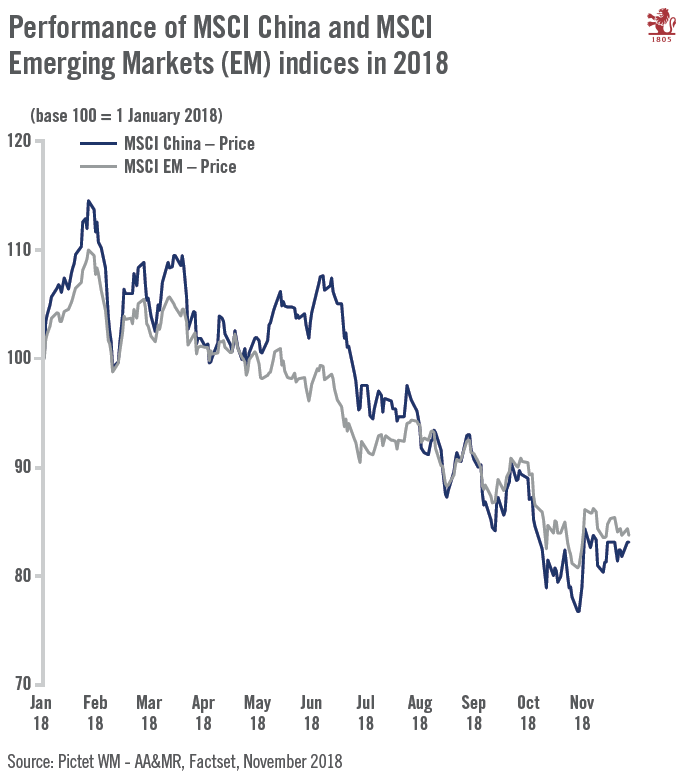

Emerging market currencies: idiosyncratic risks strike back

The environment will remain challenging for EM currencies next year.Despite a dovish shift by the Fed and the temporary truce in the US-Chinese trade dispute, the global environment remains challenging for emerging market (EM) currencies. In fact, our latestEM FX scorecard, which ranks 10 EM currencies according to key criteria such as growth and vulnerability to external shocks, is still unable to identify a single attractive EM currency among the...

Read More »

Read More »

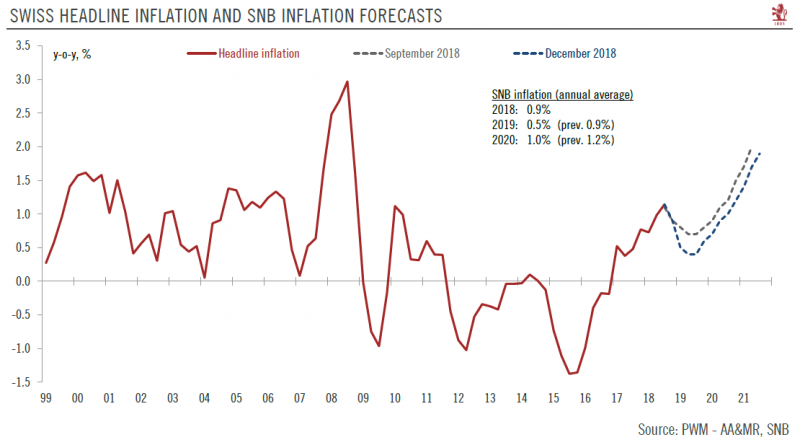

Large downward revisions to the Swiss National Bank’s inflation forecasts

Fresh inflation projections likely to keep the central bank on the path of prudence.The Swiss National Bank (SNB) left its monetary policy unchanged at its quarterly meeting today.The main policy rate was left at a record low (-0.75%) and the central bank reiterated its currency intervention pledge.

Read More »

Read More »

ECB Preview: an end to net asset purchases

With the ECB’s asset purchases due to end this month and forward guidance set to remain unchanged, a focus at next week’s policy meeting will be staff forecasts for growth and inflation. At its Governing Council meeting next week, we expect the European Central Bank (ECB) to confirm that its asset purchases will cease at year’s end.

Read More »

Read More »

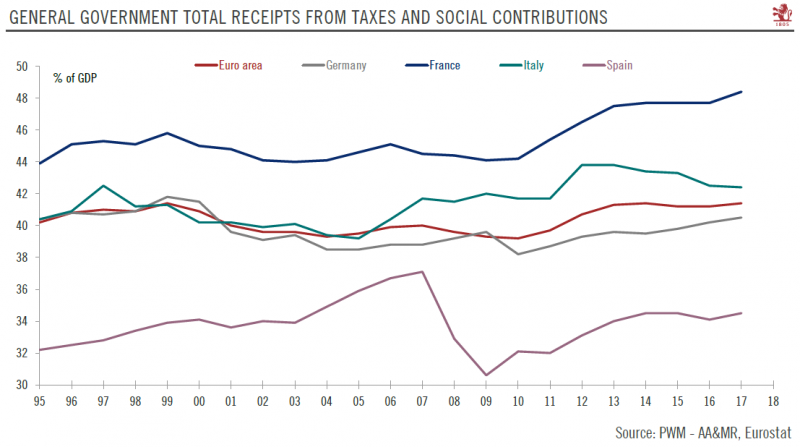

Yellow vest protests cast cloud over Macron’s reform plans

Recent protests could have a negative impact on French growth, tax revenue and president Macron’s reform plans for his country and for Europe. French protests began on November 17 over hikes in fuel taxes, but have progressively broadened out into an expression of general anger with the French government about the cost of living and high taxes.

Read More »

Read More »

House View, December 2018

We remain neutral on global equities overall, seeing relatively limited potential for developed market stocks in particular as earnings growth declines. We favour companies with pricing power as well as measurable growth drivers and low leverage.

Read More »

Read More »

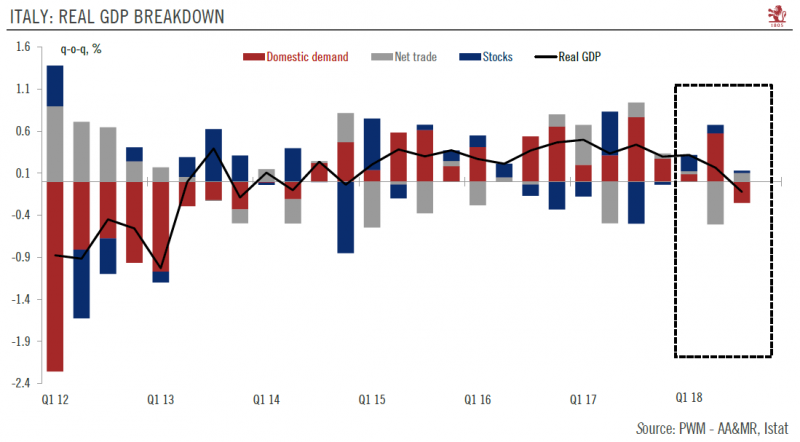

Growth Contraction puts pressure on Italian Government

The downward revision to 3Q GDP will make the Italian government’s targets more difficult to achieve and complicate the budget debate with Europe. The Italian statistical office’s (ISTAT) final reading showed that the economy shrank 0.1% q-o-q (-0.5% q-o-q annualised) in Q3, whereas a preliminary reading on October 30 showed that growth was flat.

Read More »

Read More »

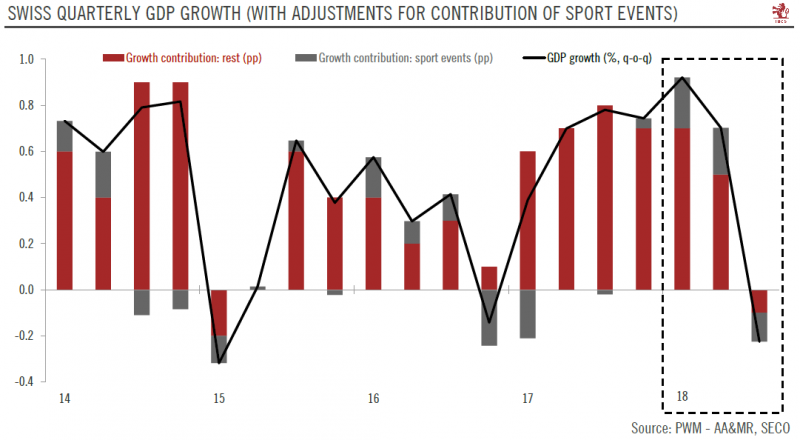

Surprise contraction in Swiss Q3 GDP

Switzerland’s growth unexpectedly contracted in the third quarter, pushing down our GDP growth forecast for 2018. Recent softening in the euro area also casts doubts about the pace of monetary tightening by the SNB.The strong growth enjoyed by the Swiss economy since Q1 2017 came suddenly to an end in Q3 18, when real GDP shrank unexpectedly by 0.2% q-o-q (-0.9% q-o-q annualised).

Read More »

Read More »

Italy and the EU: a debt-based excessive deficit procedure

European Commission deems Italy's budget noncompliant with EU rules.This week, the European Commission issued its opinion on Italy’s budget plans. Deeming them noncompliant with the EU’s budgetary rules, it recommended that an Excessive Deficit Procedure (EDP) be opened.Of the options available to the EU, a debt-based EDP would be the most difficult for Italy to deal with, as it would last longer and require Italy to ensure its debt stock...

Read More »

Read More »