Tag Archive: M1

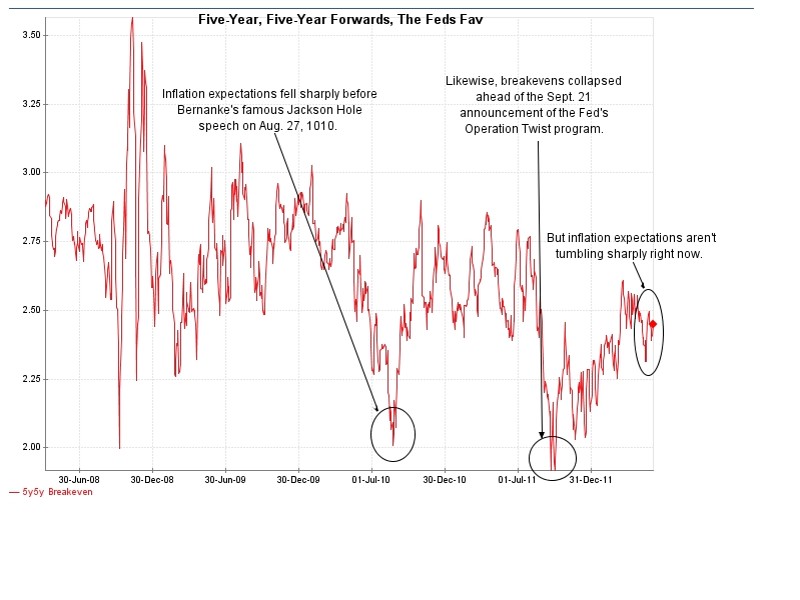

Taper Discretion Means Not Loving Payrolls Anymore

When Alan Greenspan went back to Stanford University in September 1997, his reputation was by then well-established. Even as he had shocked the world only nine months earlier with “irrational exuberance”, the theme of his earlier speech hadn’t actually been about stocks; it was all about money.The “maestro” would revisit that subject repeatedly especially in the late nineties, and it was again his topic in California early Autumn ’97.

Read More »

Read More »

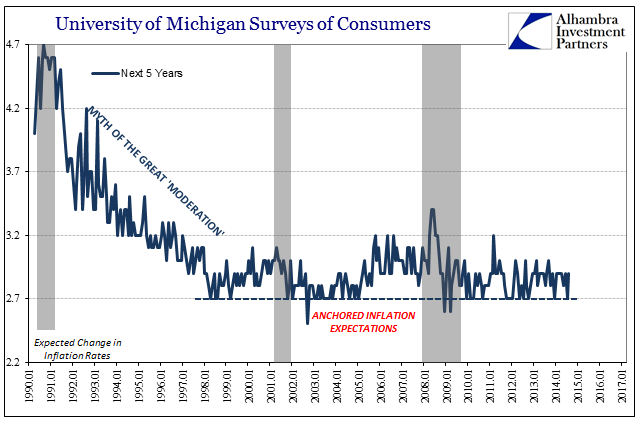

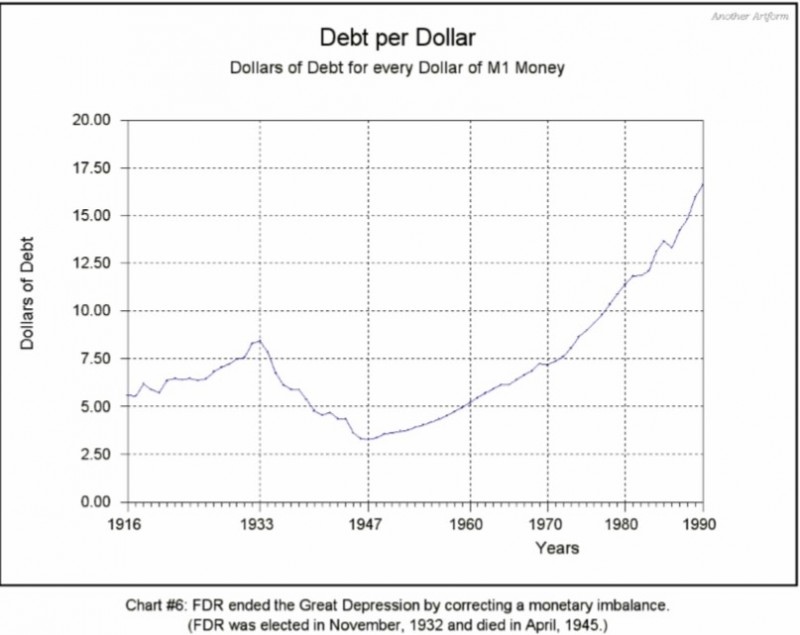

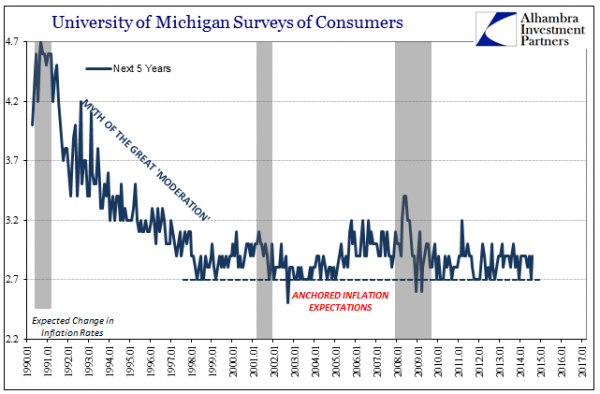

Further Unanchoring Is Not Strictly About Inflation

According to Alan Greenspan in a speech delivered at Stanford University in September 1997, monetary policy in the United States had been shed of M1 by late 1982. The Fed has never been explicit about exactly when, or even why, monetary policy changed dramatically in the 1980’s to a regime of pure interest rate targeting of the federal funds rate.

Read More »

Read More »

Global Risk Off: China Reenters Bear Market, Oil Tumbles Under $30; Global Stocks, US Futures Gutted

"We're gonna need a bigger Bullard"

- overheard on a trading desk this morning.

Yesterday, when looking at the market's "Bullard 2.0" moment, which was a carbon copy of the market's kneejerk surge higher response to Bullard's "QE4" comments fr...

Read More »

Read More »

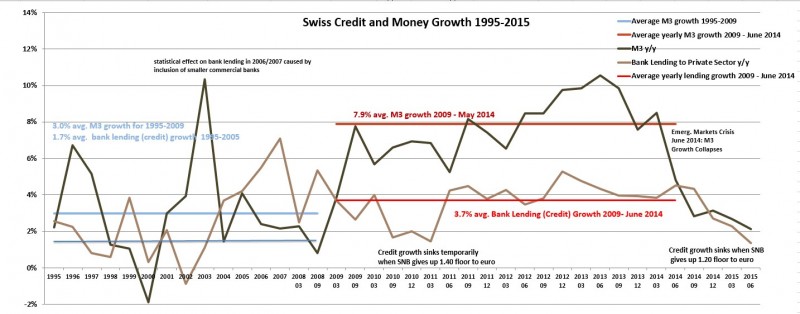

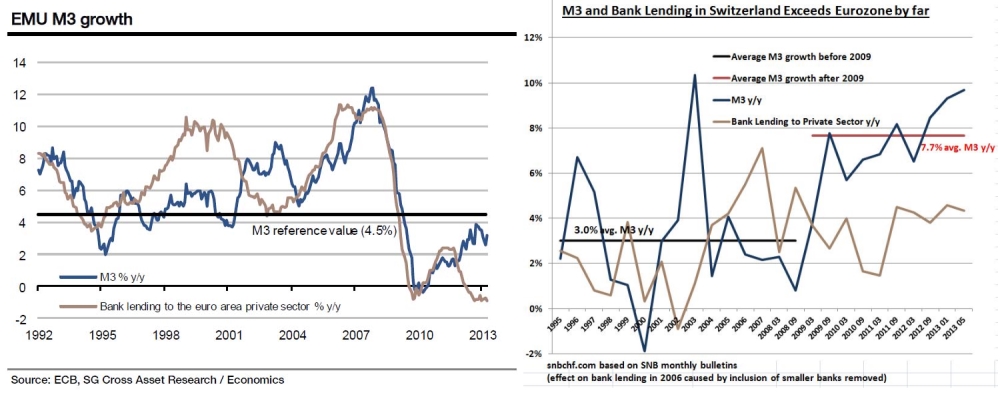

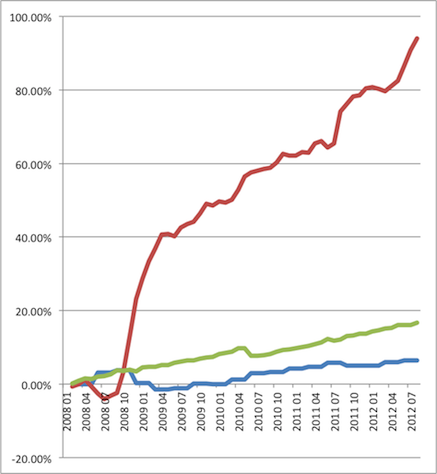

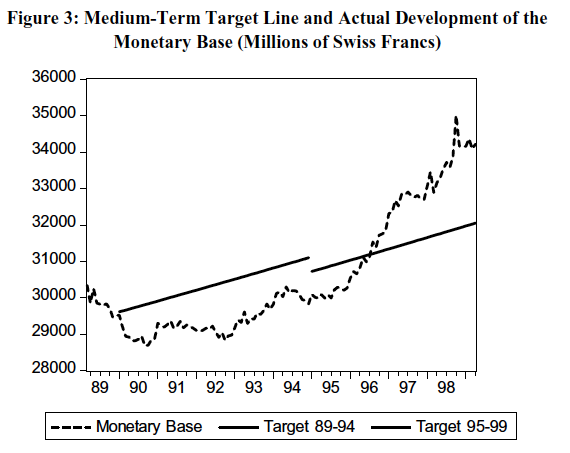

The 2015 Update: Risks on the Rising SNB Money Supply

We explain the risks on the rising money supply in Switzerland. We distinguish between broad money supply (M1-M3) and narrow money supply (M0). Both are rising quickly.

Read More »

Read More »

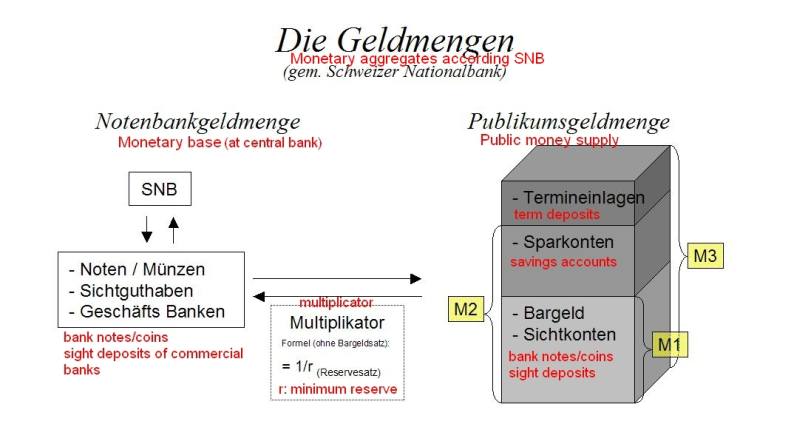

Rising Sight Deposits at SNB Means Rising SNB Debt

Money creation and sight deposits may have two points of view:

1. The central bank creates money - i.e. the SNB decides to increase sight deposits when it does currency interventions

2. Commercial banks create money - inflows in CHF on Swiss bank accounts make those banks increase their "sight deposits at the SNB. If inflows in CHF are higher than outflows then CHF must rise, unless the central bank does currency interventions.

We will present...

Read More »

Read More »

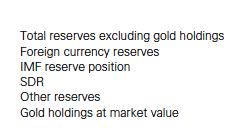

SNB’s IMF data

This IMF data on the SNB website shows SNB Forex and gold reserves in the last month. It is so-called "IMF Special Data Dissemination Standard (SNB Data)"

Read More »

Read More »

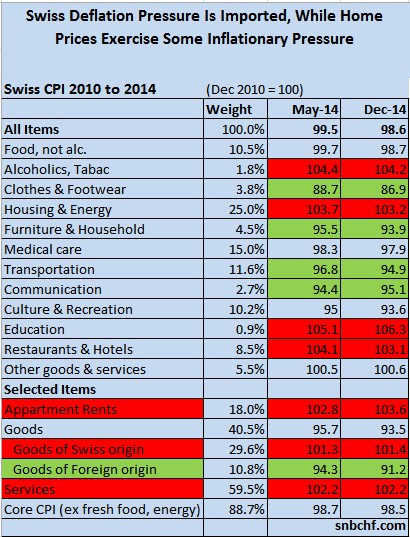

Downwards and Upwards Drivers of Swiss Inflation

In the following we present the drivers of Swiss price inflation. We first present the components of the consumer price index. Then we explain which are upwards-drivers of inflation and which ones cause downwards adjustments.

Read More »

Read More »

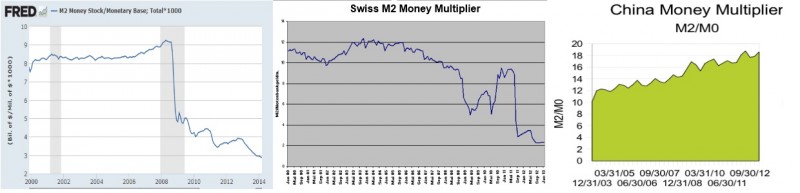

QE, QEE, the Money Multiplier and the Secular Stagnation Confusion

In some countries, the money multiplier is falling, in some others it is increasing, mostly due to central bank tightening. Does this justify to speak of secular stagnation?

Read More »

Read More »

Pros and Cons of the Swiss Countercyclical Capital Buffer

Switzerland is currently living in a big real estate boom. The bubble bursting would imply that banks' collateral in the form of real estate falls in value. Therefore the banks' assets might fall because many home buyers might not be able to repay their mortgage. If a real estate bubble pops, then banks should be better capitalized to absorb such a shock. Therefore the Swiss National Bank introduced macro-prudential measures, like the so-called...

Read More »

Read More »

SNB Sight Deposits Fall by 1.2 Billion CHF, Weeks ending February 1 and 8

The latest improvement in U.S. unemployment and good PMIs, finally let the sight deposits (money supply) at the SNB fall by 800 million francs in week ending on February 1 and 400 million for the one of Feb 8 . See the recent history of sight deposits.

Read More »

Read More »

SNB Sight Deposits Rise by 100 Million CHF, Week January28

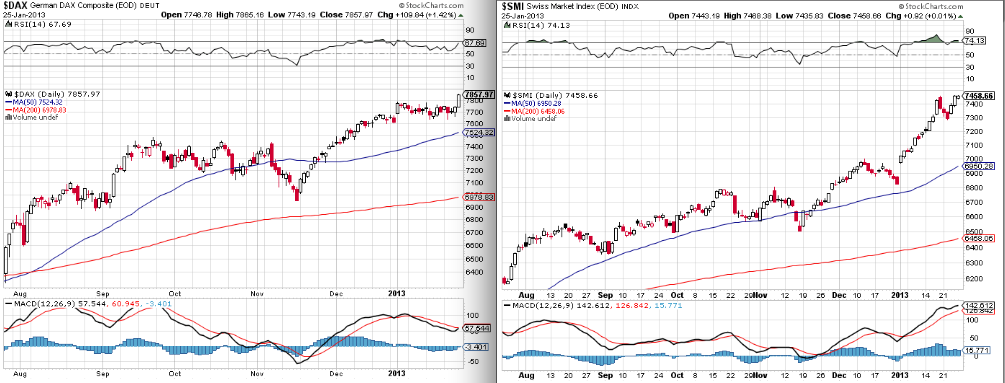

While FX traders and some hedge funds are long EUR/CHF and some short covering happened, sight deposits show a different picture. They rise again, this time with 100 million francs (see details) in one week. Risk-off investors are not convinced yet that the euro crisis is finished, while other investors keep profit of the rising SMI...

Read More »

Read More »

SNB Sight Deposits Rise by 2 Bln. Francs, M3 by 10 Bln., Week January 21

While FX traders and some hedge funds go long the EUR/CHF, sight deposits at the SNB rise by 2 bln. francs (see details) in one week, M3 by nearly 10 bln. (nearly 2%) francs in one single month (see

Read More »

Read More »

SNB Monetary Data Week October 26

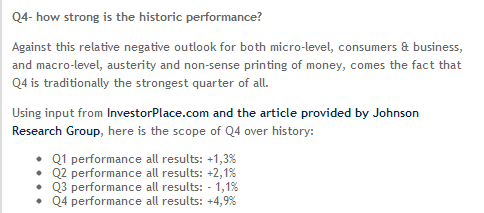

Seasonal effects, the good months for the SNB and the US economy, but weaker ones for emerging markets and Switzerland Despite the seasonal effects between October and March, the SNB is not able to sell currency reserves consistently. Traditionally the USD gets stronger and stocks rise over the autumn months till January. This year’s stocks appreciation was possibly already anticipated …

Read More »

Read More »

SNB Monetary Data Week October 19

Seasonal effects, the good months for the SNB and the US economy, but weaker ones for emerging markets and Switzerland Given that the seasonal effects between October to March have started, the SNB might be able to sell some currency reserves. Traditionally both the USD gets stronger and stocks rise over the autumn months till January. This year’s stocks appreciation was …

Read More »

Read More »

SNB Monetary Data Week October 12

Seasonal effects, the good months for the SNB and the US economy, but weaker ones for emerging markets and Switzerland, have started Given that the seasonal effects between October to March have started, the SNB might be able to sell some currency reserves. Traditionally both the USD gets stronger and stocks rise over the autumn months till January. This year’s stocks …

Read More »

Read More »

IMF Data: SNB Forex Reserves and Gold in September 2012

This link on the SNB website shows the data the central bank provides to the International Monetary Fund (IMF). It shows the SNB Forex and gold reserves in the last month. It is so-called “IMF Special Data Dissemination Standard (SNB Data)” It is released together with the international investment position, some monetary aggregates and the balance of payments two weeks after …

Read More »

Read More »

SNB Monetary Data Week October 5

Seasonal effects, the good months for the SNB and the US economy, but weaker ones for emerging markets and Switzerland, have started Given that the seasonal effects between October to March have started, the SNB might be able to sell some currency reserves. Traditionally the United States and the USD dollar become stronger and stocks rise over the autumn months …

Read More »

Read More »

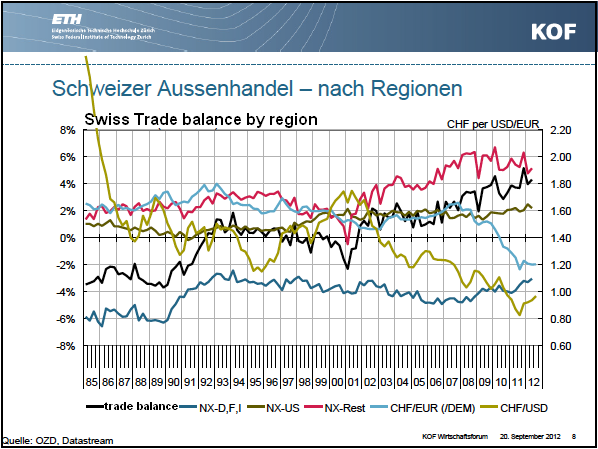

The win of the pro-bailout parties in the Greek elections was no win for the SNB

The win for the pro-bailout parties in the Greek elections was no win for the Swiss National Bank (SNB), even if the fear of an immediate bank-run and extreme money flows into Switzerland are avoided. Also the fact that QE3 is not coming in the next weeks did not help the SNB.

Read More »

Read More »