Tag Archive: labour costs

What Drives Government Bond Yields?

For us the five major drivers of government bond yields are:

Inflation expectations and inflation: The by far most important criterion. High inflation expectations must be compensated via higher bond yields. The main driver behind inflation expectations is the wage development, this is the form of inflation that typically persists. Price inflation follows inflation expectations with a certain lag.

Wealth: The higher the wealth of a country, the...

Read More »

Read More »

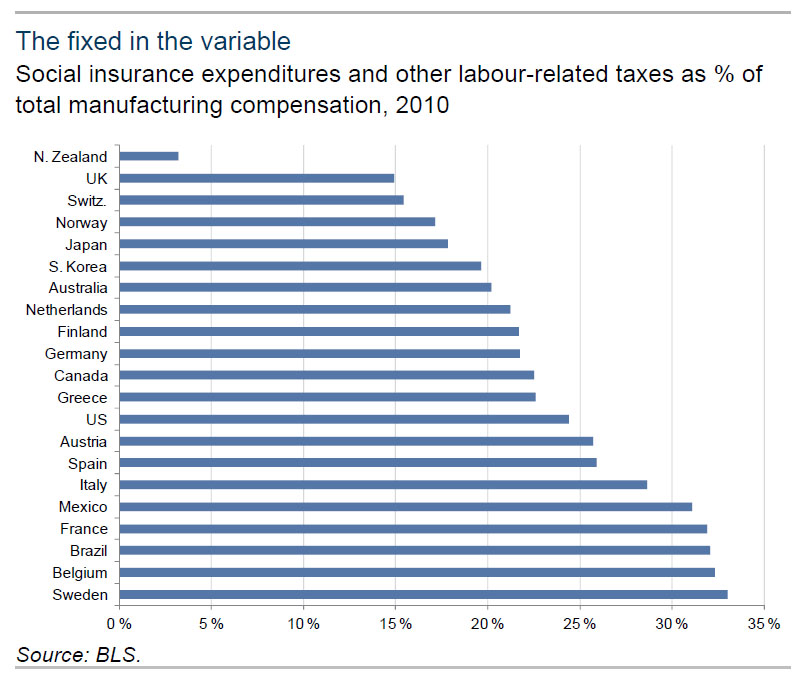

Labor Costs to Total Expenses, Global Comparison

The conflict between labor and capital is a long and illustrious one, and one in which ideology and politics have played a far greater role than simple economics and math.

Read More »

Read More »

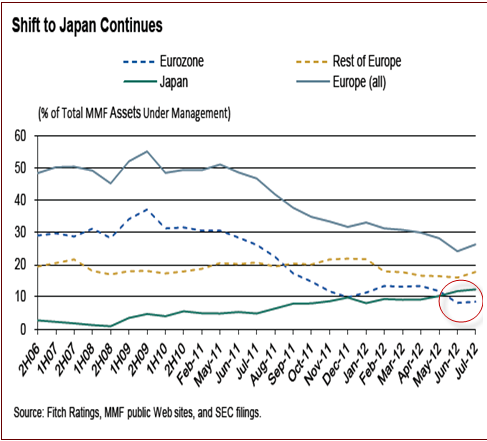

Roubini and Deutsche Bank’s Sanjeev Sanyal: Still Waiting for the Chinese Consumer

Nouriel Roubini and Deutsche Bank’s Sanjeev Sanyal are quite pessimistic about future global and Chinese growth. They think that we need to wait a long time for the Chinese consumer that should boost global growth.

Read More »

Read More »

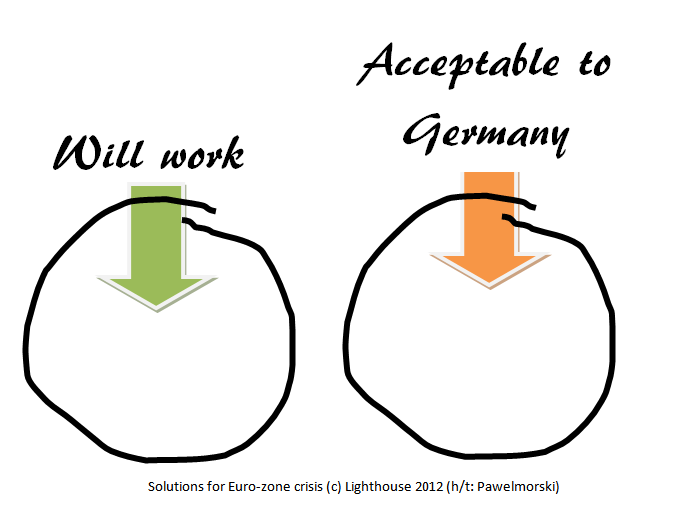

Who Says No to Austerity and Global Imbalances, Must Say Yes to the Northern Euro

Eventually the euro will be abolished, a Northern Euro introduced: politicians and their economic advisors might just be waiting for a calm moment, especially with upcoming German inflation.

Read More »

Read More »

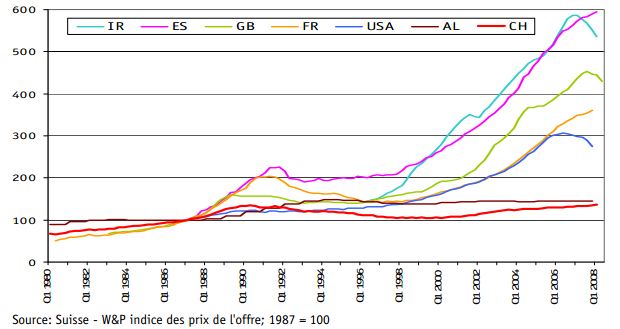

The Fairy Tale of Rising Competitiveness in the European Periphery

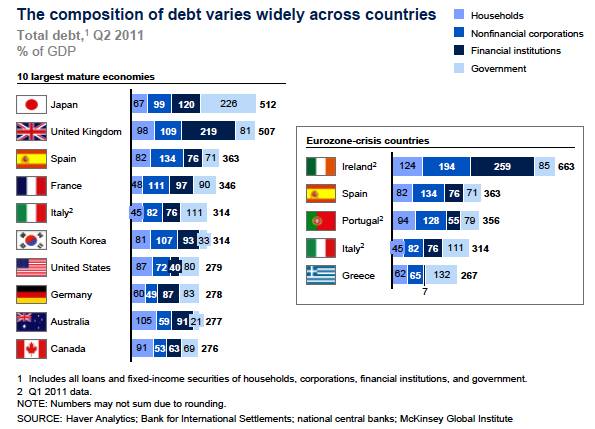

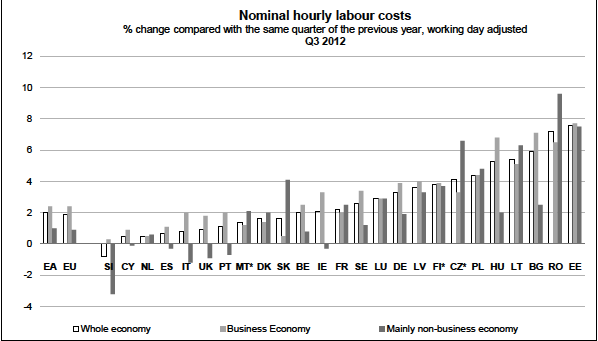

In our post we look on two questions concerning competitiveness for the European periphery: When will local production be cheaper than imported products? Do people have the money to buy these local products? It does not help reducing labor costs if local production costs still more than imported products. The second aspect is: even if …

Read More »

Read More »

4 Different Solutions for the Euro Crisis: Can it Be the Northern Euro? A Discussion

The discussion about the future of the Euro: Among a Post-Keynesian, a European Etatist, an Austrian economist and an advocate of a Northern Euro on the French website www.atlantico.fr. The French paper is asking: “Sommet européen : créer un euro du Nord est-il le seul moyen de sauver l’Europe de l’austérité ?” Is the creation of …

Read More »

Read More »

Euro Morons: Hyperinflation Successfully Avoided, Stagflation Successfully Created

Keeping Greece in euro zone, eurocrats or better “euro morons” have successfully avoided a weak drachma and a following Greek hyperinflation. Instead they successfully created stagflation. Currently European HICP inflation is at 2.5%, far above the max. 2.0% official ECB mandate, but the euro is becoming weaker and weaker. German salaries are rising with 2.6% …

Read More »

Read More »

Can The SNB Make Profit On Currency Reserves ?

Abstract We determine the main criteria with which markets evaluate currency prices. We focus on explaining the differences between the carry trade era (or like Ben Barnanke called it “The Great Moderation”) and the period after the financial crisis. Our research shows that each one of the following three main preconditions must be fulfilled, …

Read More »

Read More »

All roads lead to a euro zone break-up

For us all roads lead to a euro zone break-up and multiple sovereign defaults. Our reasoning can be summarized as follows: Equities are worthless when associated debt becomes encumbered (risk capital takes the first loss). Equity is not an asset; it is merely the remainder that is left over once debt is subtracted from …

Read More »

Read More »

Why the Euro Crisis may last another 15 years

Abstract In the following article we will explain which types of crisis occur in the euro area and will argue that this crisis will last at least another fifteen years. (1) Competitiveness crisis: Before the euro introduction peripheral countries regularly saw their currency depreciate against the German Mark and helped them to increase their competitiveness. …

Read More »

Read More »