Tag Archive: Kenneth Rogoff

Proposed Negative Rates Really Expose The Bond Market’s Appreciation For What Is Nothing More Than Magic Number Theory

By far, the biggest problem in Economics is that it has no sense of itself. There are no self-correction mechanisms embedded within the discipline to make it disciplined. Without having any objective goals from which to measure, the goal is itself. Nobel Prize winning economist Ronald Coase talked about this deficiency in his Nobel Lecture:

Read More »

Read More »

Don’t Blame Trump When the World Ends

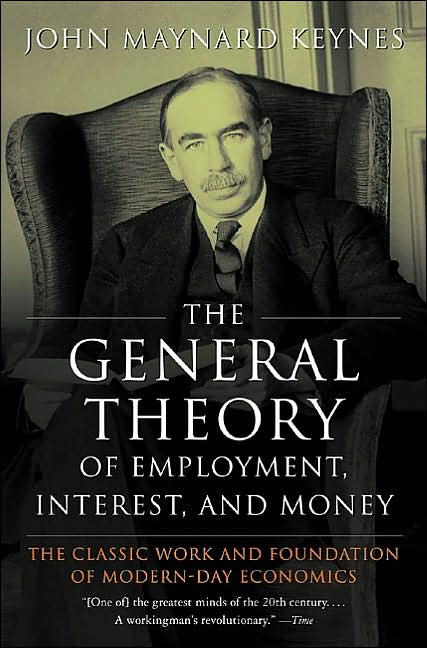

There was, indeed, a time when clear thinking and lucid communication via the written word were held in high regard. As far as we can tell, this wonderful epoch concluded in 1936. Everything since has been tortured with varying degrees of gobbledygook.

Read More »

Read More »

Cash Bans and the Next Crisis

Money sometimes goes “full politics”. Take poor Kenneth Rogoff at Harvard. He wants a dollar with a voter registration card, a U.S. flag on its windshield, and a handgun in its belt – the kind of money that supports the Establishment and votes for Hillary.

Read More »

Read More »

Rogoff Warns “Cash Is Not Forever, It’s A Curse”

Kenneth Rogoff, Professor of Public Policy at Harvard University, postulates to get rid of cash. In his opinion, killing big bills would hamper organized crime and make negative interest more effective. Kenneth Rogoff makes a provocative proposal. One of the most influential economists on the planet, he wants to phase out cash.

Read More »

Read More »

Macro Thinking: FOMC, USD, and EU

The Federal Reserve modified its stance yesterday without changing rates. It is not just about how fast the Fed sees itself normalizing monetary policy but also where the level of the equilibrium rate. The FOMC statement, but especially the officials’ forecasts (dot plots) effective unwound the impact of the earlier Fed talk of the likely …

Read More »

Read More »

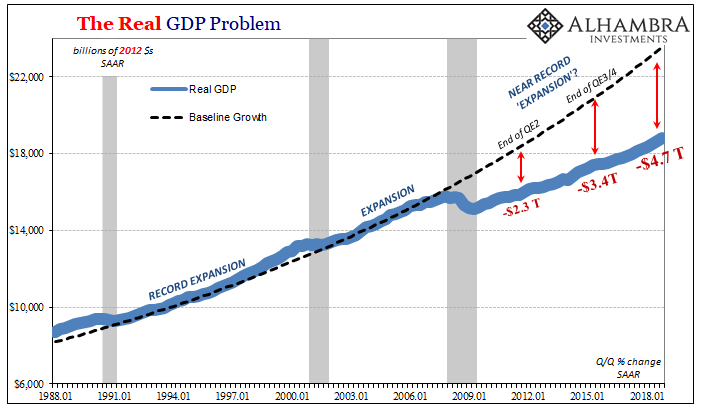

Great Graphic: Measuring Cost of Extend and Pretend

There is a debate. On one hand is Summers, who argues that modern economies have entered an era of secular stagnation. Full utilization of the factors of production and particularly capital and labor is not possible without stimulating aggregate demand in a way that facilitates bubbles. The broad strokes of the argument can be found …

Read More »

Read More »

100 Years of Mismanagement

Lost From the Get-Go There must be some dark corner of Hell warming up for modern, mainstream economists. They helped bring on the worst bubble ever… with their theories of efficient markets and modern portfolio management. They failed to see it fo...

Read More »

Read More »

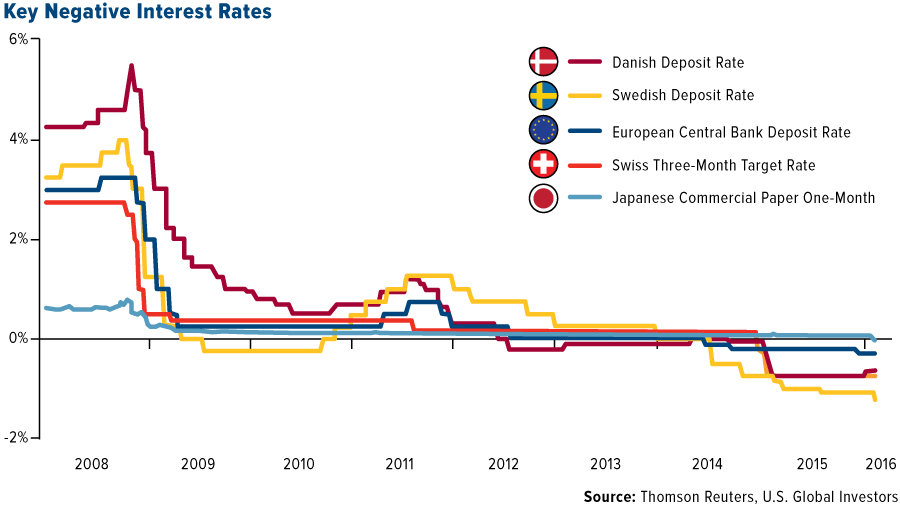

The Path to the Final Crisis and Negative Rates

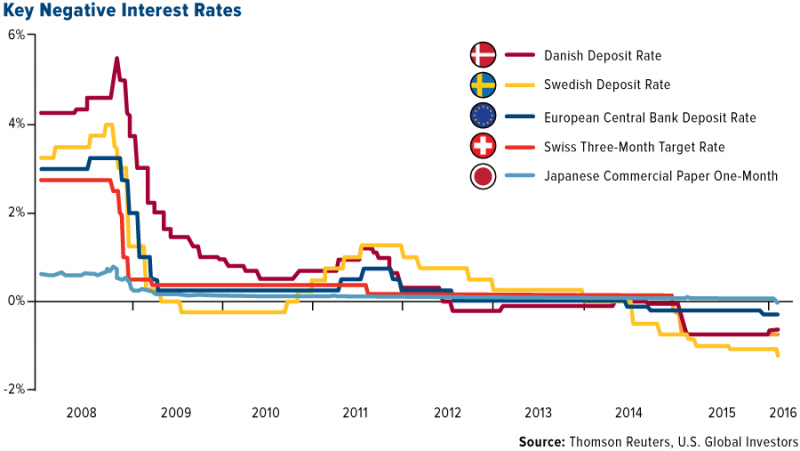

Reader Questions on Negative Interest Rates Our reader L from Mumbai has mailed us a number of questions about the negative interest rate regime and its possible consequences. Since these questions are probably of general interest, we have decided ...

Read More »

Read More »

The S.H.O.E. Crisis

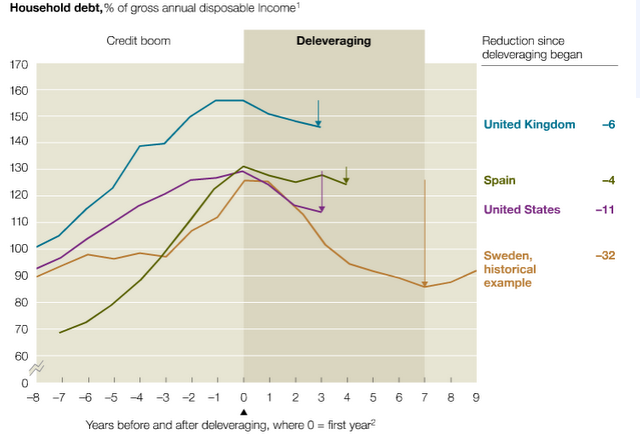

The weak growth, large output gap, low return on capital, and a host of other economic malaise are widely recognized. There seem to be two main schools. One is associated with Reinhart and Rogoff. They argue that "this time is not diffe...

Read More »

Read More »

Great Graphic: US 2-Year Premium over Japan and Germany

This Great Graphic was composed on Bloomberg. It shows two time series. The yellow line shows the premium the US pays over Germany for two-year money. The white line shows the premium the US pays over Japan for two-year money. The premiums have risen sharply since mid-October and today are at new multi-year highs. … Continue...

Read More »

Read More »

They’re Coming to Take Away Your Cash

They're coming to take away your cash. Not for the sake of control or steal your money, but to protect the banks.

Read More »

Read More »

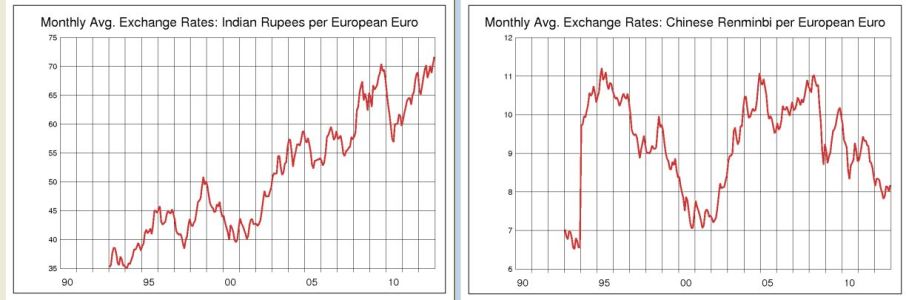

(1.2) Explaining price movements in FX rates

We indicate the main factors that influence FX rates in the longer term. We explain the movements of currencies based on these factors.

Read More »

Read More »

What Drives Government Bond Yields, Part2: Emerging Markets and Recent Discussions

Two additional criteria important for Emerging Markets: High foreign debt, a weak net investment position and a current account deficit increases government bond yields.

Read More »

Read More »

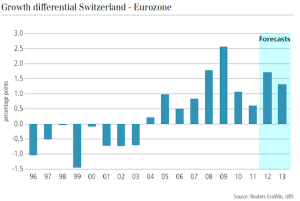

What Ernst Baltensperger Got Wrong: Why SNB FX Losses Might Not Be Recovered By Income on Reserves

Opposed to Ernst Baltensperger, we think that the risk of losses on the SNB balance sheet and of an asset price bubble might be more important than the dangers of upcoming Swiss inflation.

Read More »

Read More »

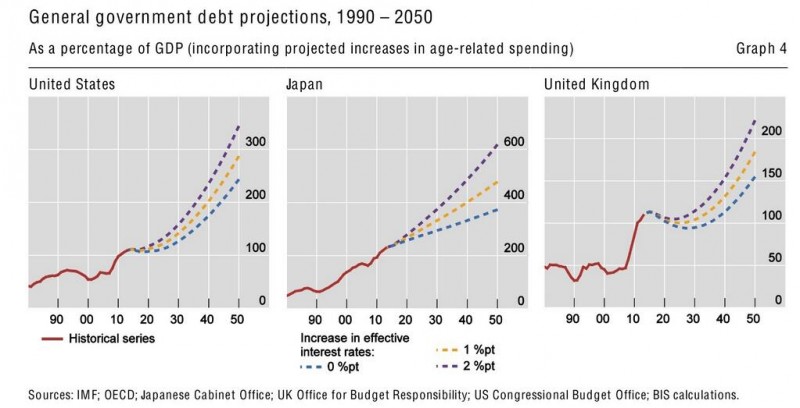

Debt, the Financial Cycle Determinant between 2011 and 2017

Between 2011 and 2017, the reduction of debt , the hunt on the rich and investment into countries with low debt will become the main rational expectation and the determinant of the next financial cycle.

Read More »

Read More »