Tag Archive: jobs

Simple (economic) Math

The essence of capitalism is not strictly capital. In the modern sense, the word capital has taken on other meanings, often where money is given as a substitute for it. When speaking about things like “hot money”, for instance, you wouldn’t normally correct someone referencing it in terms of “capital flows.” Someone that “commits capital” to a project is missing some words, for in the proper sense they are “committing funds to...

Read More »

Read More »

Hopefully Not Another Three Years

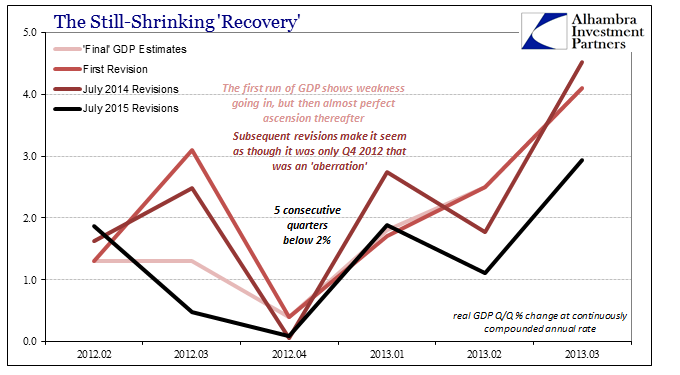

The stock market has its earnings season, the regular quarterly reports of all the companies that have publicly traded stocks. In economic accounts, there is something similar though it only happens once a year. It is benchmark revision season, and it has been brought to a few important accounts already. Given that this is a backward looking exercise, that this season is likely to produce more downward revisions shouldn’t be surprising.

Read More »

Read More »

Auto Pressure Ramps Up

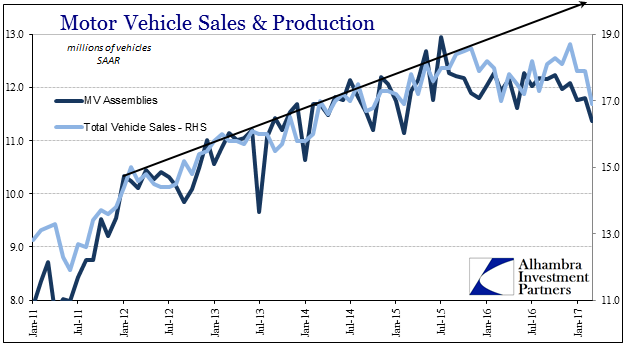

The Los Angeles Times today asked the question only the mainstream would ask. “Wages are growing and surveys show consumer confidence is high. So why are motor vehicle sales taking a hit?” Indeed, the results reported earlier by the auto sector were the kind of sobering figures that might make any optimist wonder.

Read More »

Read More »

April Jobs Won’t Change Minds

There is something for everyone in today's US jobs report, and at the end of the day, it is unlikely to sway opinion about the direction and timing of the next Fed move. The greenback itself may remain range bound after the initial flurry. On the other hand, the disappointing but noisy Canadian data underscores the risk of a more dovish slant to the central bank's neutral stance next week.

Read More »

Read More »

FX Daily, May 05: Mixed Dollar Ahead of US Jobs Data and Fed Talk

The US dollar is narrowing mixed as the employment data, and Fed speeches are awaited. Six Fed officials speak today, including Yellen and Fischer. Regional Presidents Williams, Rosengren Evans and Bullard also speak. It will be the first flurry of speeches since the FOMC meeting.

Read More »

Read More »

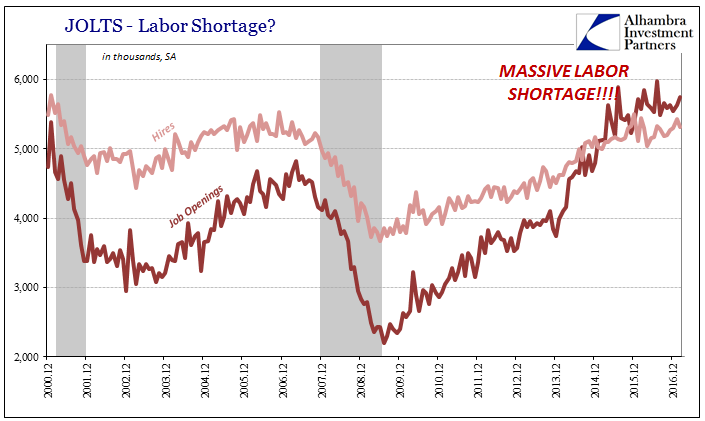

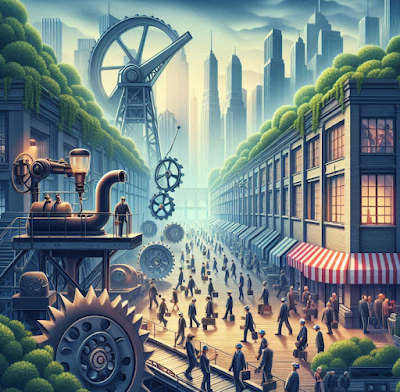

Defining Labor Economics

Economics is a pretty simple framework of understanding, at least in the small “e” sense. The big problem with Economics, capital “E”, is that the study is dedicated to other things beyond the economy. In the 21st century, it has become almost exclusive to those extraneous errands. It has morphed into a discipline dedicated to statistical regression of what relates to what, and the mathematical equations assigned to give those relationships some...

Read More »

Read More »

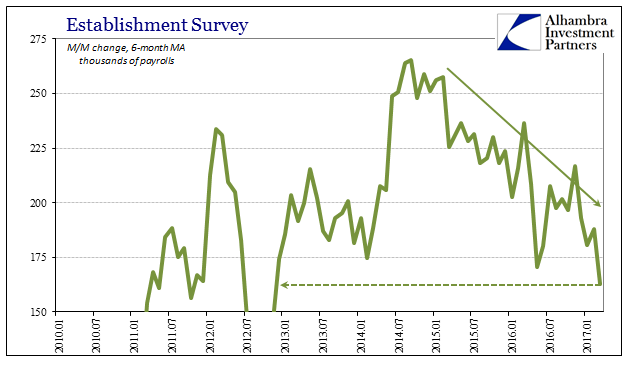

It Was And Still Is The Wrong Horse To Bet

The payroll report disappointed again, though it was deficient in ways other than are commonly described. The monthly change is never a solid indication, good or bad, as the BLS’ statistical processes can only get it down to a 90% confidence interval, and a wide one at that. It means that any particular month by itself specifies very little, except under certain circumstances.

Read More »

Read More »

US Jobs Growth Disappoints

The US jobs growth slowed considerably more than expected in March and the disappointment pushed the dollar and equities initially lower. The US created 98k jobs in March, well below market expectations for around 175k jobs. Adding insult to injury, revisions to the January and February data took off another 38k job.

Read More »

Read More »

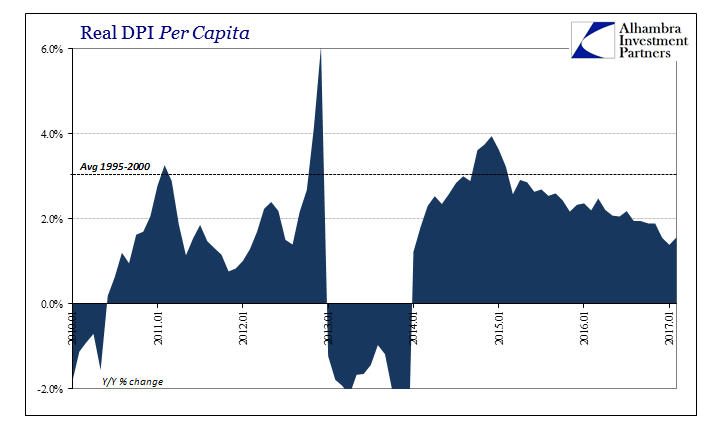

Incomes Always Deviate Negative

Personal Income growth in February 2017 was more mixed than it had been of recent months. Nominal Disposable Per Capita Income increased 3.73% year-over-year, while in real terms Per Capita Income was up 1.57%. For the former, that was among the better monthly results over the past year, while the latter was near the worst.

Read More »

Read More »

FX Weekly Preview: The Macro Backdrop at the Start of the Second Quarter

The macroeconomic fundamentals have not changed much in the first three months of the year. The US growth remains near trend, the labor market continues to improve gradually, both headline and core inflation remain firm, and the Federal Reserve remains on course to hike rates at least a couple more times this year, even though the market is skeptical. The uncertainty surrounding US fiscal has not been lifted, and it may not be several more months.

Read More »

Read More »

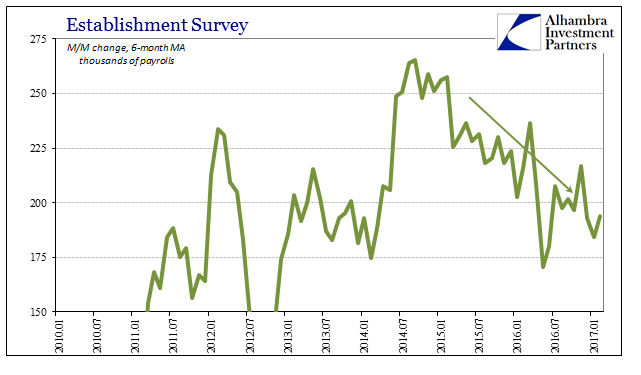

Payrolls Still Slowing Into A Third Year

Today’s bland payroll report did little to suggest much of anything. All the various details were left pretty much where they were last month, and all the prior trends still standing. The headline Establishment Survey figure of 235k managed to bring the 6-month average up to 194k, almost exactly where it was in December but quite a bit less than November. In other words, despite what is mainly written as continued “strength” is still pointing down...

Read More »

Read More »

Solid US Jobs Report in line with Expectations

The US jobs report was largely in line with expectations. February was the second consecutive month that the US economy created more than 200k jobs. It is the first time since last June and July. The 235k is just below the revised January 238k gain (initially 227k).

Read More »

Read More »

A Few Thoughts about the US Labor Market

The 94 mln people POTUS claims are not working is true but terribly misleading. What happened to agriculture a century ago is happening to manufacturing. New industries are less labor intensive than smokestack industries.

Read More »

Read More »

FX Weekly Preview: Yellen nor Kuroda nor Carney will Take the Spotlight from Trump

Fed, BOJ, and BOE meet next week, each may adjust economic assessments in more favorable direction. Key challenge for many investors is the new US Administration. US employment, EMU inflation, Q4 GDP, and China's PMI are among the data highlights.

Read More »

Read More »

US Jobs Details Better than the Headline

The dollar and US yields are recouping more of yesterday’s decline. A break of $1.0480-$1.05 would suggest the euro’s upside bounce is exhausted. A dollar move above JPY116.80-JPY117.25 would also hint that the greenback was going to make an other run toward JPY118.30-JPY118.60. Sterling support is seen in the $1.2285-$1.2310 area.

Read More »

Read More »

A Few Thoughts Ahead of the US Jobs Report

ADP and Non-Manufacturing ISM lend credence to our fear of a disappointing national jobs report. Economists estimate only a small part of the manufacturing jobs loss can be traced to trade policy. 19 states increased min wage at the start of the year, but the impact on the nation's average weekly earnings will likely be too small to detect.

Read More »

Read More »

Where Do US Companies Hire Abroad?

High-wage economies of Canada, EU, Japan and Australia account for nearly half of US corporate employment abroad. And even in low-wage regions, the high-wage parts tend to draw more US employment. The new US administration may have second thoughts about pivot to Asia, but US companies may not.

Read More »

Read More »

Mixed Jobs Report, but Unlikely to Deter Expectations for Fed Hike

The US dollar has slipped lower in response to the jobs data, but quickly recovered. The details are mixed, but is unlikely to change views on the outlook for Fed policy. The headline job creation was in line with expectations at 178k. Job growth of the back two months were shaved by 2k, concentrated in October. The unemployment rate dropped to 4.6%, the lowest since 2007.

Read More »

Read More »

US and Canada Jobs: Sill Strong Enough for a Rate Hike

The US grew 156k jobs in August, missing the median estimate by about 16k. The July series was revised up by 16k. The unemployment and participate rate ticked up 0.1% to 5.0% and 62.9% respectively. Hourly earnings rose 0.2% to lift the year-over-year rate to 2.6% from 2.4%. The average work week increased to 34.4 hours from 34.3.

Read More »

Read More »

FX Weekly Preview: Next Week’s Two Bookends

The start of next week will likely be driven by Deutsche Bank's travails and dollar funding pressures, which may or may not be related. The end of the week features the US monthly jobs report. Despite being a noisy, high frequency time series subject to significant revisions, this report like none other can drive expectations of Fed policy.

Read More »

Read More »