Tag Archive: Jim Rogers

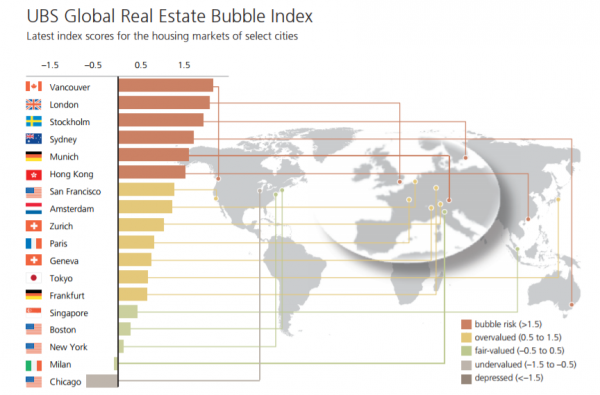

London Property Bubble Bursting? UK In Unchartered Territory On Brexit and Election Mess

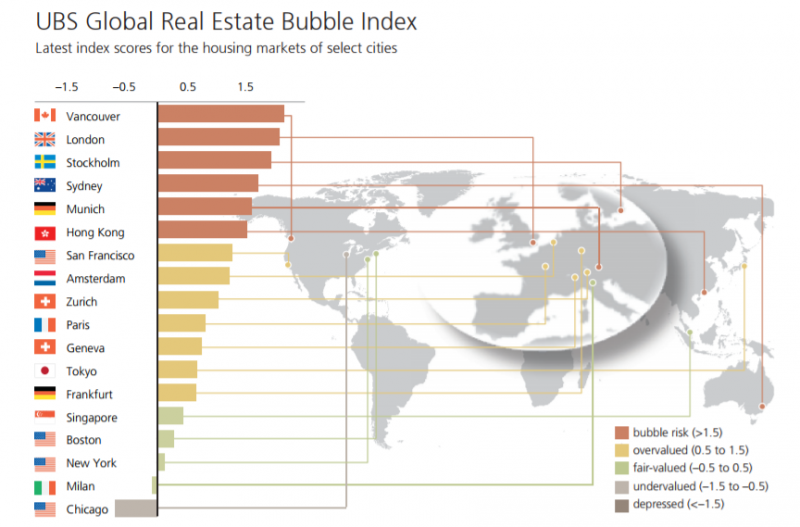

Is the London property market heading for tough times? The most recent housing figures and a new Bank of England report suggest it may well be. Recent figures show that 77% of London houses sold in May went at below asking price, up from 72% in April.

Read More »

Read More »

Jim Rogers: EU Should Address Real Problem: Their Excessive Spending Habits

Switzerland's banking secrecy is under threat. EU finance ministers have agreed to put pressure. Jim Rogers EU leaders should address the real problems - like their own unchecked spending habits. Video

Read More »

Read More »

Why the SNB will not Imitate Hong Kong, but Potentially Singapore

The SNB will not be able to realize a fixed currency peg over the long-term. The consequence would be that Switzerland loses its competitive advantage, lower Swiss rates, if it follow euro inflation.

Read More »

Read More »

Jim Rogers, 2012: When Will the Peg Fall? Will Switzerland Become Bulgaria?

Given that most farmers are rather old, he says that the world should be very grateful to speculators that bet on food prices, this helps to obtain the required younger farmers. Jim Rogers has exchanged all his euros into francs, he thinks that the EUR/CHF peg will fall soon. Tagesanzeiger (

Read More »

Read More »

Marc Faber argues against Jim Rogers

The most famous investors Marc Faber and Jim Rogers were in a common interview on CNBC. Marc Faber is of our position, whereas Jim Rogers is still bullish on commodities. Marc points out that China’s bench mark stock index the Shanghai Stock Exchange Composite Index was at 6100 in 2007 even as it … Continue reading...

Read More »

Read More »

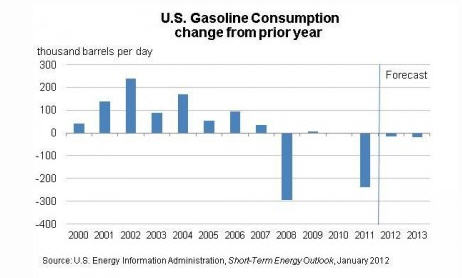

Oil price increases in 2012 and why they are not real

Oil prices Oil prices will rise quickly this year along with the recovery, the Iran issues and last but not least driven by investor demands of yield, implemented in the HFT algos. Interestingly the Iran issues already existed in December, but oil prices were falling, at that moment investors did not believe in a global recovery yet, …

Read More »

Read More »