Tag Archive: Japanese yen

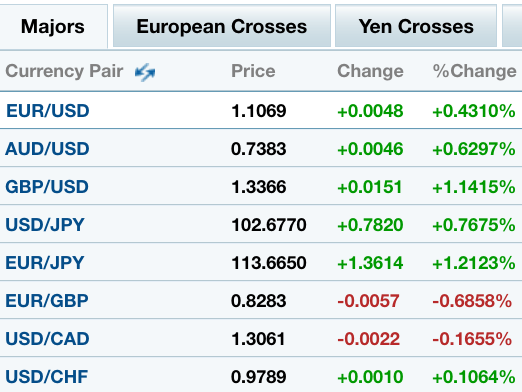

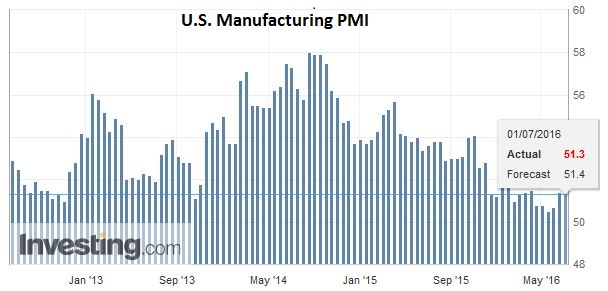

FX Daily, July 11: Dollar Extends Gains

The combination of the rebounding US job growth and gains in the S&P 500 to near record levels before the weekend is helping boost the US dollar against the major currencies, while the emerging market currencies are mixed. In addition, indications that Japan will put together another fiscal stimulus package and the Bank of England may cut rates late this week are helping global equities.

Read More »

Read More »

FX Weekly Preview: Sources of Movement

Electoral politics remains significant. BOE is likely to cut rates, while BoC may tilt more dovishly. US Q2 earnings season formally begins.

Read More »

Read More »

Fearing Confiscation, Japanese Savers Rush To Buy Gold And Store It In Switzerland

Japan has pushed further away from being the nation that embraces "Krugman Era" economics and deeper into the new "Bernanke Era" economics of helicopter money. As a result Japan's citizens have been on a blitz to save what little purchasing power they still possess, before hyperinflation finally arrives.

Read More »

Read More »

SIBOR Forex Banking Fraud – another FX rate rigging scandal

Forex has been the big banks secret gold mine, supporting their other losing operations (like normal banking business, lending, etc.). To a large extent this has been unraveling, and this SIBOR lawsuit is another attack on their risk free profit center (FX). Read the entire lawsuit released by Elite E Services here in full.

Read More »

Read More »

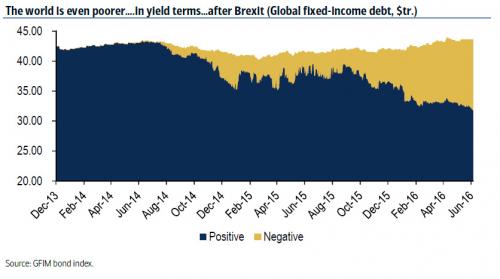

FX Daily, July 06: Dollar and Yen Advance Amid Growing Investor Angst

What a difference a few days make. Many saw last week's equity market advance a sign that Brexit anxiety was overdone. However, quarter-end position adjustments appear to have been misread. Equity markets are falling now. Bond yields in the US, Japan, and Germany, are at new record low. Japan's 20-year bond yield briefly dipped below zero for the first time.

Read More »

Read More »

FX Daily, July 05: Sterling Hammered to New Lows, Yen Pops, SNB intervenes

The British pound has been hammered to fresh lows just above $1.3115. The euro is moving toward GBP0.8500. The immediate catalyst is three-fold. First, one of the UK's largest property funds has moved to prevent retail liquidation. Second, the BOE reversed an earlier decision on the capital buffer for banks, which is tantamount to easing policy by boosting the banks' lending capability by as much as GBP150 bln.

Read More »

Read More »

(1.3.) Let’s improve the way we report FX rates

This post is motivated by recent headlines suggesting that the Chinese yuan has depreciated in recent days. Here's an example: China's yuan weakens to 5-1/2 low as c.bank tolerates depreciation. This headline is completely inaccurate - the Chinese yuan has been appreciating in recent days. So that's one problem I'd like to fix.

Read More »

Read More »

FX Daily, July 01: Markets Head Quietly into the Weekend

EUR/CHF finished the week after Brexit with slight improvement of 0.18%. The scare mongering by the Swiss media was misplaced. The euro even recovered from a dip after BoE governor Carney's comments on Thursday. We do not see strong SNB interventions at this elevated price level. We judged that the interventions happened below 1.08.

Read More »

Read More »

FX Daily, June 30: Calm Continues, but Rot Below the Surface

During the week the Swiss Franc lost momentum. It could regain speed only on June 30, after BoJ Carney's speech.

Read More »

Read More »

FX Daily, June 29: Fragile Calm Ahead of Quarter-End

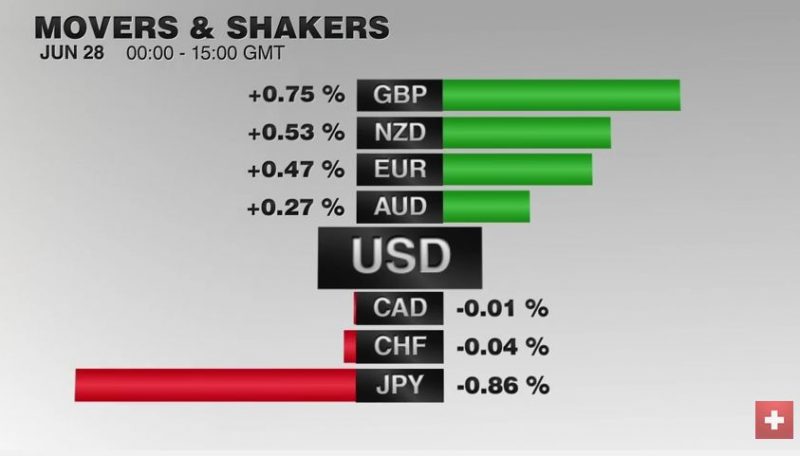

Sterling is firmer, but quarter-end considerations seem to be the key driver. Poor Japanese retail sales keep focus on policy response likely next month. New Zealand and Australian dollars are leading today's advance against the US dollar.

Read More »

Read More »

There Is Now A Staggering $11.7 Trillion In Negative Yielding Debt

It was not even a month ago when we last looked at the total amount of negative yielding debt around the globe, and were shocked to find that according to Fitch, for the first time in history (obviously), there was over $10 trillion in negative yielding debt. Fast forward 4 weeks later, and the grand total is now $1.3 trillion higher, or $11.7 trillion.

Read More »

Read More »

FX Daily, June 28: Markets Stabilize on Turn Around Tuesday

The global capital markets are stabilizing for the first time since the UK referendum. It is not uncommon for markets to move in the direction of underlying trends on Friday's; see follow-through gains on Monday, and a reversal on Tuesday. That is what is happening today.

Read More »

Read More »

How Exceptional are Conditions?

If conditions are exceptional, isn't BOJ intervention more likely? If conditions are exceptional, the ban on European government supporting banks might not be valid. Italy is leading the charge in Europe.

Read More »

Read More »

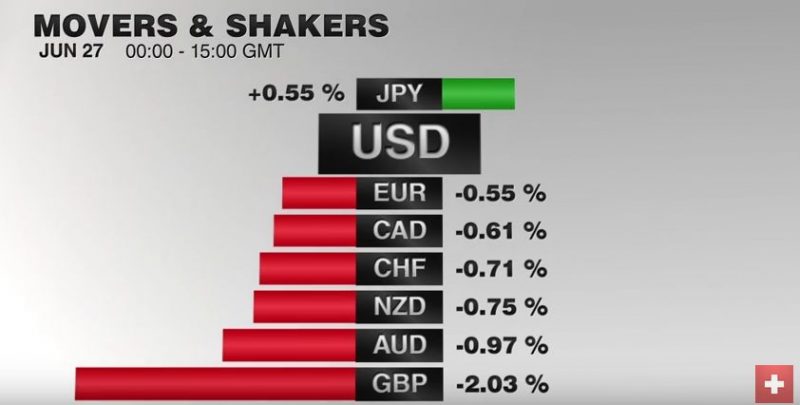

FX Daily, June 27: Post-Referendum Confusion Continues

Sterling has been sold beyond the panic low seen when it became clear that UK voters were choosing to leave the EU though nearly every economists warned of at least serious short- to medium-term negative economic implications.

Read More »

Read More »

FX Daily, June 23: R-Day is Here, but Can it Prove Anti-Climactic?

The UK's referendum is underway. The capital markets are

continuing the move that began last week with the murder of UK MP Cox.

The tragedy seemed to mark a shift in investor sentiment. Sterling

bottomed on June 17 just ahead...

Read More »

Read More »

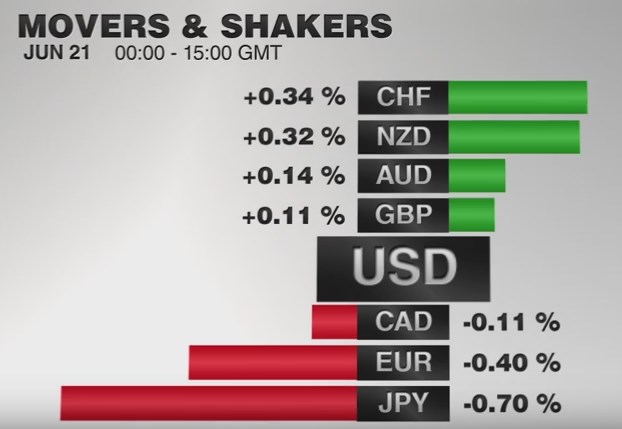

FX Daily, June 21: CHF Strongest Currency Again

The Swiss Franc was the strongest currency. The euro fell from 1.0877 to 1.0808. Two fundamental reasons:

Speculator anticipate that German investors buy Swiss francs in response to the court decision in favor of the OMT and the positive ZEW.

Read More »

Read More »

FX Daily, June 17: Martyrdom of Cox Acts as Catharsis

The assassination of Jo Cox, a member of the UK parliament is a personal

and political tragedy. Her needless death provided an inflection

point. The suspension of the referendum campaigns and a steady stream of reports and speech...

Read More »

Read More »

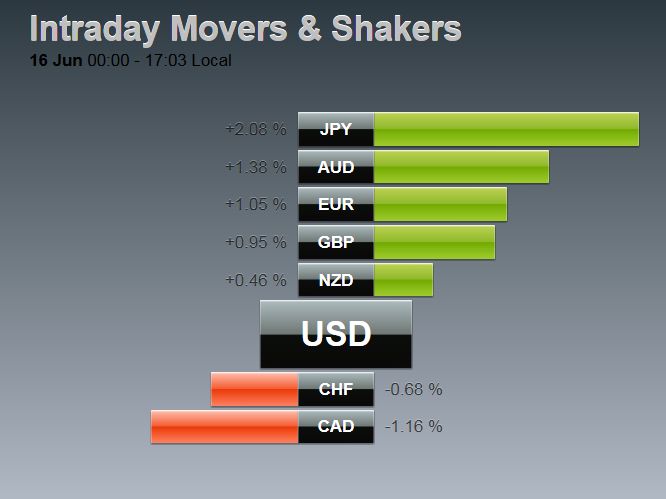

FX Daily, June 16: Markets are Anxious, Yen Soars

The US dollar is higher against the major currencies but the Japanese yen and the New Zealand dollar. The dollar fell to new two-year lows against the yen to JPY103.55 before bouncing in the European morning back to JPY104.40. The...

Read More »

Read More »

Kuroda and the BOJ

Following today's FOMC meeting, the central banks of Japan, Switzerland, and the UK meet tomorrow.

The SNB will keep its powder dry to be able to respond to the results of the UK

referendum if needed. The Bank of England is als...

Read More »

Read More »