Tag Archive: Japanese yen

Fed Violates its Own Inflation Targets. Should QE3 Be Postponed?

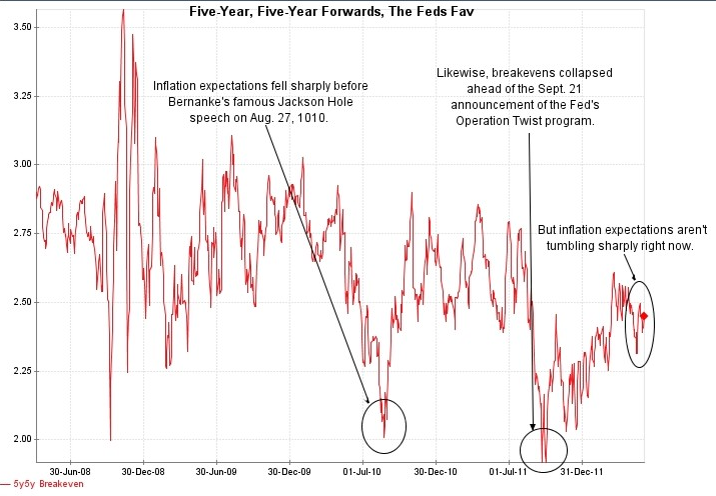

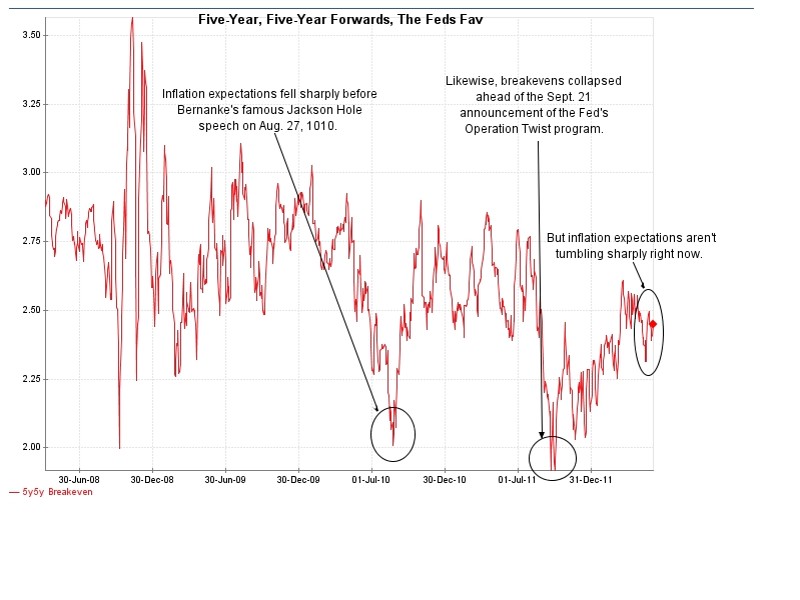

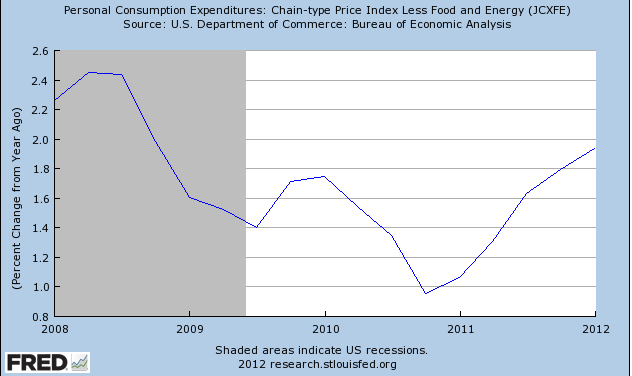

At this year’s Jackson Hole symposium, Ben Bernanke promised to help the economy via further easing if needed. We doubt his promises because because the Fed might contradict their inflation targets. Current levels of around 2 % for the consumer price inflation excluding food and energy (“core CPI“) and the deflator of the GDP …

Read More »

Read More »

Net Speculative Positions and Outlook, week of August 13

Currency Positioning and Outlook, week of August 13 Submitted by Marc Chandler from MarctoMarkets.com Market positioning in the week ending August 10 suggests that speculators in the futures market generally agree with our assessment that ECB President Draghi’s recent proposal was not a game changer. The recent pattern continued. Essentially what this entails is buying …

Read More »

Read More »

Net Speculative Positions and Technical Analysis,week from August 6

Currency Positioning and Technical Analysis, week from August6 Submitted by Marc Chandler from MarctoMarkets.com The overall technical tone of the US dollar is suspect. During the last few months, it has been trending lower against the dollar-bloc currencies, Canadian and Australian dollars and the Mexican peso. The greenback has trended higher against the euro and Swiss …

Read More »

Read More »

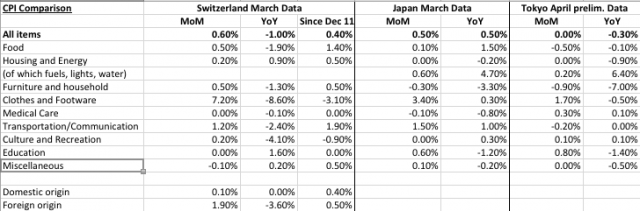

The End of Swiss and Japanese Deflation

At a time of speculations about global deflation, we show an interesting and very different aspect. Our CPI and wage data comparison among different developed countries, shows that Switzerland and Japan will see both inflation, whereas other countries like Australia will see disinflation.

Read More »

Read More »

At EUR/CHF 1.10 SNB with 31 bln. loss, each Swiss losing 150 francs per week

The Swiss National Bank would realize a loss of 31 bln. francs, if it accepted a EUR/CHF exchange rate of 1.10 instead 1.20 and if we assume that the Swissie also appreciates against the dollar and other currencies

Read More »

Read More »

Quantitative Easing Indicators, June 2012

The main drivers for demand for Swiss francs are the Euro crisis, but even more the behavior of American investors, who go out of the dollar in the fear of further bad US economic data and in the fear of Quantitative Easing. This will push down the dollar and safe-havens like the CHF, gold or the … Continue reading »

Read More »

Read More »

The vicious cycle of the US economy or why the US dollar must ultimately fall again

Just some simple words about the vicious cycle of the US economy and the consequences on the US dollar: A stronger USD will not rescue the US economy, quite the contrary. US companies will not hire in the US, but outsource or hire overseas. If they hire in the US, due to the high number …

Read More »

Read More »

Former SNB chief economist: Capital controls are just empty words

A former SNB chief economist says that capital controls are impossible, just empty words. In case of a Euro break-up the Swissie must rise together with USD, GBP and JPY An article, surprisingly from the usually left-wing Tagesanzeiger, more or less closely translated with some additional remarks.

Read More »

Read More »

SNB buys Swiss Francs and sells Euro: Welcome to the EUR/CHF peg

Why the big Q1 loss of the SNB was actually a big win for the central bank Anybody watching the EUR/CHF exchange rate this year was wondering why the volatility the pair saw last year had completely left. The pair slowly fell from 1.2156 over 1.2040 at the end of Q1 to 1.2014 today. FX … Continue reading...

Read More »

Read More »

EUR/CHF, A History, The Game Changes: April 2012

EUR/GBP: If You Want To Know Why Its Falling, Have A Look At The SNB Thanks Goose for the reminder that the SNB released figures on its FX reserves holdings and these showed a marked increase in GBP holdings. This has been a constant theme over the last few weeks/months, the SNB buys EUR/CHF in the marketplace … Continue reading »

Read More »

Read More »

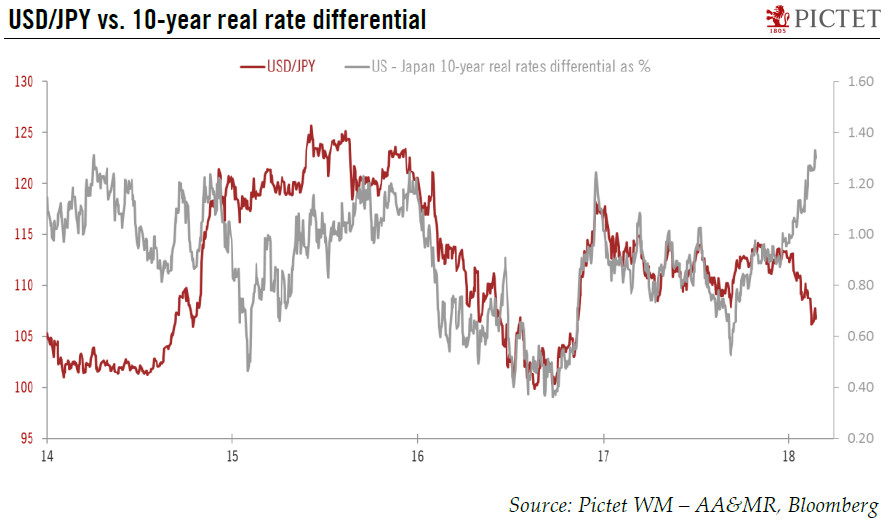

Why is the Swiss safe-haven so completely different from the Yen ?

4 future scenarios for the Swiss franc and the Japanese yen For many people it is astonishing that the Swiss franc continuously rises against the euro, especially when markets are up. Is the CHF no safe-haven any more ? This year the Japanese yen has strongly fallen against the major currencies. Together with the upturn …

Read More »

Read More »

EUR/CHF, A History, Market Betting on Floor Hike: February 2012

EUR/CHF Busy Doing Jack; Jordan Gobbing Off Later EUR/CHF sits at 1.2048, some 7 pips easier from when I started out. Barrier option interest sits at 1.2025 and ofcourse 1.2000. SNB interim head honcho Jordan speaks later this evening (18:30 GMT) in Zurich. Might be giving instructions on how to make his favourite alpine muesli … Continue reading...

Read More »

Read More »

Swiss Franc at record highs (May 2011)

May. 27th 2011 Extracts from the history of the Swiss franc (May 2011) This month, the Swiss Franc touched a record high against not one, but two currencies: the US dollar and the Euro. Having risen by more than 30% against the former and 20% against the latter, the franc might just be the world’s … Continue reading »

Read More »

Read More »

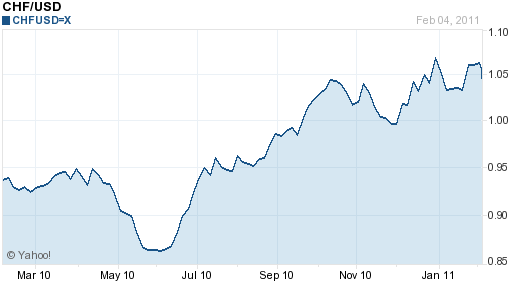

Has the Swiss Franc Reached its Limit? (February 2011)

Feb. 6th 2011 Extracts from the history of the Swiss franc (February 2011) The second half of 2010 witnessed a 20% rise in the Swiss Franc (against the US Dollar), which experienced an upswing more closely associated with equities than with currencies. It has managed to entrench itself well above parity with the Dollar, and …

Read More »

Read More »

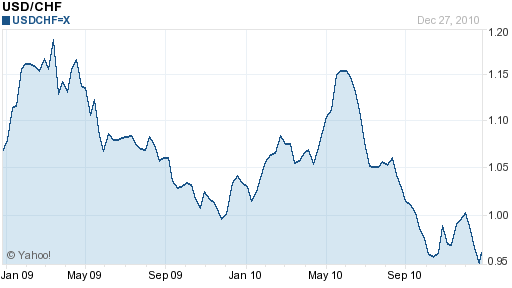

Swiss Franc Surges to Record High (December 2010)

Dec. 29th 2010 Extracts from the history of the Swiss franc (December 2010) In the last two weeks, the Swiss Franc rose to record highs against not one, not two, but three major currencies: the US Dollar, Euro, and British Pound. The Franc is now entrenched well above parity against the Dollar, and is … Continue...

Read More »

Read More »

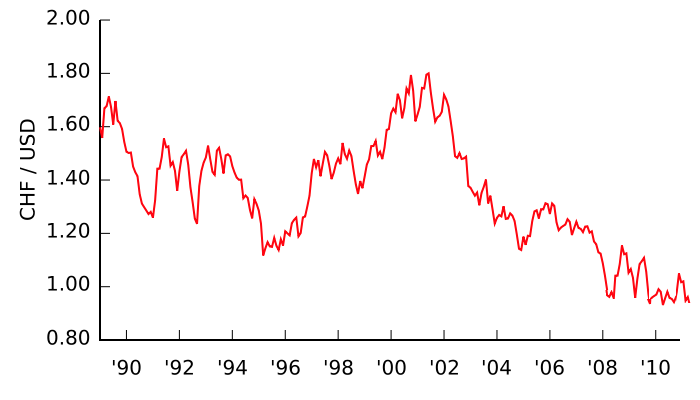

Swiss Franc Touches Record High, Nears Parity (September 2010)

Sep. 9th 2010 Extracts from the history of the Swiss franc (September 2010) In the year-to-date, the Swiss Franc has risen 3% against the Dollar, 15% against the Euro, and more than 5% on a trade-weighted basis. It recently touched a record low against the Euro, and is closing in on parity with the …

Read More »

Read More »

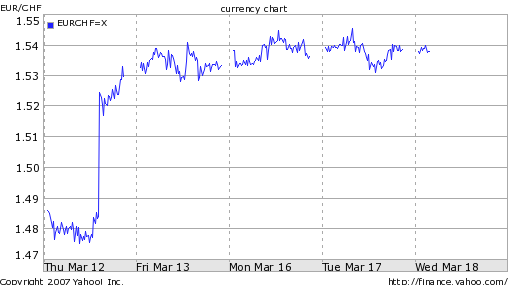

SNB Fulfills Promise of Forex Intervention, Franc Collapses (March 2009)

Extracts from the history of the Swiss franc (March 2009). Mar. 17th 2009 Last week, the Forex Blog concluded a post on the Swiss Franc by suggesting that the Swiss National Bank (SNB) could artificially depress the value of its currency, which had “not just posted strong gains against the eurosince late August …

Read More »

Read More »

Swiss Franc in Spotlight (January 2009)

Jan. 29th 2009 Extracts from the history of the Swiss franc (January 2009). The Swiss Franc is in the same boat as the US Dollar and Japanese Yen, benefiting from an increase in risk aversion and an unwinding of carry trade positions. In other words, the currency rising on the back of the sound monetary … Continue reading...

Read More »

Read More »