Tag Archive: Janet Yellen

Central Banks = Welfare for the Wealthy

The fact that central banks provide welfare for the wealthy is now entering the mainstream. The fact that all central bank policies since 2008 have dramatically increased wealth and income inequality is now grudgingly being accepted as reality by mainstream economists and the financial media. The central banks' PR facade of noble omniscience on behalf of the great unwashed masses has cracked wide open.

Read More »

Read More »

FX Weekly Preview: Yellen Pushes Divergence Front and Center

The summer dynamics of the capital markets has changed by the enhanced prospects of a Fed hike. Equity markets and other risk assets look particularly vulnerable. Sterling may do better against the euro than the dollar.

Read More »

Read More »

The Helicopter Mortgage

Medical vs. Financial Engineering. I broke my elbow a month ago, pretty badly as I was told. The surgeon screwed the pieces back together, using a steel alloy bracket and six screws. Two hours later, I left the hospital with no cast, a bandage (just to cover a very ugly scar), a prescription for painkillers and therapy started a week later.

Read More »

Read More »

Fed to Stand Pat, but Statement may be More Constructive

The Fed's nervousness in June has likely largely eased on the back of better economic data and stable international climate. The Fed may reintroduce its risk assessment. Who are the possible dissents?

Read More »

Read More »

FX Weekly Preview: BOJ and FOMC Meetings Featured in the Last Week of July

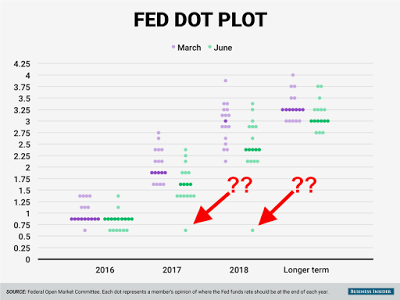

A recent Reuters poll found about half of the 100 economists surveyed expect a hike in Q4, which really means December since the November meeting is too close to the national election. The other half is split between a Q3 rate hike (September) and some time in 2017. That said, two primary dealers anticipate no hike until the end of 2017.

Read More »

Read More »

FX Daily, July 20: Sterling’s Jump Slows Dollar’s Ascent

It is a bizarre turn of events. Just like the Game of Throne's Westeros is a map of the UK put on top of an inverted Ireland, so too do UK events seem to be a strange permutation of the pre-referendum views. Although sterling and interest rates have not fully recovered from the Brexit decision, equity markets have, and fear of contagion has died down.

Read More »

Read More »

The World’s Central Banks Are Making A Big Mistake

While everyone was talking about Brexit last month, the Bank for International Settlements released its 86th annual report. Based in Basel, Switzerland, the BIS functions as a master hub for all the world’s central banks. It settles transactions among central banks and other international organizations. It doesn’t serve private individuals, businesses, or national governments.

Read More »

Read More »

FX Daily, July 11: Dollar Extends Gains

The combination of the rebounding US job growth and gains in the S&P 500 to near record levels before the weekend is helping boost the US dollar against the major currencies, while the emerging market currencies are mixed. In addition, indications that Japan will put together another fiscal stimulus package and the Bank of England may cut rates late this week are helping global equities.

Read More »

Read More »

Alan “Bubbles” Greenspan Returns to Gold

Under a gold standard, the amount of credit that an economy can support is determined by the economy’s tangible assets, since every credit instrument is ultimately a claim on some tangible asset. […] The abandonment of the gold standard made it possible for the welfare statists to use the banking system as a means to an unlimited expansion of credit.

Read More »

Read More »

Larry Summers Wants to Give You a Free Lunch

Consequences of Central Bank Policies The existing capital stock continues to be frittered away at the expense of savers and retirees. Nonetheless, central bankers don’t give a doggone about it. This, after all, is one consequence of roughly eight years of near zero interest rate policy.

Read More »

Read More »

Planet Debt

She is a low-interest-rate person. She has always been a low-interest-rate person. And I must be honest. I am a low-interest-rate person. If we raise interest rates, and if the dollar starts getting too strong, we’re going to have some very major problems.

Read More »

Read More »

FX Weekly Preview: If No Article 50 Soon, What are the Fundamental Drivers?

Impact of Brexit will take some time to be seen, but the U.K. is already losing influence. U.S. employment data is not sufficient to get the Fed to hike this month. Pressure continues to build on the BOJ to act.

Read More »

Read More »

BofA: To Save Markets Central Banks Just Made Inequality And Populism Even Worse

There is a large dose of irony to the post-Brexit market response: while on one hand stocks have soared and as of today the S&P500 has already recouped more than half its post-Brexit losses (the SPX sank 5.7% peak-to-trough since the referendum and has since bounced 3.5%) an even sharper reaction has been observed in bonds.

Read More »

Read More »

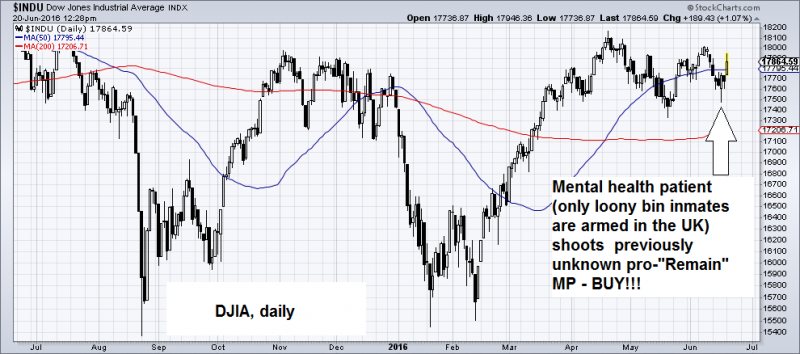

FX Daily, June 22: Markets Consolidate as Table is Set for Referendum

There is a nervous calm in the capital markets today. The focus is squarely on tomorrow’s UK referendum. Brexit According to a BBC focus group, the leeave camp won the debate 39%-34%. The last polls show a contest that it too close to calls in that the results are within the margin of error. The … Continue...

Read More »

Read More »

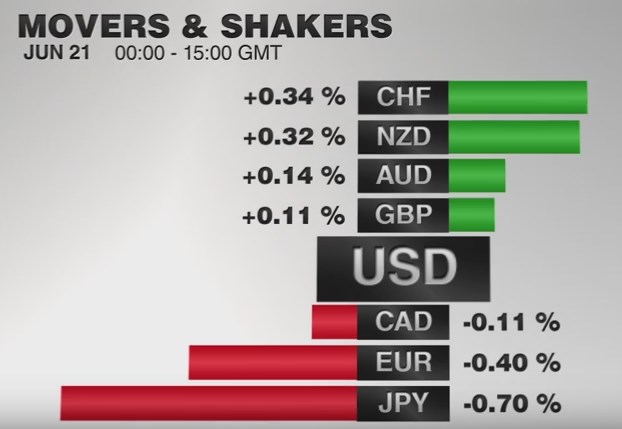

FX Daily, June 21: CHF Strongest Currency Again

The Swiss Franc was the strongest currency. The euro fell from 1.0877 to 1.0808. Two fundamental reasons:

Speculator anticipate that German investors buy Swiss francs in response to the court decision in favor of the OMT and the positive ZEW.

Read More »

Read More »

Janet Yellen’s $200-Trillion Debt Problem

More than $10 trillion of government bonds now trade at negative yields. And another $10 trillion or so worth of U.S. stocks trade well above their long-term average valuations.

And there’s more than $200 trillion of debt in the world. All of this sits on the Fed’s financial applecart. Does Janet Yellen dare upset it?

Read More »

Read More »

Bullard’s New Paradigm and the Federal Reserve

There is much to like in Bullard's new paradigm.

The problem is that it does not reflect the Federal Reserve's view or approach.

Policy emanates from the Fed's leadership, but be confused by the noise.

Read More »

Read More »

Down Go the Hopes and Dreams of Three Generations

On Wednesday, Janet Yellen pressed on the broken buttons again. After the two day FOMC meeting, the Fed Chair announced they’d continue pressing the federal funds rate down to just a ¼ to ½ percent – effectively zero. What type of insanity is this?

If she keeps it up, and whole thing doesn’t implode, the yield on the 10-Year Treasury note could also slip below zero…along with the hopes and dreams of three generations of retirees.

Read More »

Read More »