Tag Archive: Investing

Paul Tudor Jones: I Won’t Own Fixed Income

Paul Tudor Jones recently voiced concerns that rising U.S. deficits and debt and increasing interest rates could lead to a fiscal crisis. His perspective reflects the long-standing fear that sustained borrowing will trigger inflation, raise interest rates, and eventually overwhelm the government’s ability to manage its debt obligations. In short, his thesis is that interest …

Read More »

Read More »

The MACD: A Guide To This Powerful Momentum Gauge

When we discuss technical analysis in our articles and podcasts, we often examine the moving average convergence divergence indicator, better known as the MACD, or colloquially the Mac D. The MACD is one of our favored technical indicators to help forecast prices and manage risk. Accordingly, let's learn more about the MACD to see how …

Read More »

Read More »

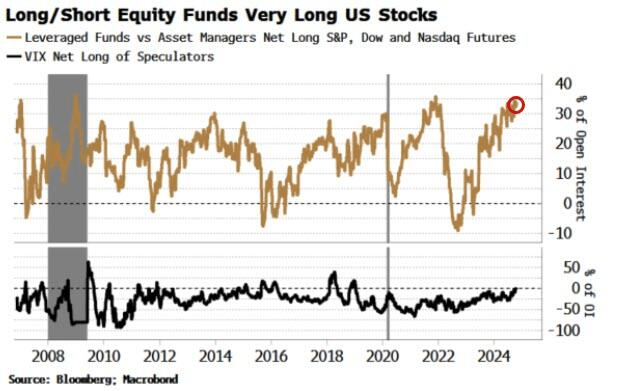

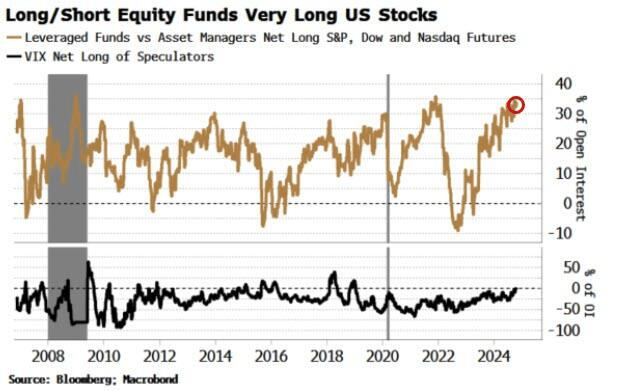

Exuberance – Investors Have Rarely Been So Optimistic

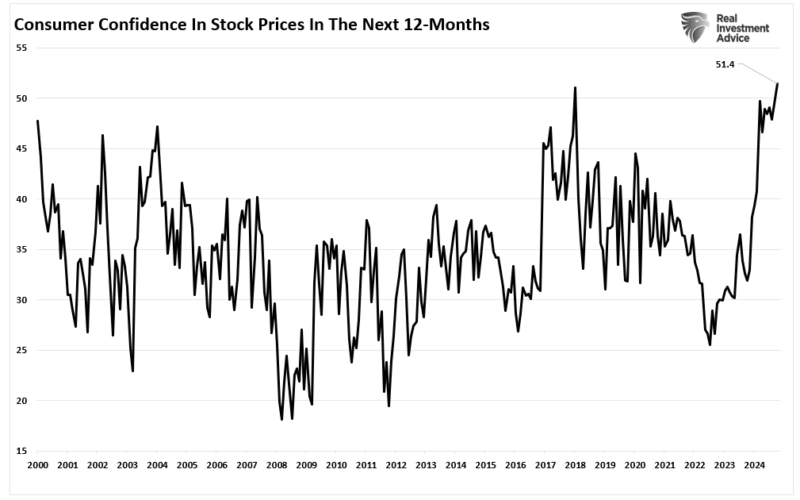

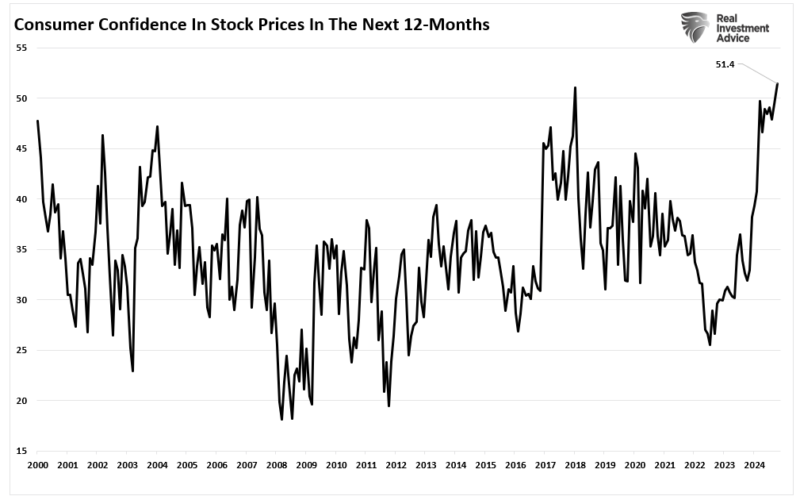

Investor exuberance has rarely been so optimistic. In a recent post, we discussed investor expectations of returns over the next year, according to the Conference Board's Sentiment Index. To wit: "Consumer confidence in higher stock prices in the next year remains at the highest since 2018, following the 2017 “Trump” tax cuts." (Note: this survey was …

Read More »

Read More »

Exuberance – Investors Have Rarely Been So Optimistic

Investor exuberance has rarely been so optimistic. In a recent post, we discussed investor expectations of returns over the next year, according to the Conference Board’s Sentiment Index. To wit:

“Consumer confidence in higher stock prices in the next year remains at the highest since 2018, following the 2017 “Trump” tax cuts.“ (Note: this survey was completed before the Presidential Election.)

We also discussed households’ allocations...

Read More »

Read More »

Trump Presidency – Quick Thoughts On Market Impact

The prospect of a Trump presidency has led to much debate and speculation about how markets might react. Depending on what policies are eventually passed, there are potential risks and opportunities in both the stock and bond markets. While the market surged immediately following the election, many potential future headwinds may impact returns from economic …

Read More »

Read More »

Trump Presidency – Quick Thoughts On Market Impact

The prospect of a Trump presidency has led to much debate and speculation about how markets might react. Depending on what policies are eventually passed, there are potential risks and opportunities in both the stock and bond markets. While the market surged immediately following the election, many potential future headwinds may impact returns from economic growth, monetary and fiscal policy, and geopolitical events.

Here are some quick...

Read More »

Read More »

Why Is Gold Surging?

Record deficit spending, soaring money supply, and inflation are among the likely responses we would hear from investors to the question of why gold is surging. Instead of presuming those or other market narratives about gold prices are correct, let's analyze historical correlations between gold and economic and market data. In addition to helping you …

Read More »

Read More »

Why Is Gold Surging?

Record deficit spending, soaring money supply, and inflation are among the likely responses we would hear from investors to the question of why gold is surging. Instead of presuming those or other market narratives about gold prices are correct, let’s analyze historical correlations between gold and economic and market data.

In addition to helping you better appreciate why gold is surging, our analysis will help you recognize that market...

Read More »

Read More »

Election Day! Plan For Volatility

With Election Day finally here, markets are bracing for potential volatility. History shows that the stock market can react unpredictably to election outcomes, especially when the results are unclear or contested. In past elections, sudden policy shifts, political uncertainty, or contentious outcomes caused heightened volatility—making it essential to prepare your portfolio now to weather whatever …

Read More »

Read More »

Election Day! Plan For Volatility

With Election Day finally here, markets are bracing for potential volatility. History shows that the stock market can react unpredictably to election outcomes, especially when the results are unclear or contested. In past elections, sudden policy shifts, political uncertainty, or contentious outcomes caused heightened volatility—making it essential to prepare your portfolio now to weather whatever the day brings.

The S&P 500 has averaged a...

Read More »

Read More »

Corporate Buybacks: A Wolf In Sheep’s Clothing

Corporate buybacks have become a hot topic, drawing criticism from regulators and policymakers. In recent years, Washington, D.C., has considered proposals to tax or limit them. Historically, buybacks were banned as a form of market manipulation, but in 1982, the SEC legalized open-market repurchases through Rule 10b-18. Although intended to offer companies flexibility in managing …

Read More »

Read More »

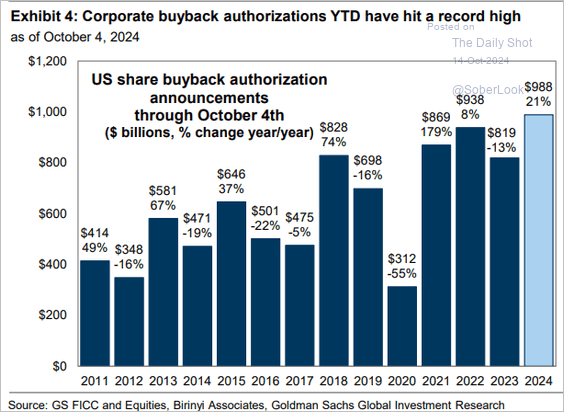

Corporate Buybacks: A Wolf In Sheep’s Clothing

Corporate buybacks have become a hot topic, drawing criticism from regulators and policymakers. In recent years, Washington, D.C., has considered proposals to tax or limit them. Historically, buybacks were banned as a form of market manipulation, but in 1982, the SEC legalized open-market repurchases through Rule 10b-18. Although intended to offer companies flexibility in managing capital, buybacks have evolved into tools often serving executive...

Read More »

Read More »

Can Paul Tudor Jones and Stanley Druckenmiller Be Wrong?

Can famed investors Paul Tudor Jones and Stan Druckenmiller, who recently proclaimed they are short bonds, thus betting on higher yields, be wrong? Instead of mindlessly assuming such legendary investors are correct, let's do some homework. First, though, let's remind ourselves that Paul Tudor Jones and Stanley Druckenmiller are known for their aggressive trading styles. …

Read More »

Read More »

Can Paul Tudor Jones and Stanley Druckenmiller Be Wrong?

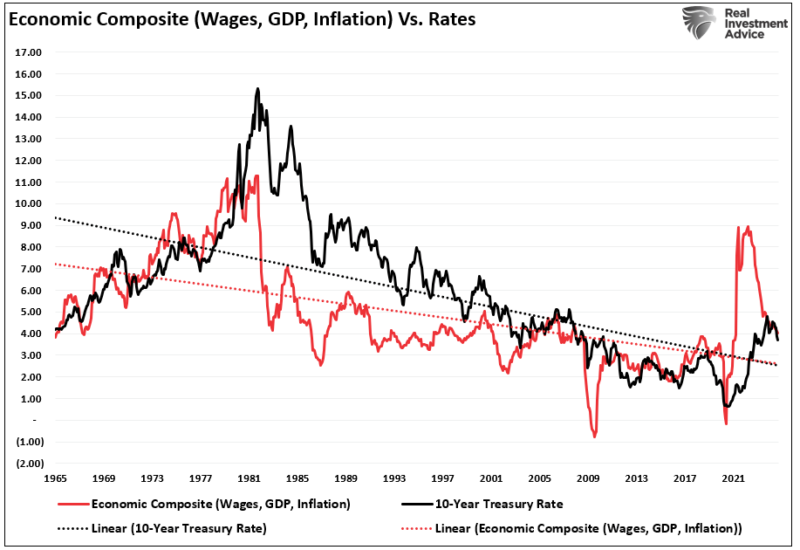

Can famed investors Paul Tudor Jones and Stan Druckenmiller, who recently proclaimed they are short bonds, thus betting on higher yields, be wrong? Instead of mindlessly assuming such legendary investors are correct, let’s do some homework.

First, though, let’s remind ourselves that Paul Tudor Jones and Stanley Druckenmiller are known for their aggressive trading styles. Therefore, we don’t know whether their bets are short term trades for a...

Read More »

Read More »

Key Market Indicators for November 2024

Key market indicators for November 2024 present a complex but opportunity-filled environment for traders and investors. Following the first phase of Federal Reserve rate cuts and growing global uncertainties, the technical landscape suggests several notable shifts. Let’s explore the key market indicators to watch.

Note: If you are unfamiliar with basic technical analysis, this video is a short tutorial.

Seasonality and Breakout...

Read More »

Read More »

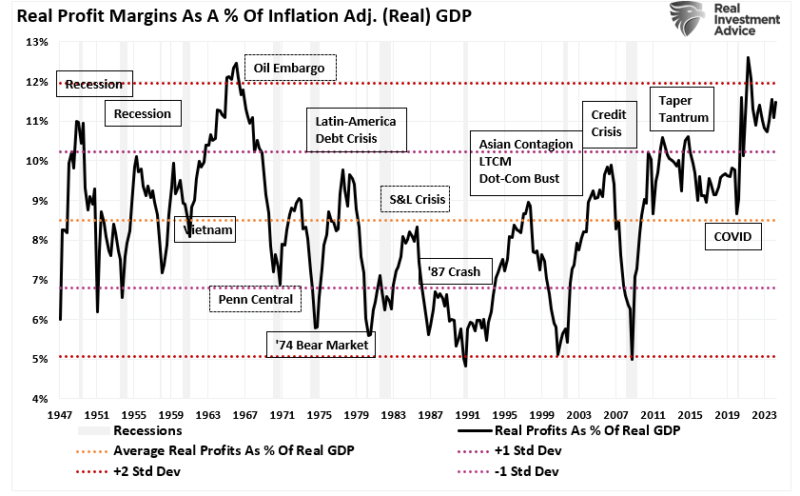

Lower Forward Returns Are A High Probability Event

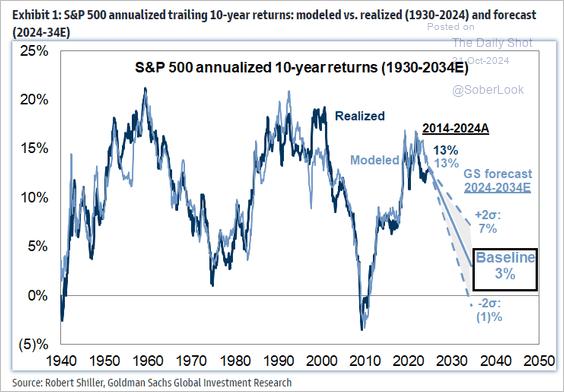

I was emailed several times about a recent Morningstar article about J.P. Morgan’s warning of lower forward returns over the next decade. That was followed up by numerous emails about Goldman Sachs’ recent warnings of 3% annualized returns over the next decade.

While we have previously covered many of these article’s points, a comprehensive analysis is needed. Let’s start with the overall conclusion from JP Morgan’s article:

“The...

Read More »

Read More »

Memory Inflation Warps Bond Yields

The Mayo Clinic defines Post Traumatic Stress Disorder, or PTSD, as “a mental health condition that’s caused by an extremely stressful or terrifying event — either being part of it or witnessing it.” Within the field of PTSD research is a concept called “memory inflation.” Memory inflation occurs when memories of traumatic events become more intense over time.

Memory inflation of past events amplifies one’s emotions and behaviors. As we will...

Read More »

Read More »

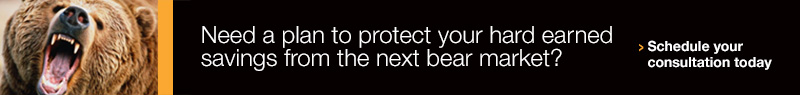

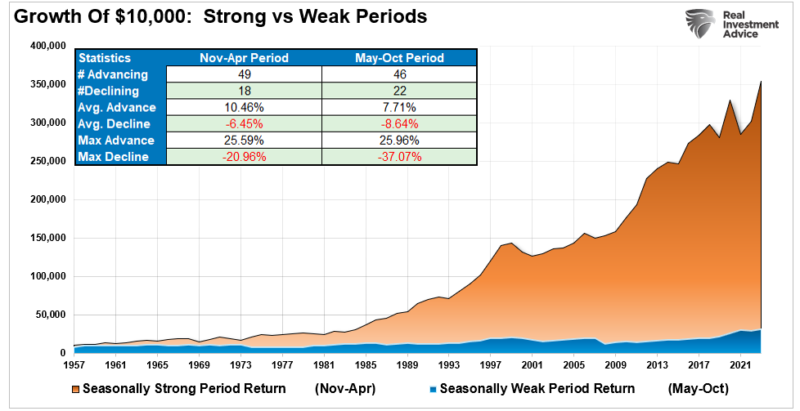

Seasonality: Buy Signal And Investing Outcomes

Seasonality has long influenced stock market trends, offering insights into predictable cycles of strength and weakness throughout the year. Yale Hirsch, the creator of the Stock Trader’s Almanac, is one of the most well-known contributors to studying these patterns. His research has highlighted that certain periods of the year consistently present better opportunities for investors to generate returns, while other times warrant caution.

The...

Read More »

Read More »

Bastiat And The “Broken Window”

In times of disaster and destruction, a common narrative often emerges that rebuilding efforts will lead to economic growth. The idea that repairing damage and replacing destroyed goods creates jobs that spur consumption and stimulate economic activity is tempting. However, as French economist Frédéric Bastiat explained in his famous “Broken Window Theory,” this reasoning is fundamentally flawed. Rather than generating net economic benefits,...

Read More »

Read More »

The VIX And Market Climb: Should We Care?

The financial media frequently opines on what the daily gyrations of the VIX (implied volatility index) signal regarding investor sentiment. Despite how often it is quoted and discussed, many investors do not truly appreciate what implied volatility measures.

We take this opportunity to help you better understand implied volatility. Furthermore, we discuss other lesser-followed measures of implied volatility that help better assess whether...

Read More »

Read More »