Tag Archive: inflation

True Cognitive Dissonance

There is gold in Asia, at least gold of the intellectual variety for anyone who wishes to see it. The Chinese offer us perhaps the purest view of monetary conditions globally, where RMB money markets are by design tied directly to “dollar” behavior. It is, in my view, enormously helpful to obsess over China’s monetary system so as to be able to infer a great deal about the global monetary system deep down beyond the “event horizon.”

Read More »

Read More »

Some Notes On GDP Past And Present

The second estimate for GDP was so similar to the first as to be in all likelihood statistically insignificant. The preliminary estimate for real GDP was given as $16,804.8 billion. The updated figure is now $16,804.1 billion. In nominal terms there was more variation, where the preliminary estimate of $18,860.8 billion is now replaced by one for $18,855.5 billion.

Read More »

Read More »

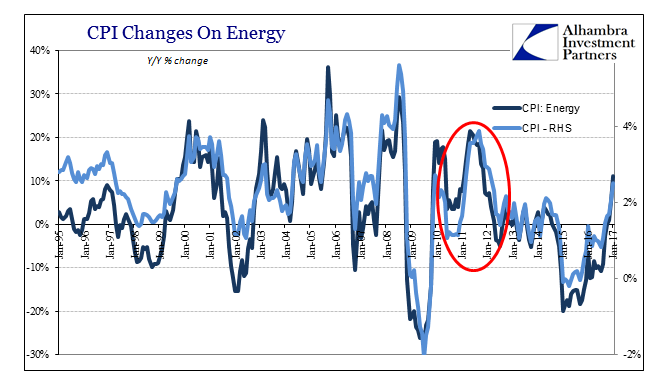

U.S. CPI after the energy push

The Consumer Price Index for January 2017 rose 2.5%, pulled upward by its energy component which thanks to oil prices now being comparing to the absolutely lows last year saw that part of the index rise 11.1% year-over-year. Given that oil prices bottomed out on February 11, 2016, this is the last month where oil prices and thus energy inflation will be at its most extreme (except, of course, should WTI actually rise between now and the end of...

Read More »

Read More »

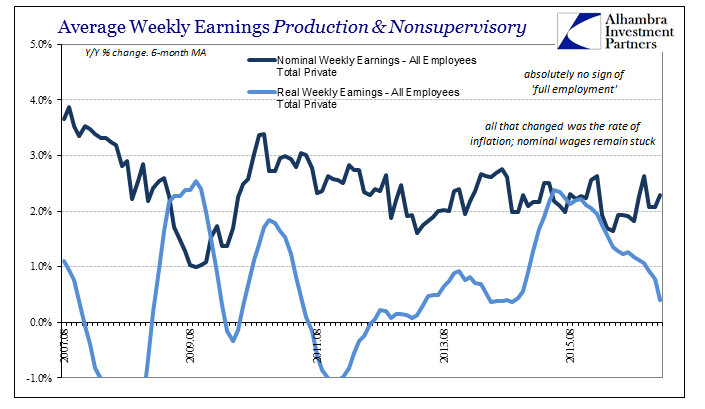

Real Wages Really Inconsistent

Real average weekly earnings for the private sector fell 0.6% year-over-year in January. It was the first contraction since December 2013 and the sharpest since October 2012. The reason for it is very simple; nominal wages remain stubbornly stagnant but now a rising CPI subtracts even more from them.

Read More »

Read More »

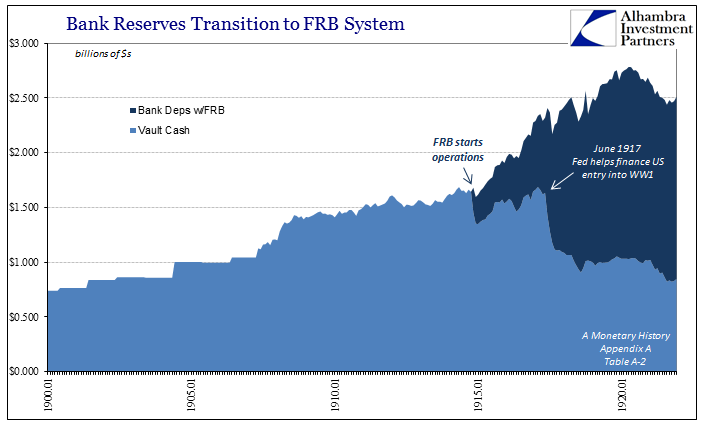

A New Frame Of Reference Is Really All That Is Necessary To Start With

In the middle of 1919, the United States was beset by a great many imbalances. Having just conducted a wartime economy, almost everything before then had been absorbed by the World War I effort. With fiscal restraint subsumed by national emergency, inflation was the central condition. Given that the Federal Reserve was by then merely a few years old, no one was quite sure what to do about it.

Read More »

Read More »

Risk Reward Analysis for Financial Markets

We focus this video regarding the potential upside for stocks versus the considerable downside risk for investors. All Technical Analysis is flawed and backward looking, it is a Critical Thinking flaw to extrapolate the future from the most recent past. I want to know the next market move, and not still be stuck on the most recent market move. And the most important fact of all is valuations, stocks are in a bubble right now due to Central Banks...

Read More »

Read More »

WTI Crude tumbles To $49 Handle, Erases OPEC/NOPEC Deal Gains

But, but, but... growth, and inflation, and supply cuts, and growth again... Well that de-escalated quickly... As Libya restarts exports and The Fed sends the dollar soaring so WTI crude prices just broke back to a $49 handle for the first time since Dec 8th.

Read More »

Read More »

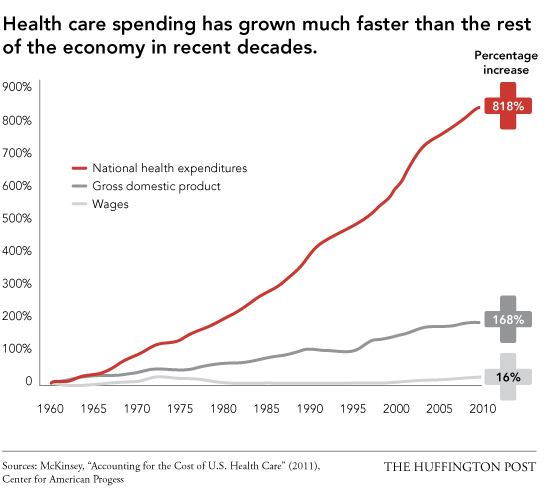

Healthcare: Inflation Hidden in Plain Sight

Charles Hugh Smith shows how health care costs are exploding in the United States and how this will lead sooner or later to inflation.

Read More »

Read More »

Great Graphic: Consumer Inflation: US, UK, EMU

Price pressures appear to have bottomed for the US, UK, and to a lesser extent, EMU. Rise in prices cannot be reduced solely to the increase of oil. Core prices are also rising.

Read More »

Read More »

Great Graphic: China’s PPI and Commodities

China's PPI rose for the first time in four years. It is related to the rise in commodities. Yet there are good reasons there is not a perfect fit between China's PPI and commodity prices. US and UK CPI to be reported next week, risk is on the upside.

Read More »

Read More »

Great Graphic: Low Wages in US Rising

The bottom of the US wage scale is rising. The added wage costs are being blunted by less staff turnover, hiring and training costs. It is consistent with our expectation of higher price pressures.

Read More »

Read More »

Great Graphic: The Decline in Durable Goods Prices

This economic graph is maybe the most important in the last decade. Service prices are rising, while goods prices have steadily fallen. The main reason for us is the possibility to outsource big parts of the durables supply-chain to China and East Asia. This is where productivity growth happens. Prices of services, however, are ever increasing. …

Read More »

Read More »

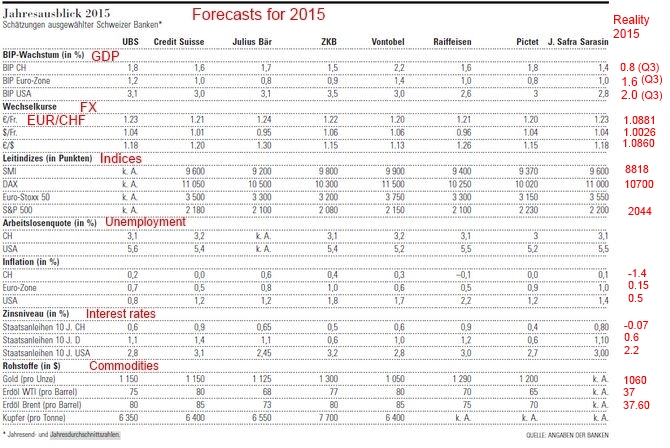

Economic Forecasts for 2015: Swiss Banks were too Optimistic

Our analysis of the forecasts of economic data for 2015 shows that the Swiss banks were too optimistic for most data. US growth, the oil price, inflation and interest rates are far lower than expected. The errors for stock indices were smaller.

Read More »

Read More »

Keith Weiner: Inflation Caused the Greek Tragedy

By inflation, I don’t refer to rising consumer prices in Athens. My Greek friends tell me that prices have been steady there in recent years. The focus on prices is the greatest sleight of hand ever perpetrated. It diverts your attention away from the real action.

Inflation is the counterfeiting of credit. It is borrowing, when you can’t pay and you know it. Inflation is taking money under false pretenses, and issuing fraudulent bonds.

This...

Read More »

Read More »

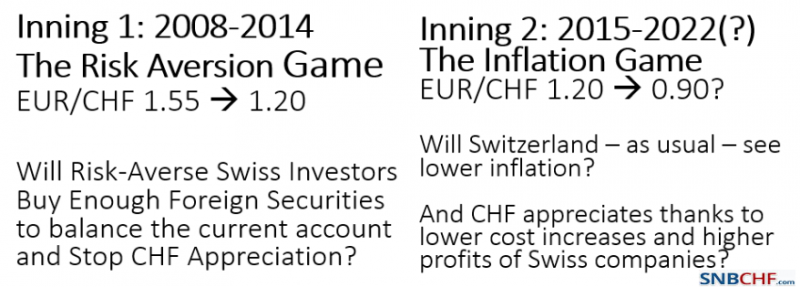

The two phases of CHF appreciation… and what is in between

We show the two phases or "two innings" of Swiss franc appreciation: The risk aversion phase and the high inflation phase.

With the weakening of emerging markets and the strengthening of the United States in 2013/2014, the Swiss National Bank (SNB) had won the first battle in the war against financial market, the "risk aversion game", the first inning in two-part match. Risk aversion is lower because the United States recovered with weaker oil...

Read More »

Read More »

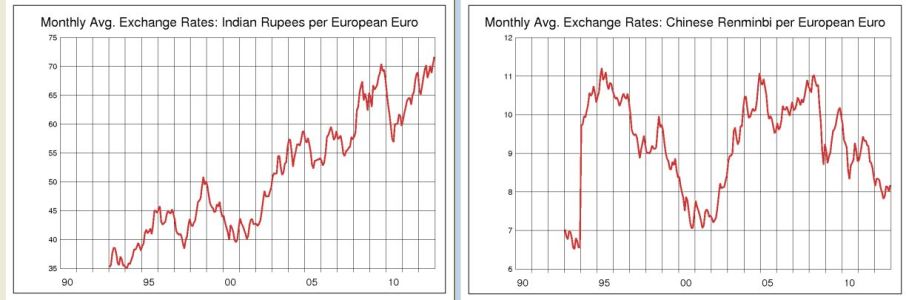

(1) What Determines FX Rates?

The effects of so-called “currency wars” and other central bank actions are small compared to the long-term impact made by these five catalysts, which include credit cycles, trade balance, differences in economic growth, and more.

Read More »

Read More »

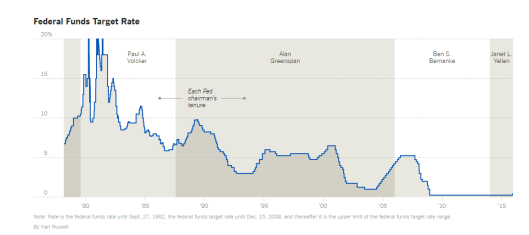

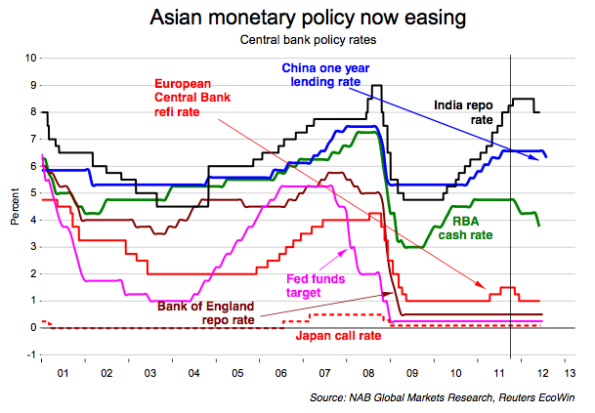

(3) Inflation, Central Banks and Interest Rates

In this chapter we connect three related concepts: inflation, central banks and interest rates.

Read More »

Read More »

The Six Major Fundamental Factors that Determine Gold and Silver Prices

Gold and silver are the most complicated assets to price. Stocks, currencies, commodities mostly depend on their fundamental data, supply and demand. Gold and silver, however, are priced indirectly.

Read More »

Read More »