Tag Archive: inflation

Can’t Hide From The CPI

On the vital matter of missing symmetry, consumer price indices across the world keep suggesting there remains none. Recoveries were called “V” shaped for a reason. Any economy knocked down would be as intense in getting back up, normal cyclical forces creating momentum for that to (only) happen. In the context of the past three years, symmetry is still nowhere to be found.

Read More »

Read More »

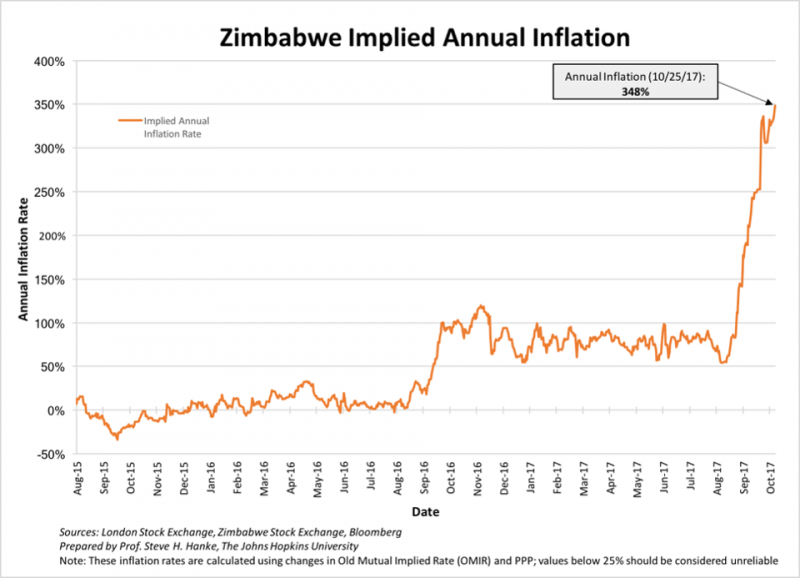

Deepening Crisis In Hyper-inflationary Venezuela and Zimbabwe Show Why Physical Gold Is Ultimate Protection

Deepening Crisis In Hyper-inflationary Venezuela and Zimbabwe. Real inflation in Zimbabwe is 313 percent annually and 112 percent on a monthly basis. Venezuela's new 100,000-bolivar note is worth less oday thehan USD 2.50. Maduro announces plans to eliminate all physical cash. Gold rises in response to ongoing crises.

Read More »

Read More »

Aligning Politics To economics

There is no argument that the New Deal of the 1930’s completely changed the political situation in America, including the fundamental relationship of the government to its people. The way it came about was entirely familiar, a sense from among a large (enough) portion of the general population that the paradigm of the time no longer worked. It was only for whichever political party that spoke honestly to that predicament to obtain long-term...

Read More »

Read More »

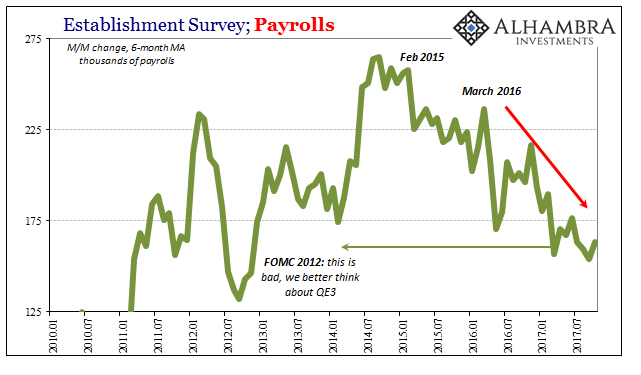

Four Point One

The payroll report for October 2017 was still affected by the summer storms in Texas and Florida. That was expected. The Establishment Survey estimates for August and September were revised higher, the latter from a -33k to +18k. Most economists were expecting a huge gain in October to snapback from that hurricane number, but the latest headline was just +261k.

Read More »

Read More »

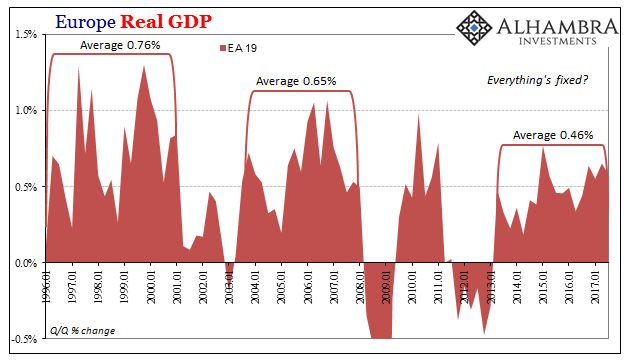

Europe Is Booming, Except It’s Not

European GDP rose 0.6% quarter-over-quarter in Q3 2017, the eighteenth consecutive increase for the Continental (EA 19) economy. That latter result is being heralded as some sort of achievement, though the 0.6% is also to a lesser degree. The truth is that neither is meaningful, and that Europe’s economy continues toward instead the abyss.

Read More »

Read More »

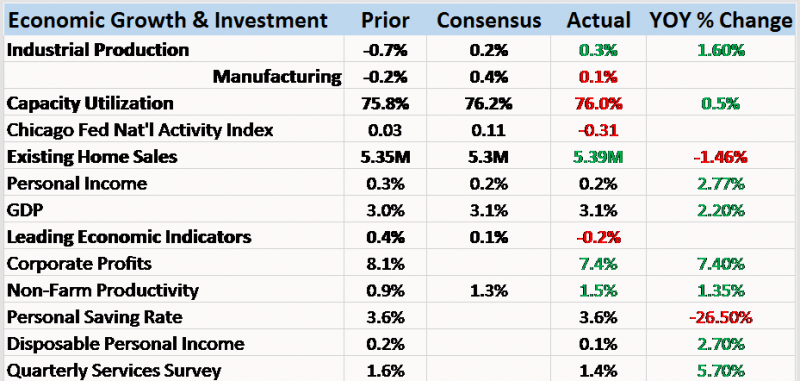

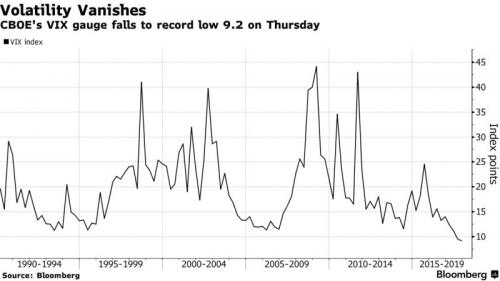

Bi-Weekly Economic Review: Yawn

When I wrote the update two weeks ago I said that we might be nearing the point of maximum optimism. Apparently, there is another gear for optimism in this market as stocks have just continued to slowly but surely reach for the sky.

Read More »

Read More »

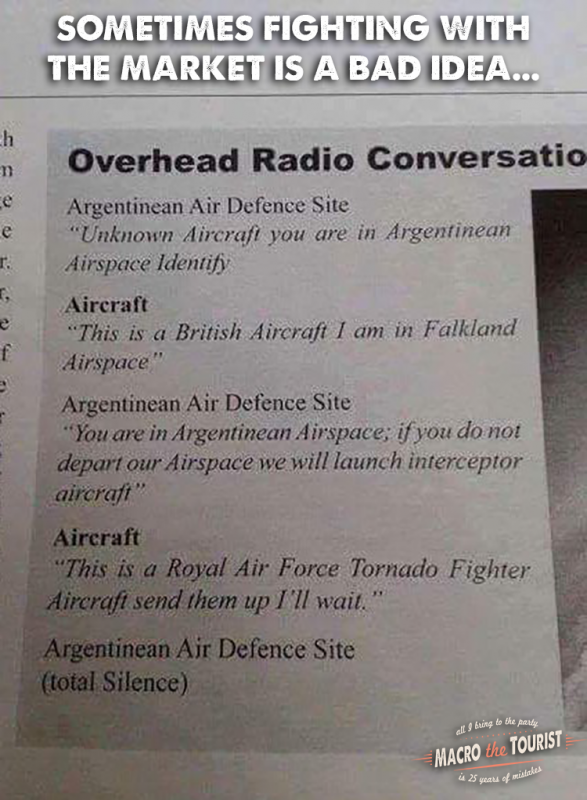

Is This The Best Way To Bet On The Fed Losing Control Of The Bond Market?

Authored by Kevin Muir via The Macro Tourist blog, Lately, one of my biggest duds of a call has been for the yield curve to steepen. Sure, I have all sorts of fancy reasons why it should steepen, but reality glares back at me in black and white on my P&L run. Sometimes fighting with the market is an exercise in futility.

Read More »

Read More »

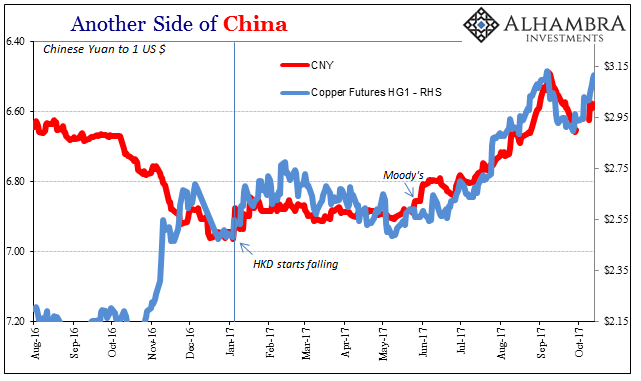

Global Inflation Continues To Underwhelm

Chinese producer prices accelerated in September 2017, while consumer price increases slowed. The National Bureau of Statistics reported this weekend that China’s PPI was up 6.9% year-over-year, a quicker pace than the 6.3% estimated for August and a 5.5% rate in July. Earlier in the year producer prices were driven mostly by 2016’s oil rebound, along with those in the rest of the global economy, but in recent months there has been more influence...

Read More »

Read More »

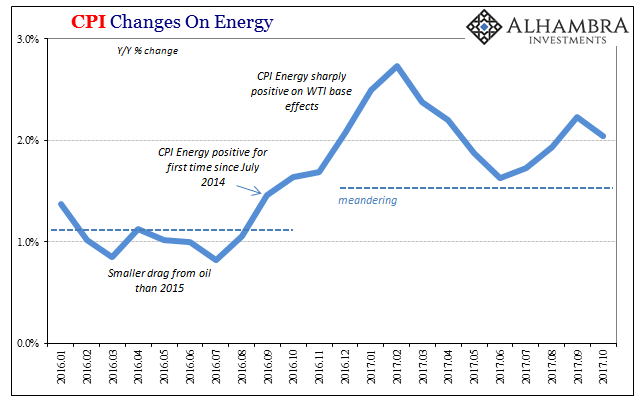

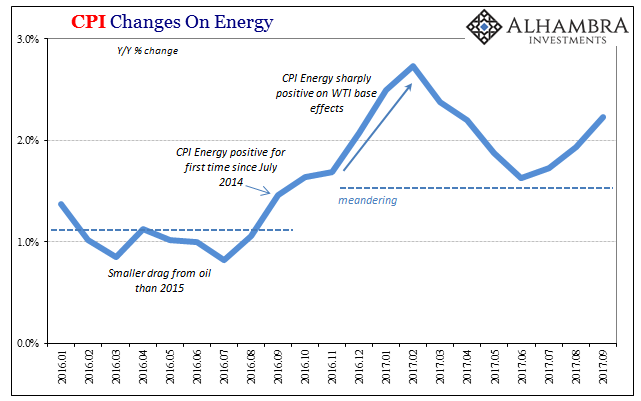

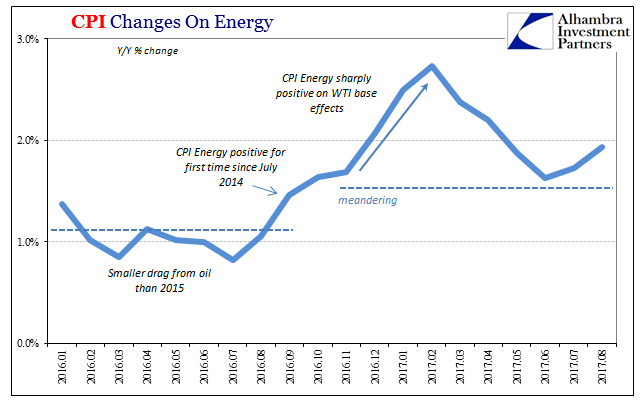

US CPI: Inflation Still Isn’t About Inflation

The US Consumer Price Index (CPI) rose back above 2% in September 2017 for the first time since April. Boosted yet again by energy prices, consumer prices overall still aren’t where the Fed needs them to be (by its own policies, not consumer reality). In fact, despite a 10.2% gain in the energy price index last month, the overall CPI just barely crossed the 2% mark (though for the Fed it really needs to be closer to 3% to match a 2% PCE Deflator).

Read More »

Read More »

Dollar Dropped like Hot Potato After Core CPI Disappointed

The dollar was bid before the US economic data. The market responded quickly upon seeing the disappointing 0.1% rise in core CPI. Given the base effect, the 0.1% increase kept the year-over-year rate at 1.7% for the fourth consecutive month. The dollar reversed lower.

Read More »

Read More »

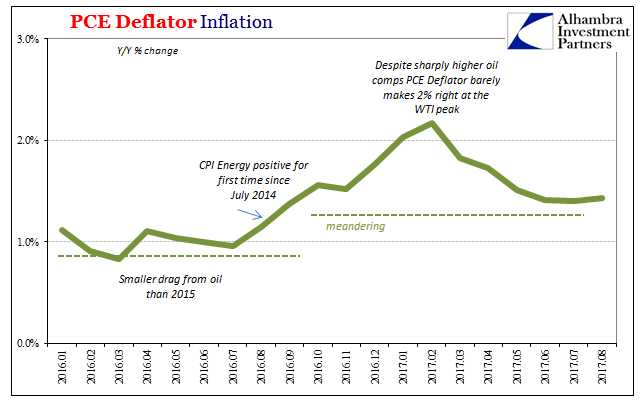

Non-Transitory Meandering

Monetary officials continue to maintain that inflation will eventually meet their 2% target on a sustained basis. They have no other choice, really, because in a monetary regime of rational expectations for it not to happen would require a radical overhaul of several core theories. Outside of just the two months earlier this year, the PCE Deflator has missed in 62 of the past 64 months. The FOMC is simply running out of time and excuses.

Read More »

Read More »

Evolving Thoughts on Inflation

In early 2005, Greenspan said that the fact that long-term rates were lower despite the Fed's campaign to raise short-term rates was a "conundrum." Many rushed to offer the Fed Chair an explanation of the conundrum, which given past cycles may not have been such an enigma in the first place.

Read More »

Read More »

The CPI Comes Home

There seems to be an intense if at times acrimonious debate raging inside the Federal Reserve right now. The differences go down to its very core philosophies. Just over a week ago, Vice Chairman Stanley Fischer abruptly resigned from the Board of Governors even though many believed he was a possible candidate to replace Chairman Yellen at the end of her term next year. His letter of resignation only cited “personal reasons.”

Read More »

Read More »

When You Are Prevented From Connecting The Dots That You See

In its first run, the Federal Reserve was actually two distinct parts. There were the twelve bank branches scattered throughout the country, each headed by almost always a banker of local character. Often opposed to them was the Board in DC. In those early days the policy establishment in Washington had little active role. Monetary policy was itself a product of the branches, the Discount Rate, for example, often being different in each and every...

Read More »

Read More »

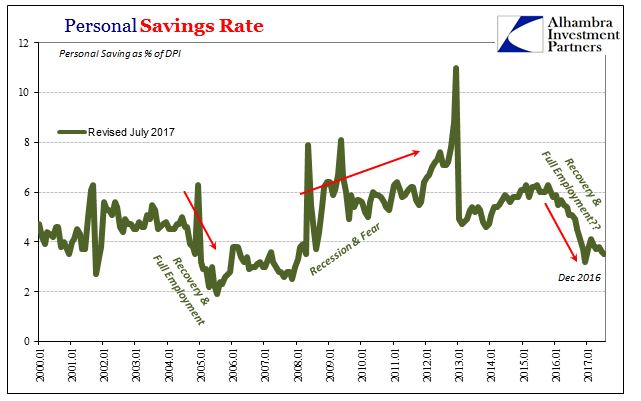

Toward The Housing Bubble, Or Great Depression?

During the middle 2000’s, one more curious economic extreme presented itself in an otherwise ocean of extremes. Though economists were still thinking about the Great “Moderation”, the trend for the Personal Savings Rate was anything but moderate, indicated a distinct lack of modesty on the part of consumers. In early 2006, the Bureau of Economic Analysis calculated that the rate had been negative for all of 2005. It was the first time in seventy...

Read More »

Read More »

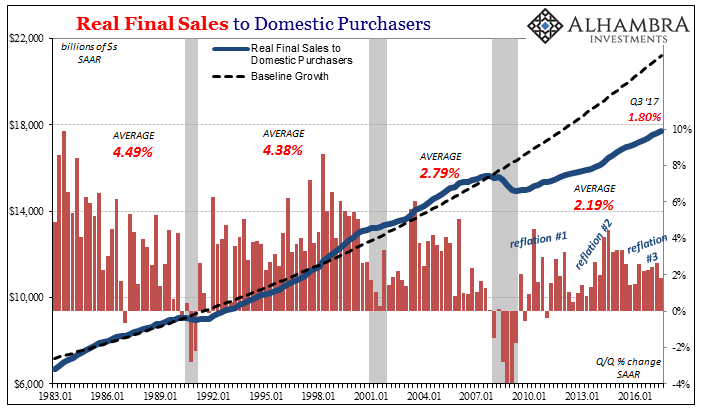

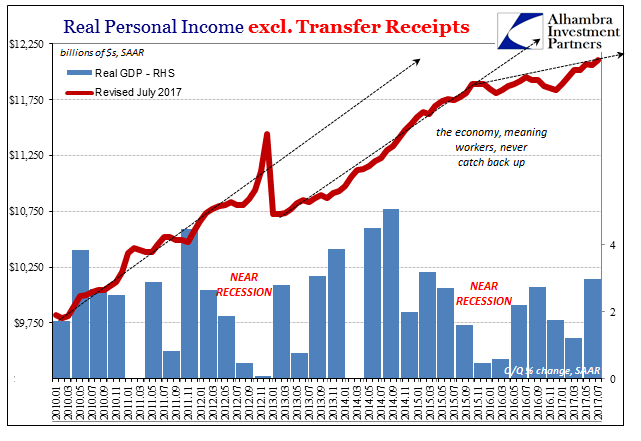

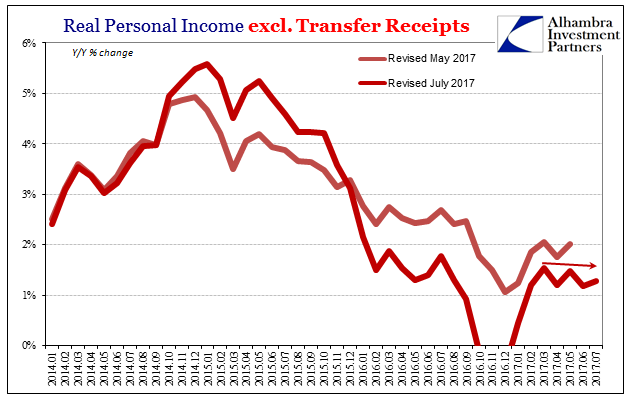

Proving Q2 GDP The Anomaly, Incomes Yet Again Fail To Accelerate

One day after reporting a slightly better number for Q2 GDP, the BEA reports today that there is little reason to suspect it was anything more or lasting. The data for Personal Income and Spending shows that the dominant condition since 2012 remains in effect – “good” quarters, or whatever passes for one these days, are the anomaly. There still is no meaningful rebound in income.

Read More »

Read More »

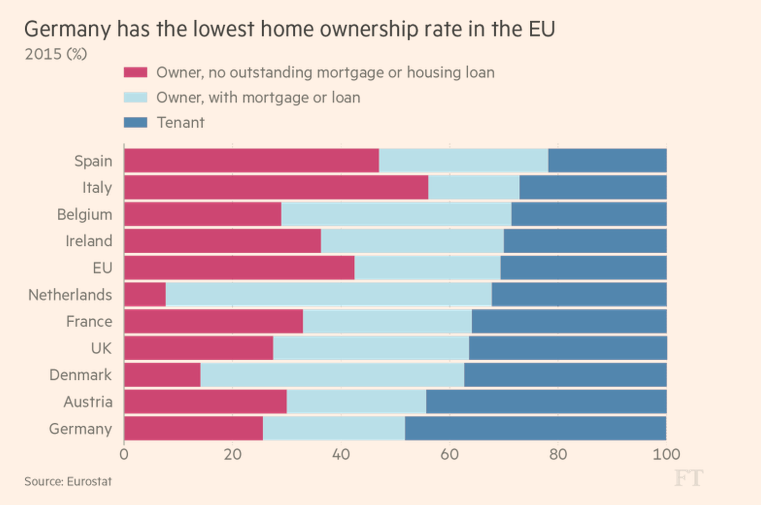

Great Graphic: Home Ownership and Measuring Inflation

Home ownership varies throughout the EU but is overall near US levels. Germany has the lowest home ownership, and Spain has the most. Italy has the least amount of mortgages. US include owner equivalent rents in CPI, the EU does not.

Read More »

Read More »

Data Dependent: Interest Rates Have Nowhere To Go

In October 2015, Federal Reserve Vice Chairman Bill Dudley admitted that the US economy might be slowing. In the typically understated fashion befitting the usual clownshow, he merely was acknowledging what was by then pretty obvious to anyone outside the economics profession.

Read More »

Read More »