Tag Archive: IMF

SNB’s IMF data

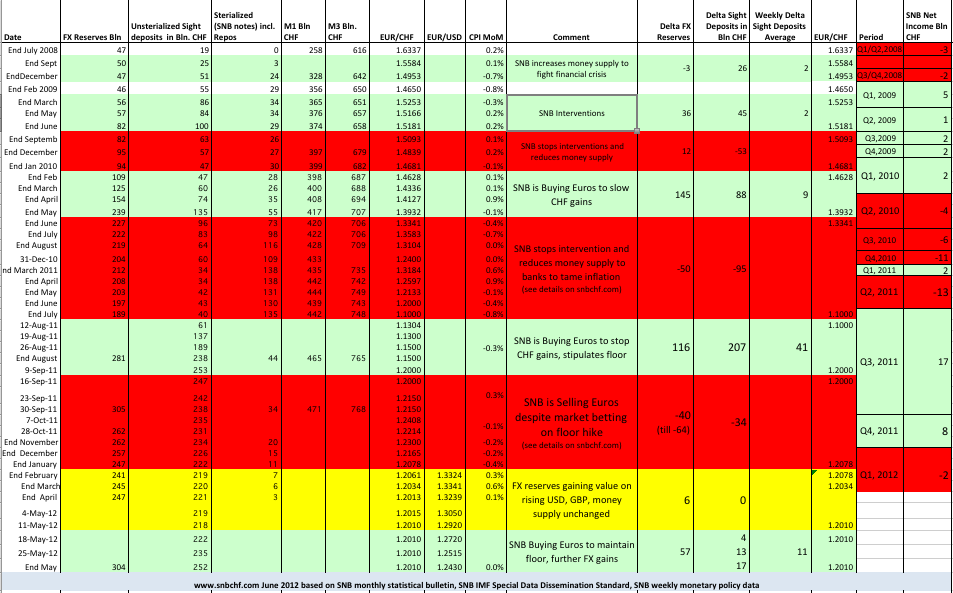

This IMF data on the SNB website shows SNB Forex and gold reserves in the last month. It is so-called "IMF Special Data Dissemination Standard (SNB Data)"

Read More »

Read More »

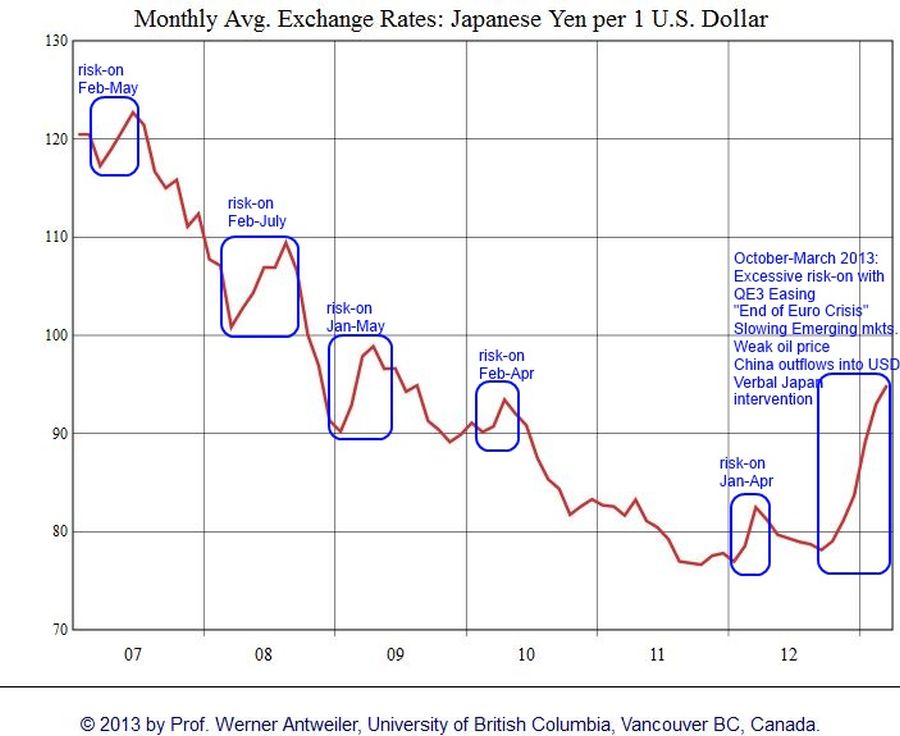

(8.1) Yen Weakness: Risk-Off Environment, Abenomics or Trade Deficit?

The yen overshot during and after the financial crisis. The USD/JPY fell from 120 in 2008 to lowest levels of 74, by 62%, but rose to 102 again. What are the reasons?

Read More »

Read More »

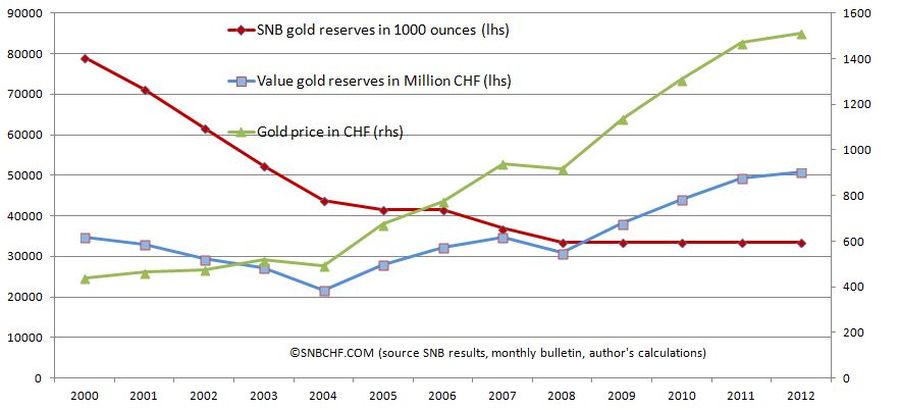

Swiss Franc History, 2000-2007: The sale of the Swiss gold reserves

A critical Swiss Franc History: Between 2000 and 2007, the SNB made the Swiss cantons happy and delivered some billions of francs to prop up their finances. The gains were unfortunately not caused by strong asset management capabilities, but mostly due to gold price improvements and gold sales at quite cheap prices.

Read More »

Read More »

The IMF Assessment for Switzerland 2014 and our critique

In the 2014 assessment for Switzerland by the International Monetary Fund, several sentences sparked in our eyes; we will contrast them with our recent critique.

Read More »

Read More »

IMF (2013): Sees Considerable Risks on SNB Balance Sheet

The International Monetary Fund (IMF) judges "that the SNB’s net revenue is subject to large fluctuations, and sizeable losses could occur if an appreciation of the Swiss franc was to take place before foreign exchange interventions were unwound."

Read More »

Read More »

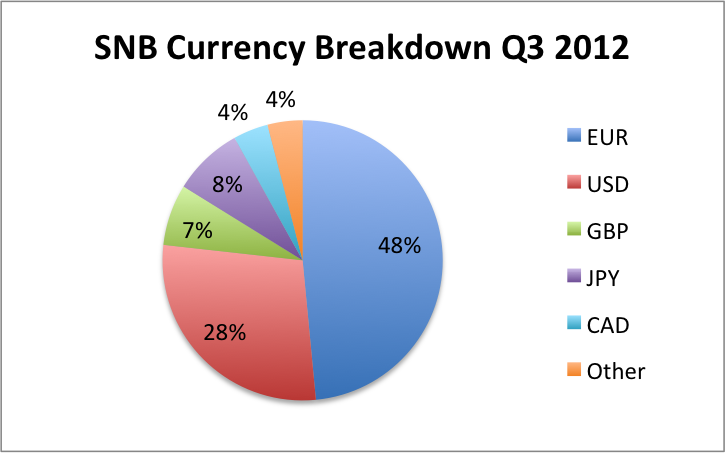

SNB Results Q3 2012: SNB Radically Reduces Euro Share from 60% to 48%

SNB Q3 Profits: 10 billion francs The Swiss National Bank (SNB) radically reduced its euro share, in the third quarter from 60% to 48%, and bought US dollars and sterling instead. In the second quarter, however, it increased the euro share from 51% to 60% and concentrated on buying euros. Given that the EUR/USD was … Continue reading...

Read More »

Read More »

IMF Data: SNB Forex Reserves and Gold in September 2012

This link on the SNB website shows the data the central bank provides to the International Monetary Fund (IMF). It shows the SNB Forex and gold reserves in the last month. It is so-called “IMF Special Data Dissemination Standard (SNB Data)” It is released together with the international investment position, some monetary aggregates and the balance of payments two weeks after …

Read More »

Read More »

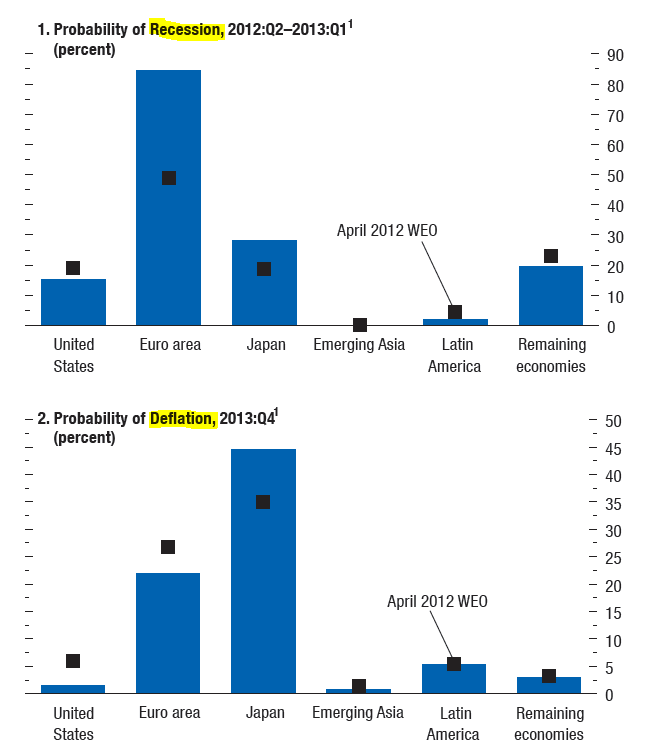

IMF World Economic Outlook

Alexander Gloy is founder and president of Lighthouse Investment Management The IMF’s (International Monetary Fund) “World Economic Outlook”, a slim 250-page piece, came out. Some excerpts: Substantial reductions in estimated output (GDP) growth for 2013 for all major countries: Unemployment in the Euro-Area (“EA”) is now expected to rise above the level …

Read More »

Read More »

Full text Spanish banks bailout: Memorandum of Understanding

Here the full text of the European’ Commission’s Memorandum of Understanding with Spain regarding the bailout of the Spanish banking sector released earlier today.

Memorandum of Understanding on Financial-Sector Policy Conditionally

Read More »

Read More »

The End of Swiss and Japanese Deflation

At a time of speculations about global deflation, we show an interesting and very different aspect. Our CPI and wage data comparison among different developed countries, shows that Switzerland and Japan will see both inflation, whereas other countries like Australia will see disinflation.

Read More »

Read More »

Another week, another 14 bln. francs printed

According to the newest monetary data, in the week ending June 8th, the unsterialized money supply (as measured in sight deposits of domestic and foreign banks and deposits by the Swiss confederation) increased by 14 billion Swiss francs.

Read More »

Read More »