Tag Archive: floor

Swiss ZEW Investor Survey Sees 1.20 per Euro Cap Gone within 2 Years

The Swiss ZEW investor sentiment has risen to 4.8 by 2.6 points, news that do not influence markets. More interesting is the following: Swiss ZEW Investor Survey Sees 1.20 per Euro Cap Gone within 2 Years * Majority see no change in euro/franc for next 6 months (Reuters) – The Swiss National Bank will most … Continue reading »

Read More »

Read More »

IMF (2013): Sees Considerable Risks on SNB Balance Sheet

The International Monetary Fund (IMF) judges "that the SNB’s net revenue is subject to large fluctuations, and sizeable losses could occur if an appreciation of the Swiss franc was to take place before foreign exchange interventions were unwound."

Read More »

Read More »

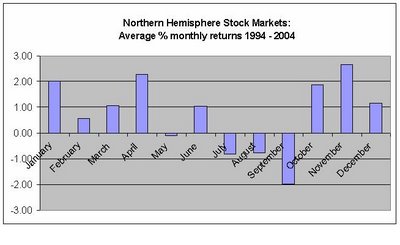

The “Get Stress in May and Relax in October Effect” for the SNB

The U.S. economy regularly improves between October and March. The SNB should use the moment to sell some currency reserves. From May on, the typical seasonal effects will push the SNB into a defense.

Read More »

Read More »

The next SNB rumor: Wall Street Journal and our response

A bit breathlessly…. The next SNB rumor story comes from the so-well established Wall Street Journal, its columnist Nick Hastings. WSJ: The Swiss National Bank was bold before. And the central bank would be well advised to be just as bold again. When the SNB announced just over a year ago that it was setting a …

Read More »

Read More »

The Full English Translation of the Interview with Thomas Jordan

Here a translation of the interview with the president of the Swiss National Bank, Thomas Jordan, in the finance magazine ECO of the Swiss television SF1. Here the original German video. Question: Given that the SNB has reserves of over 200 bln. Euros, are you still able to sleep ? Jordan: We are in a … Continue reading...

Read More »

Read More »

The End of Swiss and Japanese Deflation

At a time of speculations about global deflation, we show an interesting and very different aspect. Our CPI and wage data comparison among different developed countries, shows that Switzerland and Japan will see both inflation, whereas other countries like Australia will see disinflation.

Read More »

Read More »

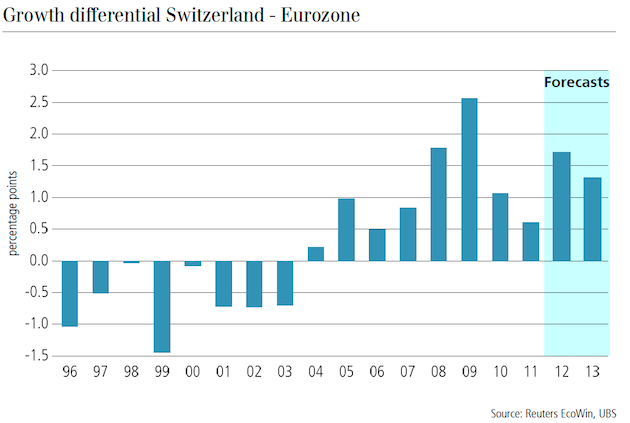

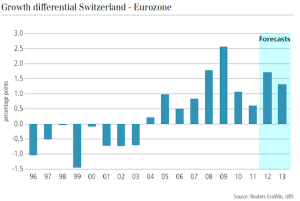

Spread Swiss Eidgenossen vs. German Bund to see further gains

The spread between the Swiss government Eidgenossen bond against the Germany 10yrs. Bund will see further gain in the future, after the Euro summit opened the door for ESM direct financing of banks. Differences between EFSF and ESM explained

Read More »

Read More »

The win of the pro-bailout parties in the Greek elections was no win for the SNB

The win for the pro-bailout parties in the Greek elections was no win for the Swiss National Bank (SNB), even if the fear of an immediate bank-run and extreme money flows into Switzerland are avoided. Also the fact that QE3 is not coming in the next weeks did not help the SNB.

Read More »

Read More »

Steen Jakobsen, Chief Economist Saxo Bank is buying in our arguments

Steen Jakobsen sees 25% percent chance that the floor breaks and if it does it breaks to parity. Last week Thomas Jordan removed any hopes on a hike of the EUR/CHF and invited smart money and hedge funds to a no-risk, high return game on the Swiss franc, which these gratefully accepted. After Morgan Stanley …

Read More »

Read More »

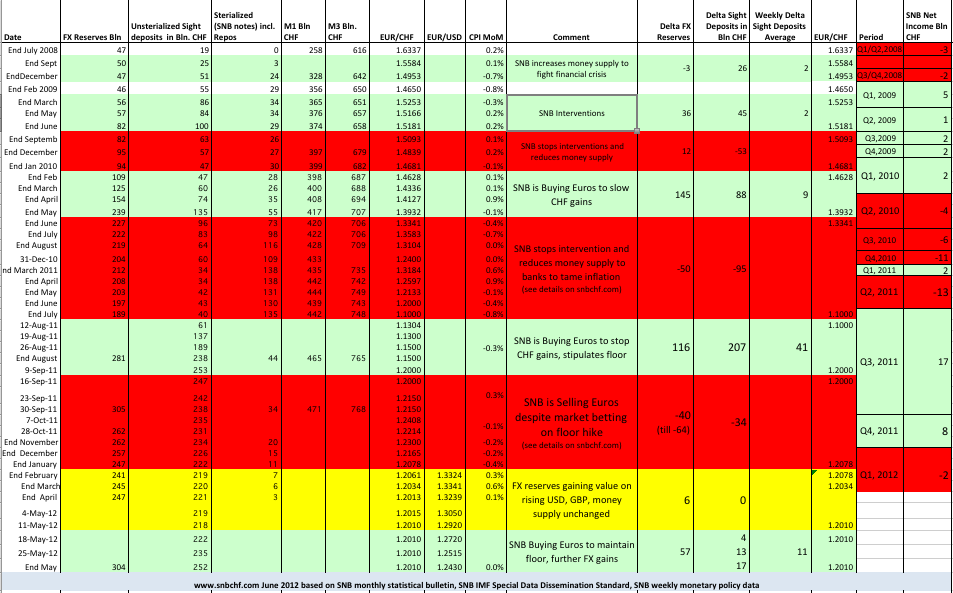

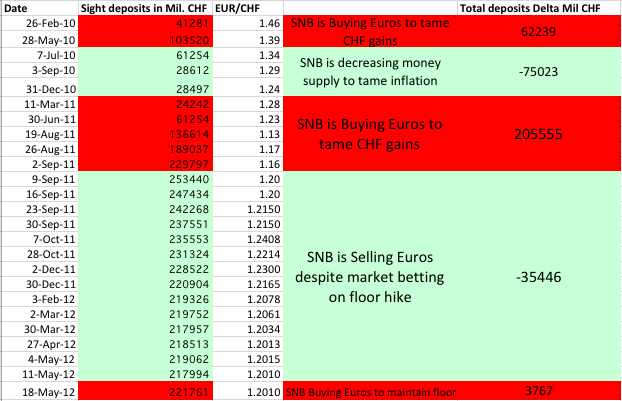

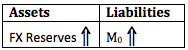

Another week, another 14 bln. francs printed

According to the newest monetary data, in the week ending June 8th, the unsterialized money supply (as measured in sight deposits of domestic and foreign banks and deposits by the Swiss confederation) increased by 14 billion Swiss francs.

Read More »

Read More »

The “Sell in May, come back in October” effect and its equivalent for the SNB

The "Sell in May, come back in October" effect It is the same seasonal anomaly nearly every year: The statistically flawed (see here and here) Non-Farm Payrolls (NFP) report delivers some good winter readings with 200K new jobs, this time additionally fuelled by a weather effect; biased data that let hard-core Keynesian policy makers doubt Okun's law. Consequently the stock markets rally …

Read More »

Read More »

A central bank running suicide ? SNB prints at pace never seen since EUR/CHF parity in August 2011

The most recent money supply data from the Swiss National Bank (SNB) has shown increases of huge amounts. As compared with its loss of 19 bln. francs in 2010 (3% percent of the Swiss GDP), the central bank printed tremendous 17.3 bln. in the week ending in June 1st and 13 bln. in the one …

Read More »

Read More »

CNBC rumors: Different peg methods for the SNB

There are currently rumors going on on CNBC that the SNB is planning something this night. As we explained here, the SNB had to strongly restart the printing press and printed tremendous 13 bln francs in one week. Moreover, they probably sold some of their in Q4 2011 and Q1 2012 acquired GBP, JYP and …

Read More »

Read More »

Huge rise in Currency Reserves: The SNB has restarted the printing press

The game for the Swiss National Bank seems to have changed completely. Again the central bank had increase money supply, as measured by deposits at the SNB by local banks and other sight deposits, this time even by 13219 mil. francs (source). This money printing implies that the SNB had to buy in Euros in …

Read More »

Read More »

SNB’s Jordan admits that EUR/CHF floor will not be raised

For the first time the chairman of the Swiss National Bank Jordan has admitted that the EUR/CHF floor of 1.20 will not be raised. In an interview with the Swiss Sonntagszeitung, here also cited by Bloomberg, he said:

Read More »

Read More »

Rumors about tax on Swiss deposits for foreigners and further SNB measures: SNB begging for pips

Exactly when the US had a relatively good Markit Flash PMI, rumors are sent out that deposits in CHF for foreigners should be taxed. To send out this rumor together with good US data seems to be intentional. According to Banque CIC the SNB has declined to comment. We remember the last SNB meeting when similar rumors circulated.

Read More »

Read More »

Why the floor will never be lifted to 1.25 ?

Or why the biggest opponents of the SNB are not Weltwoche and the SVP (Swiss People’s Party) but the Federal Reserve

Read More »

Read More »

Will the SNB double or triple the forex reserves before they give in ?

Some economists have claimed that the Swiss National Bank (SNB) will be always able to maintain the floor. As opposed to George Soros’ defeat of the Bank of England, the SNB is able to print money ad infinitum, whereas the BoE had limited currency reserves to support sterling. The question, however, is where this “infinitum” …

Read More »

Read More »

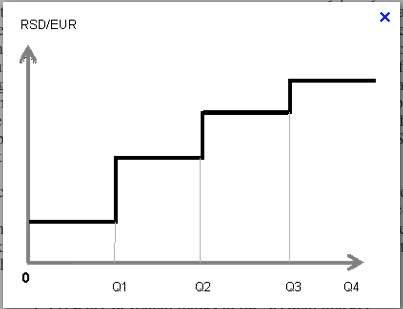

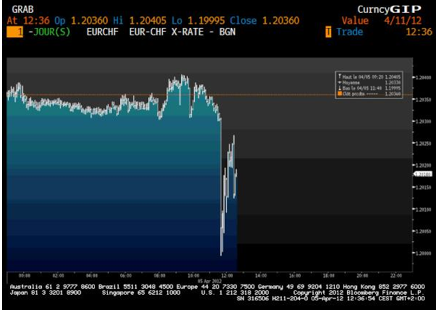

Why the SNB fixed the peg at 1.2010 and not at 1.2000 ?

As we have showed in a preceding post, the SNB seems to have decided the peg the franc to the euro at 1.20. Therefore the SNB traders were actively selling euros and buying francs even close to the floor limit of 1.20. But then in the beginning of April some Asian traders managed to push the … Continue reading...

Read More »

Read More »