Tag Archive: federal-reserve

FX Daily, March 2: Central Banks’ Words of Assurance have Short Life

Overview: Comments beginning with Powell before the weekend, and BOJ and BOE earlier today promising support have saw equity markets briefly stabilize after last week's dramatic moves. The G7 will hold a teleconference this week, but speculation of a coordinated rate move does not seem particularly likely. Most of the large stock markets in the Asia Pacific region rallied, led by a 3%+ advance in China.

Read More »

Read More »

FX Daily, February 28: Fallout Accelerates

Overview: The dramatic response by investors to Covid-19 continues unabated and worse. The slide is accelerating. The S&P 500 posted a 4.4% loss yesterday, its worst session since 2011, and the sell-off is continuing. Many markets in Asia Pacific, including Japan, China, Korea, Australia, India, Singapore, and Thailand, fell by more than 3%.

Read More »

Read More »

FX Daily, February 14: Investors Continue to Look Past the Coronavirus

Overview: The capital markets are heading into the weekend, still trying to look past the coronavirus despite the new cases in Hubei. Tokyo was a notable exception in the Asia Pacific region, as the other major equity markets, like in Hong Kong, China, Taiwan, South Korea, and Australia, advanced. The MSCI Asia Pacific Index rose for the second week.

Read More »

Read More »

FX Daily, February 12: The Greenback Slips in Subdued Activity

Investors appear to be increasingly looking past the latest coronavirus from China as new afflictions slow. Despite the soggy close of US equities yesterday, Asia Pacific bourses are nearly all higher, led by more than 1% gains in Singapore and Thailand. The Dow Jones Stoxx 600 is at new record highs, led by consumer discretionary and materials sectors.

Read More »

Read More »

FX Daily, February 11: New Calm in the Capital Markets Continues, Powell Moves to Center Stage

Overview: Investors are taking solace from reports indicating that the increase in the new coronavirus at ground zero (Hubei) is slowing. After the S&P 500 reversed early losses yesterday to close at new record highs helped keep the bullish sentiment intact. Benchmarks in Hong Kong, South Korea, Australia, and China rose for the sixth session.

Read More »

Read More »

FX Weekly Preview: US Soars while Rivals are Hobbled

We are approaching the mid-point of the first quarter, and the coronavirus from China is the new key development for businesses and investors. The economic impact appears to be still growing as the disruption to supply chains, production, and demand continues. The re-opening of China from the extended Lunar New Year holiday brought some relief to the markets as officials ensured ample liquidity, leaned against short selling, and offered...

Read More »

Read More »

FX Daily, January 30: Contagion Impact not Peaked, Weighs on Risk Appetites

Overview: The ongoing concerns about the geometric progression of the new coronavirus continues to swamp other considerations for investors. Risk continues to be unwound, as the World Health Organization meets to decide if this is indeed a global health emergency. Several large equity markets in Asia were hit particularly hard.

Read More »

Read More »

FX Daily, January 29: Escaped from a Crocodile’s Mouth, Entered a Tiger’s Mouth

Overview: This colorful Malay saying captures the spirit of the animal spirits. Narrowly escaping an escalation of a trade war between the world's two largest economies, the outbreak of a deadly virus has spurred moves, especially the sell-off in stocks and rally in bonds, for which many investors seemed ill-prepared. Even though the virus contagion has not peaked, the recovery in US equities yesterday points to a break the fear and anxiety.

Read More »

Read More »

FX Weekly Preview: The Week Ahead and Why the FOMC Meeting may not be the Most Interesting

The week ahead is arguably the most important here at the start of 2020. The Federal Reserve and the Bank of England meet. The US and the eurozone report initial estimates of Q4 19 GDP. The eurozone also reports its preliminary estimate of January CPI. China returns from the extended Lunar New Year celebration and reports its official PMI. Japan will report December retail sales and industrial production.

Read More »

Read More »

FX Daily, January 17: China and the UK Surprise in Opposite Directions

Overview: Helped by new record highs in the US, global stocks are moving higher today. Nearly all the markets in the Asia Pacific region advanced and the seventh consecutive weekly rally is the longest in a couple of years. Europe's Dow Jones Stoxx 600 is at new record highs and appears set to take a four-day streak into next week. US shares are trading firmly.

Read More »

Read More »

FX Weekly Preview: Back to Macro?

The US-China trade conflict and then US-Iran confrontation distracted investors from the macroeconomic drivers of the capital markets. It is not that there is really much

closure with the exogenous issues, but they are in a less challenging place, at least on the surface.

Read More »

Read More »

FX Daily, January 8: Hopes of De-Escalation Help Markets Stabilize

The Iranian retaliatory missile strike on Iraqi-bases housing US forces initially sparked a dramatic risk-off response throughout the capital markets. The muted response by the US coupled with signals from Tehran that it had "concluded" its proportionate measures saw the markets retrace the initial reaction. It was too late for equities in the Asia Pacific region, and several markets (Japan, China, Korea, Malaysia, and Thailand) fell more than 1%.

Read More »

Read More »

FX Daily, January 03: Geopolitics Saps Risk Appetite

Iran's Ayatollah Ali Khamenei has threatened "severe retaliation" for the US attacked that killed an important head of a force within the Islamic Revolutionary Guard. At the same time, reports indicate that North Korea's Kim Jong Un is no longer pledging to halt its nuclear weapons testing and has threatened to unveil a new weapon. Meanwhile, Turkish forces have reportedly entered Libya.

Read More »

Read More »

The Turn

The year is winding down quietly, and the last week of 2019 is likely to be more of the same. The general mood of the market is quite different than a year ago. Then investors had marked down equities dramatically amid fears of what was perceived as a synchronized downturn. Now with additional monetary easing in the pipeline and renewed expansion of the Federal Reserve and European Central Bank's balance sheets, risk appetites have been stoked.

Read More »

Read More »

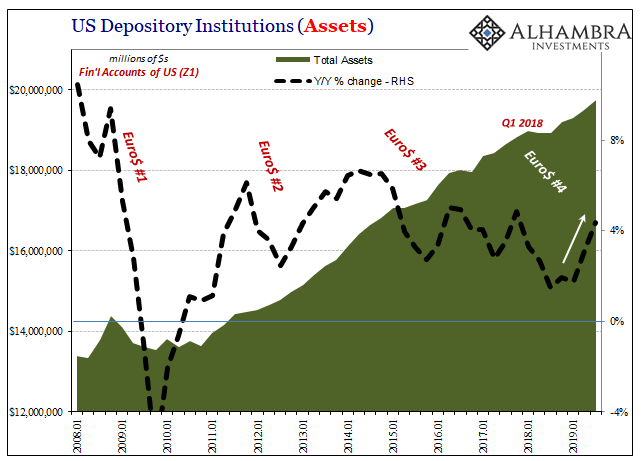

A Repo Deluge…of Necessary Data

Just in time for more discussions about repo, the Federal Reserve delivers. Not in terms of the repo market, mind you, despite what you hear bandied about in the financial media the Fed doesn’t actually go there. Its repo operations are more RINO’s – repo in name only. No, what the US central bank actually contributes is more helpful data.

Read More »

Read More »

FX Weekly Preview: Central Bank Meetings and Flash PMI Reports, but its Over except for the Shouting

After last week's flurry of events, market activity is set to slow over the next three weeks. But what a flurry of events it was. A new NAFTA apparently has been agreed, and it is set to be approved by the US House of Representatives next week and the Senate early next year. The US and China struck an agreement that will get rid of the immediate tariff threat and unwind half of the punitive tariffs in exchange for a commitment to buy twice the...

Read More »

Read More »

FX Daily, December 13: Stunning Tory Victory and US-China Trade Boosts Risk Assets

Overview: The combination of a US-China trade deal and exit polls showing the Tories securing a majority in the House of Commons boosted risk assets, sent sterling flying, and the euro sharply higher. Separately, the Fed stepped up its efforts to make as smooth as possible funding over the turn of the year.

Read More »

Read More »

FX Daily, December 12: Enguard Lagarde

With the FOMC meeting delivered no surprises, attention turns to the ECB meeting as the UK go to the polls. Lagarde will hold her first press conference as ECB president today, and it will naturally command attention. Equities are advancing today, and tech appears to be leading the way. In Asia Pacific, Taiwan and South Korea rallied more than 1%, while the Hang Seng gapped higher to almost its best level in three weeks.

Read More »

Read More »

FX Weekly Preview: An Eventful Week Ahead

The US employment report on the first Friday of December usually marks the unofficial end of the year. The desks are often lighter and dealers are loath to jeopardize the year’s bonuses in thin and often erratic markets. This year is an exception. Next week features the first ECB meeting with Lagarde at the helm and the final FOMC meeting of the year.

Read More »

Read More »