Tag Archive: Federal Reserve

Two Overlooked Takeaways from Draghi at Jackson Hole

The consensus narrative from the Jackson Hole Symposium was the Yellen and Draghi used their speeches to argue against dismantling financial regulation and the drift toward protectionism. Many cast this as a push against US President Trump, but this may be too narrow understanding.

Read More »

Read More »

How will Yellen Address Fostering a Dynamic Global Economy?

Yellen has identified two challenges regarding the US labor market, the opioid epidemic and women participation in the labor force. The topic of the Jackson Hole gathering lends itself more to a discussion of these issues than the nuances of monetary policy. Dynamic world growth needs a dynamic US economy, and that requires more serious thinking about these socio-economic and political issues.

Read More »

Read More »

Real GDP: The Staggering Costs

How do we measure what has been lost over the last ten years? There is no single way to calculate it, let alone a correct solution. There are so many sides to an economy that choosing one risks overstating that facet at the expense of another. It’s somewhat of an impossible task already given the staggering dimensions.

Read More »

Read More »

SNB Balance Sheet, Markets and Economy: As Good As It Gets?

Late 2014/early 2015 will perhaps be the closest to a real recovery from the Great “Recession” we shall see in this cycle. Q1 2015 marked the peak year over year growth rate of GDP in this recovery at 3.76%. That rate compares quite unfavorably with even the feeble post dot com crash recovery high of 4.41% in Q1 2004.

Read More »

Read More »

FX Weekly Preview: Moving Toward September

The technical and fundamental case for the euro has weakened. Rate differentials have begun moving back in the US favor. France's Macron and Japan's Abe have sunk in the polls lower than Trump.

Read More »

Read More »

FOMC Sticks to Script: Balance Sheet Unwind to Begin “Relatively Soon” and USD Retreats

Little new in FOMC statement. Seems consistent with a Sept announcement to begin reducing the balance sheet in Oct. USD sold off as if reflecting sentiment held in bay until the statement was out of the way.

Read More »

Read More »

FX Daily, July 26: Quiet Fed Day without Yellen

By definition, the Federal Reserve Open Market Committee meeting is the highlight of the day. Without a press conference, and following last month's rate hike, there is practically no chance of a new policy initiative either on the balance sheet or the Fed funds target.

Read More »

Read More »

FX Weekly Preview: Don’t Be Confused by the Facts or Why Neither the Data nor the Fed Will Alter Market Trends

FOMC is the highlight of the week. Early look at July inflation in Europe may see less pressure. Overall household consumption in Japan is rising, helped by robust labor market, but little new price pressures. The data this week is expected to confirm what many investors have come to assume.

Read More »

Read More »

Fighting inflation with FX, a real traders market

The much anticipated document (press release and link to full document) released by U.S. Trade Representative Robert Lighthizer said the Trump administration aimed to reduce the U.S. trade deficit by improving access for U.S. goods exported to Canada and Mexico and contained the list of negotiating objectives for talks that are expected to begin in one month.

Read More »

Read More »

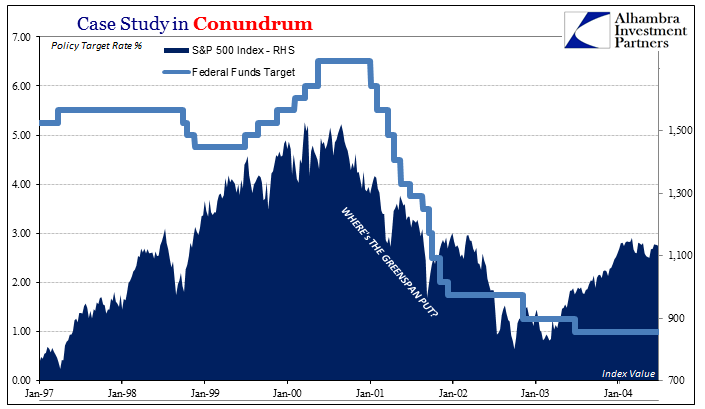

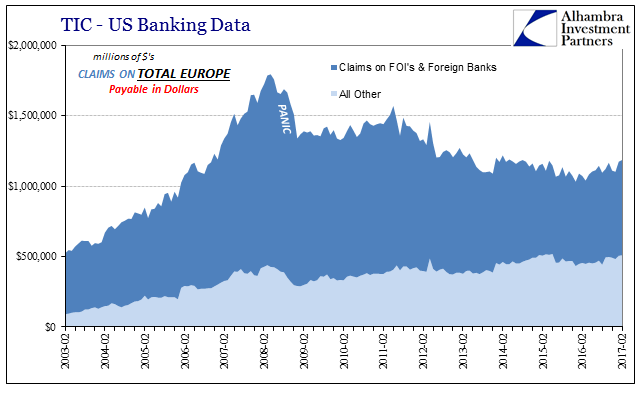

US S&P 500 Index, Federal Funds Target, Manufacturing Payrolls, US Imports and US Banking Data: All Conundrums Matter

Since we are this week hypocritically obsessing over monetary policy, particularly the federal funds rate end of it, it’s as good a time as any to review the full history of 21st century “conundrum.” Janet Yellen’s Fed has run itself afoul of the bond market, just as Alan Greenspan’s Fed did in the middle 2000’s.

Read More »

Read More »

Global Manufacturing PMI’s, Inflation and CPI: Some Global Odd & Ends

When it comes to central bank experimentation, Japan is always at the forefront. If something new is being done, Bank of Japan is where it happens. In May for the first time in human history, that central bank’s balance sheet passed the half quadrillion mark.

Read More »

Read More »

FX Daily, July 06: Stocks and Bonds Mostly Heavier, while Dollar Hovers Little Changed

The US dollar is narrowly mixed against the major currencies after being confined to tight ranges through the Asian session and European morning. Equities are nursing small losses, and interest rates are pushing higher. The yield on the 10-year German Bund reached 50 bp for the first time since early 2016. Oil prices have steadied after yesterday's slide.

Read More »

Read More »

Weird Obsessions

People often ask why I care so much about China. In some ways the answer is obvious, meaning that China is the world’s second largest economy (the largest under certain methods of measurement). Therefore, marginal changes in the Chinese economy are important to understanding our own global situation.

Read More »

Read More »

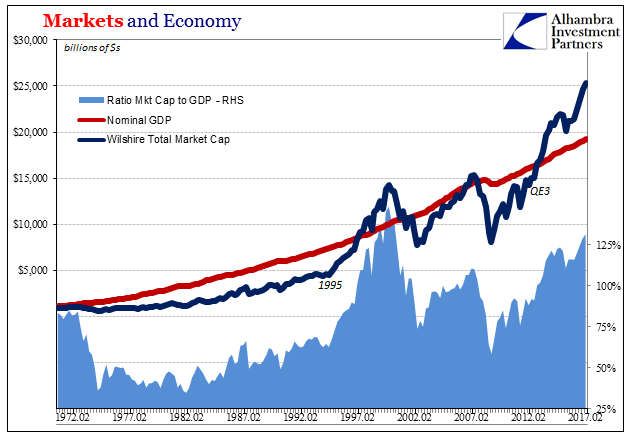

Central Banks Buying Stocks Have Rigged US Stock Market Beyond Recovery

Central banks buying stocks are effectively nationalizing US corporations just to maintain the illusion that their “recovery” plan is working because they have become the banks that are too big to fail. At first, their novel entry into the stock market was only intended to rescue imperiled corporations, such as General Motors during the first plunge into the Great Recession, but recently their efforts have shifted to propping up the entire stock...

Read More »

Read More »

FX Daily, June 22: Greenback Goes Nowhere Quickly, While Yen Remains Bid

The summer doldrums begin early. The US dollar is little changed against most of the major currencies. Bond yields are mostly one-two basis points lower, and equity markets are mixed but with a downside bias. Oil prices slump more than 2% on Tuesday and again on Wednesday. This is weighing on bond yields and equities.

Read More »

Read More »

Great Graphic: Selected GDP Performance since 2008 and Policy

This Great Graphic was tweeted by Martin Beck, and it comes from Oxford Economics, using Haver Analytics database. It shows the relative economic growth since 2008 for the US, UK, Japan, and EMU.

Read More »

Read More »

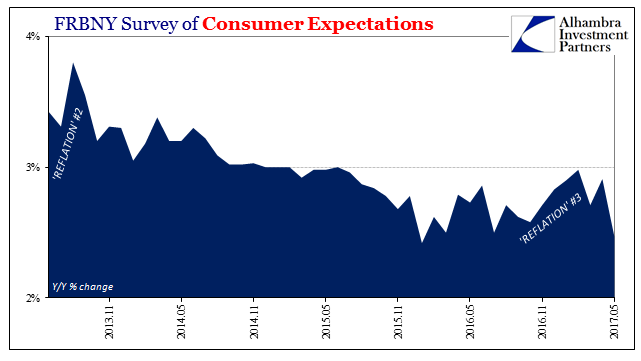

American Expectations, Chinese Prices

The Federal Reserve Bank of New York has for the past almost four years conducted its own assessment of consumer expectations.Though there are several other well-known consumer surveys, FRBNY adding another could be helpful for corroborating them. Unfortunately for the Fed, it has.

Read More »

Read More »

“It’s A Perfect Storm Of Negativity” – Veteran Trader Rejoins The Dark Side

After many months of fighting all the naysayers predicting the next big stock market crash, I am finally succumbing to the seductive story of the dark side, and getting negative on equities. I am often early, so maybe this means the rally is about to accelerate to the upside.

Read More »

Read More »