Tag Archive: Featured

Will the S&P Reach 4,170? | 3:00 on Markets & Money

(7/21/22) From a bullish standpoint, there seems to be a lot of bullish input: MACD's on a buy signal, and markets are on a defined uptrend. The next level up will be 4170 on the S&P. We've seen this before, but here come the seasonally-weak months of the year.

Read More »

Read More »

Was ist Börse?

► Mein neues eBook "Meine 5 Top Aktien 2022" findet ihr hier:

https://mariolueddemann.com/aktuelles/#ebooks

► Von 50.000 € auf 1 Million in 10 Jahren

Willst du wissen, wie das auch für dich geht? Dann melde dich hier zum kostenfreien Beratungsgespräch an: https://deinmillionendepot.com/termin-buchen/

- - -

► Für Trader: sicher dir hier kostenfrei mein E-Book, damit du dein kleines Konto groß tradest:...

Read More »

Read More »

The EURUSD moves higher after the ECB 50 basis point hike

The ECB rate decision has pushed the EURUSD higher. WHat is in play for that pair and what about the GBPUSD and the USDJPY too

Read More »

Read More »

Hasbro, Target, Wal-Mart’s Inventory Surpluses

(7/21/22) Will the Fed cave to inflation and pivot on its interest rate hike course--and what will the effects be on markets? Will Markets' recent bottoms hold? Negative sentiment prevails--much of the recent rally has been driven by short-selling.

Read More »

Read More »

Italian Politics Complicate the ECB’s Task

The appetite for risk seen earlier this week is fading. Yesterday’s US equity gains helped lift most of the large markets in the Asia Pacific region, but China’s CSI 300 fell 1.1%, giving back most of this week’s gains as credit issues from the property sector haunt sentiment.

Read More »

Read More »

Keine NFTs im Minecraft Universum

Eines der größten und erfolgreichsten Videospiele aller Zeiten hat gestern seine Position zu NFTs veröffentlicht. In einem offiziellen Blogpost heißt es, dass Minecraft NFTs weder unterstützt noch erlaubt. Eine Integration des Marktes ist damit in weite Ferne gerückt.

Read More »

Read More »

The UK and Switzerland’s fall outs with the EU

What do Brexit and the Swiss breakdowns in relations with the EU have in common? According to a Swiss social historian, quite a lot. Switzerland has never been an EU member but enjoys almost full access to the EU’s internal market, thanks to 120 bilateral agreements. Attempts to update these with a new framework agreement collapsed in 2021 when the Swiss walked out of talks with the EU. The Financial Times dubbed the fallout “Swexit” in reference...

Read More »

Read More »

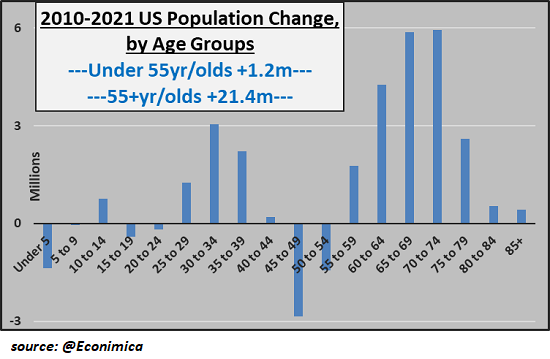

Why the Labor Shortage Isn’t Going Away

It's getting hard to fill toxic low-pay jobs, and that's not going to change. The nature of work and the labor market are changing in ways few discern or perhaps are willing to discern because these changes are disrupting the exploitive system they want to remain unchanged. But refusing to discern change doesn't stop change.

Read More »

Read More »

Swiss customs crack down on fake medicinal imports

Switzerland’s customs and border security authorities have seized more than 230 packages of illegally imported counterfeit medical products.

Read More »

Read More »

DAS SOLLTE JEDER HABEN!

Wirtschaft aktuell: Was passiert jetzt? Ray Dalio, Markus Krall, Dirk Müller und andere Experten klären auf! Wirtschaftliche Entwicklung kompakt zusammengefasst! Wie soll ich jetzt investieren?

Read More »

Read More »

Dr. Frank Shostak and Yra Harris on the Economy and Financial Markets from an Austrian School View

Dr. Frank Shostak and Yra Harris on the Economy and Financial Markets from an Austrian School View

Read More »

Read More »

The (almost) everything Bubble | Ronald Stöferle & Mike Maloney

Ronald Stöferle joins Mike Maloney of GoldSilver to discuss the current state of the market. They go over the fact, that we will soon enter a recession and discuss, how governments and central banks will react to this fact.

Read More »

Read More »

Warren Buffetts rechte Hand Charlie Munger Es ist verrückt, das jetzt zu kaufen

#finace #bitcoin $altcoin #financenews #finanzen #wirtschaft #finanzen #geldanlage #wirtschaftaktuell

Read More »

Read More »

Contrary to Public Myths, Rent Control Hasn’t Been a Success in Sweden

Sweden's rent control is widely touted by many who don't understand economics as a model for how a property market should work. Young people in Ireland, for example, like to point to Sweden as a nirvana where rent control ensures easy availability of affordable and high-quality rental stock.

Read More »

Read More »

Putin, Erdogan discuss deal to resume Ukrainian grain exports | Latest English News

Russian President Vladimir Putin met his Turkish counterpart Recep Tayyip Erdogan and thanked him for mediation to help “move forward” a deal on Ukrainian grain exports.

Read More »

Read More »

Hans-Werner Sinn: EZB muss dringend reagieren, tut es aber nicht

▶︎ EINLADUNG ▶︎ „Die größten Gefahren für Ihr Vermögen“ - Online-Info-Veranstaltung

✅ Hier gratis anmelden: https://bit.ly/3AIuZtB

▶︎ Abonnieren Sie hier unseren Kanal ▶︎ https://bit.ly/FinanzNEWS_abonnieren

HANS-WERNER SINN ONLINE

▶︎ Hans-Werner Sinns Webseite: https://www.hanswernersinn.de/

▶︎ Hans-Werner Sinns Bücher auf Amazon: http://bit.ly/Hans-Werner-Sinn-auf-Amazon

Das könnte Sie auch interessieren:

▶︎ LEBENSVERLÄNGERUNG ▶︎ Die "Nie...

Read More »

Read More »

Bitcoin technical analysis, short the measured move

Bitcoin seems to be in a good spot for a potential bearish measured move driven trade, with an attractive reward vs risk.

See the technical analysis for BTCUSD and the potential bearish measured move.

https://www.forexlive.com/technical-analysis/a-bitcoin-technical-analysis-with-a-bearish-measured-move/

Reminder: technical analysis can increase your chances of better reading the market but does not guarantee it. That is why traders must have...

Read More »

Read More »

Parity hysterics: What it means and what it doesn’t – Part II

Part II of II, by Claudio Grass, Hünenberg See, Switzerland

“Reverse currency wars”?

Although the parity event may have captured the attention of the mainstream financial press and most western citizens, there’s a much bigger shift that has been going on in the background, which received much less coverage.

Read More »

Read More »

Inflation Crisis 2022 – Marc Faber Interview (Full)

2022-07-21

by Stephen Flood

2022-07-21

Read More »