Tag Archive: Featured

Markets Slicing Through Support Levels | 3:00 on Markets & Money

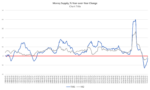

(8/23/22) Friday's market sell-off is followed by mayhem on Monday, with the worst day of performance since the market found its bottom back in July. Markets sliced clean through levels of support yesterday and this morning are poised for a mild opening; we don't think it will be able to stick, however, as the 20-DMA is retested. Will Markets follow the trendline established for the past 20-weeks? The 100-DMA of 4080 is likely a more logical level...

Read More »

Read More »

How to Navigate Through Stagflation

(8/23/22) Markets slice through the 100-DMA; potential impact of the coming Jackson Hole extravaganza; We export inflation and import cheap stuff; how to navigate through stagflation; back to college, self-checking at Walmart, Full-service filling stations; the saga of Meme Stocks; don't try to always make money in the market; outperforming a down market is key to success. Watch for slower economic growth as Fed continues to tighten; how Zoome...

Read More »

Read More »

Surging Energy Prices Pushing Europe Closer to Recession

The poor eurozone PMI underscores likely recession and weighs on the single currency, which was sold to a new 20-year low. Rather than a "Turn Around Tuesday" a broadly consolidative session is unfolding. Asian and European equities are weaker, while US futures are positive but little changed. Benchmark 10-year bond yields are mostly firmer and the premium offered by Europe's periphery is edging higher. The US 10-year is little changed near...

Read More »

Read More »

Gravitas: Russia thwarts terror plot against India, detains I-S operative

Russia has thwarted a terror plot against India. The FSB has apprehended an Islamic state operative who planned to carry out a 'suicide attack' in India over the blasphemy row.

Read More »

Read More »

Marc Faber: An Kriegen ist niemals nur einer schuld

▶︎ EINLADUNG ▶︎ „Die größten Gefahren für Ihr Vermögen“ - Online-Info-Veranstaltung

✅ Hier gratis anmelden: https://bit.ly/3AaFfst

MARC FABER ONLINE

▶︎ Marc Fabers Gloom Boom Doom Webseite: https://www.gloomboomdoom.com/

▶︎ Marc Faber auf Twitter: twitter.com/gloomboomdoom

▶︎ Marc Faber auf Facebook: www.facebook.com/gloomboomdoom

#marcfaber #aktien #sachwertfonds

Marc Faber - Jahrgang 1946 - ist ein renommierter Schweizer Börsenexperte,...

Read More »

Read More »

Warning: Oil Moving Rapidly to “Contango” [Ep. 277, Eurodollar University]

The calendar spread (1- and 3-month) in the oil futures market (West Texas Intermediate) is compressing and is THIS close to being in contango. That would be the oil market saying, 'We don't see the demand. Keep your barrels—don't call us, we'll call you.'

Read More »

Read More »

Adipositas – Eine Volkskrankheit aus Investorensicht – Podcast mit Maximilian-Benedikt Köhn

In der industrialisierten Welt spielen Zivilisationskrankheiten eine zunehmend bedeutsame Rolle. Insbesondere Adipositas ist auf dem Vormarsch. Wohin zeigen die Trends? Welche Therapien gibt es? Woran arbeitet die Forschung und welche neuen Entwicklungen könnten nicht nur für die Betroffenen, sondern auch aus Sicht von Investoren spannend sein?

Darüber sprechen wir heute mit dem Healthcare-Spezialisten im DJE Research Team: Maximilian-Benedikt...

Read More »

Read More »

Developer invests CH170 million in new Swiss tourist resort

The Andermatt Swiss Alps (ASA) company, majority owned by Egyptian financier Samih Sawiris, is to build a new 1,800-bed Alpine resort in the Sedrun region in southeast Switzerland.

Read More »

Read More »

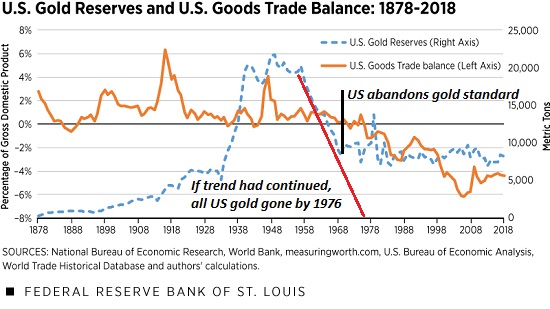

The Real Story of America Abandoning the Gold Standard

Even currencies maintaining convertibility to gold are still subject to bond yields, interest rates, trade and capital flows. It's widely held that all of our financial woes are the result of abandoning the discipline of the gold standard in 1971. The premise here is that if the U.S. had maintained the gold standard, the excesses of the fiat currencies regime could not have arisen.

Read More »

Read More »

The Sphere of Economic Calculation

Economic calculation can comprehend everything that is exchanged against money. The prices of goods and services are either historical data describing past events or anticipations of probable future events. Information about a past price conveys the knowledge that one or several acts of interpersonal exchange were effected according to this ratio. It does not convey directly any knowledge about future prices.

Read More »

Read More »

Das ist ihr großer PLAN…so gehts JETZT weiter!

Wie wird sich die aktuell kritische Lage weiter entwickeln?

Wir schauen uns regelmäßig an, was Experten wie Ernst Wollf, Dr. Markus Krall, Prof. Hans-Werner Sinn, Dirk Müller, Max Otte oder Marc Friedrich zur aktuellen Lage sagen.

Read More »

Read More »

EUR/CHF forecast to 0.93 (Swiss National Bank to hike rates in September and December)

"We expect the SNB to hike by 50bp again in September and December to curtail underlying inflation pressures bringing the policy rate to 0.75%. With the SNB broadly following the ECB, we see relative rates as an inferior driver for the cross," Danske notes.

Read More »

Read More »

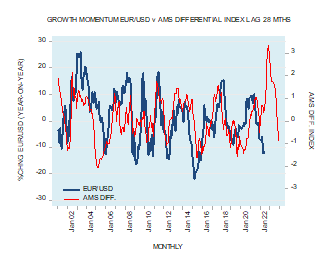

Will the US Dollar Weaken against Other Currencies?

In the July 26 Financial Times article entitled “Is the Dollar about to Take a Turn?,” Barry Eichengreen writes that the US dollar has had a spectacular run, having risen more than 10 percent against other major currencies since the start of the year. According to Eichengreen, the key reason behind the spectacular strengthening in the US Dollar is that the Federal Reserve has been raising interest rates faster than other big central banks, drawing...

Read More »

Read More »

Dax im Abwärtstrend? Und 3 Short Chancen…

Während der Euro wieder auf dem Weg zur Parität ist, droht der Dax erneut in den Abwärtstrend zu rutschen. Für den Fall weiter schwacher Indizes schaut unser Analyst Martin Goersch heute auf drei Short Chancen im Aktienuniversum...

Read More »

Read More »

USDCAD trades to the highest level since July 15

The USDCAD on the daily chart has admittedly been sloppy. There are a lot of moves higher and moves lower on the daily chart going back to October 2021.

In the short term, however, the price of the USDCAD has been up 5 of the last 6 trading days. Price action is more trending, or is it?

The price is approaching topside swing levels between 1.3076 to 1.3092. That area will be eyed for the next clues for that pair. Move above is more bullish....

Read More »

Read More »

Diese DIVIDENDEN-ETFs sind Perfekt für PASSIVES EINKOMMEN!

Der #DividendenDienstag Livestream findet jeden Dienstag um 19:00 Uhr auf YouTube statt, zusammen mit Johannes Lortz philosophieren wir über #Dividenden #Aktien, das Investieren, die Börse und vieles mehr.

Read More »

Read More »

Überteuerte Immobilien und steigende Zinsen mit Prof. Dr. Max Otte

Ein spannendes Gespräch mit Prof. Dr. @Max Otte. Wir sprechen über die aktuelle Immobilienpreisentwicklung und ob sich Investments in Immobilien noch lohnen. Dies ist der vierte Teil des Gesprächs.

Read More »

Read More »

Star-Investoren kaufen JETZT diese 6 Aktien!

Daniel Loeb, David Einhorn, David Tepper, George Soros - die absolute Crème de la Crème der Hedgefonds-Manager hat im letzten Quartal kräftig eingekauft. Bei welchen Aktien, 6 sind es an der Zahl die ich euch heute vorstellen möchte, lohnt es sich, mal genauer hinzuschauen? Das möchte ich heute für euch besprechen. Legen wir los.

Read More »

Read More »

Heiner Flassbeck: Nord Stream 2 öffnen! + Darum wird die Inflation einfach verschwinden

"Daran wird die Demokratie scheitern", warnt Heiner Flassbeck. Der bekannte Ökonom macht sich große Sorgen, weil wir nach seiner Meinung keinen klaren Gedanken mehr fassen können und demnach zu keinen Lösungen kommen.

Read More »

Read More »

Why we couldn’t be happier that gold is boring

2022-08-23

by Stephen Flood

2022-08-23

Read More »