Tag Archive: Featured

Rat zu Unternehmenskauf: Mach das noch Sinn in Deutschland?

Ein Zuseher plant ein Klein- oder Mittelunternehmen #KMU zu kaufen und findet in seiner Bekanntschaft Niemanden, der eine solche Aktion für sinnvoll hält. Ich nehme seine Mail zum Anlass und spreche allgemein über #Merger & #Acquisition (Fusionen und Übernahmen) mit deren Chancen und Risiken.

Read More »

Read More »

Sprott Money Ask The Expert August 2022 – David Garofalo

Precious metals industry veteran David Garofalo joins us to answer your questions regarding gold and the gold mining shares.

0:00 - Introduction

3:09 - What is the difference between a royalty company and a producing miner?

6:10 - Where do you see gold prices headed in the next 12 months?

8:10 - How do rising energy and inflation concerns impact future M&A in the mining sector?

10:25 - How can a company minimize or counteract higher costs to...

Read More »

Read More »

The morning technical report: The EURUSD/GBPUSD drag along lows.The USDJPY is up & down.

- The trading week is off and running.

- The EURUSD is lower and trading above and below the key parity level. Sellers in control. What might give a short term positive bias in the face of difficult fundamentals

- GBPUSD is also suffering largely from the same fundamental down bias. The price got closer to the low for 2022 at 1.1759. Sellers are more in contol, but the price action is confined

- USDJPY is up for the 5th day, in an up and down...

Read More »

Read More »

Has the 9-week Rally Ended? | 3:00 on Markets & Money

(8/22/22) Over-extended markets sold off on Friday after breaching the 50-DMA, and ran into resistance at the 200-DMA. This 9-week rally aligns with similar bear market rallies historically; one thing we're looking for is a sell-signal in the MACD indicator. The money flow indicator is also showing a sell-signal, suggesting some downward pressure follow-through this morning (futures are pointing lower.) The first support test will be at the 20-DMA....

Read More »

Read More »

The Economy Improved In July

The Chicago Fed National Activity Index rose to 0.27 in July with all four categories of indicators rising. The 3 month average was unchanged at -0.09. That indicates growth is slightly below trend and is far from the recession threshold of -0.7.

Read More »

Read More »

3 GRÜNDE FÜR DEN MARKT CRASH

Der Markt hat wieder einen Rücksetzer gemacht und wie immer schreiben mir unglaublich viele Leute, was die Gründe sein können und wie es jetzt weiter gehen kann. In diesem kurzen Video erkläre ich dir die Top 3 Gründe, nicht verpassen!

Read More »

Read More »

Börsen im Rückwärtsgang | Blick auf die Woche | KW 34

Wie von uns vermutet, haben die Börsen den Rückwärtsgang eingelegt. Die Bullen geraten zunehmend unter Druck und die spannende Frage ist, ob es das schon wieder mit der Aufwärtsbewegung war oder ist die kleine Verschnaufpause gerade lediglich als Korrektur zu bewerten und bietet gute Einstiegschancen auf der Long-Seite.

Read More »

Read More »

The Reddit Run-up on AMC Stock

(8/22/22) The Roberts' House Squirrel Infestation; Historic stats on Bear Market Rallies: 30% of the 17% market gain is on the backs of four stocks: Apple, Meta, Microsoft, & Tesla; Why 40% of executives are rescinding job offers; why we'll be lucky to hit 1% GDP in 2023; check out our "Five for Friday" report; comparing stock fundamentals to ETF performance; what's going to happen when ETF's sell-off? How Reddit ran up the price of...

Read More »

Read More »

No Relief for the Euro or Sterling

Overview: The euro traded below parity for the second time this year and sterling extended last week’s 2.5% slide. While the dollar is higher against nearly all the emerging market currencies, it is more mixed against the majors.

Read More »

Read More »

Markus Krall mit bestechender Zustandsbeschreibung zu Inflation und EZB

Dirk Müller, Banken Deutschland, Sparkassen Deutschland, Wirtschaft Deutschland, Finanzen Deutschland , Geld Deutschland , Kapital Deutschland, Aktien Deutschland , Börse Deutschland , Immobilien Deutschland , Politik Deutschland , Medien Deutschland , Gold, Goldmünzen,

Read More »

Read More »

Weekly Market Pulse: Same As It Ever Was

History never repeats itself. Man always does. Mark Twain is credited with a similar saying, that history doesn’t repeat but it rhymes. Of course, there is scant evidence that Clemens said anything of the sort just as Voltaire may or may not have penned the quote above. But both men were much wittier than I – than most – so I’ll take them both as being representative if not genuine.

Read More »

Read More »

Swiss prepare for energy shortage ‘extreme scenarios’

The Swiss government and cantons are aiming to be prepared for “extreme scenarios” in the face of possible energy shortages this winter, a top cantonal security official says. For example, a power grid shutdown or blackout would have far-reaching consequences, Fredy Fässler, the president of the Conference of Cantonal Justice and Police Directors, said in an interview published in the tabloid Blick on Saturday.

Read More »

Read More »

So funktioniert das Geschäft mit Edelmetallen mit Robert Vitye und Enes Witwit

Ein spannendes Gespräch mit Robert Vitye. Wir sprechen über das Edelmetallgeschäft. Dies ist der dritte Teil des Gesprächs.

Read More »

Read More »

Money Is Not Wealth, Nor Is Wealth Natural Resources

The misconception that money and natural resources are wealth is rampant among intellectuals and other educated individuals, and even economists. Prevailing monetary and economic policy choices reflect this entrenched misconception.

Read More »

Read More »

Modern Information Control: State Intervention and Mistakes to Avoid

History: Regulation of Communications. A hundred years of the public interest standard has been applied to radio and television, with the explicit goal of protecting free speech. The very opposite was the case, as John Samples and Paul Matzko have clearly shown. A 1920–30s radio host, Bob Shuler, had exposed the Julian Petroleum Corporation’s defrauding of investors, and subsequently accused the district attorney and city prosecutor of negligence....

Read More »

Read More »

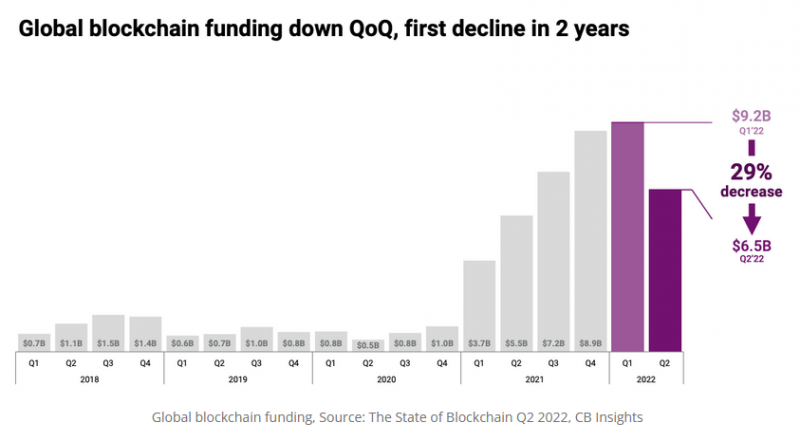

Global Blockchain Funding Dip; Mega-Rounds Shrink

After a record year 2021, the venture capital (VC) market for blockchain investment is slowing down significantly in 2022 amid uncertain macroeconomic conditions and financial markets turmoil. In Q2 2022, VC investors scaled back cryptocurrency investments due to macroeconomic pressures, concerns about valuations and market volatility.

Read More »

Read More »