Tag Archive: Featured

UBS Issues USD 50 Million Tokenized Debt Securities for Asia Pacific

UBS has closed the first tokenized debt transaction for Asia Pacific investors, underlining its commitment to expand regional investment opportunities. UBS AG London branch issued USD 50 million in digital fixed rate security tokens (‘digital securities’) using blockchain technology to a series of high net worth and global family and institutional wealth investors across Hong Kong and Singapore.

Read More »

Read More »

Vorsorgezahlen 2023 2 Säule

Die neuen BVG-Vorsorgezahlen für 2023.

Mehr zum Thema erfahren? Besuchen Sie uns auf https://www.fintool.ch

?? Auf diesen Kanälen könnt ihr uns erreichen:

–––––––––––––––––––––––––––––––––––––––––––––

►Unsere Website: https://www.fintool.ch

►Unser FACEBOOK: https://www.facebook.com/fintool

►Unser LinkedIn: https://www.linkedin.com/company/fint...

►Unser INSTAGRAM: https://www.instagram.com/fintool.ch/...

Read More »

Read More »

5 Hidden Secrets To Amp-Up Your Company’s Marketing Strategy

You may be wondering why some companies seem leaps and bounds above others when it comes to creating comprehensive marketing strategies that guarantee positive results. Well, they are actually successful for one simple reason, and that is that they have knowledge that their competitors do not have.

Read More »

Read More »

Swiss defy inflation to splash out on Christmas gifts

Swiss consumers have budgeted more for Christmas presents this year despite the growing spectre of inflation. The average shopper plans to splash out CHF343 ($367) on presents, up CHF9 from the average spend in 2021.

Read More »

Read More »

ESKALIERT DIE LAGE jetzt komplett? Es brodelt gewaltig! Tausende Unternehmen gehen unter!

Wie wird sich die aktuell kritische Lage weiter entwickeln?

Wir schauen uns regelmäßig an, was Experten wie Ernst Wollf, Dr. Markus Krall, Prof. Hans-Werner Sinn, Dirk Müller, Max Otte oder Marc Friedrich zur aktuellen Lage sagen.

Read More »

Read More »

Wichtige Morning News mit Oliver Klemm #20

Klicke hier, um Dich gemeinsam mit Oli unabhängig zu machen:

? http://bit.ly/oli-ausbildung

Meine Webseite: https://tradingcoacholi.com/

►Mein Telegram Kanal: http://t.me/tradingcoacholi

►Folge Oliver auf Facebook: http://bit.ly/TOFBpage

►Folge Oliver auf Instagram: http://bit.ly/TOInst

►Oli macht auch TikToks: https://www.tiktok.com/@tradingcoacholi

►Abonniere Oliver auf YouTube: http://bit.ly/Oli-Kanal

DIE TRADING COMMUNITY VON OLIVER KLEMM...

Read More »

Read More »

A Great Madness Sweeps the Land

Those who see the madness for what it is have only one escape: go to ground, fade from public view, become self-reliant and weather the coming storm in the nooks and crannies. A great madness sweeps the land. There are no limits on extremes in greed, credulity, convictions, inequality, bombast, recklessness, fraud, corruption, arrogance, hubris, pride, over-reach, self-righteousness and confidence in the rightness of one's opinions.

Read More »

Read More »

Bleibt die Jahresendrally nun aus? – “DAX Long oder Short?” mit Marcus Klebe – 19.12.22

HIER geht´s direkt zur LIVE- oder DEMOKONTOERÖFFNUNG:

https://partners.jfdbrokers.com/visit/?bta=35101&nci=5424

Ich freue mich über eure Daumen ???

#DAX #MarcusKlebe #Trading

ÜBER JFD:

WER WIR SIND:

JFD ist eine führende Unternehmensgruppe, die Finanz- sowie Investmentdienstleistungen und -aktivitäten anbietet. Die Muttergesellschaft, JFD Group Ltd, wurde im Dezember 2011 gegründet und ist heute ein international lizenzierter, globaler...

Read More »

Read More »

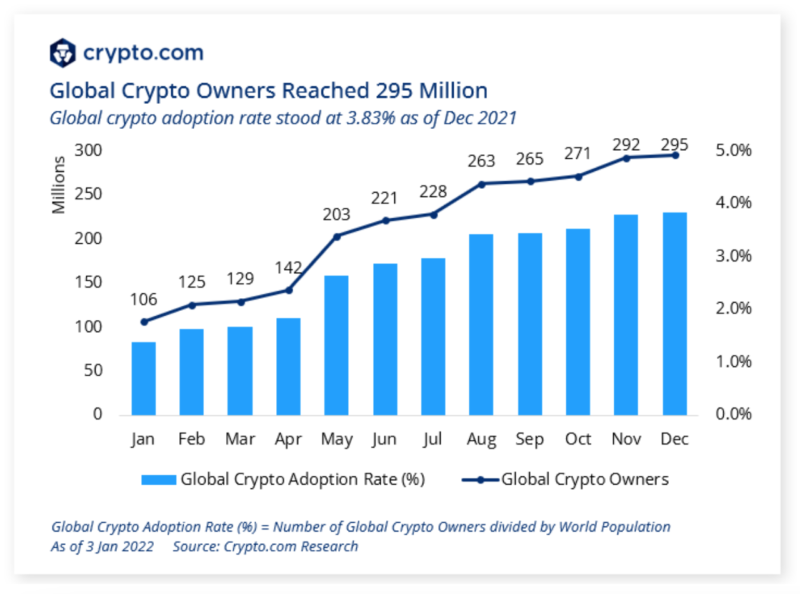

Governments, International Bodies Ramp up Crypto Tax Regulations

Over the past year, governments and regulatory bodies from around the world have increased their focus on the taxation of the cryptocurrency industry, a trend that comes on the back of increasing investment, adoption and innovation in the space despite collapsing prices and high profile business failures, a new report by consulting firm PwC says.

PwC’s 2022 Global Crypto Tax Report, released earlier this month, looks at the state of crypto taxation...

Read More »

Read More »

New Swiss Fintech Startup Map Design for 2023

Together with their partners Lucerne University of Applied Sciences and Arts, Swisscom and Clarafinds, eForesight has revised the Swiss Fintech Map and expanded the database as well as deleted some old and inactive players.

The main business area categories contain now 130 Swiss Investment Management Fintechs, 106 Banking Infrastructure Fintechs, 48 Deposit&Lending Fintechs and 55 Payment Fintechs. On top of that, the fintechs in the main...

Read More »

Read More »

DIE SECHS ZONEN STADT…

Klicke hier, um Dich gemeinsam mit Oli unabhängig zu machen:

? http://bit.ly/oli-ausbildung

Meine Webseite: https://tradingcoacholi.com/

►Mein Telegram Kanal: http://t.me/tradingcoacholi

►Folge Oliver auf Facebook: http://bit.ly/TOFBpage

►Folge Oliver auf Instagram: http://bit.ly/TOInst

►Oli macht auch TikToks: https://www.tiktok.com/@tradingcoacholi

►Abonniere Oliver auf YouTube: http://bit.ly/Oli-Kanal

DIE TRADING COMMUNITY VON OLIVER KLEMM...

Read More »

Read More »

Andreas Beck – warum der Star-Fonds-Manager optimistisch ist , seine Strategie für 2023/Aktien

Andreas Beck ist endlich back im Money Talk. Im Gegensatz zu den meisten Experten schaut er optimistisch ins neue Jahr . Wo er die positiven Impulse sieht und wie er sich mit seinem Fonds aufstellt, beschreibt er im Interview.

Mehr dazu in seinem neuen Buch , das Du hier bestellen kannst :

DAS NEUE BUCH VON ANDREAS BECK

https://amzn.to/3v0hQrv

#Aktien #AndreasBeck #Geldanlage

✅ HIER VERLOSE ICH ZU WEIHNACHTEN 10 HANDSIGNIERTE BÜCHER VON MIR...

Read More »

Read More »

Die erfolgreichste Anlagestrategie für die kommende Zeit

Im heutigen Video geht es darum, wie du in einer Zeit, in der alle Anlagemöglichkeiten gerade fallen, etwas findest, das dennoch eine profitable Anlagestrategie ist.

Read More »

Read More »

Trading Wochenanalyse für KW 51/2022 mit Marcus Klebe – DAX – DOW – EUR/USD – Gold #Chartanalyse

HIER geht´s direkt zur Demo-oder Livekontoeröffnungt:

https://partners.jfdbrokers.com/visit/?bta=35101&nci=5424

In dieser Analyse blickt Marcus Klebe auf die vergangene Handelswoche im DAX, Dow, EUR/USD und Gold und bespricht wichtige charttechnische Bereiche und mögliche Bewegungen für die kommenden Handelstage.

#Chartanalyse #MarcusKlebe #LevelUpTrading

DAX: xx:xx

DOW JONES: xx:xx

EUR/USD: xx:xx

GOLD: xx:xx

WTI xx:xx

DAX/ DE30Cash -...

Read More »

Read More »

KLIMA “Proteste” der letzten Generation: DAS ist ihr PERFIDER PLAN!

Klima "Aktivisten" der letzten Generation lassen die Luft aus den Reifen von SUVs, kleben sich auf die Straße und schänden historische Kunstwerke! Die Politik sollte aufhören wegzuschauen und den Rechtsstaat mobilisieren. Was uns Bürger angeht, wir können und sollten uns dagegen wehren.

Gratisaktie bei Depoteröffnung für ETFs & Sparpläne gewinnen ► http://link.aktienmitkopf.de/Depot *

20 € in Bitcoin bei Bison-App ►...

Read More »

Read More »

Ist die ENERGIEWENDE gescheitert? (Interview Fritz Vahrenholt)

Ist unsere Energiepolitik gescheitert? Haben wir verlernt Risiken einzugehen und setzen wir unsere grüne Energieideologie über die Entwicklung und Forschung stabiler und sicherer Alternativen? In diesem sehenswerten Interview mit Prof. Dr. Fritz Vahrenholt (Politiker, Chemiker und Buchautor) besprechen wir unter anderem, ob Klimakleber eine eigene "Religion" bilden, wieso die hohen Gas- und Strompreise politisch gewollt sind, wie präsent...

Read More »

Read More »