Tag Archive: Featured

The Greenback Recovers After the Initial Post-Fed Wobble

Overview: The US dollar has come back bid after losing ground against

most currencies as the markets reacted to the FOMC decision and press

conference. The Antipodeans and Scandis have been tagged the hardest, illustrating

the risk-off mood, and arguably the weakening growth prospects. Countries that

peg their currencies to the dollar have hiked rates, as has the Philippines and

Taiwan. The Swiss National Bank and Norway have also lifted policy...

Read More »

Read More »

Marktausblick | Jahresausblick 2023 | Mario Lüddemann | Ihre Fragen zu Einzelwerte

Trader und Investor Mario Lüddemann bespricht im aktuellen großen Marktausblick die Indizes von S&P bis zum FDAX, SLV, Tesla, Nvidia, Lufthansa, LVMH, MicroStrategy und vielen anderen Einzelwerten und am Ende ein Jahresausblick 2023 vom Börsenexperten Mario Lüddemann.

0:00:00 Begrüßung

0:00:50 Aktienmärkte DAX, S&P 500, NASDAQ etc.

0:12:20 Euro / US Dollar

0:17:34 Heico Corporation - HEI

0:20:08 Daimler Truck - DTG

0:21:34 Intuitive...

Read More »

Read More »

Was gewinnt: Fleiß oder Talent? ?? #shorts

? https://betongoldwebinar.com/yts ?Jetzt Gratis Immobilien-Webinar ansehen!

Gerald Hörhan ist der österreichische Selfmade Multi-Millionär mit Lederjacke und 50+ Millionen EUR Immobilienportfolio, und erklärt auf diesem Kanal, wie auch in seiner Investmentpunk Academy, finanzielle Grundlagen und komplexes Finanz-Insider-Wissen einfach, kurzweilig und verständlich. Als erfolgreicher Investmentbanker mit Harvard Abschluss, verdiente er sich schnell...

Read More »

Read More »

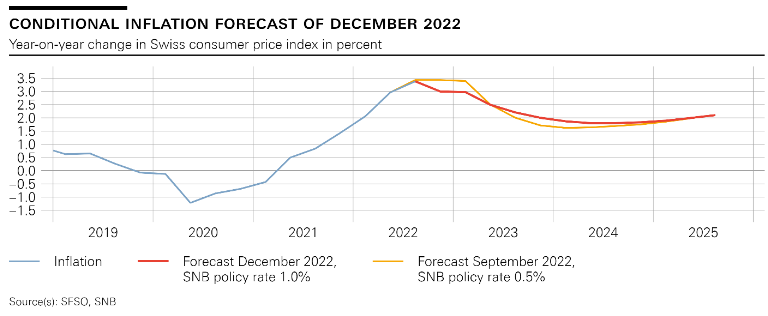

Thomas Jordan: Introductory remarks, news conference

Ladies and gentlemen

It is my pleasure to welcome you to the news conference of the Swiss National Bank. I would also like to welcome all those who are joining us today online. After our introductory remarks, the members of the Governing Board will take questions from journalists as usual.

Read More »

Read More »

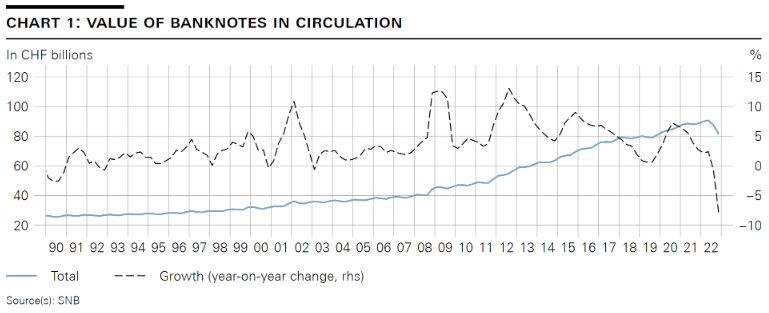

Martin Schlegel: Introductory remarks, news conference

I am pleased to give you an assessment of current developments with regard to cash. Since June, after many years of strong growth, we have seen a significant decline in banknote circulation. To contextualise this decline of approximately 10%, let me first say a few words about the above-average growth in recent years.

Read More »

Read More »

Andréa M. Maechler: Introductory remarks, news conference

In my remarks, I will talk in more detail about the implementation of today’s monetary policy decision, which Thomas Jordan has already touched on. I will start, however, by giving you an overview of how we have steered interest rates since the switch to a positive SNB policy rate in September.

Read More »

Read More »

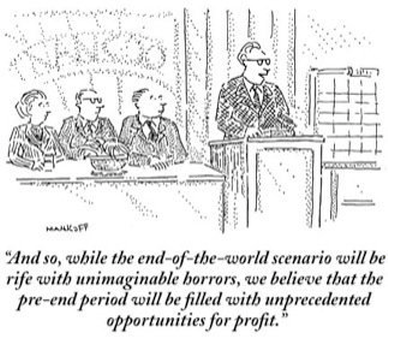

Monopolies and Cartels Are "Communism for the Rich"

What's unfettered in America is "Communism for the Rich" and the normalization of corruption that results from the auctioning of political power to protect monopolies and cartels. The irony of constantly being accused of being a communist is rather rich.

Read More »

Read More »

Dimitri Speck – Platzt gerade die größte Finanz-Blase aller Zeiten? (ganzer Vortrag, 5.11.2022)

Blasen sind keine neuen Erscheinungen, ob Tulpen, Eisenbahnaktien, Immobilien, es gab sie immer wieder. Derzeit, in Zeiten ungedeckten Papiergeldes, sind die Assets im allgemeinen stark überhöht, wobei der chinesische Immobilienmarkt ein Extrem darstellt. Begleitet werden solche Blasen von noch extremeren Exzessen, wie BTC zeigte.

Read More »

Read More »

Holcim divests cement business in Russia

Swiss cement giant Holcim said on Wednesday it would leave Russia, adding that the business there would then operate independently under a different brand.

Read More »

Read More »

Vorsorgezahlen 2023

Die neuen Vorsorgezahlen für 2023

Mehr zum Thema erfahren? Besuchen Sie uns auf https://www.fintool.ch

?? Auf diesen Kanälen könnt ihr uns erreichen:

–––––––––––––––––––––––––––––––––––––––––––––

►Unsere Website: https://www.fintool.ch

►Unser FACEBOOK: https://www.facebook.com/fintool

►Unser LinkedIn: https://www.linkedin.com/company/fint...

►Unser INSTAGRAM: https://www.instagram.com/fintool.ch/...

Read More »

Read More »

Wie Du Die Rezession 2023 Nutzt, Um Reich Zu Werden

?Hol dir 100 CHF Trading Credits bei einer Aktien-Depoteröffnung ►► http://sparkojote.ch/swissquote *

(only for swiss residents)

▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬

☛ Die BESTEN Gutscheine aus dem Finanzrudel ☚

Tools die ich tagtäglich nutze findet ihr hier. Mein 6-stelliges Aktien-Depot habe ich bei Swissquote und Yuh. Für meine privaten Finanzen nutze ich Zak von der Bank Cler. Meine Säule 3a für die Altersvorsorge betreibe ich bei frankly der Zürcher...

Read More »

Read More »

Wichtige Morning News mit Oliver Klemm #18

Klicke hier, um Dich gemeinsam mit Oli unabhängig zu machen:

? http://bit.ly/oli-ausbildung

Meine Webseite: https://tradingcoacholi.com/

►Mein Telegram Kanal: http://t.me/tradingcoacholi

►Folge Oliver auf Facebook: http://bit.ly/TOFBpage

►Folge Oliver auf Instagram: http://bit.ly/TOInst

►Oli macht auch TikToks: https://www.tiktok.com/@tradingcoacholi

►Abonniere Oliver auf YouTube: http://bit.ly/Oli-Kanal

DIE TRADING COMMUNITY VON OLIVER KLEMM...

Read More »

Read More »

Father Time vs. Central Bankers

An excellent new book from Edward Chancellor, The Price of Time, sets out to explain both the theory and history of interest rates across five millennia and countless cultures. The theory is frequently bungled by economists; the history is frequently glossed over by historians. But thankfully Mr. Chancellor is up to the task. He is an excellent and engaging writer, owing presumably to his long career as a financial journalist.

Read More »

Read More »

Prepare Now: 2023 Gold Price Will Shock Everyone!! – Alasdair MacLeod | Gold & Silver Price

Prepare Now: 2023 Gold Price Will Shock Everyone!! - Alasdair MacLeod | Gold & Silver Price

#AlasdairMacLeod #Silver #goldprice

Read More »

Read More »

Börsen-Ticker: Wall Street nach Fed-Zinsentscheid erneut im Minus – Schweizer Börse legt dank Indexriesen Nestlé und Novartis zu

Der SMI fällt 0,40 Prozent auf 11'091,93 Punkte. Vor der am Abend erwarteten Zinsentscheidung der US-Notenbank haben die Anleger einen Gang zurückgeschaltet. Die Freude von Vortag, als die Nachricht über den nachlassenden Inflationsdruck in den USA die Märkte angetrieben hatte, sei wieder der Vorsicht gewichen, heisst es in Börsenkreisen.

Read More »

Read More »

EL DESASTRE DE LAS PENSIONES

#crisis #economia #pensiones #pension #impuestos

Te animo a suscribirte a mi canal y te invito a seguirme en mis redes sociales:

☑ Twitter - https://twitter.com/dlacalle

☑ Instagram - https://www.instagram.com/lacalledanie

☑ Facebook - https://www.facebook.com/dlacalle

☑ Página web - https://www.dlacalle.com

☑ Mis libros en Amazon - https://www.amazon.es/Daniel-Lacalle/e/B00P2I78OG

¡Un saludo!

Read More »

Read More »