Tag Archive: Eurozone Industrial Production

Industrial Production measures the change in the total inflation-adjusted value of output produced by manufacturers, mines, and utilities.

FX Daily, June 12: Licking Yesterday’s Wounds Today

Overview: The nearly three-month rally in risk assets ended with high drama with a stomach-churning almost 6% slide in the S&P 500 yesterday. Follow-through selling was seen in the Asia Pacific region, but most markets recovered from their lows, and although losses were still recorded, the downside momentum seemed broken. The same holds true for Europe. Bourses opened lower but by mid-morning had moved higher (~1.4%) and US shares are trading...

Read More »

Read More »

The global economy doesn’t care about the ECB (nor any central bank)

The monetary mouse. After years of Mario Draghi claiming everything under the sun available with the help of QE and the like, Christine Lagarde came in to the job talking a much different approach. Suddenly, chastened, Europe’s central bank needed assistance. So much for “do whatever it takes.”They did it – and it didn’t take.Lagarde’s outreach was simply an act of admitting reality.

Read More »

Read More »

FX Daily, May 13: Will Powell have any more Luck Pushing against Negative Rate Expectations in the US?

Overview: Another late sell-off in US shares, this one perhaps related to the sobering assessment by the leading medical adviser for the Trump Administration about the risks of opening too early, failed to deter investors in the Asia Pacific region. Although Japanese shares slipped, most other markets rose. India led the way (~2%) after a fiscal stimulus program was announced.

Read More »

Read More »

FX Daily, April 16: Markets Brace for another Jump in US Weekly Jobless Claims

Overview: Equity losses in the US appeared to drag most Asia Pacific markets lower today, with China and India the notable exceptions. European bourses are higher, and the only energy sector is a drag on the Dow Jones Stoxx 600, which is around 1% higher in late morning turnover, while US shares are also trading firmer. Asia Pacific 10-year benchmark yields eased.

Read More »

Read More »

FX Daily, March 12: Trump Dump as Market Turns to ECB

Overview: After the Bank of England and the UK Treasury announced both monetary and fiscal support, the focus turns to the ECB, but the proximity of the US Congressional recess (next week) without strong fiscal measures being in place sucked the oxygen away from other issues. President Trump's national address in the Asian session failed to reassure investors.

Read More »

Read More »

FX Daily, February 12: The Greenback Slips in Subdued Activity

Investors appear to be increasingly looking past the latest coronavirus from China as new afflictions slow. Despite the soggy close of US equities yesterday, Asia Pacific bourses are nearly all higher, led by more than 1% gains in Singapore and Thailand. The Dow Jones Stoxx 600 is at new record highs, led by consumer discretionary and materials sectors.

Read More »

Read More »

Two Years And Now It’s Getting Serious

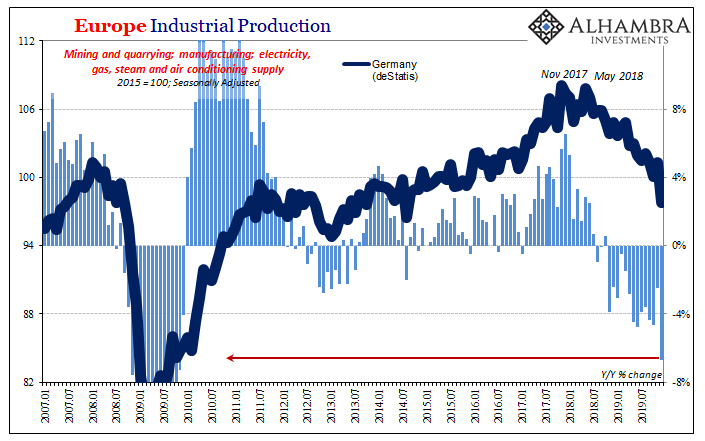

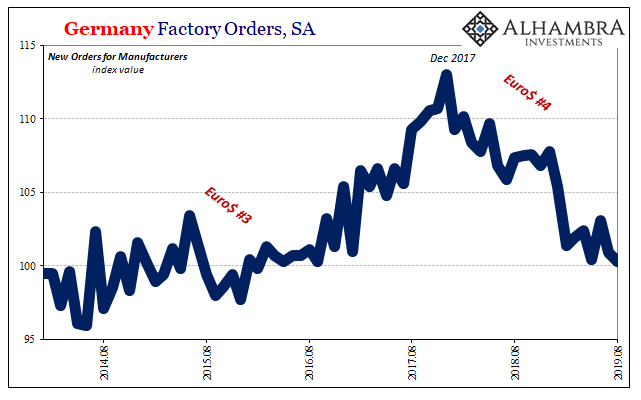

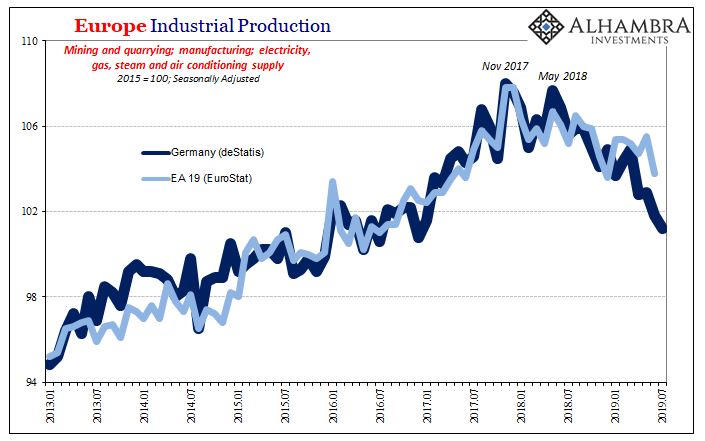

We knew German Industrial Production for December 2019 was going to be ugly given what deStatis had reported for factory orders yesterday. In all likelihood, Germany’s industrial economy ended last year sinking and maybe too quickly. What was actually reported, however, exceeded every pessimistic guess and expectation – by a lot.

Read More »

Read More »

Germany, Maybe Europe: No Signs Of The Bottom

For anyone thinking the global economy is turning around, it’s not the kind of thing you want to hear. Germany has been Ground Zero for this globally synchronized downturn. That’s where it began, meaning first showed up, all the way back at the start of 2018. Ever since, the German economy has been pulling Europe down into the economic abyss along with it, being ahead of the curve in signaling what was to come for the whole rest of the global...

Read More »

Read More »

FX Daily, January 15: Phase 1 Trade Deal Shifts Terrain of US-China Rivalry

News that US tariffs on China will remain until through at least the November US election and continued US attempts to stymie China (e.g., more curbs on Huawei under consideration and stepped up efforts to force it to cut subsidies to business) have taken some momentum from the push into risk assets. The MSCI Asia Pacific Index snapped a four-day advance today, with only Australian equities among the large regional markets able to sustain upticks.

Read More »

Read More »

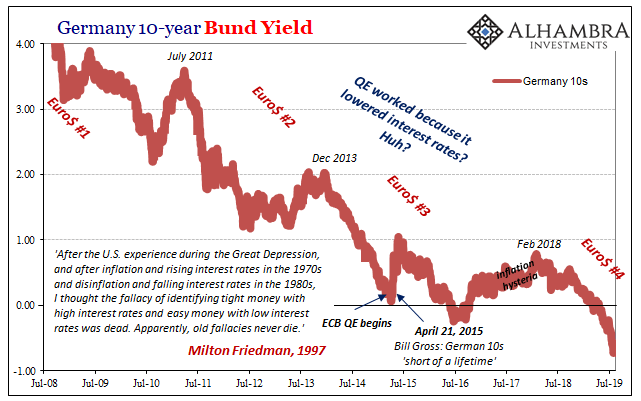

Lagarde Channels Past Self As To Japan Going Global

As France’s Finance Minister, Christine Lagarde objected strenuously to Ben Bernanke’s second act. Hinted at in August 2010, QE2 was finally unleashed in November to global condemnation. Where “trade wars” fill media pages today, “currency wars” did back then. The Americans were undertaking beggar-thy-neighbor policies to unfairly weaken the dollar.

Read More »

Read More »

FX Daily, December 12: Enguard Lagarde

With the FOMC meeting delivered no surprises, attention turns to the ECB meeting as the UK go to the polls. Lagarde will hold her first press conference as ECB president today, and it will naturally command attention. Equities are advancing today, and tech appears to be leading the way. In Asia Pacific, Taiwan and South Korea rallied more than 1%, while the Hang Seng gapped higher to almost its best level in three weeks.

Read More »

Read More »

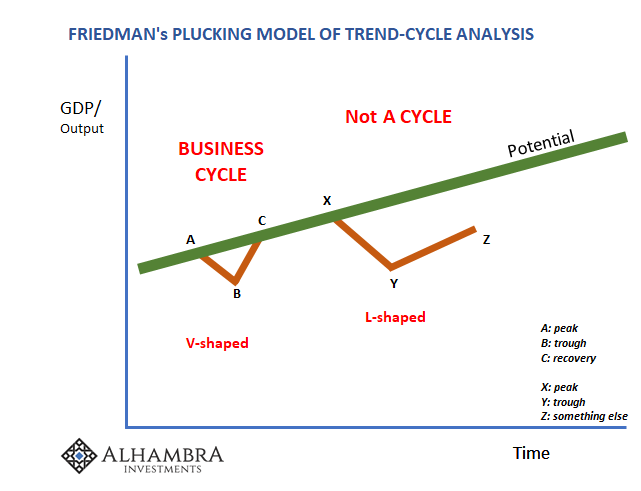

You Will Never Bring It Back Up If You Have No Idea Why It Falls Down And Stays Down

It wasn’t actually Keynes who coined the term “pump priming”, though he became famous largely for advocating for it. Instead, it was Herbert Hoover, of all people, who began using it to describe (or try to) his Reconstruction Finance Corporation. Hardly the do-nothing Roosevelt accused Hoover of being, as President, FDR’s predecessor was the most aggressive in American history to that point, economically speaking.

Read More »

Read More »

FX Daily, November 13: Investors Temper Euphoria

Overview: The recent rise in equity markets and backing up in yields spurred many observers to upgrade their macroeconomic outlooks rather than the other way around. Yet we continue to see may worrisome signs. It is not just trade, though, of course, that is part of it. Sentiment itself is fragile and will likely follow prices.

Read More »

Read More »

FX Daily, October 14: Optimism Took the Weekend Off

Overview: Japanese and Canadian markets are on holiday today. While the US bond market is closed, equities maintain their regular hours today. Asia Pacific equities rallied, led by 1% of more gains in China, Taiwan, South Korea, and Thailand. The buying did not continue in Europe, and after a 2.3% rally before the weekend, the Dow Jones Stoxx 600 is about 0.75% lower in the European morning.

Read More »

Read More »

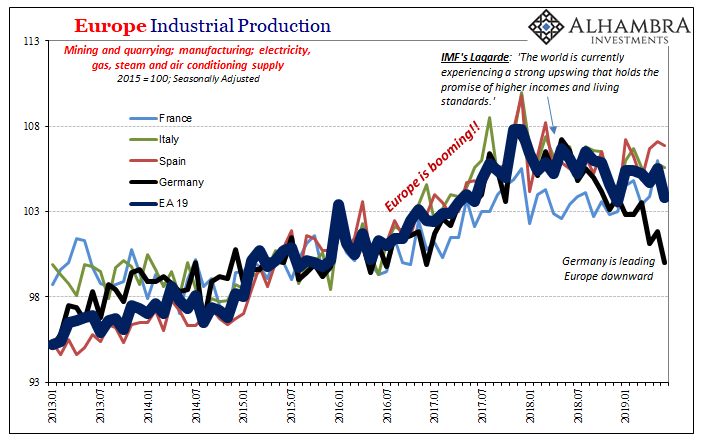

The Scientism of Trade Wars

One year ago, last October, the IMF published the update to its World Economic Outlook (WEO) for 2018. Like many, the organization began to talk more about trade wars and protectionism. It had become a topic of conversation more than concern. Couched as only downside risks, the IMF still didn’t think the fuss would amount to all that much.

Especially not with world’s economy roaring under globally synchronized growth. Even though there were...

Read More »

Read More »

The Obligatory Europe QE Review

If Mario Draghi wanted to wow them, this wasn’t it. Maybe he couldn’t, handcuffed already by what seems to have been significant dissent in the ranks. And not just the Germans this time. Widespread dissatisfaction with what is now an idea whose time may have finally arrived.

Read More »

Read More »

FX Daily, September 12: Focus on the ECB, while the Dollar Slips below CNY7.09

Overview: Some gestures in the US-China trade spat have given the market the reason to do what it had been doing, and that is taking on more risk. Equities are higher in Asia Pacific and opened in Europe higher before slipping. The MSCI Asia Pacific and the Dow Jones Stoxx 600 are advancing for the fourth consecutive week.

Read More »

Read More »

A Bigger Boat

For every action there is a reaction. Not only is that Sir Isaac Newton’s third law, it’s also a statement about human nature. Unlike physics where causes and effects are near simultaneous, there is a time component to how we interact. In official capacities, even more so.

Read More »

Read More »

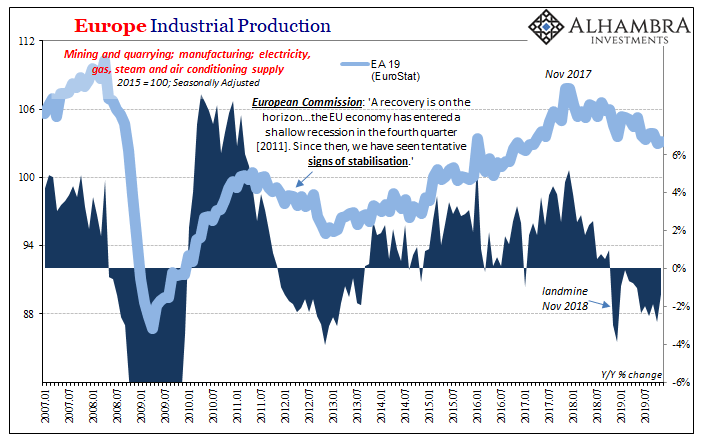

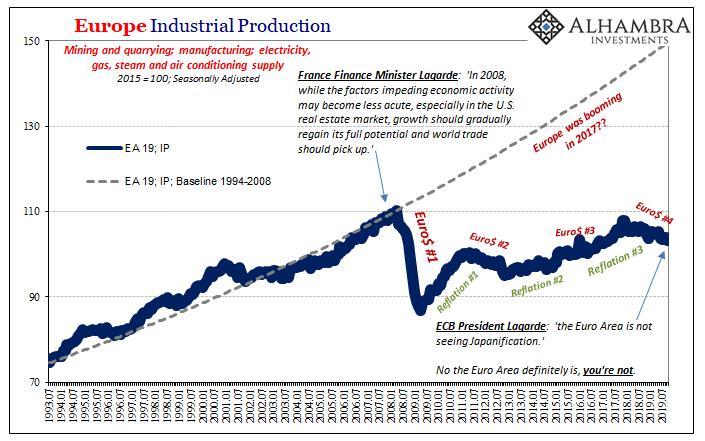

Some Brief European Leftovers

Some further odds and ends of European data. Beginning with Continent-wide Industrial Production. Germany is leading the system lower, but it’s not all just Germany. And though manufacturing and trade are thought of as secondary issues in today’s services economies, the GDP estimates appear to confirm trade in goods as still an important condition and setting for all the rest.

Read More »

Read More »

FX Daily, August 14: Markets Paring Exaggerated Response to US Blink

The US cut its list of Chinese goods that will be hit with a 10% tariff at the start of next month by a little roe than half, delaying the others until the mid-December. This spurred a near-euphoric response by market participants throughout the capital markets. However, as the news was digested, it did not seem as much of a game-changer as it may have initially.

Read More »

Read More »