Tag Archive: EUR/GBP

FX Weekly Preview: Five Events that Will Drive the Capital Markets in the Week Ahead

Bank of Canada may be more upbeat following strong jobs and trade figures. China's President Xi will speak at Davos and likely defend globalization and free trade, which some think the US is abandoning. UK PM May's speech on Brexit may be blunted by few surprises, collapse of the government in Northern Ireland, and the pending Supreme Court ruling. ECB will leave rates on hold and look for Draghi to push back against ideas that rise in CPI means QE...

Read More »

Read More »

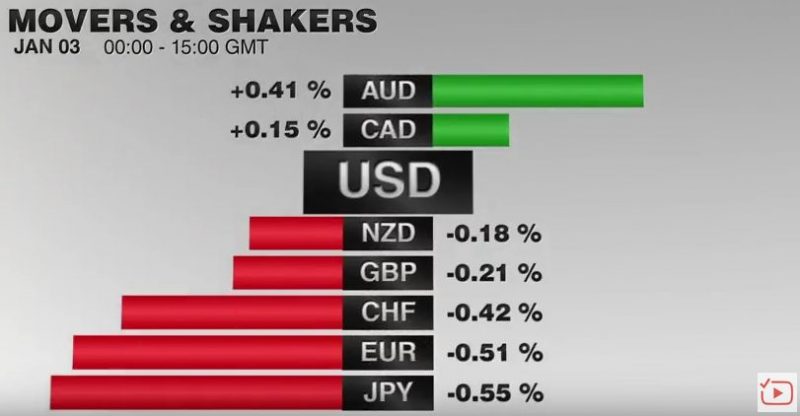

FX Daily, January 03: Dollar-Bloc and Sterling Advance, while Euro and Yen Slip

The US dollar is mixed. After a soft start in Asia, where Tokyo markets were closed, the dollar recovered smartly against the euro and yen. The dollar-bloc and sterling are firmer. Sterling's earlier losses were recouped following news that the manufacturing PMI jumped to 56.1, its highest since June 2014.

Read More »

Read More »

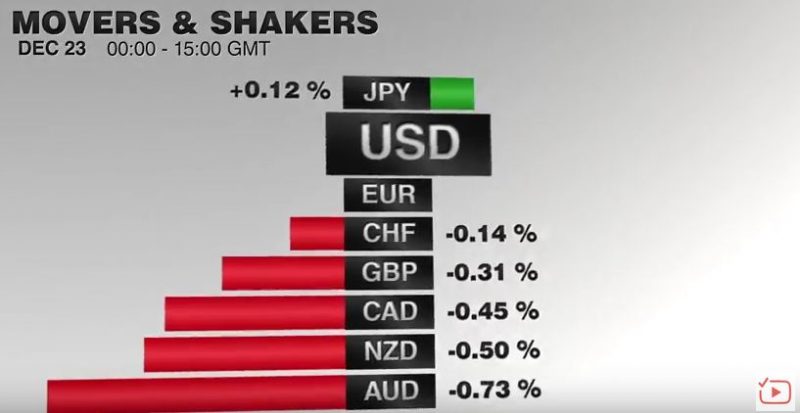

FX Daily, December 23: Markets Edge into Holiday Weekend

Asian shares trade heavily. The MSCI Asia-Pacific Index ex-Japan fell 0.4%. It is the fourth lower close this week and brings the loss to 1.75% for the week. It is fallen in seven of the past nine weeks. The Dow Jones Stoxx 600 is little changed on the session and is nursing a minor loss on the week and could snap a two-week advance.

Read More »

Read More »

FX Daily, November 25: Corrective Forces Emerge, but Underlying Trend is Evident

The US dollar's recent gains are being trimmed today, and it is down against all the major currencies. Many emerging market currencies, including the Turkish lira, Indian rupee, and Hungarian forint are firmer today.

Read More »

Read More »

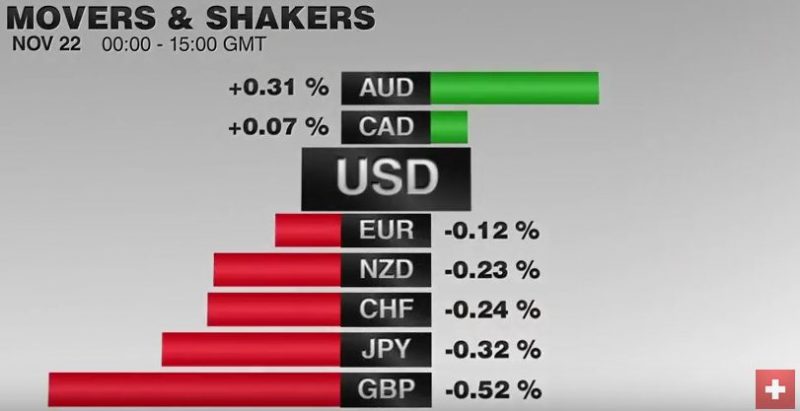

FX Daily, November 22: Bonds and Stocks Rally, Leaving Greenback to Meander

The US dollar entered a consolidative phase yesterday, and this carried into today's activity.While the foreign exchange market is sidelined as the two-week trend slows, the stocks and bonds are posting strong gains today. Equities are being led by energy and materials, as oil and industrial metals continue to advance. Bond are recovering from their recent slide.

Read More »

Read More »

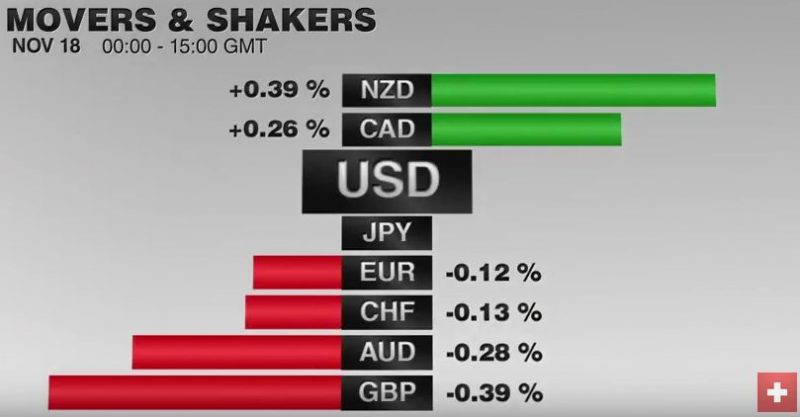

FX Daily, November 18: Revaluation of the Dollar Continues

Since the US election, the dollar has been on a tear. Pullbacks have been brief and shallow. There are powerful trends in place. The euro has fallen nearly five percent over the past ten sessions, during which it is not closed higher once. The dollar rose four days this week against the yen and four days last week.

Read More »

Read More »

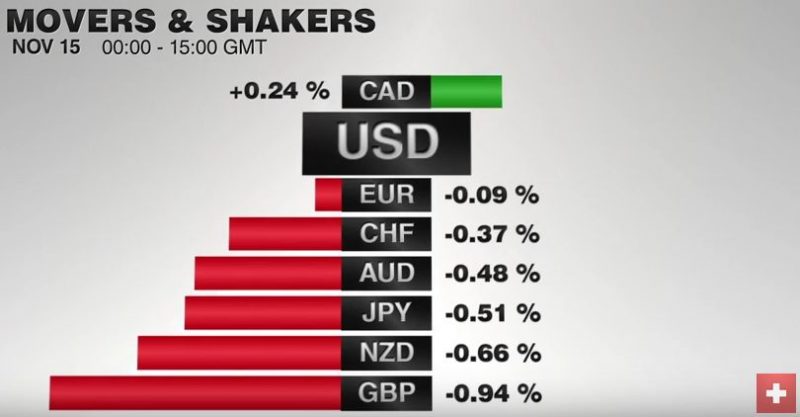

FX Daily, November 15: Investors Catch Breath, Markets Consolidate

After a dramatic run since the US election, the capital markets are consolidating today. It is a bit too restrained to such a Turn Around Tuesday is unfolding. The euro is struggling to sustain corrective upticks through $1.08, and after a pullback is, the greenback pushed back above the JPY108 level like a beach ball held under water.

Read More »

Read More »

FX Weekly Preview: Forces of Movement

US election results accelerated forces that were already present. Interest rates have appeared to bottom, fiscal stimulus in Canada and Japan already evident, and divergence between US and EMU/Japan monetary policy. US stimuli may reach when the economy is already near trend.

Read More »

Read More »

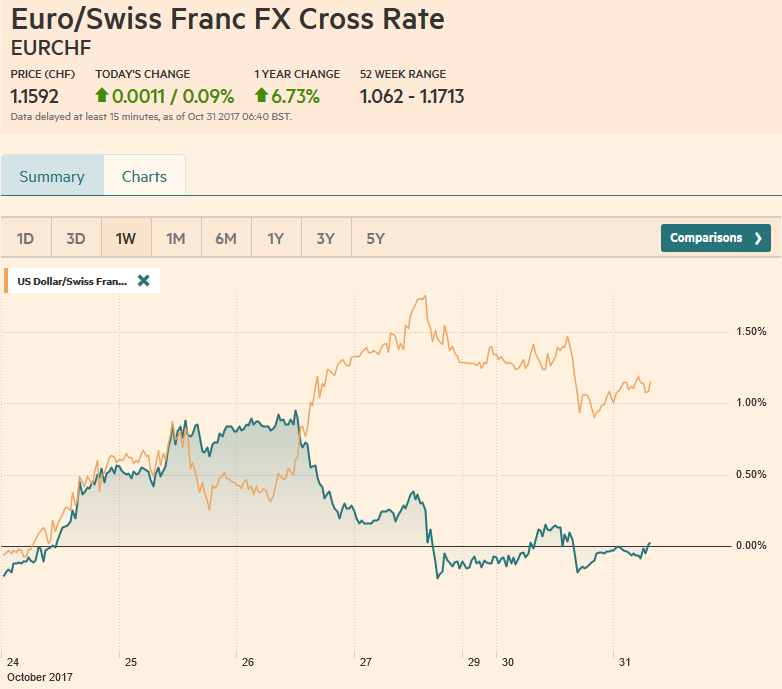

Great Graphic: Shifting Trade-Weighted Exchange Rates

The dollar's trade-weighted index is firming and a couple percentage points from the year's high set in January. The yen's trade-weighted index is at several month lows, but remains dramatically higher ear-to-date. The euro's trade-weighted index has begun falling amid concerns that it is the next focus for the anti-globalization/nationalism movement. Sterling's trade-weighted index is extending its recovery as a softer Brexit is anticipated, the...

Read More »

Read More »