Tag Archive: EUR/CHF

FX Daily, July 31: Monday Morning Blues

The euro is up by 0.15% to 1.1385 CHF. The US dollar is enjoying a respite from the recent selling, but its gains have been shallow, and will likely prove brief. The upticks have been concentrated in the recently high-flying dollar-bloc currencies, and sterling. The tone appears to be more consolidative than corrective, and month-end adjustment provides an additional wrinkle.

Read More »

Read More »

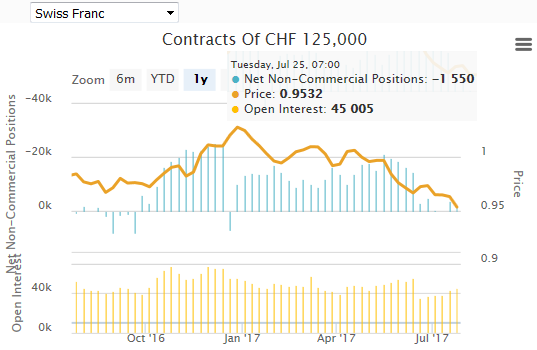

Weekly Speculative Positions (as of July 25): Speculators Continue to Pour into Australian and Canadian Dollar Futures

The net speculative CHF position has risen from -3.7K short to -1.5K contracts short (against USD). Speculators were active in the currency futures in the CFTC reporting week ending July 25. In particular, speculative sentiment continues to be drawn to the Canadian and Australian dollars.

Read More »

Read More »

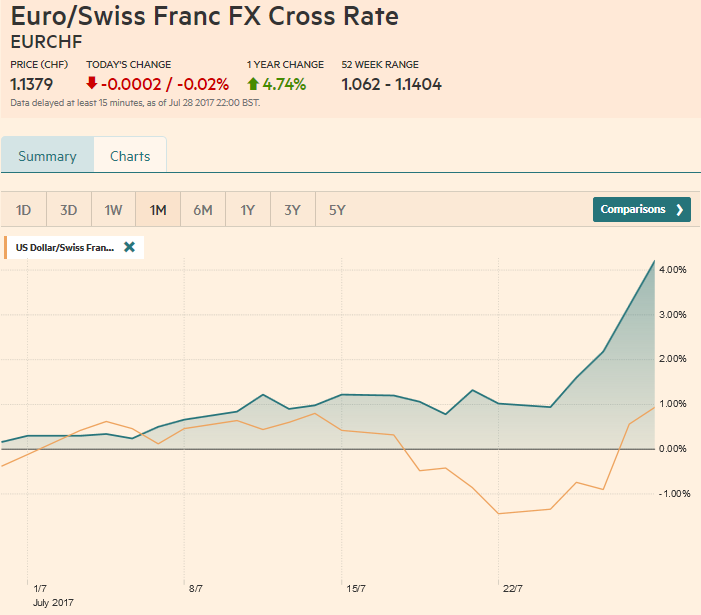

FX Weekly Review, July 24 – July 29: Swiss Franc getting crushed

The Swiss franc was the only major foreign currency that fell against the dollar last week. The 2.6% decline was the largest in two years.

Read More »

Read More »

FX Daily, July 28: Dollar and Equities Closing Week on Heavy Note

The US dollar is mostly lower, though one of the features of recent days has been the dramatic slide of the Swiss franc, and that is continuing today. The franc is off another 0.5% today, to bring its weekly loss to a sharp 2.5%. The euro finished last week near CHF1.1030 and is now near CHF1.1370; its highest level since the cap was lifted in mid-January 2015.

Read More »

Read More »

FX Daily, July 27: Dollar Remains on the Defensive

The US dollar is narrowly mixed after selling off following the FOMC statement. Sometimes the narrative explains the price action, and sometimes the price action explains the narrative. This seems to be the case of the latter. The dollar and interest rates fell, and so the Fed was dovish.

Read More »

Read More »

FX Daily, July 26: Quiet Fed Day without Yellen

By definition, the Federal Reserve Open Market Committee meeting is the highlight of the day. Without a press conference, and following last month's rate hike, there is practically no chance of a new policy initiative either on the balance sheet or the Fed funds target.

Read More »

Read More »

FX Daily, July 25: Summer Markets Ahead of FOMC

The global capital markets are subdued today; a dearth of fresh news and tomorrow's FOMC meeting are making for light activity and limited price movement. The US dollar is little changed against most of the major currencies. The net change on the day through most of the European morning is +/- 0.15%. The exception is the Norwegian krone and Swedish krona, which is about 0.25% stronger.

Read More »

Read More »

FX Daily, July 24: Euro Recovers from Softer Flash PMI

The euro made a marginal new high in early Asia, but participants rightly drew cautious ahead of the flash eurozone PMI. The flash PMI was softer than expected, and although the composite fell to six monthly lows, it is more a reflection of how steady it has been at elevated levels.

Read More »

Read More »

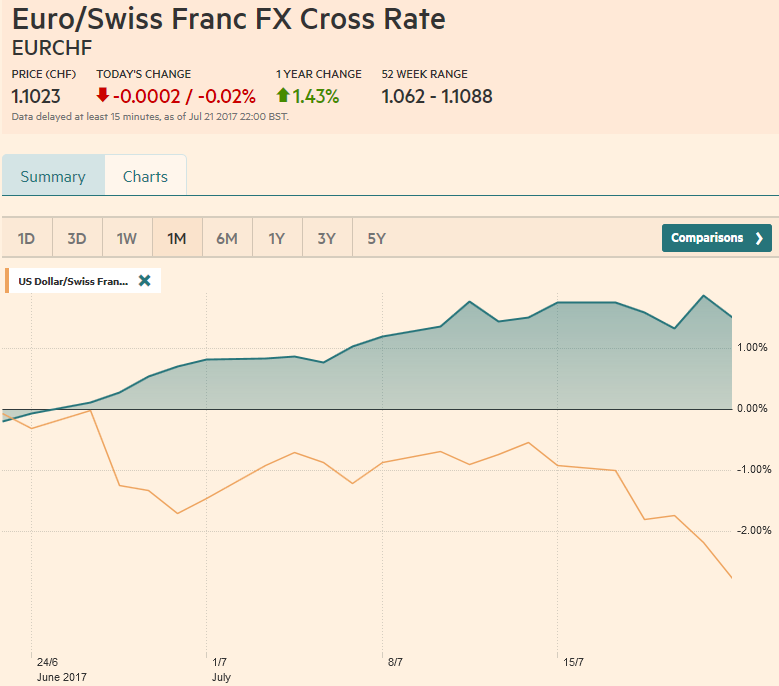

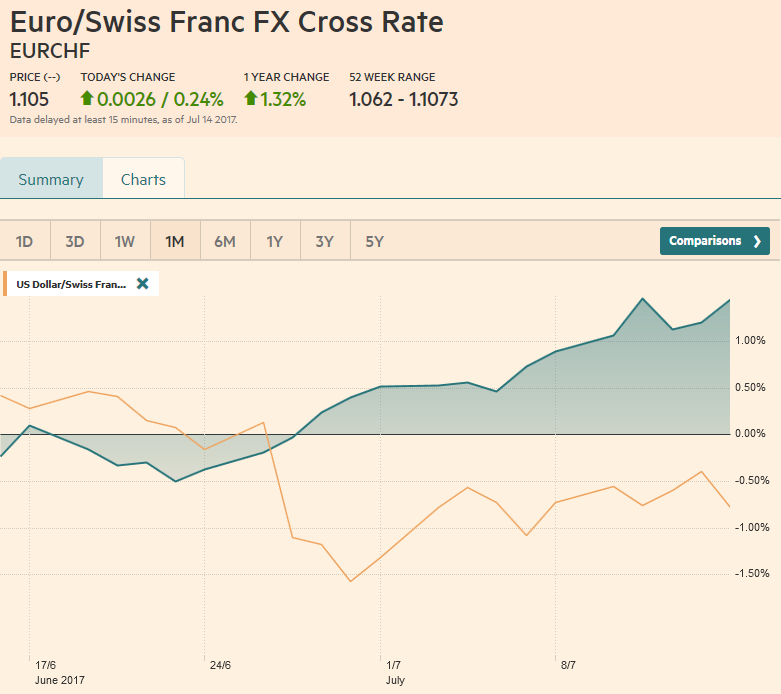

FX Weekly Review, July 17 – July 22: Euro and CHF move upwards against Dollar

Both Swiss Franc and Euro were moving upwards against the dollar. So CHF gained 3% versus the dollar in the last month. CHF losses against the euro are smaller, around 1.3%.

Read More »

Read More »

FX Daily, July 21: Dollar Licks Wounds as News Stream Doesn’t Improve

The euro has depreciated by 0.13 to 1.1043 CHF. ECB President Draghi did not argue forcefully enough at yesterday's press conference to dampen the enthusiasm for the euro. The initial dip was quickly bought and the euro chased above last year's high near $1.1615, and the gains have been extended to nearly $1.1680 today. The next target is the August 2015 near $1.1715 is near.

Read More »

Read More »

FX Daily, July 20: ECB Game Day

The US dollar is enjoying a firmer tone against the major currencies today. It does not appear to be simply position adjustments ahead of the ECB meeting. Consider that Australia reported strong employment data, and after making new highs, reaching almost $0.8000, it has reversed to toy with yesterday's low. A convincing break of that area (~$0.7910), especially on a closing basis, could be the kind of technical reversal that momentum traders take...

Read More »

Read More »

FX Daily, July 19: Dollar Stabilizes on Hump Day, Awaits Thursday’s BOJ and ECB Meetings

After being shellacked to start the week, the US dollar is being given a small reprieve today as investors await tomorrow's BOJ and ECB meetings. The US may also report a bounce back in housing starts (residential investment) after a three-month slide.

Read More »

Read More »

FX Daily, July 18: Dollar Dumped on Doubts on US Economic Agenda

News of the defection of two more Republican Senators doomed the Senate attempt to replace and repeal America's national health care. The failure to replace the system dubbed Obamacare, despite the Republican majority in both legislative chambers and the executive branch raises questions about the broader strategy of the Administration and raises serious questions about the rest of its legislative agenda.

Read More »

Read More »

FX Daily, July 17: Markets Mark Time, Dollar Consolidates Losses

After falling to new lows for the year against several major currencies in response to disappointing retail sales and uninspiring CPI before the weekend, the US dollar has begun the new week on a more stable note. It is firmer against nearly all the major currencies, though is mixed against the emerging market currencies.

Read More »

Read More »

FX Weekly Review, July 10 – July 15: CHF Winning against USD, but losing vs. Euro

The Euro remained the strongest among EUR, CHF and USD during the last month.

The Swiss lost against EUR 1.5%, while it gained versus the dollar 0.75%.

Read More »

Read More »

FX Daily, July 14: Aussie Scales New Highs for the Year, as the Greenback Remains on the Defensive

The Australian dollar has taken over leadership in the dollar bloc from the Canadian dollar. The Aussies are up about 0.35% today to extend this week's gains to more than 2% and reach a new high for the year a little more than $0.7760. The Canadian dollar is up 1.1% this week, in comparison.

Read More »

Read More »

FX Daily, July 13: Sterling and Antipodeans Trade Higher

The US dollar is mostly consolidating yesterday's move. Sterling is pushing back through $1.29 as the hawks on the MPC may not have been dissuaded by disappointing PMI readings and the softer earnings growth. The table is being set for another 5-3 vote at next month's MPC meeting.

Read More »

Read More »

FX Daily, July 12: Currencies Stabilize, but Yen Strengthens

The US dollar and sterling have stabilized after being sold off yesterday. The yen, which had begun recovering from a four-month low, is the strongest of the major currencies today, gaining around 0.5% against the dollar (@~JPY113.40).

Read More »

Read More »

FX Daily, July 11: Markets Looking for Next Cue

Investors await fresh policy clues as the Bank of England's Broadbent is seen as a key vote on a closely balanced MPC, while the Fed's Brainard, is also seen as a bellwether, will speak shortly after midday in NY. Broadbent has not spoken since the election, and his current views are not known.

Read More »

Read More »

FX Daily, July 10: Firm Dollar Tone may be Challenged by Softer Yields

The US dollar has begun the new week on a firm note, but the decline in yields limit the gains. The US 10-year yield is pulling back from the 2.40% area, which is it not been able to sustain gains above since Q1. European bond yields are also 1-3 basis points lower today after jumping last week.

Read More »

Read More »