Tag Archive: EMU

Cautious Markets after China Disappoints

Overview: Ukraine's Mariupol refuses to surrender as the war is turning more brutal according to reports. Iran-backed rebels in Yemen struck half of a dozen sites in Saudi Arabia, driving oil prices higher. China’s prime lending rates were unchanged. The MSCI Asia Pacific Index, which rallied more than 4% last week, traded heavily today though China and Taiwan's markets managed to post small gains. Tokyo was closed for the spring equinox.

Read More »

Read More »

How the Market Responds to US CPI may set the Near-Term Course

Overview: US stocks built on the recovery started on Monday and Powell's suggestion of letting the balance sheet shrink later this year eased some speculation of a fourth hike this year, which seemed to allow the Treasury market to stabilize.

Read More »

Read More »

No Turnaround Tuesday for Equities?

Overview: Activity in the capital markets is subdued today, ahead of tomorrow's FOMC meeting conclusion and the ECB meeting on Thursday. The MSCI Asia Pacific equity index fell for the third consecutive session. European bourses are heavy after the Stoxx 600 posted an outside down day yesterday. Today would be the fifth consecutive decline. Selling pressure on the US futures indices continues after yesterday's losses. Australia and New Zealand...

Read More »

Read More »

The Greenback Finds Traction ahead of the Jobs Report

Overview: The Omicron variant has been detected in more countries, but the capital markets are taking it in stride. Risk appetites appear to be stabilizing. The MSCI Asia Pacific Index rose for the third consecutive session, though Hong Kong and Taiwan markets did not participate in the advance today. Europe's Stoxx 600 is struggling to hold on to early gains, while US futures are narrowly mixed. The US 10-year yield is a little near 1.43%,...

Read More »

Read More »

FX Daily, December 02: Calm Surface Masks Lack of Conviction

The downside reversal in US stocks yesterday seemed to accelerate after the first case of the Omicron variant was found in the US. In itself, it should not be surprising, but perhaps, what was especially disheartening is that the person had been fully vaccinated.

Read More »

Read More »

Fragile Calm Returns and Powell’s Anti-Inflation Rhetoric Ratchets Up

Overview: Into the uncertainty over the implications of Omicron, the Federal Reserve Chairman injected a particularly hawkish signal into the mix in his testimony before the Senate. These are the two forces that are shaping market developments. Travel restrictions are being tightened, though the new variant is being found in more countries, and it appears to be like closing the proverbial barn door after the horses have bolted. Equities are...

Read More »

Read More »

Tech Sell-Off Continues

Overview: The markets are unsettled. Bond yields have jumped, tech stocks are leading an equity slump, and yesterday's crude oil bounce reversed. Gold, which peaked last week near $1877, has been dumped to around $1793. The tech sell-off in the US carried into the Asia Pacific session, and Hong Kong led most markets lower. The local holiday let Japanese markets off unscathed, though the Nikkei futures are off about 0.4%. Australia and India...

Read More »

Read More »

Rate Adjustment Continues and the Greenback Pares the Week’s Losses

Overview: Disappointing Apple and Amazon earnings news after the NASDAQ set a record high set the stage of a weaker bias in the Asia Pacific region today. China and Japan still posted gains, while local developments, like an unexpected drop in South Korea's industrial output, and Australia struggling to exit its yield-curve control, saw equities lose more than 1%. Europe's Stoxx 600 is paring this week's gains but is holding on to some for the...

Read More »

Read More »

The Dollar Slips Ahead of CPI

The US dollar is trading with a lower bias ahead of the September CPI report due early in the North American session. Long-term yields softened yesterday and slipped further today, leaving the US 10-year yield near 1.56%. European benchmark yields are 3-4 bp lower. The shorter-end of the US coupon curve, the two-year yield is firmer.

Read More »

Read More »

Taper, No Tantrum

Overview: The market's reaction to the FOMC statement was going according to our script, with the dollar backing off on a buy rumor sell the fact type of activity until Powell provided an end date for the tapering (mid-2022) before providing a start date (maybe next month). This spurred a dollar rally.

Read More »

Read More »

FX Daily, June 01: CNY Softens after PBOC’s Move; Equities Advance on Stronger World Outlook

The US dollar fell against most major currencies following the PBOC's modest move to reduce the upward pressure on the yuan. Follow-through selling was seen earlier today, and sterling reached a new three-year high. However, the dollar found a bid in the European morning, while the Scandi currencies held on to most of their earlier gains.

Read More »

Read More »

FX Daily, February 3: The Greenback Remains Resilient as the Bulls Drive Equities Higher

Equities have charged higher, and the greenback is mostly firmer. News that Draghi may become Italy's next Prime Minister has boosted Italian bonds. The PBOC unexpectedly drained liquidity, and this may have deterred buying of Chinese stocks, a notable exception in the regional rally.

Read More »

Read More »

FX Daily, February 1: Markets Snap Back

Global equities are snapping back today, while the greenback retained the strength seen last week that was attributed to safe-haven flows. The MSCI Asia Pacific Index snapped a four-day decline led by Hong Kong, South Korea, India, and Indonesia.

Read More »

Read More »

FX Daily, January 04: Rising Equities and Slumping Dollar Greet the New Year

Overview: The first day of the New Year, but it feels a lot like last year. The dollar is under pressure, and equities are higher. Outside of Japan and Malaysia, The MSCI Asia Pacific Index extended last week's 3.6% gain. It has not rallied for seven consecutive sessions.

Read More »

Read More »

FX Daily, December 1: No Follow-Through After Month-End Adjustments

The near-record rallies seen in the major equity markets in November may have contributed to the month-end drama yesterday. There has been no follow-through activity. Stocks bounced back, and the US dollar is heavy, with few exceptions.

Read More »

Read More »

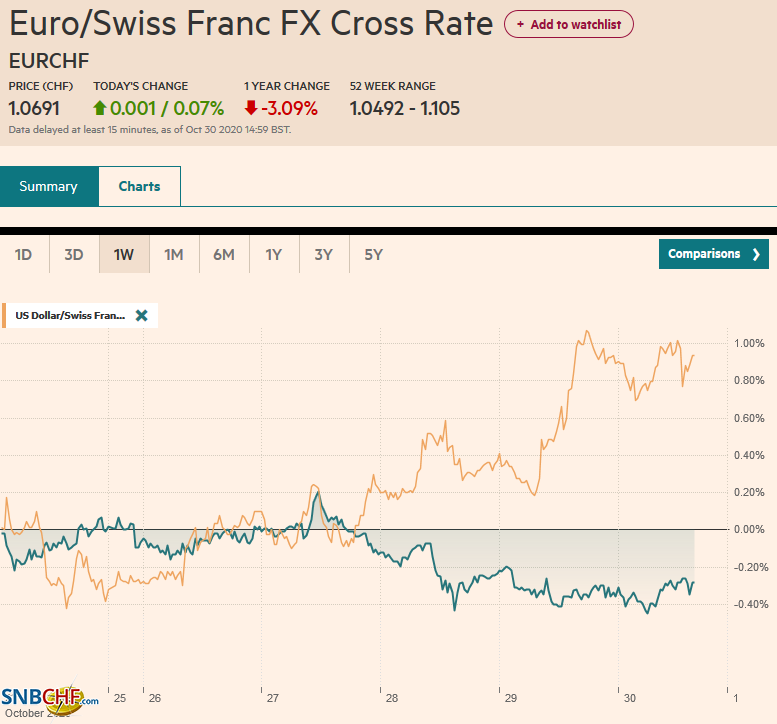

FX Daily, October 30: Investors Scared Before Halloween

Investors punished US tech giants for not delivering perfection as prices apparently had discounted, and the subsequent sell-off coupled with month-end dynamics has rocked global equities. Asia Pacific bourses were a sea of red, led by a 2.5% decline in the tech-heavy South Korean Kospi, but most major markets were off more than 1%.

Read More »

Read More »

FX Daily, October 2: POTUS Infected: Is this the October Surprise?

Before a US election, there is often speculation of a last-minute game-changing development. News earlier today that the US President and his wife have tested positive for the Covid virus has injected a new unknown into not only the US election but the markets as well.

Read More »

Read More »

FX Daily, October 1: Hope Springs Eternal

Speculation that a new round of fiscal stimulus from the US is possible is encouraging risk-taking today. Many large Asian centers were closed for holidays today, and a technical problem prevented the Tokyo Stock Exchange from opening.

Read More »

Read More »

FX Daily, September 1: Dollar Lurches Lower

The US dollar has been sold-off across the board. The euro approached $1.20, and sterling neared $1.3450. The greenback traded below CAD1.30 for the first time since January. Most emerging market currencies but the Turkish lira, are also advancing today.

Read More »

Read More »

FX Daily, August 21: PMIs Shake Investor Confidence

The second disappointing Fed manufacturing survey report and an unexpected rise in weekly jobless claims helped reverse the disappointment over the FOMC minutes. Bonds and stocks rallied--not on good macroeconomic news, but the opposite, which underscores the likelihood of more support for longer.

Read More »

Read More »