Tag Archive: ECB

FX Weekly Preview: The Week Ahead Excluding Brexit

I feel a bit like the proverbial guy that asks, "Besides that, Mrs. Lincoln, how did you like the play?" in trying to discuss the week ahead without knowing the results of the UK Parliament's decision on the new deal negotiated between Prime Minister Johnson and the EU. I will write a separate note about Brexit before the Asian open. However, there are several other developments next week that will help shape the investment climate.

Read More »

Read More »

FX Daily, October 10: Setback for the Greenback

Conflicting headlines about US-China trade whipsawed the markets in Asia, but when things settled down, perhaps, like the partial deal that has been hinted, net-net little has changed. Asian equities were mixed, with the Nikkei, China's indices, and HK gaining, while most of the others slipped lower. The 0.9% gain in the S&P 500 yesterday failed to lift European stocks, and the Dow Jones Stoxx 600 is near the week's lows.

Read More »

Read More »

The Consequences Of ‘Transitory’

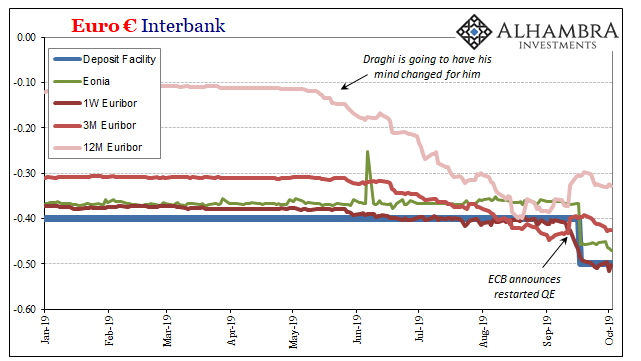

Europe’s QE, as noted this weekend, is off to a very rough start. In the bond market and in inflation expectations, the much-ballyhooed relaunch of “accommodation” is conspicuously absent. There was a minor back up in yields between when the ECB signaled its intentions back in August and the few weeks immediately following the actual announcement.

Read More »

Read More »

FX Weekly Preview: China Returns, ECB Record, Fed Minutes and the Week Ahead

Many high-income countries experienced little growth but strong price pressures in the 1970s. Since the mainstream economics said the two were mutually exclusive, a new term had to be created, hence stagflation. Fast forward almost half a century later, and mainstream economists are still having a problem deciphering the linkages between prices and economic activity, such as inflation and employment.

Read More »

Read More »

FX Daily, September 26: Greenback Remains Firm

Overview: A compelling narrative for yesterday's disparate price action is lacking. A flight to safety, which is a leading interpretation, does not explain the weakness in the yen, gold, or US Treasuries. Month- and quarter-end portfolio and hedge adjustments may be at work, but the risk is that it is a black box: is difficult to verify and lends itself to misuse as a catch-all explanation. Nevertheless, the rise in US equities yesterday helped...

Read More »

Read More »

FX Daily, September 19: Investors Looking for New Focus

Overview: Central bank activity is still very much the flavor of the day, but investors are looking for the next focus. The Bank of Japan and the Swiss National Bank stood pat, while Indonesia cut for the third consecutive time and the Hong Kong Monetary Authority and Saudi Arabia quickly followed the Fed. Brazil cut its Selic rate yesterday by 50 bp as widely expected.

Read More »

Read More »

Cool Video: Thoughts on ECB

A few hours after the ECB announced a new package of monetary accommodation, I joined a discussion on CNBC Asia with Nancy Hungerford and Sir Jegarajah. Here is a clip of part of our discussion. I make two points. The first is about the euro's price action. What impressed me about it was that the euro posted an outside up day, trading on both sides of the previous day's range and closing above its high.

Read More »

Read More »

Your Unofficial Europe QE Preview

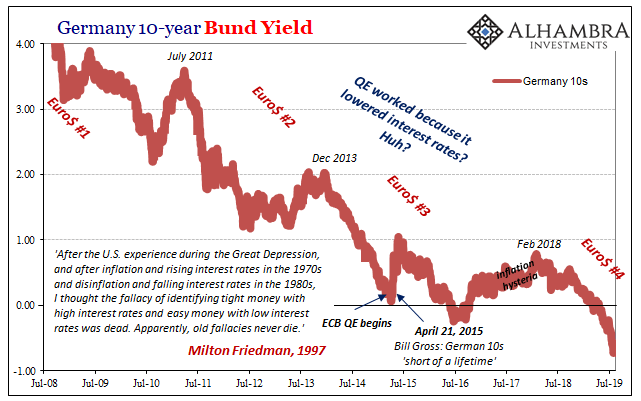

The thing about R* is mostly that it doesn’t really make much sense when you stop and think about it; which you aren’t meant to do. It is a reaction to unanticipated reality, a world that has turned out very differently than it “should” have. Central bankers are our best and brightest, allegedly, they certainly feel that way about themselves, yet the evidence is clearly lacking.

Read More »

Read More »

FX Daily, September 13: Bonds and the Dollar Remain Heavy Ahead of the Weekend

Overview: The markets are digesting ECB's actions and an easing in US-Chinese rhetoric. Next week features the FOMC meeting and three other major central banks (Japan, Switzerland, and Norway). The US equity rally that saw the S&P 500 edge closer to the record high set in late July spilled over to lift Asian markets. Chinese and Korean markets were closed for a mid-autumn holiday.

Read More »

Read More »

The Obligatory Europe QE Review

If Mario Draghi wanted to wow them, this wasn’t it. Maybe he couldn’t, handcuffed already by what seems to have been significant dissent in the ranks. And not just the Germans this time. Widespread dissatisfaction with what is now an idea whose time may have finally arrived.

Read More »

Read More »

A Bigger Boat

For every action there is a reaction. Not only is that Sir Isaac Newton’s third law, it’s also a statement about human nature. Unlike physics where causes and effects are near simultaneous, there is a time component to how we interact. In official capacities, even more so.

Read More »

Read More »

Is The Negativity Overdone?

Give stimulus a chance, that’s the theme being set up for this week. After relentless buying across global bond markets distorting curves, upsetting politicians and the public alike, central bankers have responded en masse. There were more rate cuts around the world in August than there had been at any point since 2009.

Read More »

Read More »

FX Weekly Preview: Gaming the ECB and Putting the Cart Before Horse in the Brexit Drama

The step away from the edge of the abyss may have stirred the animal spirits, but it remains precarious at best. The formal withdrawal of the extradition bill in Hong Kong is too late and too little at this juncture. The ambitions of the protests have evolved well beyond that.

Read More »

Read More »

FX Weekly Preview: Talking and Fighting in the Week Ahead

Equity markets and the US dollar closed last week and August on a firm note. Ahead of the weekend, the dollar rose to new highs for the year against the euro, Swedish krona, Norwegian krone, and the New Zealand dollar. While the next set of US and Chinese tariffs start September 1, the market is making the most of the lull.

Read More »

Read More »

“More of the same” at the ECB increases gold’s appeal

“The intellectual leaders of the peoples have produced and propagated the fallacies which are on the point of destroying liberty and Western civilization.” Ludwig von Mises, Planned Chaos. It took multiple meetings and over 50 hours of official negotiations for EU leaders to reach an agreement on the appointments for the top jobs of the EU and the ECB, but in mid-July the results finally came in.

Read More »

Read More »

FX Weekly Preview: The Dog Days of August are Upon Us

The die is cast. To defend the uneven expansion and ward off disinflationary forces, monetary authorities will provide more accommodation. The Federal Reserve delivered its first rate cut in more than a decade and stopped unwinding its balance sheet two months earlier than it previously indicated (worth $100 bln of additional buying of Treasuries and Agencies).

Read More »

Read More »

DATA ADDS TO THE CASE FOR ECB ACTION IN SEPTEMBER

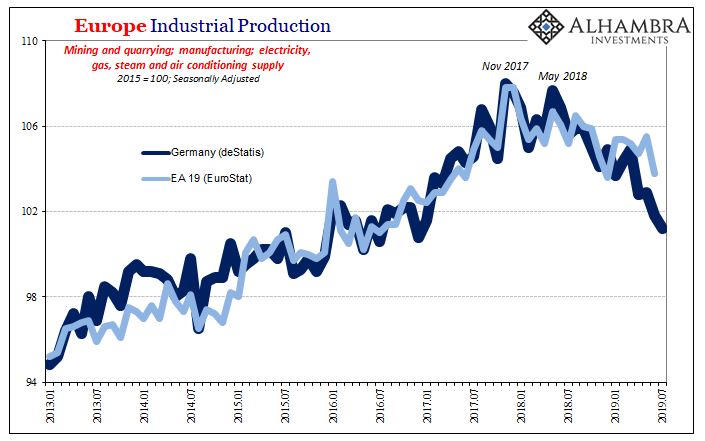

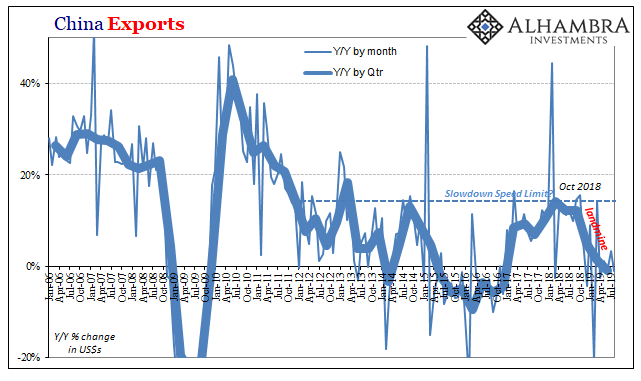

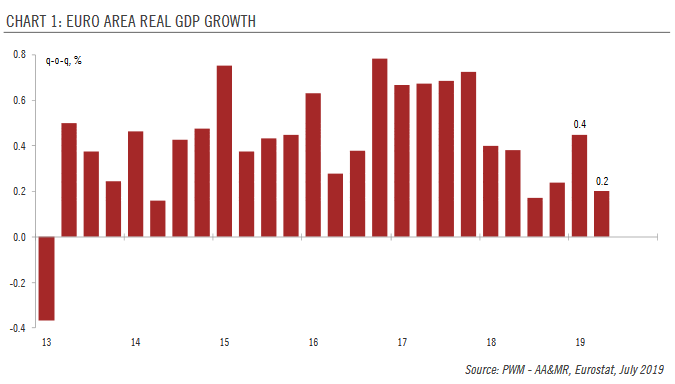

Slowing economic momentum in the euro area means that we are lowering our GDP forecasts for this year. The euro area economy grew by 0.2% q-o-q in Q2, down from 0.4% in Q1.While 0.2% is still a decent pace of growth, concerns about the economy in the second half of the year have increased. Recent data have shown that the industrial slump has started to leave some marks on the domestic economy.

Read More »

Read More »

Seven Points on the ECB and the Price Action

As soon as it was clear that the ECB was not easing today, the euro began to recover, after making a marginal new low for the year (just above $1.11). Draghi made it clear that easing was going to be delivered in September and on several fronts including rates (with mitigating measures like tiering) and new asset purchases (not decided on instruments, which plays into speculation of equity purchases—though I strongly doubt this will materialize).

Read More »

Read More »

FX Daily, July 26: Markets Consolidate as the Dollar Index Extends its Advance for the Sixth Consecutive Session

Investors are happy for the weekend. Between the ECB, Brexit, and next week's FOMC, BOJ, and BOE meetings, the markets are mostly in a consolidative mode ahead of the weekend. The first look at Q2 US GDP is the last important data point of the week, though it is unlikely to impact next week's Fed decision.

Read More »

Read More »

FX Daily, July 25: ECB Takes Center Stage

The euro remains stuck in its trough below $1.1150 ahead of the ECB meeting. The US dollar is firmer against most of the major currencies. The yen continues to resist the draw of the greenback. Most emerging market currencies are lower. The Turkish lira is weaker ahead of its central bank meeting, which is expected to deliver a large cut (~250 bp).

Read More »

Read More »