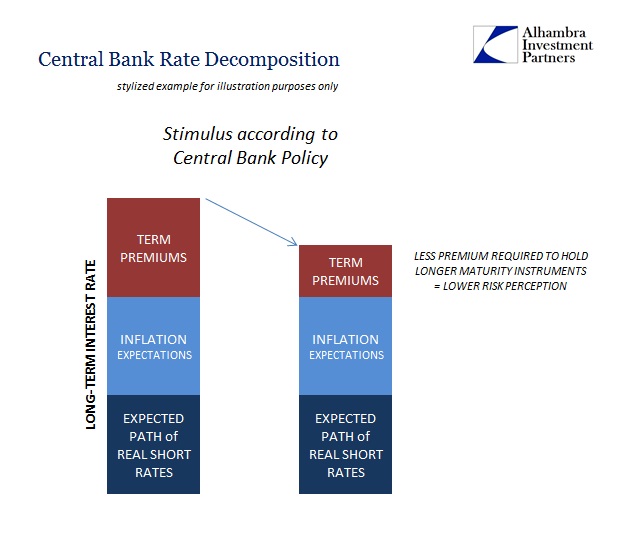

According to orthodox theory, if interest rates are falling because of term premiums then that equates to stimulus. Term premiums are what economists have invented so as to undertake Fisherian decomposition of interest rates (so that they can try to understand the bond market; as you might guess it doesn’t work any better). It is, they claim, the additional premium a bond investor demands so as to hold a security that much longer (more return to...

Read More »

Tag Archive: decomposition

Swiss National Bank: Composition of Reserves (Assets) and Investment Strategy

The Q1/2016 update on the SNB investment strategy and its assets.

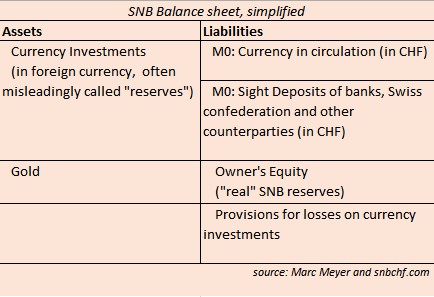

The Swiss National Bank is a passive conservative investor. As opposed to other investors, the exposure in currencies is as important as the strategic asset allocation according asset classes (bonds, equities, cash, real estate). The importance of currencies is one reason why the SNB is often called a hedge fund, the second the volatility of gains and losses.

Read More »

Read More »

SNB Q2/2013 Composition of Reserves

We regularly publish the SNB asset structure by currency, rating & duration, they might be a template for the tactical asset allocation in these dimensions (CHF certainly excluded) for other fixed income and/or rather conservative asset managers. here the newest data Total Balance Sheet and Liabilities The total balance sheet size decreased from 511 bln. …

Read More »

Read More »

SNB Q1 Results: Bottom-Fishing Cheap Yen, Increases Equity Share with Gains and Margin Debt

We regularly publish the SNB asset structure by currency, rating & duration, they might be a template for the tactical asset allocation in these dimensions (CHF certainly excluded) for other fixed income and/or rather conservative asset managers. Composition of SNB Forex Reserves, Q1/2013 With the strong results of 11.2 billion francs, the SNB reduced the …

Read More »

Read More »

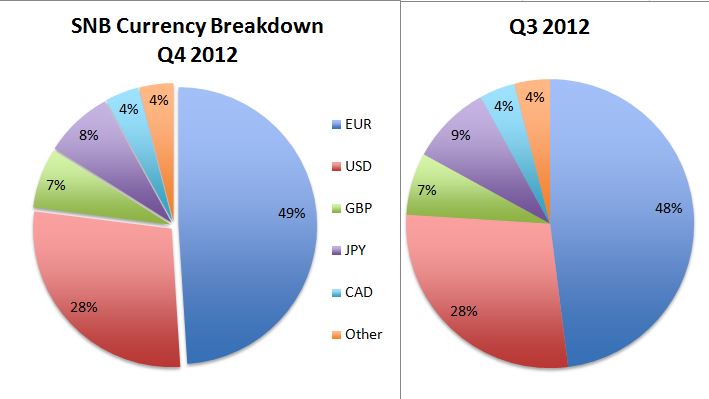

Composition of SNB Reserves Q4, 2012, Yield on Investment

We regularly publish the SNB asset structure by currency, rating & duration, they might be a template for the tactical asset allocation in these dimensions (CHF certainly excluded) for other fixed income asset managers. Moreover we publish the yield on investment. Composition of SNB Forex Reserves, Q4 2012 The Swiss National Bank (SNB) saw …

Read More »

Read More »

How the SNB Destroyed Ashraf Laidi’s EUR/USD 1.35 Party

Trend Follower Ashraf Laidi Loses Against the Contrarian Investor SNB The currency strategist Ashraf Laidi recently evoked a EUR/USD exchange rate of 1.35 thanks to the risk appetite after the easing operations of the Fed and the ECB. We show that he and the masses of his Forex rooters actually traded against a big central …

Read More »

Read More »

Trade Like a Central Bank: Buy EUR/USD at 1.24 and sell at 1.30! .. SNB

Composition of SNB Forex Reserves, Q3 2012 The Swiss National Bank (SNB) reduced the share of euros in the third quarter substantially from 60% in Q2 to 48% in Q3 and increased dollar and pound positions. The SNB bought 80 billion euros or more when the common currency was trading around 1.24$, especially at the end of …

Read More »

Read More »

Receive a Daily Mail from this Blog

Live Currency Cross Rates

On Swiss National Bank

On Swiss National Bank

-

SNB’s Chairman Schlegel: A few months of negative inflation wouldn’t be a problem

9 days ago -

SNB Sight Deposits: decreased by 3.6 billion francs compared to the previous week

2025-12-17 -

2025-07-31 – Interim results of the Swiss National Bank as at 30 June 2025

2025-07-31 -

SNB Brings Back Zero Percent Interest Rates

2025-06-26 -

Hold-up sur l’eau potable (2/2) : la supercherie de « l’hydrogène vert ». Par Vincent Held

2025-06-24

Main SNB Background Info

Main SNB Background Info

-

SNB Sight Deposits: decreased by 3.6 billion francs compared to the previous week

2025-12-17 -

The Secret History Of The Banking Crisis

2017-08-14 -

SNB Balance Sheet Now Over 100 percent GDP

2016-08-29 -

The relationship between CHF and gold

2016-07-23 -

CHF Price Movements: Correlations between CHF and the German Economy

2016-07-22

Featured and recent

-

SAP verliert 30 Milliarden Euro Börsenwert in wenigen Stunden!

SAP verliert 30 Milliarden Euro Börsenwert in wenigen Stunden! -

Video_7_Deal oder kein deal europa

Video_7_Deal oder kein deal europa -

High on a Swiss hill: the oldest playable organ in the world

High on a Swiss hill: the oldest playable organ in the world -

Why the Federalists Hated the Bill of Rights

-

Paukenschlag: Nächste SPARKASSE musste dran glauben! Wilhelmshaven im Schock!

Paukenschlag: Nächste SPARKASSE musste dran glauben! Wilhelmshaven im Schock! -

Fällst Du auf unsere Geld-Fallen rein?

Fällst Du auf unsere Geld-Fallen rein? -

Die wichtigsten Änderungen für Deine Finanzen 2026

Die wichtigsten Änderungen für Deine Finanzen 2026 -

SCHOCK: Maschmeyer warnt ALLE Deutschen Bürger?!

SCHOCK: Maschmeyer warnt ALLE Deutschen Bürger?! -

Doktor-Titel Eklat: Höcke wischt mit Mario Voigt den Boden auf!

Doktor-Titel Eklat: Höcke wischt mit Mario Voigt den Boden auf! -

Dollar Gyrations but Little Changed ahead of the North American Session

Dollar Gyrations but Little Changed ahead of the North American Session

More from this category

Deja Vu

Deja Vu1 Sep 2017

SNB Q2/2013 Composition of Reserves

SNB Q2/2013 Composition of Reserves2 Aug 2013

SNB Q1 Results: Bottom-Fishing Cheap Yen, Increases Equity Share with Gains and Margin Debt

SNB Q1 Results: Bottom-Fishing Cheap Yen, Increases Equity Share with Gains and Margin Debt30 Apr 2013

Composition of SNB Reserves Q4, 2012, Yield on Investment

Composition of SNB Reserves Q4, 2012, Yield on Investment7 Mar 2013

How the SNB Destroyed Ashraf Laidi’s EUR/USD 1.35 Party

How the SNB Destroyed Ashraf Laidi’s EUR/USD 1.35 Party31 Oct 2012

Trade Like a Central Bank: Buy EUR/USD at 1.24 and sell at 1.30! .. SNB

Trade Like a Central Bank: Buy EUR/USD at 1.24 and sell at 1.30! .. SNB31 Oct 2012