Tag Archive: Daily News

Dollar Bid as Market Sentiment Worsens

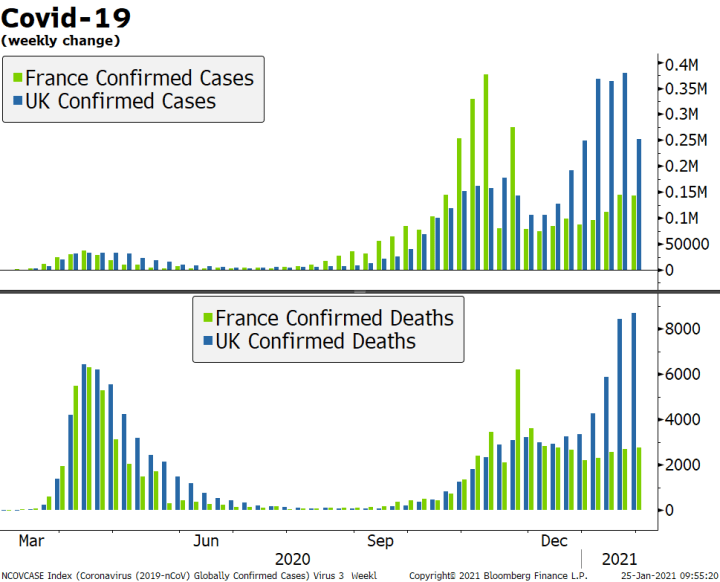

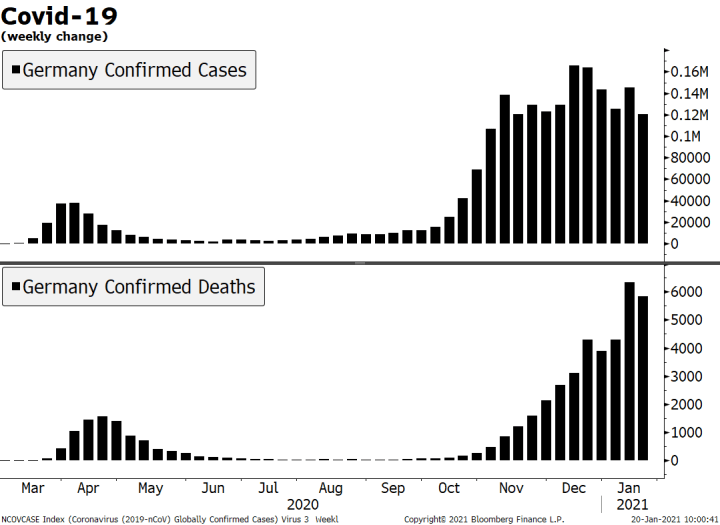

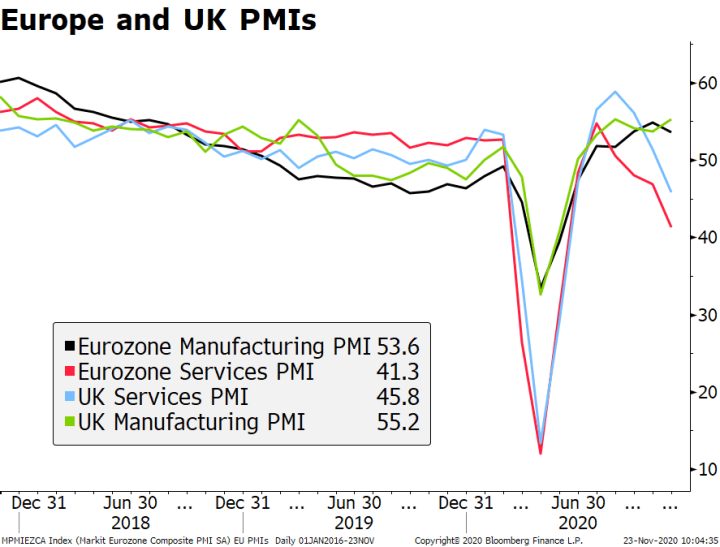

The virus news stream out of Europe has improved a bit. The US is already taking about the next relief bill; the Fed continues to roll out measures to address dollar funding issues. ADP and ISM manufacturing PMI are the US data highlights. Regulators across Europe are asking banks to stop paying dividends; eurozone and UK reported final manufacturing PMIs.

Read More »

Read More »

Dollar Firm, Markets Unsettled Despite Aggressive Policy Responses Worldwide

Markets remain unsettled even as policymakers worldwide continue to take aggressive emergency measures; the dollar continues to power higher. Fed rolled out another crisis-era program last night; US Senate passed the House virus relief bill by a 90-8 vote. ECB held an emergency call last night and announced an additional bond purchase program to the tune of €750 bln that now includes commercial paper.

Read More »

Read More »

Dollar Firms, Equities Sink Ahead of ECB Decision as US Fails to Deliver

President Trump spoke to the nation last night and did little to calm markets; reports suggest that the Democrats are working on a bill. Fed easing expectations are intensifying. The ECB decision will be out at 845 AM ET; over the past 17 ECB decision days, the euro has finished lower in 11 of them.

Read More »

Read More »

Dollar Soft as BOE Surprises Ahead of UK Budget

The dollar is stabilizing but remains vulnerable to disappointment as markets await details of US fiscal measures. US reports February CPI; Joe Biden moved closer to clinching the Democratic nomination. BOE delivered a surprise 50 bp rate cut to 0.25% and initiated a new lending scheme; UK government releases its budget today; UK reported weak data.

Read More »

Read More »

Dollar Firm as Global Financial Markets Calm

Global financial markets are finally seeing a measure of calm return; local Chinese media is sounding more confident that the situation is now under control. The White House will announce fiscal measures today; five states hold primaries and one holds a caucus with 352 total pledged delegates up for grabs.

Read More »

Read More »

Dollar Mixed as Coronavirus News Stream Deteriorates

The virus news stream continues to deteriorate. Lower US yields and growing concerns about the spread of the coronavirus in the US are taking a toll on the greenback. OPEC officials are trying to work out another supply cut; The outlook for Turkey is going from bad to worse. Simply put, there is nothing the Fed can do to address the economic impact of supply chain disruptions and social distancing.

Read More »

Read More »

Dollar Firm as Risk-Off Sentiment Picks Up Again

Negative news on the coronavirus has kept risk appetite subdued across the board; the dollar rally continues. During the North American session, we will get some more clues to the state of the US economy; FOMC minutes were largely as expected. UK January retail sales came in firm; ECB releases the account of its January 23 meeting.

Read More »

Read More »

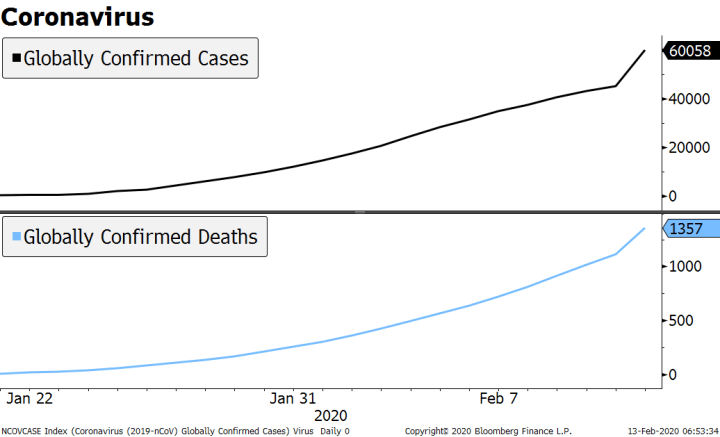

Virus Concerns Resurface

Markets are reacting badly to upward revisions to coronavirus cases in China. The euro fell to the weakest level since mid-2017 against the dollar. UK housing data adds to relatively upbeat figures since the December elections. Malaysia’s government is joining in the counter-cyclical fiscal effort.

Read More »

Read More »

Markets on Edge as New Week Begins

The coronavirus death toll is just over 900, exceeding the SARS epidemic; the dollar remains firm. President Trump will unveil his budget proposal for FY2021 beginning October 1 today. The faltering eurozone economy comes just as political uncertainty is picking up in Germany.

Read More »

Read More »

Dollar Firm Ahead of US Jobs Report

The number of confirmed coronavirus cases and deaths continue to rise; the dollar continues to climb. The January jobs data is the highlight for the week; Canada also reports jobs data. The Fed submits its semiannual Monetary Policy Report to Congress today; Mexico and Brazil report January inflation data.

Read More »

Read More »

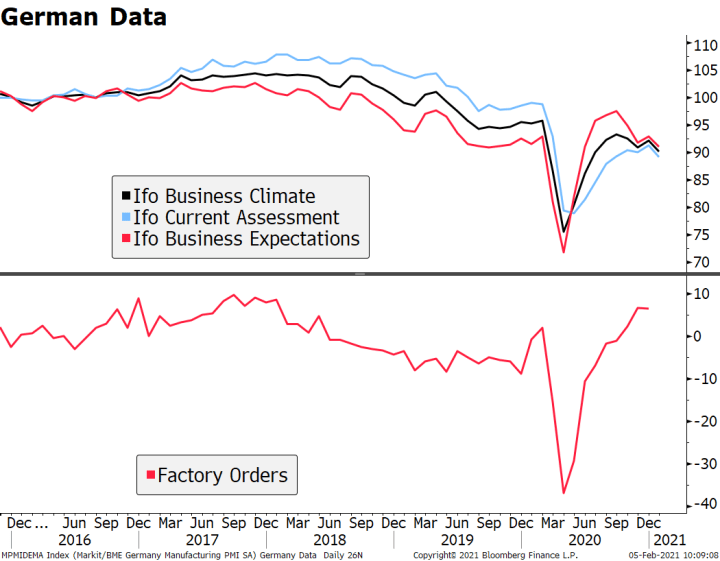

Dollar Firm as Markets Await Fresh Drivers

China cut tariffs on $75 bln of US imports by half, while the US said it could reciprocate in some way. The dollar continues to climb; during the North American session, only minor data will be reported; Brazil cut rates 25 bp. Germany reported very weak December factory orders; all is not well in the German state of Thuringia.

Read More »

Read More »

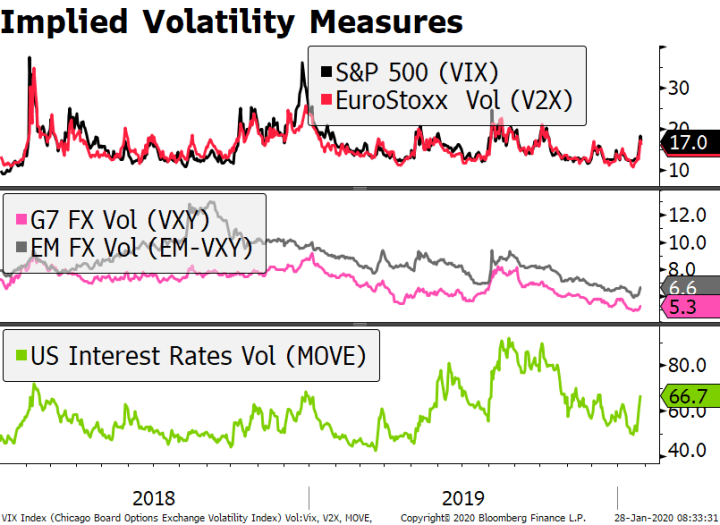

Tentative Stabilization

Risk-off continues in Asia, but moves have been less dramatic. European market jittery but stable. Implied rates now pricing in a full Fed cut by September. The UK will announce its decision on Huawei’s access to the country’s 5G network.

Read More »

Read More »

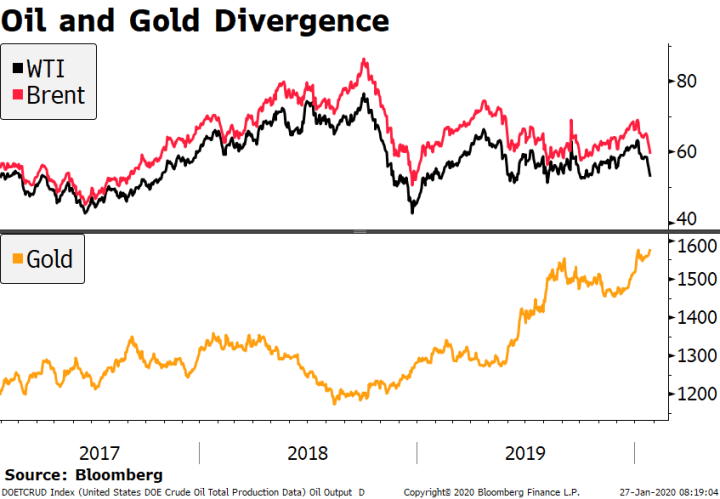

Sharp Sell-Off on Virus Concerns

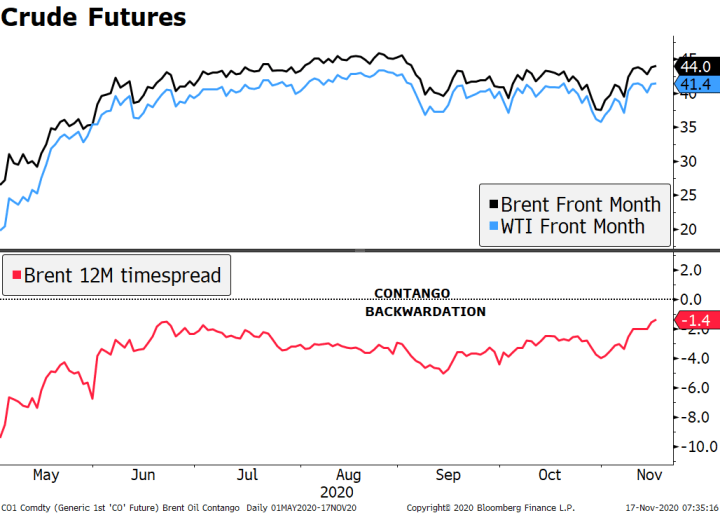

Global stocks lower on virus fears, yen appreciates, and yield curves flatten. Oil prices continue to fall while gold rises. Italian assets outperform on favorable election results for ruling coalition. German IFO survey disappoints, trimming nascent green shoots.

Read More »

Read More »

Virus and Trade Tensions

Asian markets hit by a further outbreak of the coronavirus. US steps up trade rhetoric against EU and pushes back against UK digital tax plan. AUD stronger on solid Australian jobs report and pricing out of RBA easing. CAD weaker on dovish BOC communication yesterday.

Read More »

Read More »

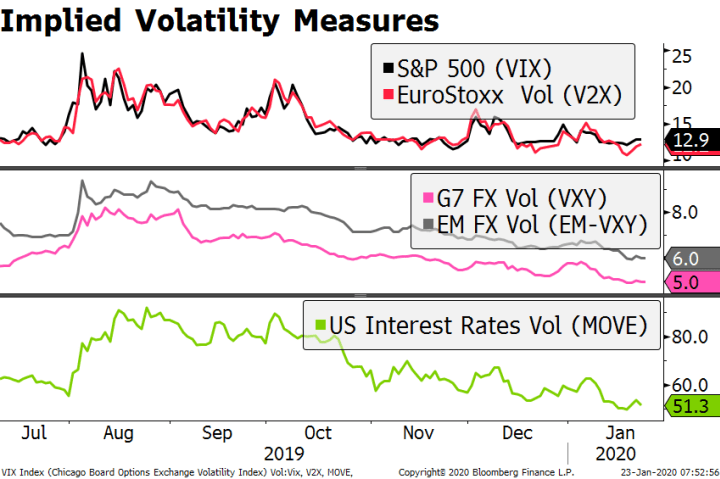

Dollar Mixed as Risk-Off Impulses Spread from Virus

Reports that Wuhan coronavirus continues to spread hurt risk appetite overnight. US President Trump and French president Macron agreed to take a step back from the digital tax dispute. The dollar is taking a breather today; after last week’s huge US data dump, releases this week are fairly light. The UK reported firm jobs data for November; BOJ kept policy steady, as expected.

Read More »

Read More »

Dollar Soft Ahead of Retail Sales Data

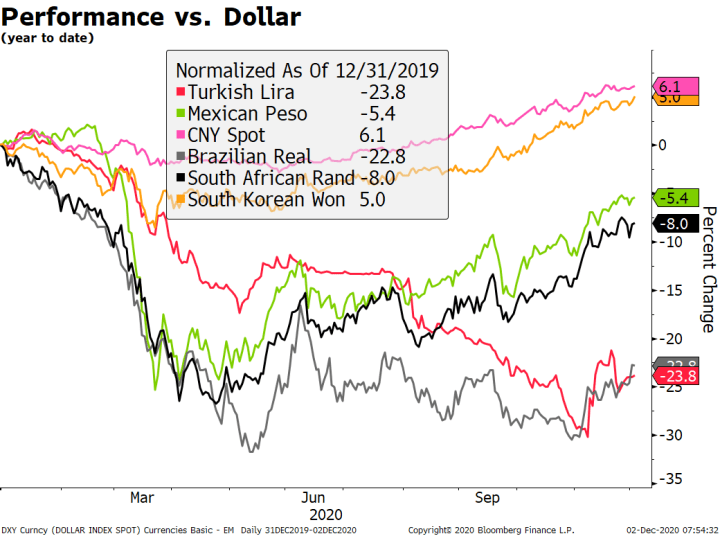

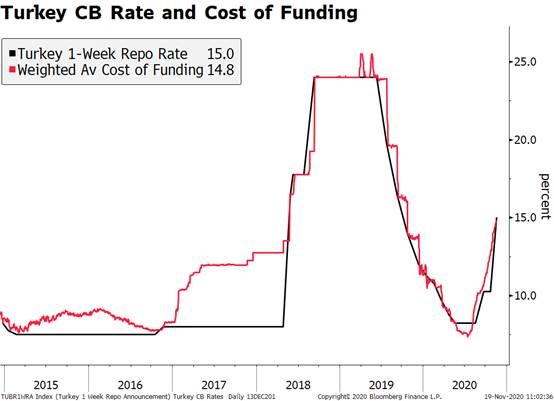

There were no surprises in the US-China Phase One trade deal. The dollar is drifting lower ahead of the key retail sales data; there are other minor US data out today. Bank of England credit survey showed demand for loans fell in Q4. Turkey cut its one-week repo rate by 75 bps to 11.25%; South Africa is expected to keep rates steady at 6.5%.

Read More »

Read More »

Dollar Builds on Gains as Iran Tensions Ease

Markets have reacted positively to President Trump’s press conference yesterday, while the dollar continues to gain traction. The North American session is quiet in terms of US data. Mexico reports December CPI; Peru is expected to keep rates steady at 2.25%. German November IP was slightly better than expected but still tepid; sterling took a hit on dovish comments by outgoing BOE Governor Carney.

Read More »

Read More »

Risk Assets Rally as Major Tail Risks Ease

The biggest tail risks impacting markets this year have cleared up; risk assets are rallying, while safe haven assets are selling off. During the North American session, US November retail sales will be reported. Russia central bank cut rates 25 bp to 6.25%, as expected.

Read More »

Read More »

Dollar Soft on Weak Data and the Return of Tariff Man

The dollar has taken a hit from the weaker than expected data Monday. Tariff man is back. The US economy remains solid in Q4 but there are some worrying signs for the November jobs data Friday. The political pressure on Turkey from the US could increase soon; South Africa’s Q3 GDP came in well below expectations at -0.6% q/q and 0.1% y/y.

Read More »

Read More »

Dollar Builds on Recent Gains

The dollar remains resilient; optimism towards a Phase One deal continues to support risk appetite. There was also optimism from Fed Chairman Powell yesterday; the US economy is not out of the woods yet. Turkish President Erdogan started deploying Russia’s S-400 missile system, raising the specter of sanctions. Hong Kong reported weak October trade data; Philippine central bank Governor Diokno said a December cut was possible.

Read More »

Read More »